As the craze of earnings season draws to a close, here's a look back at some of the most exciting (and some less so) results from Q1. Today we are looking at the consumer internet stocks, starting with Wayfair (NYSE:W).

The ways people shop, transport, communicate, learn and play are undergoing a tremendous, technology-enabled change. Consumer internet companies are playing a key role in lives being transformed, simplified and made more accessible.

The 34 consumer internet stocks we track reported a mixed Q1; on average, revenues beat analyst consensus estimates by 2.57%, while on average next quarter revenue guidance was 1.21% under consensus. Investors abandoned cash burning companies since high interest rates will make it harder to raise capital, but consumer internet stocks held their ground better than others, with the share prices up 9.68% since the previous earnings results, on average.

Wayfair (NYSE:W)

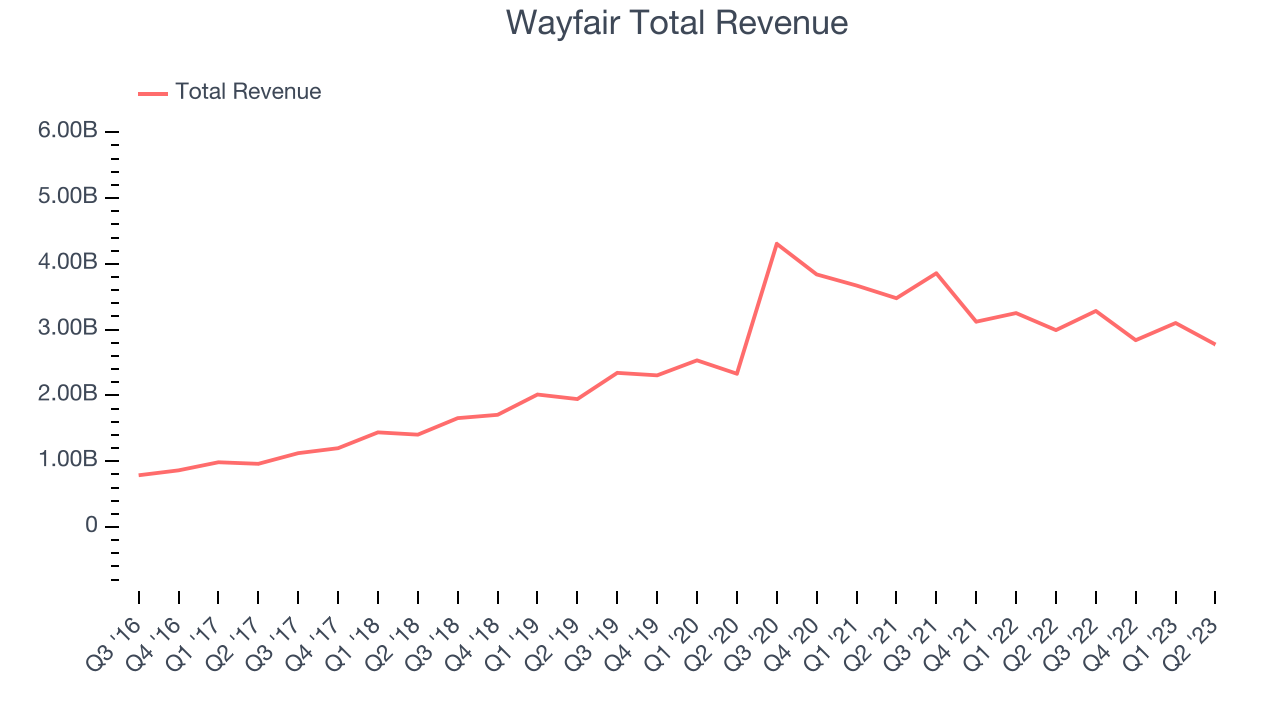

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair reported revenues of $2.77 billion, down 7.32% year on year, beating analyst expectations by 1.22%. It was a weak quarter for the company, with declining number of users and revenue.

"Last August, we shared a roadmap laying out our path to profitability and we have been executing against that plan. Through a focus on our three core initiatives of driving customer and supplier loyalty, nailing the basics, and cost efficiency, we have made significant strides in improving our offering and customer experience, simultaneously reducing our cost structure while investing for future growth," said Niraj Shah CEO, co-founder and co-chairman, Wayfair.

The company reported 21.7 million monthly active users, down 14.6% year on year. The stock is up 68.1% since the results and currently trades at $52.6.

Read our full report on Wayfair here, it's free.

Best Q1: PlayStudios (NASDAQ:MYPS)

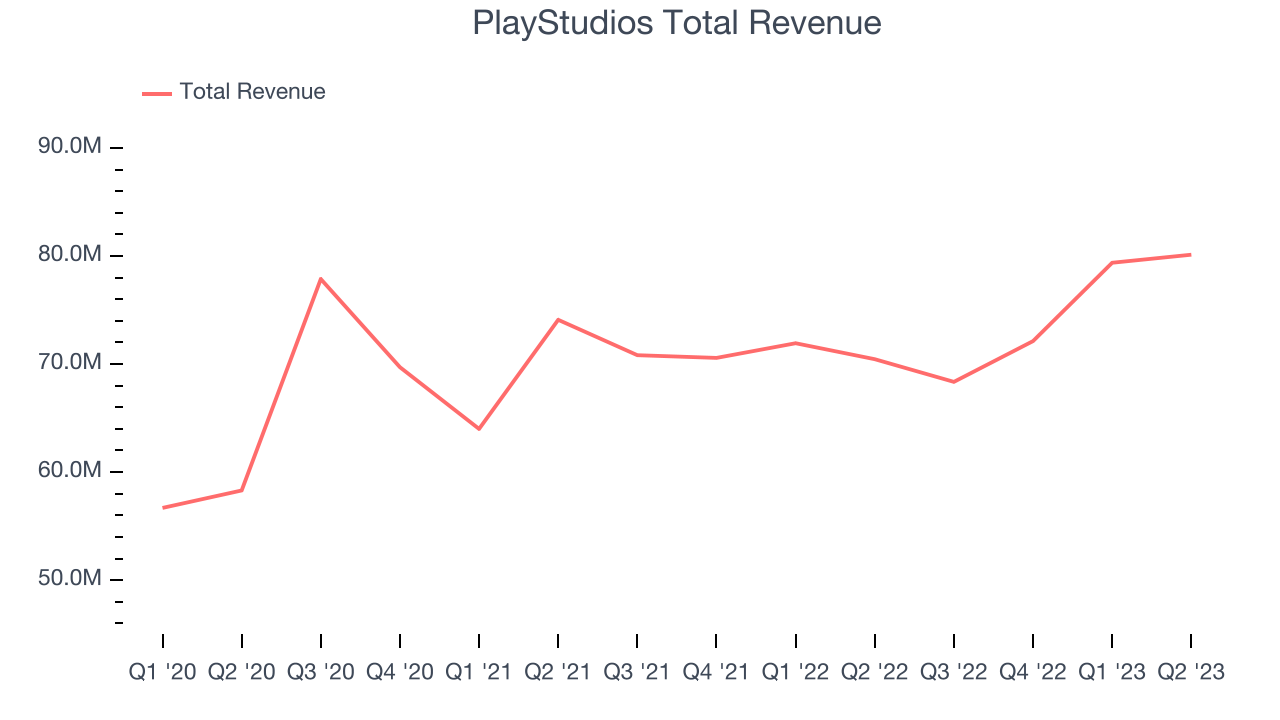

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $80.1 million, up 13.7% year on year, beating analyst expectations by 9.12%. It was a very strong quarter for the company, with growing number of users and an impressive beat of analyst estimates.

PlayStudios delivered the strongest analyst estimates beat and highest full year guidance raise among its peers. The company reported 13.1 million monthly active users, up 89.2% year on year. The stock is up 5.61% since the results and currently trades at $4.52.

Is now the time to buy PlayStudios? Access our full analysis of the earnings results here, it's free.

Weakest Q1: Skillz (NYSE:SKLZ)

Taking a new twist at video gaming, Skillz (NYSE:SKLZ) offers developers a platform to create and distribute mobile games where players can pay fees to compete for cash prizes.

Skillz reported revenues of $44.4 million, down 52.5% year on year, missing analyst expectations by 0.59%. It was a weak quarter for the company, with a declining number of users and revenue.

Skillz had the slowest revenue growth in the group. The company reported 214 thousand monthly active users, down 62.5% year on year. The stock is down 2.06% since the results and currently trades at $0.57.

Read our full analysis of Skillz's results here.

Overstock (NASDAQ:OSTK)

Originally launched as a website focusing on selling clearance sale electronics and home goods merchandise, Overstock (NASDAQ: OSTK) is a leading online retailer of home goods, primarily furniture.

Overstock reported revenues of $381.1 million, down 28.9% year on year, beating analyst expectations by 6.6%. It was a weak quarter for the company, with declining number of users and revenue.

The company reported 4.8 million active buyers, down 35.1% year on year. The stock is up 20.4% since the results and currently trades at $21.75.

Read our full, actionable report on Overstock here, it's free.

SciPlay (NASDAQ:SCPL)

Headquartered in Las Vegas, SciPlay (NASDAQ:SCPL) offers digital casino games that favor repetition over skill.

SciPlay reported revenues of $186.4 million, up 18% year on year, beating analyst expectations by 4.41%. It was a decent quarter for the company, with a beat of topline analyst estimates but slow revenue growth.

The company reported 0.63 million paying users, up 4.17% year on year. The stock is up 15.2% since the results and currently trades at $19.59.

Read our full, actionable report on SciPlay here, it's free.

The author has no position in any of the stocks mentioned