Outdoor sports and recreation products corporation (NYSE:VSTO) missed analysts' expectations in Q3 FY2024, with revenue down 9.6% year on year to $682.3 million. On the other hand, the company's outlook for the full year was close to analysts' estimates with revenue guided to $2.78 billion at the midpoint. It made a GAAP loss of $2.55 per share, down from its profit of $1.13 per share in the same quarter last year.

Vista Outdoor (VSTO) Q3 FY2024 Highlights:

- Market Capitalization: $1.64 billion

- Revenue: $682.3 million vs analyst estimates of $688.3 million (0.9% miss)

- EPS: -$2.55 vs analyst estimates of $0.82 (-$3.37 miss)

- The company reconfirmed its revenue guidance for the full year of $2.78 billion at the midpoint

- Free Cash Flow of $126.7 million, up from $28.03 million in the previous quarter

- Gross Margin (GAAP): 29.7%, down from 32.1% in the same quarter last year

Emerging from a 2015 spin-off, Vista Outdoor (NYSE:VSTO) specializes in the production and sale of outdoor gear and shooting sports equipment.

Vista Outdoor was established following a strategic decision to create a standalone entity focused on outdoor sports and recreation. The spin-off was aimed at capitalizing on the growing market for outdoor activities by concentrating resources and expertise on products that cater to outdoor enthusiasts.

The company offers an array of merchandise, ranging from shooting sports accessories and ammunition to outdoor cooking equipment and sports optics. Vista Outdoor supports a variety of outdoor activities and addresses the demand for high-quality, reliable gear that is essential for both the casual outdoorsman and serious athlete.

Vista Outdoor's revenue streams are diversified across product sales, government contracts, and partnerships within the outdoor and sporting goods industry. Its business model is built on a distribution network and direct-to-consumer sales.

Leisure Facilities and Products

Consumers have lots of choices when it comes to how they spend their free time and extra money, so the companies offering leisure products and experiences must highlight their value proposition. Fitness companies may be riding the wellness trend, for example, while those selling recreational vehicles or toys may have to lean into innovation to stand out. Either way, all leisure companies must compete against the 800-pound gorilla of social media and streaming entertainment, which offer instant gratification and have been taking share of consumers’ free time for over a decade.

Competitors in the shooting sports and outdoor gear market include Smith & Wesson Brands (NASDAQ:SWBI), Sturm, Ruger & Company (NYSE:RGR), and Clarus (NASDAQ:CLAR).Sales Growth

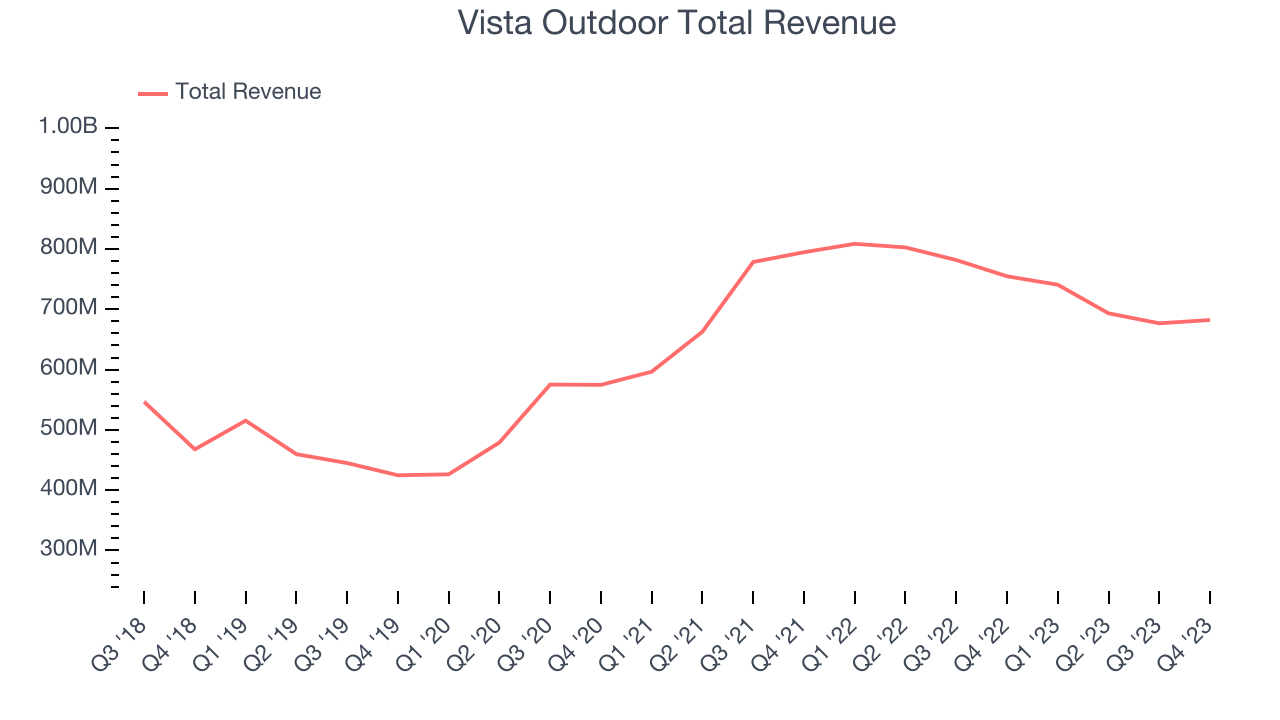

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. Vista Outdoor's annualized revenue growth rate of 6% over the last 5 years was weak for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Vista Outdoor's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Vista Outdoor's recent history shines a dimmer light on the company, as its revenue was flat over the last 2 years.

This quarter, Vista Outdoor missed Wall Street's estimates and reported a rather uninspiring 9.6% year-on-year revenue decline, generating $682.3 million of revenue. Looking ahead, Wall Street expects sales to grow 1.7% over the next 12 months, an acceleration from this quarter.

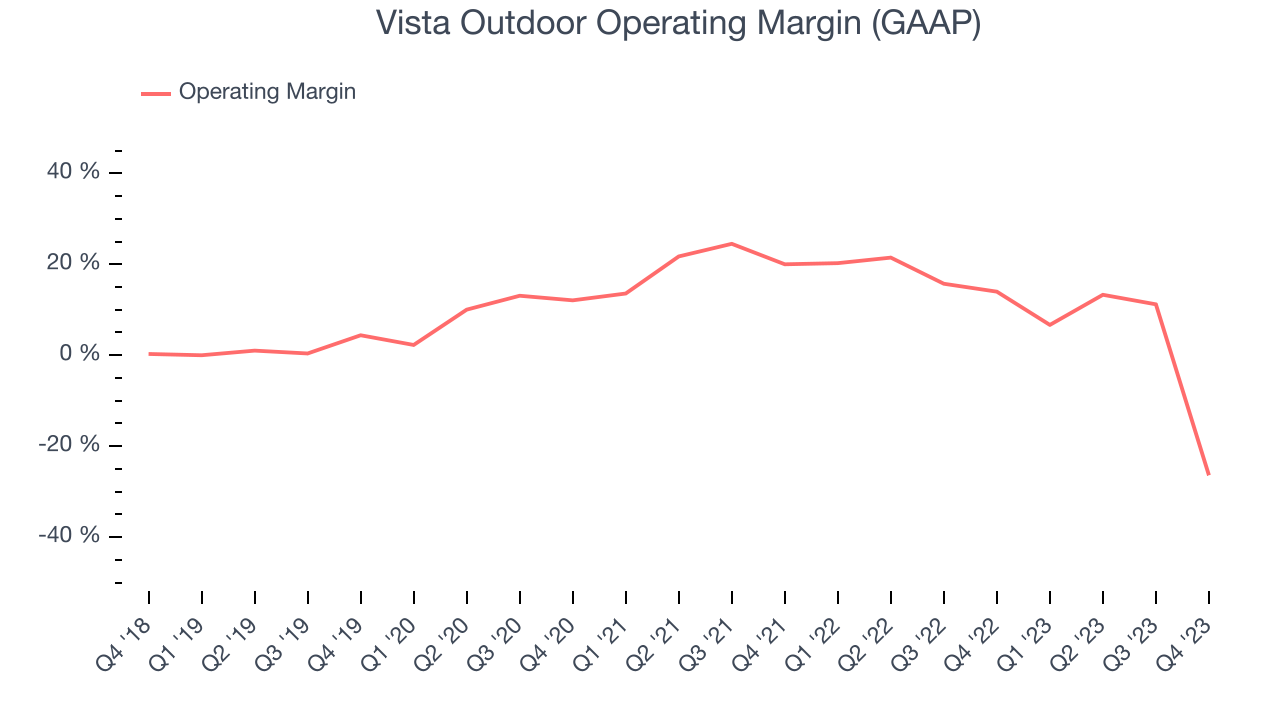

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Vista Outdoor was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 9.5%.

This quarter, Vista Outdoor generated an operating profit margin of negative 26.4%, down 40.4 percentage points year on year. This reduction indicates the company was less efficient with its expenses over the last year, spending more money in areas like corporate overhead and advertising.

Over the next 12 months, Wall Street expects Vista Outdoor to shrink its losses but remain unprofitable. Analysts are expecting the company’s operating margin to rise by 12.2 percentage points to negative 14.2%.EPS

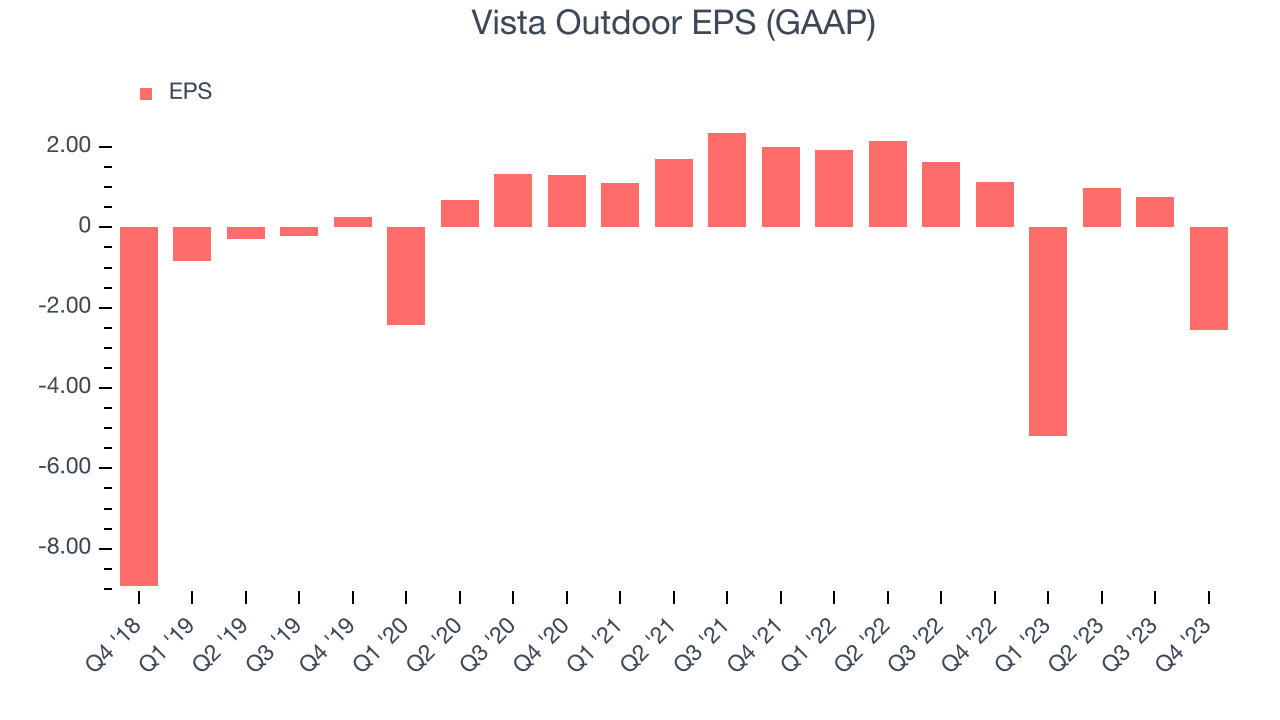

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last 5 years, Vista Outdoor cut its earnings losses and improved its EPS by 28.4% on average each year. This performance is materially higher than its 6% annualized revenue growth over the same period. There are a few reasons for this, and understanding why can shed light on its fundamentals.

Vista Outdoor's operating margin and share count haven't improved over the last 5 years, meaning its EPS growth outpaced its revenue growth because it had a lower tax rate and interest expenses as a percentage of revenue. This is fine, but we put less emphasis on the results as they don’t tell us as much about business fundamentals as operating margins and share buybacks.In Q3, Vista Outdoor reported EPS at negative $2.55, down from $1.13 in the same quarter a year ago. This print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects the company to grow earnings with analysts projecting a 174% year-on-year increase in EPS to -$6.98.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company's revenue growth was profitable. But was it capital-efficient? If two companies had equal growth, we’d prefer the one with lower reinvestment requirements.

Understanding a company’s ROIC (return on invested capital) gives us insight into this because it factors the total debt and equity needed to generate operating profits. This metric is a proxy for not only the capital efficiency of a business but also a management team's ability to allocate limited resources.

Vista Outdoor's five-year average ROIC was 15.6%, slightly better than the broader sector. Just as you’d like your investment dollars to generate returns, Vista Outdoor's invested capital has produced decent profits.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, over the last two years, Vista Outdoor's ROIC has averaged a 5.8 percentage point decrease each year. We like Vista Outdoor's average ROIC but are concerned it has declined recently, perhaps a symptom of waning opportunities to invest profitably.

Key Takeaways from Vista Outdoor's Q3 Results

It was encouraging to see Vista Outdoor provide full-year revenue guidance that slightly topped analysts' expectations, but that's where the good news ends. Its revenue missed estimates, driven by lower sales volumes across nearly all categories. In response, the company lowered its prices and increased discounting to combat the term consumer pressures. Furthermore, its operating margin flipped from positive to negative while its adjusted EPS, EBITDA, and free cash flow missed Wall Street's projections.

On the bright side, the planned $1.9 billion sale of its sporting products segment (renamed to The Kinetic Group) is going as planned. On the Revelyst side (its outdoor products segment), the company expects to start generating revenue growth next quarter.

Overall, this was a mediocre quarter for Vista Outdoor. The stock is flat after reporting and currently trades at $28.12 per share.

Is Now The Time?

Vista Outdoor may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Vista Outdoor isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been uninspiring over the last five years, and analysts expect growth to deteriorate from here. And while its projected EPS growth for the next year implies the company's fundamentals will improve, unfortunately, its declining ROIC shows it's struggled to find compelling investment opportunities.

Vista Outdoor's price-to-earnings ratio based on the next 12 months is 6.5x. We can find things to like about Vista Outdoor and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.