Online home goods retailer Wayfair (NYSE: W) missed analyst expectations in Q4 FY2021 quarter, with revenue down 11.4% year on year to $3.25 billion. Wayfair made a GAAP loss of $202 million, down on its profit of $23.8 million, in the same quarter last year.

Is now the time to buy Wayfair? Access our full analysis of the earnings results here, it's free.

Wayfair (W) Q4 FY2021 Highlights:

- Revenue: $3.25 billion vs analyst estimates of $3.27 billion (0.75% miss)

- EPS (non-GAAP): -$0.92 vs analyst expectations of -$0.70 (31.7% miss)

- Free cash flow of $15 million, up from negative free cash flow of $203.1 million in previous quarter

- Gross Margin (GAAP): 27%, down from 29% same quarter last year

- Trailing 12 Months Active Customers: 27.3 million, down 3.9 million year on year

“As we celebrate Wayfair’s 20th anniversary and the company’s rapid growth to a $14 billion household brand, we are proud of our accomplishments and even more excited about what’s ahead,” said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

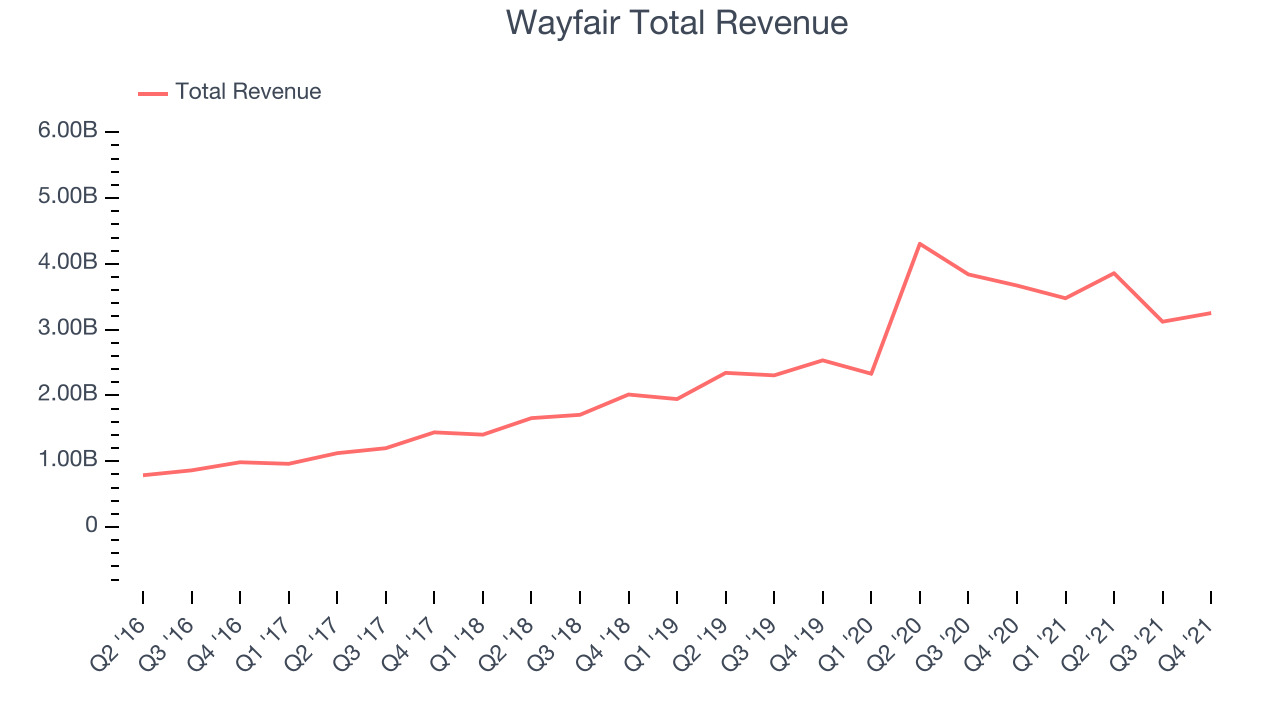

Sales Growth

Wayfair's revenue growth over the last three years has been very strong, averaging 30.3% annually. The initial impact of the pandemic was positive for Wayfair's revenue, pulling forward sales, but quarterly revenue subsequently normalized, year over year.

This quarter, Wayfair reported a rather lacklustre 11.4% year on year revenue decline, missing analyst expectations.

There are others doing even better than Wayfair. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 150% since the IPO last December. You can find it on our platform for free.

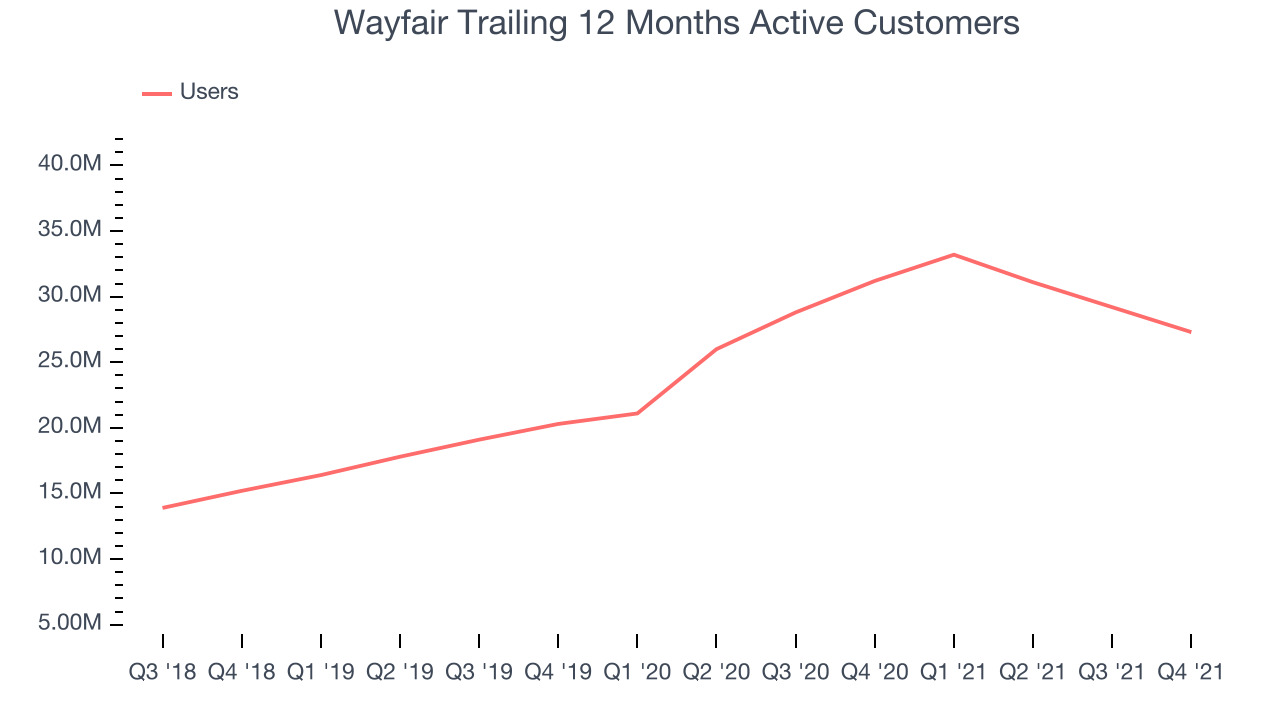

Usage Growth

As an online retailer, Wayfair generates revenue growth by growing both the number of buyers, and the average order size.

Over the last two years the number of Wayfair's active buyers, a key usage metric for the company, grew 30.6% annually to 27.3 million users. This is among the fastest growth of any consumer internet company, indicating that users are excited about the offering.

Unfortunately, in Q4 the number of active buyers decreased by 3.9 million , a 12.5% drop year on year.

Key Takeaways from Wayfair's Q4 Results

Sporting a market capitalization of $12.6 billion, more than $2.39 billion in cash and with positive free cash flow over the last twelve months, we're confident that Wayfair has the resources it needs to pursue a high growth business strategy.

We struggled to find many strong positives in these results. On the other hand, there was a decline in number of users and the revenue growth was quite weak. Overall, this quarter's results could have been better. The company is down 8.55% on the results and currently trades at $111 per share.

Wayfair may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.