Semiconductor manufacturer Vishay Intertechnology (NYSE:VSH) missed analysts' expectations in Q3 FY2023, with revenue down 7.7% year on year to $854 million. Next quarter's revenue guidance of $790 million fell short, coming in 5.9% below analysts' estimates. Turning to EPS, Vishay Intertechnology made a non-GAAP profit of $0.60 per share, down from its profit of $0.98 per share in the same quarter last year.

Is now the time to buy Vishay Intertechnology? Find out by accessing our full research report, it's free.

Vishay Intertechnology (VSH) Q3 FY2023 Highlights:

- Revenue: $854 million vs analyst estimates of $864 million (1.2% miss)

- EPS (non-GAAP): $0.60 vs analyst estimates of $0.57 (6.2% beat)

- Revenue Guidance for Q4 2023 is $790 million at the midpoint, below analyst estimates of $840 million

- Free Cash Flow of $55.5 million, up 53.1% from the previous quarter

- Inventory Days Outstanding: 95, up from 95 in the previous quarter

- Gross Margin (GAAP): 27.8%, down from 31.3% in the same quarter last year

“During the third quarter, as expected, revenue decreased from the second quarter on inventory adjustments by our distribution and EMS customers in response to softened demand in industrial markets and contracting lead times. Nevertheless, we once again intentionally increased inventory with our distribution partners as we continued to execute our strategy of broadening our participation in this higher margin channel. The capacity readiness activities we have underway are increasing our value to the distribution channel and reliably supporting our accelerating design activities related to the megatrends of e-mobility, sustainability and connectivity,” said Joel Smejkal, President and Chief Executive Officer.

Named after the founder's ancestral village in present-day Lithuania, Vishay Intertechnology (NYSE:VSH) manufactures simple chips and electronic components that are building blocks of virtually all types of electronic devices.

Analog Semiconductors

Demand for analog chips is generally linked to the overall level of economic growth, as analog chips serve as the building blocks of most electronic goods and equipment. Unlike digital chip designers, analog chip makers tend to produce the majority of their own chips, as analog chip production does not require expensive leading edge nodes. Less dependent on major secular growth drivers, analog product cycles are much longer, often 5-7 years.

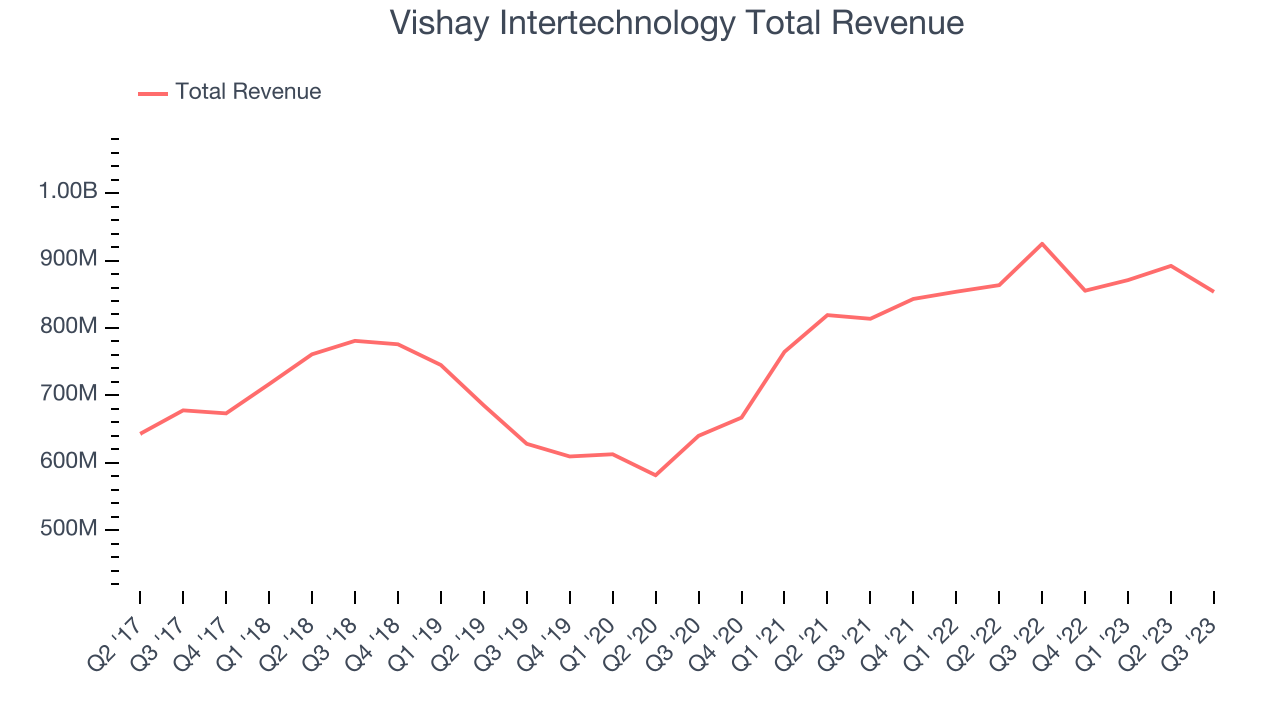

Sales Growth

Vishay Intertechnology's revenue growth over the last three years has been mediocre, averaging 13.2% annually. This quarter, its revenue declined from $925 million in the same quarter last year to $854 million. Semiconductors are a cyclical industry, and long-term investors should be prepared for periods of high growth followed by periods of revenue contractions (which can sometimes offer opportune times to buy).

Vishay Intertechnology had a difficult quarter as revenue dropped 7.7% year on year, missing analysts' estimates by 1.2%.

Vishay Intertechnology's revenue inverted from positive to negative growth this quarter, which was unfortunate to see. Looking ahead to the next quarter, the company's management team forecasts a 7.6% year-on-year revenue decline. Analysts seem to agree that the poor performance will continue, as their estimates for the next 12 months call for a 2.1% drop in revenue.

While most things went back to how they were before the pandemic, a few consumer habits fundamentally changed. One founder-led company is benefiting massively from this shift and is set to beat the market for years to come. The business has grown astonishingly fast, with 40%+ free cash flow margins, and its fundamentals are undoubtedly best-in-class. Still, its total addressable market is so big that the company has room to grow many times in size. You can find it on our platform for free.

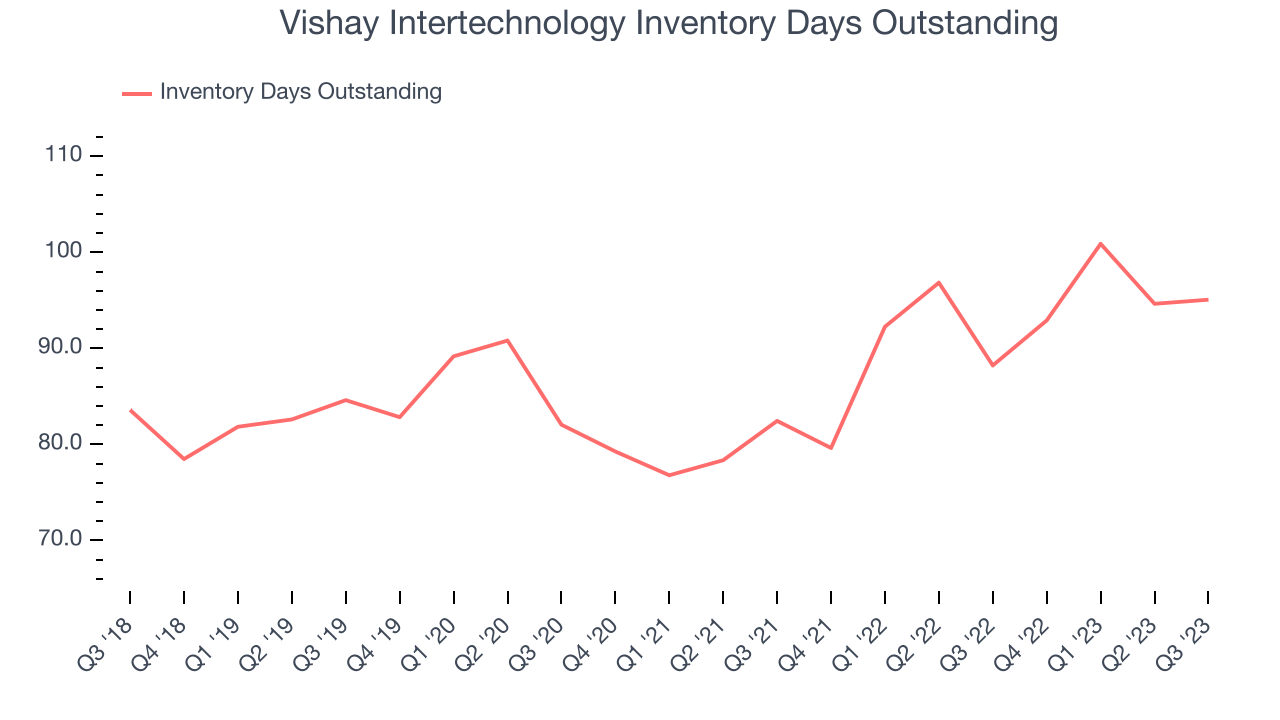

Product Demand & Outstanding Inventory

Days Inventory Outstanding (DIO) is an important metric for chipmakers, as it reflects a business' capital intensity and the cyclical nature of semiconductor supply and demand. In a tight supply environment, inventories tend to be stable, allowing chipmakers to exert pricing power. Steadily increasing DIO can be a warning sign that demand is weak, and if inventories continue to rise, the company may have to downsize production.

This quarter, Vishay Intertechnology's DIO came in at 95, which is 9 days above its five-year average, suggesting that the company's inventory levels are higher than what we've seen in the past.

Key Takeaways from Vishay Intertechnology's Q3 Results

With a market capitalization of $3.19 billion, Vishay Intertechnology is among smaller companies, but its $1.17 billion cash balance and positive free cash flow over the last 12 months give us confidence that it has the resources needed to pursue a high-growth business strategy.

It was great to see Vishay Intertechnology beat analysts' EPS expectations this quarter. On the other hand, its revenue missed Wall Street's estimates and its revenue guidance for next quarter underwhelmed. Weak guidance is something we've observed across the semiconductor sector this quarter. Overall, the results could have been better. The stock is flat after reporting and currently trades at $22.9 per share.

Vishay Intertechnology may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.