Online home goods retailer Wayfair (NYSE: W) announced better-than-expected results in the Q4 FY2022 quarter, with revenue down 4.64% year on year to $3.1 billion. Wayfair made a GAAP loss of $351 million, down on its loss of $201.6 million, in the same quarter last year.

Is now the time to buy Wayfair? Access our full analysis of the earnings results here, it's free.

Wayfair (W) Q4 FY2022 Highlights:

- Revenue: $3.1 billion vs analyst estimates of $3.07 billion (1.13% beat)

- EPS (non-GAAP): -$1.71 vs analyst estimates of -$1.66

- Free cash flow was negative $19 million, compared to negative free cash flow of $538 million in previous quarter

- Gross Margin (GAAP): 28.8%, up from 27.1% same quarter last year

- Trailing 12 Months Active Customers: 22.1 million, down 5.2 million year on year

"We are excited to see customers respond positively to improvements in our core recipe - with compelling pricing, faster delivery times and increasing availability bearing fruit in the form of market share gains," said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

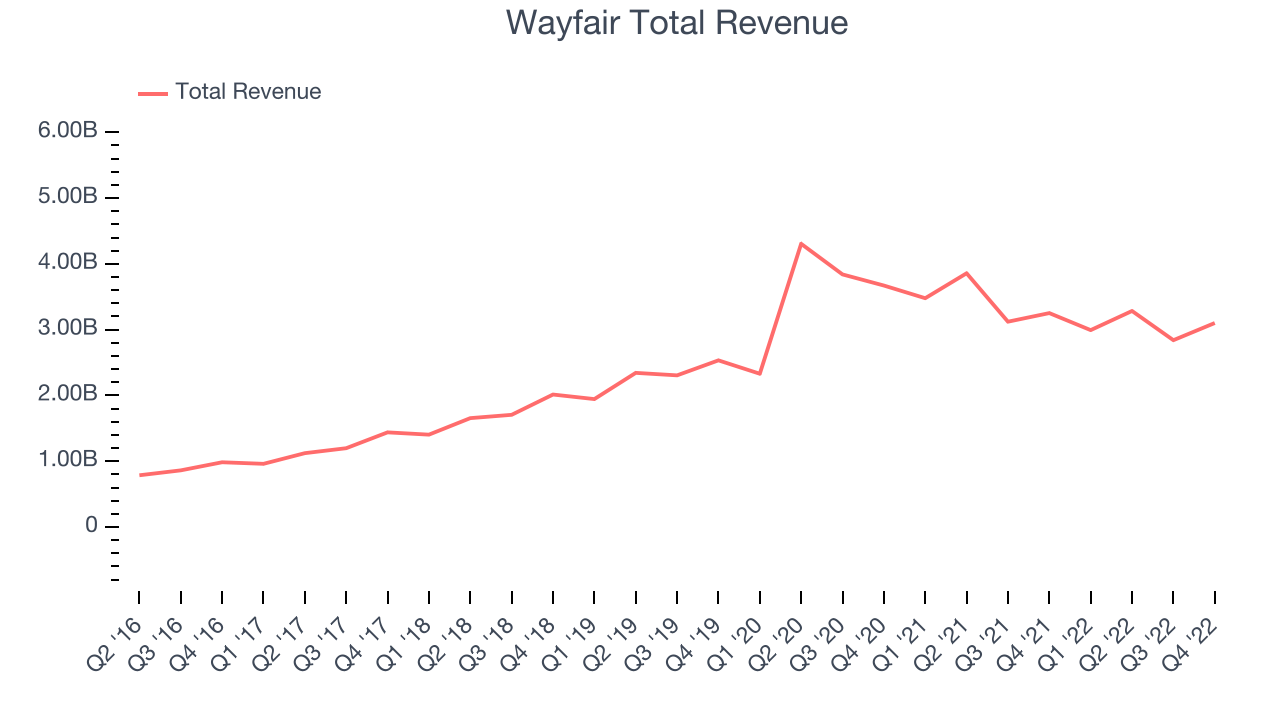

Sales Growth

Wayfair's revenue growth over the last three years has been mediocre, averaging 15.1% annually. The pandemic had a positive impact on Wayfair's revenue growth, but sales have been trending towards pre-pandemic levels since.

This quarter, Wayfair reported a rather lacklustre 4.64% year on year revenue decline, in line with analyst estimates.

In volatile times like these we look for robust businesses with strong pricing power. Unknown to most investors, this company is one of the highest-quality software companies in the world, and their software products have been the default standard in critical industries for decades. The result is an impressive business that is up an incredible 18,152% since the IPO. You can find it on our platform for free.

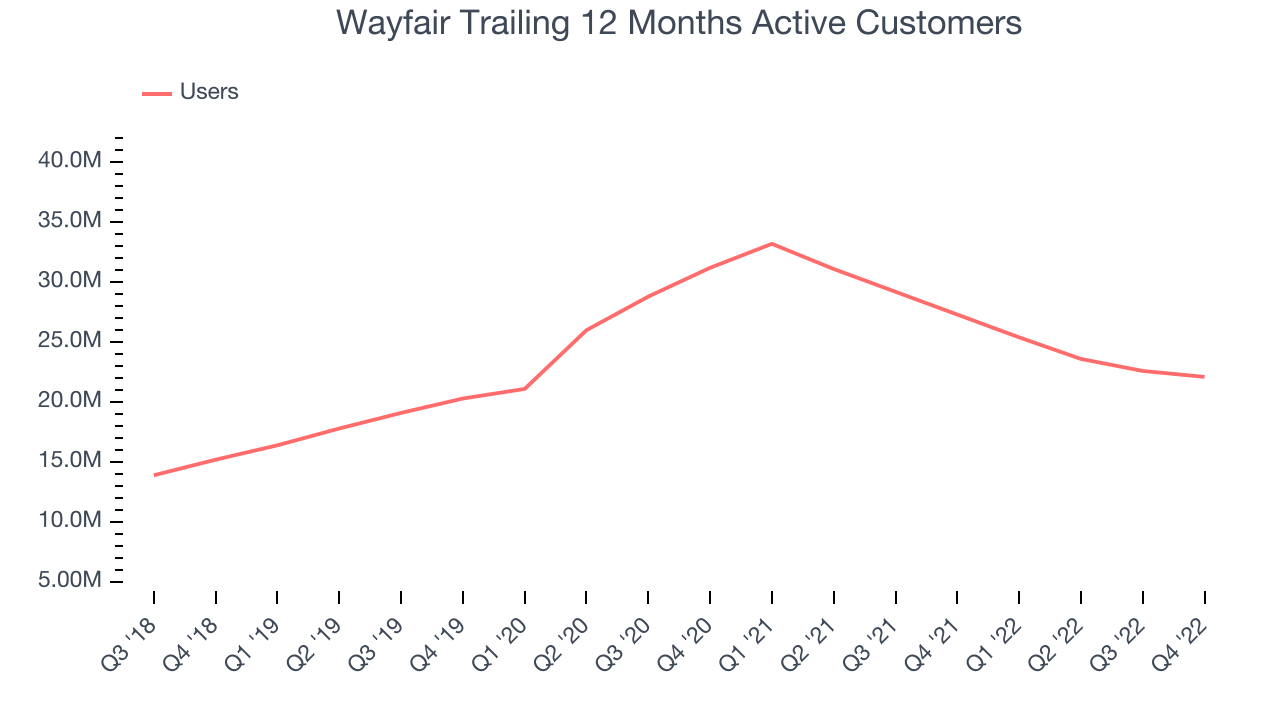

Usage Growth

As an online retailer, Wayfair generates revenue growth by growing both the number of buyers, and the average order size.

Wayfair has been struggling over the last two years as the number of active buyers, a key usage metric for the company, declined 2.93% annually to 22.1 million. This is one of the lowest levels of growth in the consumer internet sector.

In the number of active buyers decreased by 5.2 million, a 19% drop year on year.

Key Takeaways from Wayfair's Q4 Results

Since it has still been burning cash over the last twelve months it is worth keeping an eye on Wayfair’s balance sheet, but we note that with a market capitalization of $5.34 billion and more than $1.28 billion in cash, the company has the capacity to continue to prioritise growth over profitability.

Wayfair topped analysts’ revenue expectations this quarter, even if just narrowly. That feature of these results really stood out as a positive. On the other hand, there was a decline in number of users and the revenue growth was quite weak. Overall, this quarter's results could have been better. The company is up 4.1% in the pre-market and currently trades at $51.8 per share.

Wayfair may have had a tough quarter, but does that actually create an opportunity to invest right now? It is important that you take into account its valuation and business qualities, as well as what happened in the latest quarter. We look at that in our actionable report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 70% year on year and best-in-class SaaS metrics it should definitely be on your radar.

The author has no position in any of the stocks mentioned.