As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today we are looking at the consumer internet stocks, starting with Wayfair (NYSE:W).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 18 consumer internet stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 1.7%, while on average next quarter revenue guidance was 2.69% under consensus. Tech stocks have had a rocky start in 2022, but consumer internet stocks held their ground better than others, with the share price up 46.6% since earnings, on average.

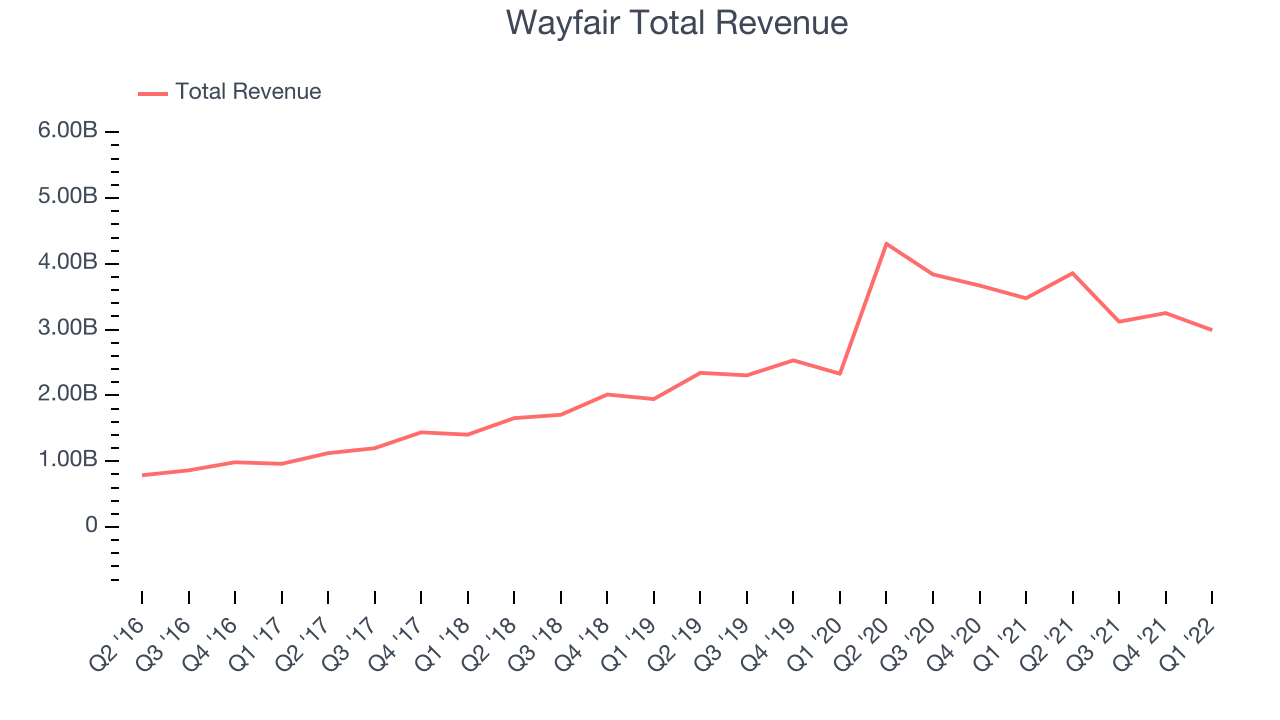

Wayfair (NYSE:W)

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.99 billion, down -14% year on year, in line with analyst expectations. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

“While multiple macro cross-currents are filtering through the global economy, consumer health remains relatively strong. Shoppers are still very interested in the home category -- as evidenced by our most successful Way Day event ever last week, which included two of the four largest days in Wayfair’s entire history,” said Niraj Shah, CEO, co-founder and co-chairman, Wayfair.

The company reported 25.4 million active buyers, down 23.5% year on year. The stock is down 44.3% since the results and currently trades at $50.51.

Read our full report on Wayfair here, it's free.

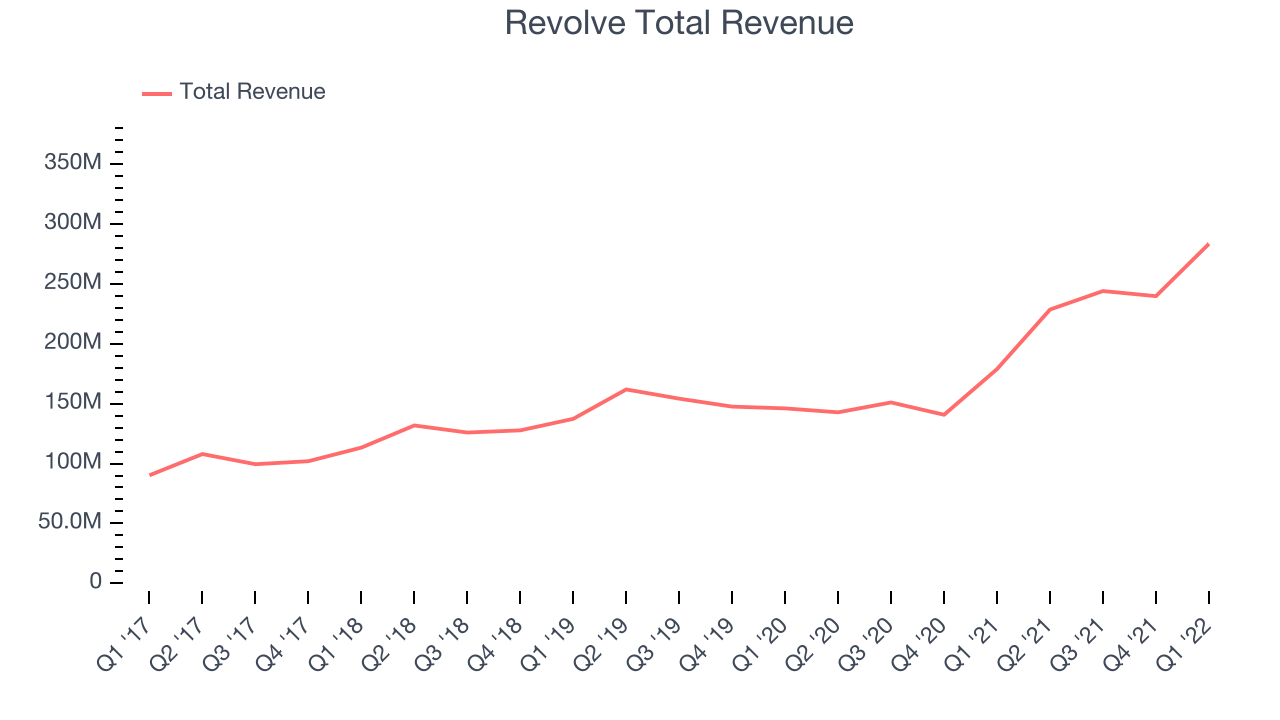

Best Q1: Revolve (NYSE:RVLV)

Launched in 2003 by software engineers Michael Mente and Mike Karanikolas, Revolve Group (NASDAQ: RVLV) is a next generation fashion retailer that leverages social media and a community of fashion influencers to drive its merchandising strategy.

Revolve reported revenues of $283.4 million, up 58.4% year on year, beating analyst expectations by 10.4%. It was an incredible quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

The company reported 2.04 million active customers, up 38.1% year on year. The stock is down 38.2% since the results and currently trades at $26.92.

Is now the time to buy Revolve? Access our full analysis of the earnings results here, it's free.

Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $536 million, down 18.8% year on year, missing analyst expectations by 6.49%. It was a weak quarter for the company, with declining number of users and a slow revenue growth.

Overstock had the slowest revenue growth in the group. The company reported 7.4 million active buyers, down 25.3% year on year. The stock is down 8.41% since the results and currently trades at $28.75.

Read our full analysis of Overstock's results here.

Snap (NYSE:SNAP)

Founded by Stanford University students Evan Spiegel, Reggie Brown, and Bobby Murphy, and originally called Picaboo, Snapchat (NYSE: SNAP) is an image centric social media network.

Snap reported revenues of $1.06 billion, up 38% year on year, missing analyst expectations by 0.57%. It was a mixed quarter for the company, with an exceptional revenue growth but a miss of the top line analyst estimates.

The company reported 332 million daily active users, up 18.5% year on year. The stock is down 53.3% since the results and currently trades at $13.70.

Read our full, actionable report on Snap here, it's free.

The RealReal (NASDAQ:REAL)

Founded by consignment store aficionado Julie Wainwright, The RealReal (NASDAQ: REAL) is an online marketplace for buying and selling secondhand luxury goods.

The RealReal reported revenues of $146.7 million, up 48.4% year on year, beating analyst expectations by 7.59%. It was a very strong quarter for the company, with an exceptional revenue growth.

The RealReal delivered the highest full year guidance raise among the peers. The company reported 828 thousand paying users, up 20.5% year on year. The stock is down 30.8% since the results and currently trades at $3.05.

Read our full, actionable report on The RealReal here, it's free.

The author has no position in any of the stocks mentioned