Sports and recreation company (NYSE:VSTO) fell short of analysts' expectations in Q1 CY2024, with revenue down 6.4% year on year to $693.7 million. The company's full-year revenue guidance of $2.72 billion at the midpoint also came in 4.3% below analysts' estimates. It made a GAAP profit of $0.69 per share, improving from its loss of $5.19 per share in the same quarter last year.

Vista Outdoor (VSTO) Q1 CY2024 Highlights:

- Revenue: $693.7 million vs analyst estimates of $702.1 million (1.2% miss)

- EPS: $0.69 vs analyst expectations of $0.98 (29.2% miss)

- Management's revenue guidance for the upcoming financial year 2025 is $2.72 billion at the midpoint, missing analyst estimates by 4.3% and implying -0.9% growth (vs -10.7% in FY2024)

- Gross Margin (GAAP): 31.8%, in line with the same quarter last year

- Free Cash Flow of $149.5 million, up 18% from the previous quarter

- Market Capitalization: $2.09 billion

Emerging from a 2015 spin-off, Vista Outdoor (NYSE:VSTO) specializes in the production and sale of outdoor gear and shooting sports equipment.

Vista Outdoor was established following a strategic decision to create a standalone entity focused on outdoor sports and recreation. The spin-off was aimed at capitalizing on the growing market for outdoor activities by concentrating resources and expertise on products that cater to outdoor enthusiasts.

The company offers an array of merchandise, ranging from shooting sports accessories and ammunition to outdoor cooking equipment and sports optics. Vista Outdoor supports a variety of outdoor activities and addresses the demand for high-quality, reliable gear that is essential for both the casual outdoorsman and serious athlete.

Vista Outdoor's revenue streams are diversified across product sales, government contracts, and partnerships within the outdoor and sporting goods industry. Its business model is built on a distribution network and direct-to-consumer sales.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the shooting sports and outdoor gear market include Smith & Wesson Brands (NASDAQ:SWBI), Sturm, Ruger & Company (NYSE:RGR), and Clarus (NASDAQ:CLAR).Sales Growth

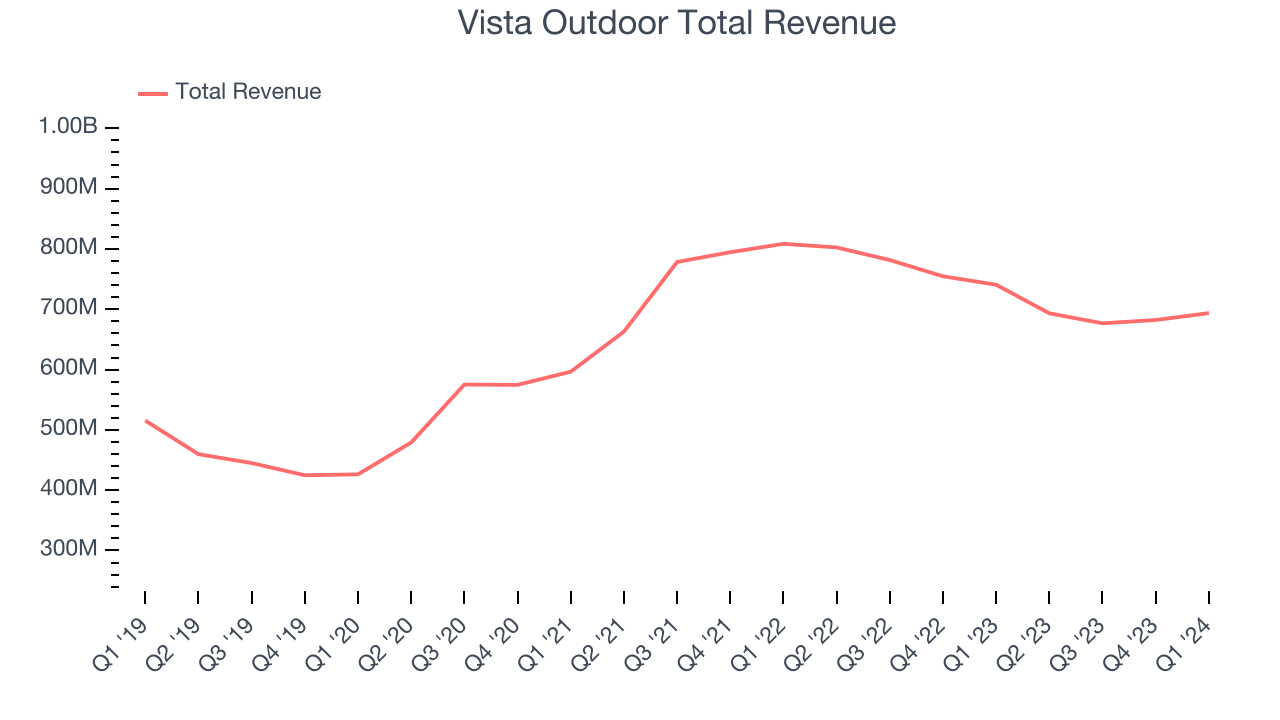

Examining a company's long-term performance can provide clues about its business quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Vista Outdoor's annualized revenue growth rate of 6.1% over the last five years was weak for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Vista Outdoor's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 5% over the last two years.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. Vista Outdoor's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 5% over the last two years.

This quarter, Vista Outdoor missed Wall Street's estimates and reported a rather uninspiring 6.4% year-on-year revenue decline, generating $693.7 million of revenue. Looking ahead, Wall Street expects sales to grow 2.4% over the next 12 months, an acceleration from this quarter.

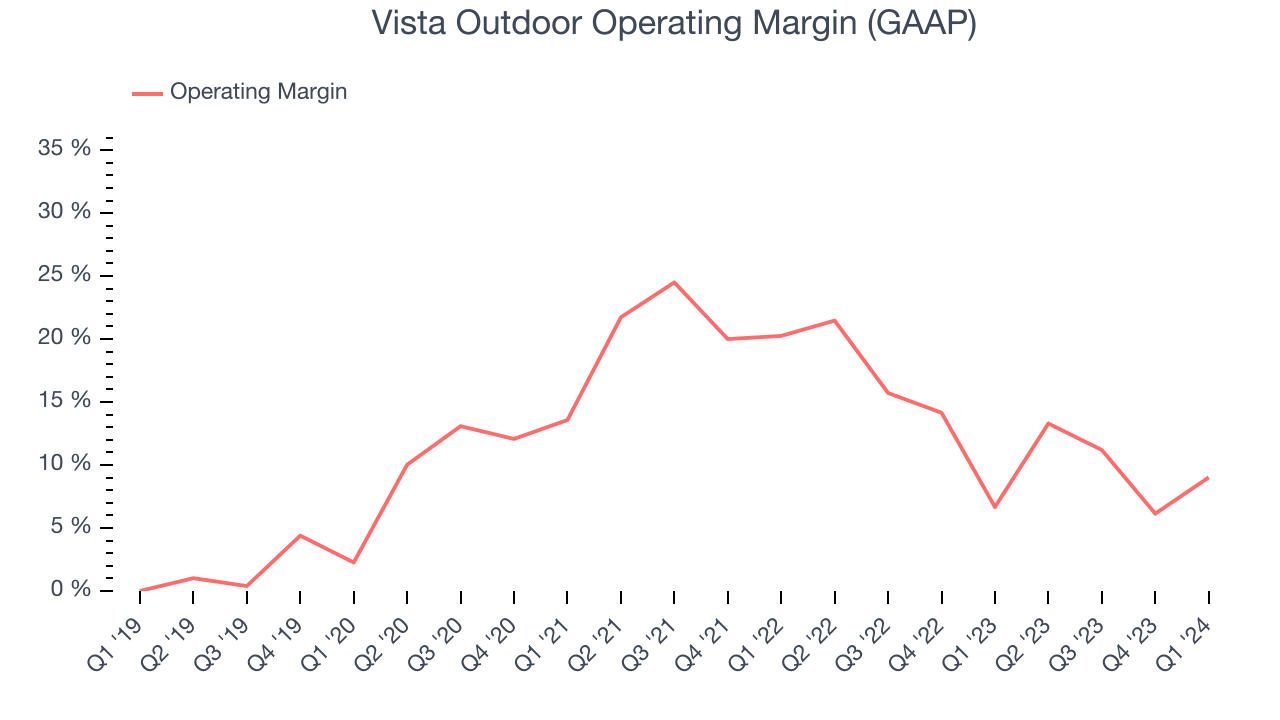

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Vista Outdoor has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.4%, higher than the broader consumer discretionary sector.

This quarter, Vista Outdoor generated an operating profit margin of 9%, up 2.3 percentage points year on year.

Over the next 12 months, Wall Street expects Vista Outdoor to become more profitable. Analysts are expecting the company’s LTM operating margin of 9.9% to rise to 13.6%.EPS

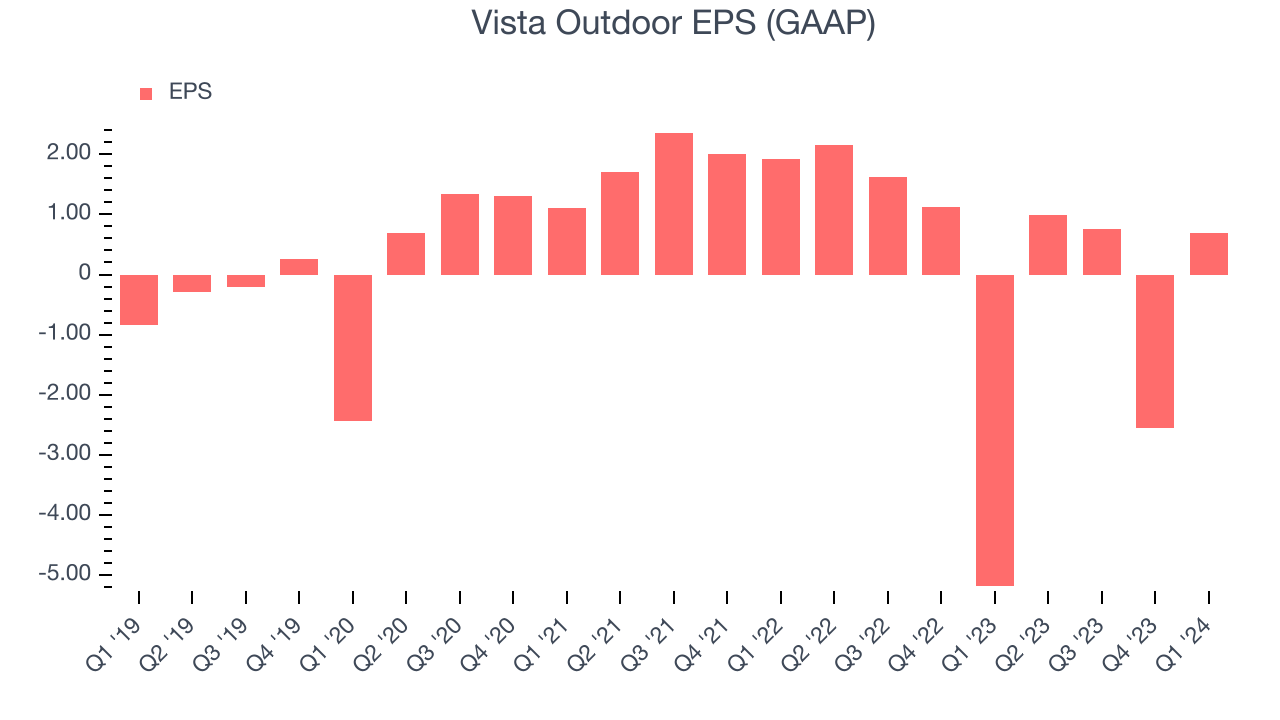

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, Vista Outdoor cut its earnings losses and improved its EPS by 36.1% each year. This performance is materially higher than its 6.1% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

Vista Outdoor's operating margin has expanded 9 percentage points over the last five years, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, Vista Outdoor reported EPS at $0.69, up from negative $5.19 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street is optimistic. Analysts are projecting Vista Outdoor's LTM EPS of negative $0.11 to flip to positive $4.48.

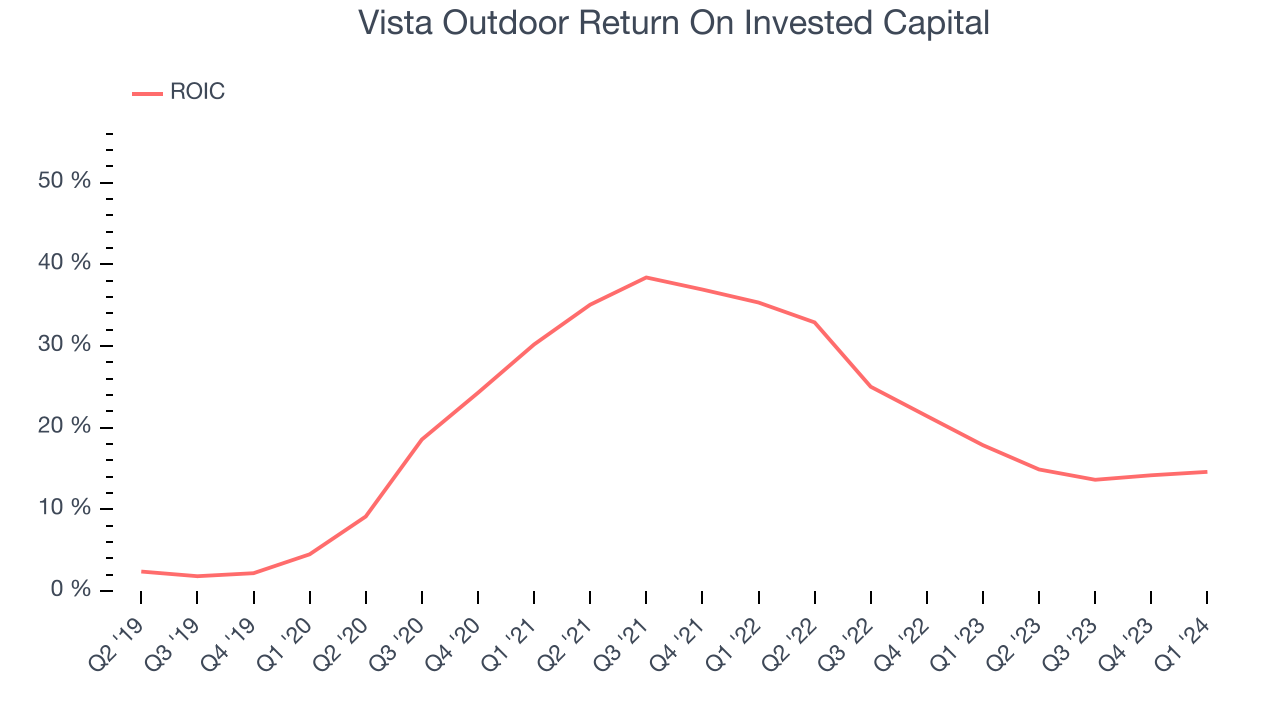

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Vista Outdoor's five-year average return on invested capital was 20.5%, beating other consumer discretionary companies by a wide margin. Just as you’d like your investment dollars to generate returns, Vista Outdoor's invested capital has produced robust profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Vista Outdoor's ROIC averaged 1.1 percentage point decreases over the last few years. The company has historically shown the ability to generate good returns, but they have gone the wrong way recently, making us a bit conscious.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Vista Outdoor reported $60.27 million of cash and $822.9 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $423.3 million of EBITDA over the last 12 months, we view Vista Outdoor's 1.8x net-debt-to-EBITDA ratio as safe. We also see its $62.95 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Vista Outdoor's Q1 Results

We struggled to find many strong positives in these results. While its free cash flow was up 18% from the previous quarter, Vista Outdoor sizably missed analysts' EPS expectations. In addition, its revenue and full-year revenue guidance missed Wall Street's estimates. Overall, this was a subpar quarter for Vista Outdoor. The company is down 2.7% on the results and currently trades at $34.69 per share.

Is Now The Time?

Vista Outdoor may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We think Vista Outdoor is a solid business. Although its revenue growth has been uninspiring over the last five years with analysts expecting growth to slow from here, its projected EPS for the next year implies the company's fundamentals will improve. On top of that, its EPS growth over the last five years has been fantastic.

Vista Outdoor's price-to-earnings ratio based on the next 12 months is 8.1x. There are definitely things to like about Vista Outdoor, and looking at the consumer discretionary landscape right now, it seems to be trading at a pretty interesting price.

Wall Street analysts covering the company had a one-year price target of $37 per share right before these results (compared to the current share price of $34.69), implying they saw upside in buying Vista Outdoor in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.