Online home goods retailer Wayfair (NYSE: W) reported Q1 CY2024 results topping analysts' expectations, with revenue down 1.6% year on year to $2.73 billion. It made a non-GAAP loss of $0.32 per share, improving from its loss of $1.13 per share in the same quarter last year.

Wayfair (W) Q1 CY2024 Highlights:

- Revenue: $2.73 billion vs analyst estimates of $2.64 billion (3.5% beat)

- Adjusted EBITDA: $75 million vs. analyst estimates of $71.8 million (4.4% beat)

- EPS (non-GAAP): -$0.32 vs analyst estimates of -$0.40

- Guidance is usually on the earnings call, and this can move the stock further

- Gross Margin (GAAP): 30%, up from 29.6% in the same quarter last year

- Free Cash Flow was -$193 million, down from $62 million in the previous quarter

- Active Customers: 22.3 million, up 600,000 year on year

- Market Capitalization: $6.09 billion

Launched in 2002 by founder Niraj Shah, Wayfair (NYSE: W) is a leading online retailer for mass market home goods in the US, UK, Canada, and Germany.

Wayfair operates an ecommerce platform that operates through 5 brands: its flagship Wayfair.com, Joss & Main, Birch Lane, AllModern, and Perigold, who collectively offer over 20 million products from over 16K suppliers in the largely unbranded furniture manufacturing industry. The company offers the widest array of home furnishing options online, and because of the unbranded nature, is often relatively low priced, due to its lack of brick and mortar infrastructure, allowing consumers to personalize home stylings that mimic designer fashions at a fraction of the price.

Wayfair’s business model differentiation is threefold: a combination of scale-driven online marketing investments and expertise in converting customers, along with holding minimal inventory, instead orchestrating a logistics network where the majority of its products are shipped directly to customers from its suppliers, while also offering an Amazon-like ability for its suppliers to house inventory in Wayfair warehouses to speed delivery (for a fee).

Online Retail

Consumers ever rising demand for convenience, selection, and speed are secular engines underpinning ecommerce adoption. For years prior to Covid, ecommerce penetration as a percentage of overall retail would grow 1-2% annually, but in 2020 adoption accelerated by 5%, reaching 25%, as increased emphasis on convenience drove consumers to structurally buy more online. The surge in buying caused many online retailers to rapidly grow their logistics infrastructures, preparing them for further growth in the years ahead as consumer shopping habits continue to shift online.

Wayfair (NYSE: W) competes with Amazon (NASDAQ:AMZN), Overstock (NASDAQ: OSTK), Bed Bath and Beyond (NYSE:BBBY), RH (NYSE:RH), Williams Sonoma (NYSE:WSM), Target (NYSE:TGT), Macy’s (NYSE:M), and privately held Ikea.

Sales Growth

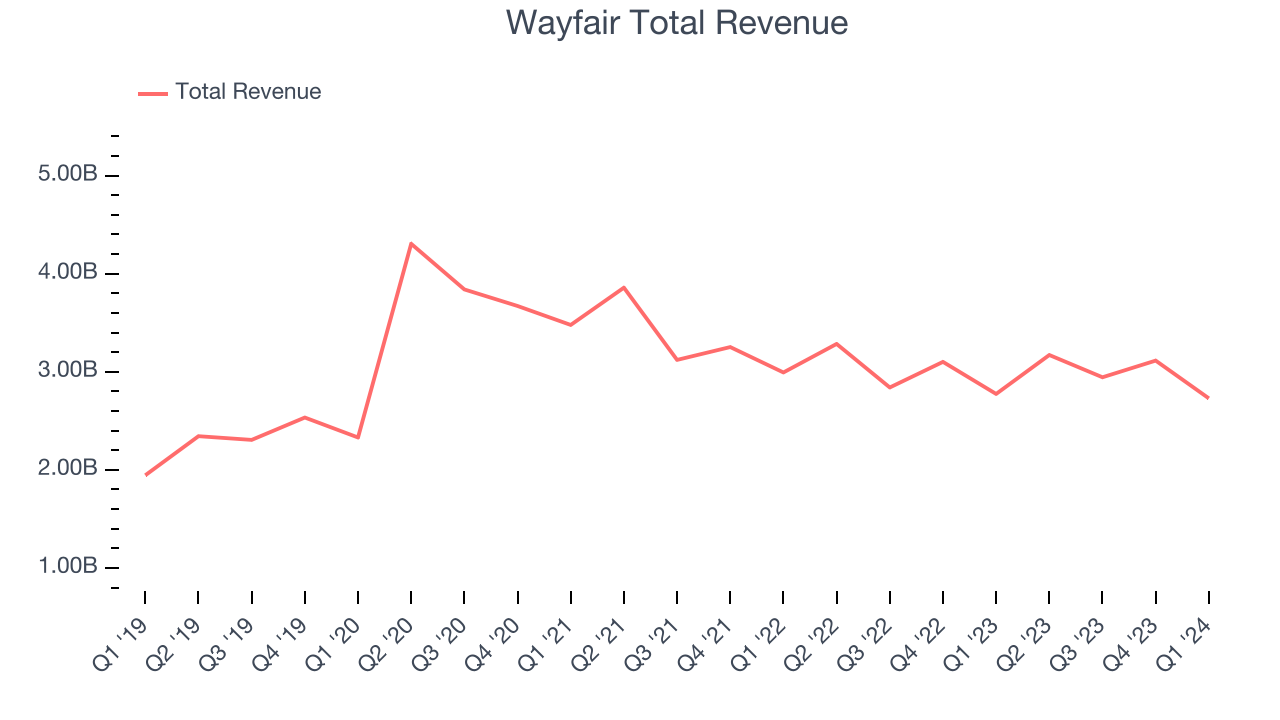

Wayfair's revenue has been declining over the last three years, dropping on average by 7.6% annually. This quarter, Wayfair beat analysts' estimates but reported a year on year revenue decline of 1.6%.

Ahead of the earnings results, analysts were projecting sales to grow 1.3% over the next 12 months.

Usage Growth

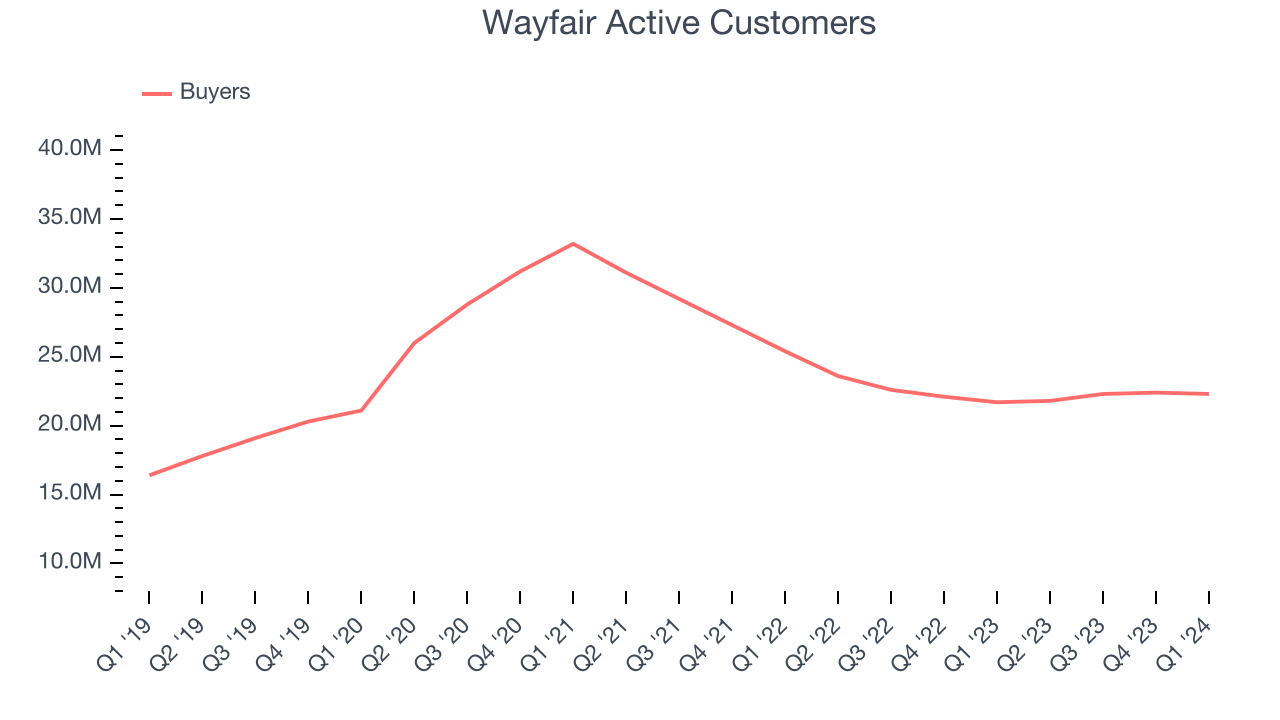

As an online retailer, Wayfair generates revenue growth by expanding its number of buyers and the average order size in dollars.

Wayfair has been struggling to grow its active buyers, a key performance metric for the company. Over the last two years, its buyers have declined 10.6% annually to 22.3 million. This is one of the lowest rates of growth in the consumer internet sector.

Luckily, Wayfair added 600,000 active buyers in Q1, leading to 2.8% year-on-year growth.

Revenue Per Buyer

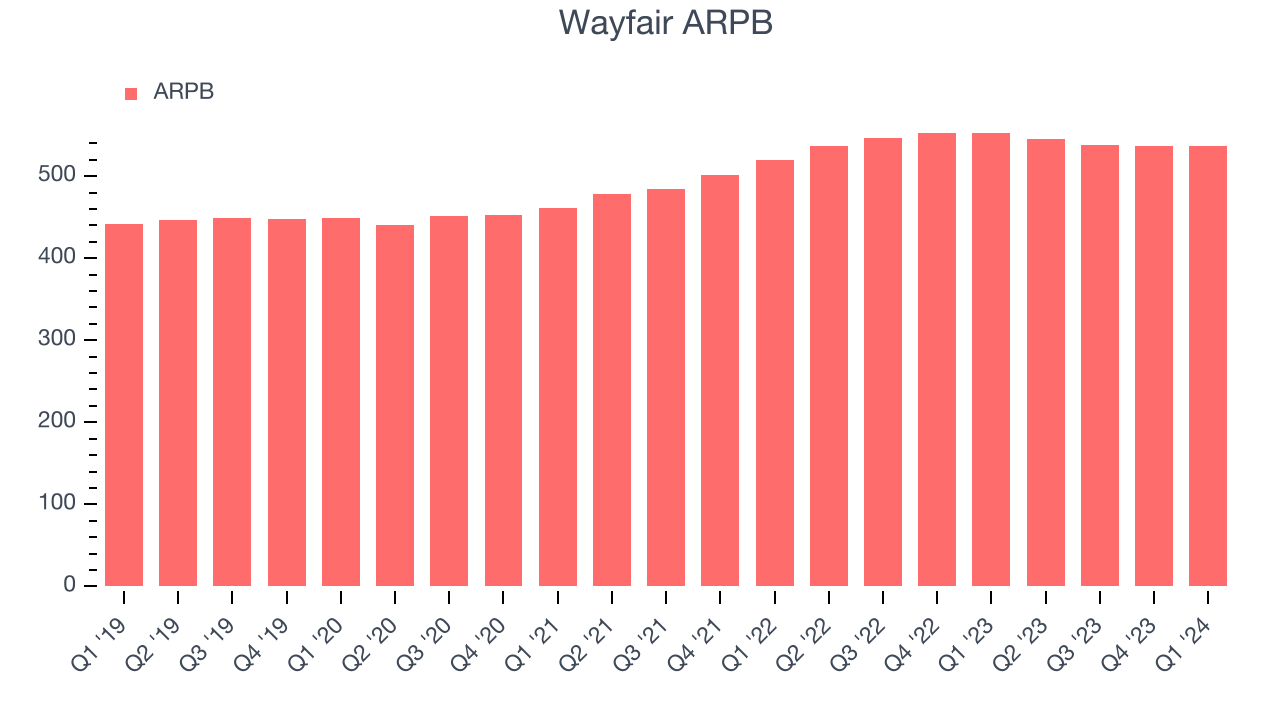

Average revenue per buyer (ARPB) is a critical metric to track for consumer internet businesses like Wayfair because it measures how much customers spend per order.

Wayfair's ARPB growth has been mediocre over the last two years, averaging 4.5%. Although its active buyers have shrunk during this time, the company's ability to increase prices shows that existing buyers still value its platform. This quarter, ARPB declined 2.7% year on year to $537 per buyer.

Pricing Power

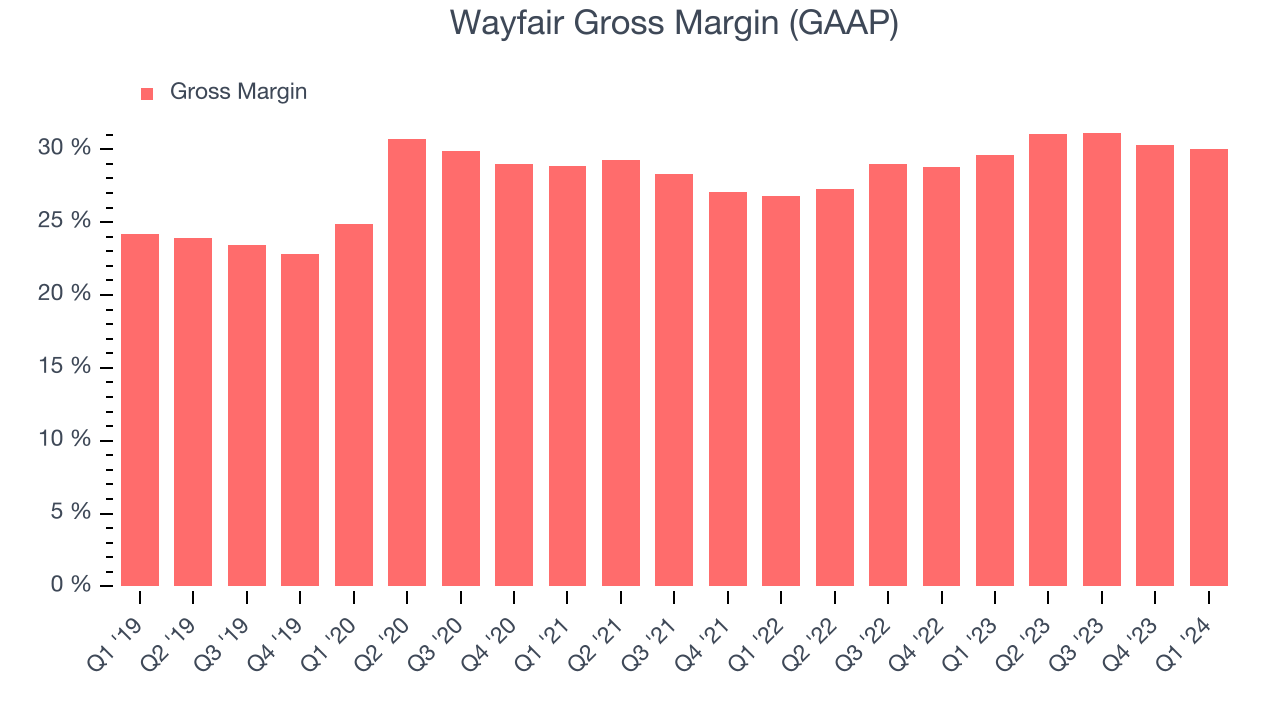

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Wayfair's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 30% this quarter, up 0.4 percentage points year on year.

For online retail (separate from online marketplaces) businesses like Wayfair, these aforementioned costs typically include the cost of acquiring the products sold, shipping and fulfillment, customer service, and digital infrastructure expenses. After paying for these expenses, Wayfair had $0.30 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Wayfair's gross margins have been trending up over the last 12 months, averaging 30.6%. This is a welcome development, as Wayfair's margins are below the industry average, and rising margins could suggest improved demand and pricing power.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Wayfair grow from a combination of product virality, paid advertisement, and incentives.

It's relatively expensive for Wayfair to acquire new users as the company has spent 49.1% of its gross profit on sales and marketing expenses over the last year. This level of efficiency indicates that Wayfair has to compete for its users and continue investing to maintain its growth trajectory.

Profitability & Free Cash Flow

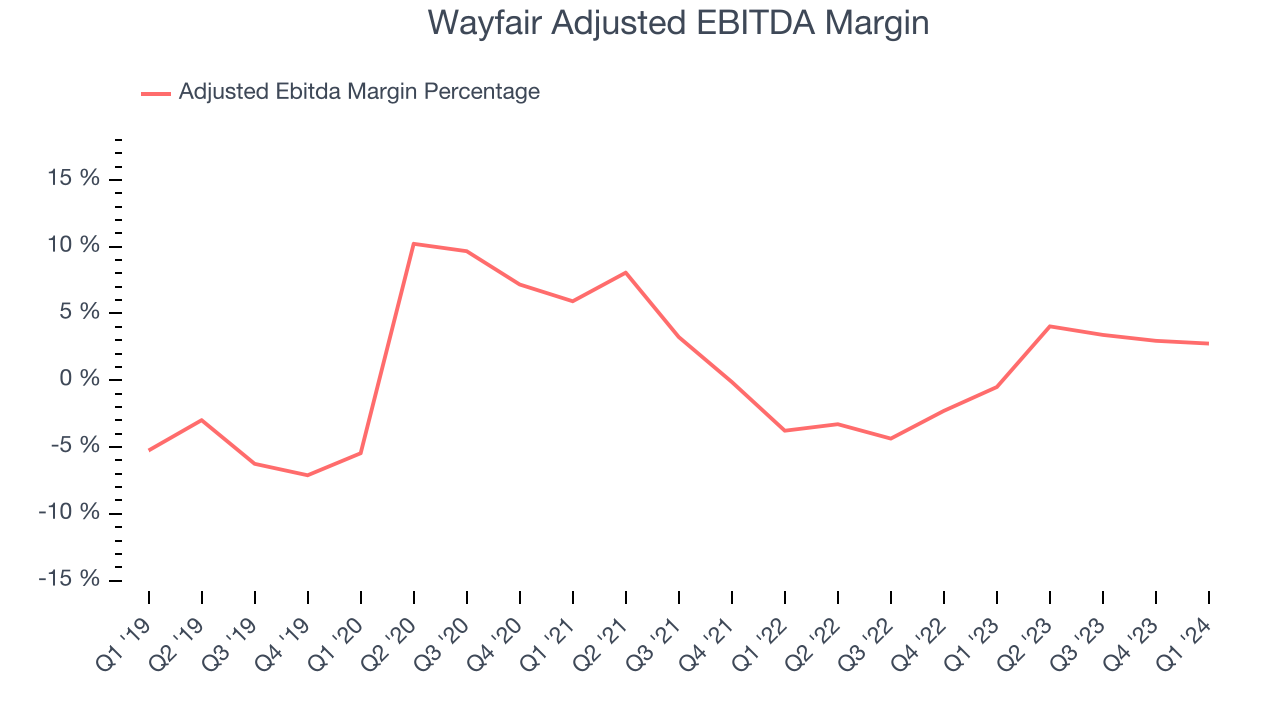

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Wayfair reported EBITDA of $75 million this quarter, resulting in a 2.7% margin. The company has also shown above-average profitability for a consumer internet business over the last four quarters, with average EBITDA margins of 3.3%.

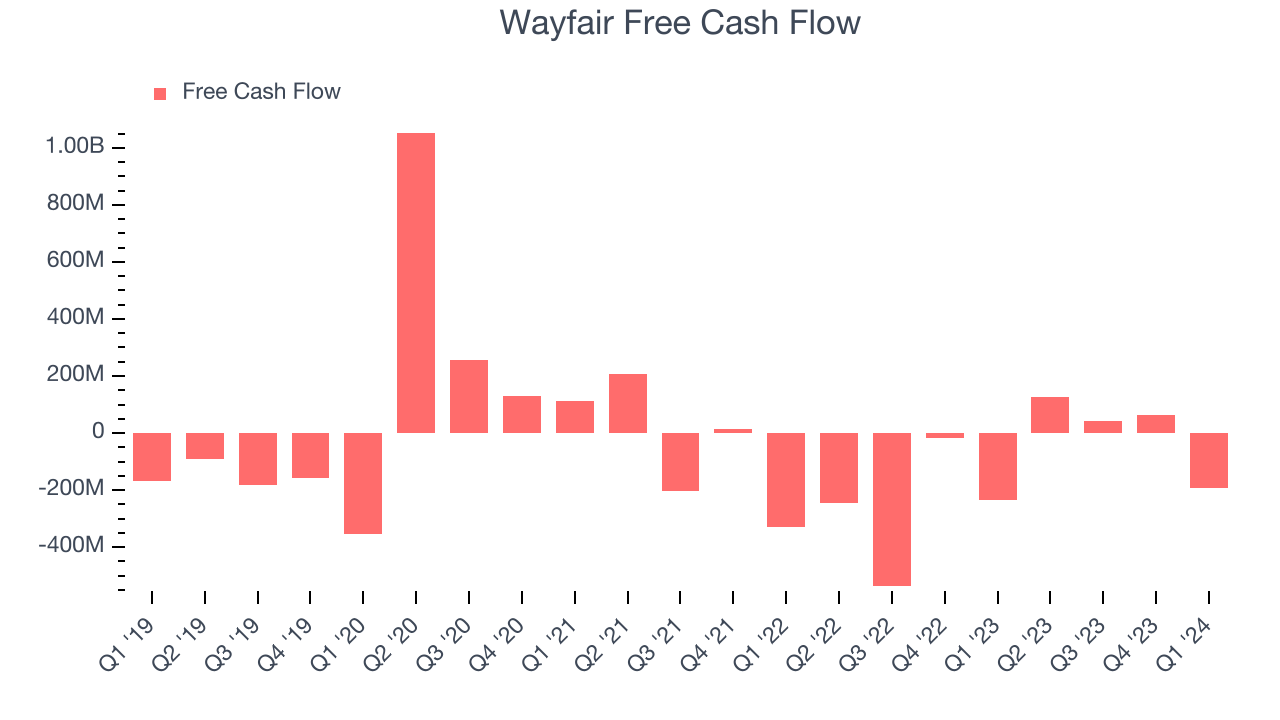

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Wayfair burned through $193 million in Q1, increasing the cash burn by 17.5% year on year.

Wayfair has generated $39 million in free cash flow over the last 12 months, or 0.3% of revenue. This FCF margin stems from its efficient business model and enables it to reinvest in its business without depending on the capital markets.

Key Takeaways from Wayfair's Q1 Results

It was great to see Wayfair beat analysts' revenue and adjusted EBITDA expectations this quarter. On the other hand, its revenue growth slowed. Guidance is typically given on the earnings call, and this can move the stock further. Overall, this was a solid quarter for Wayfair. The stock is up 8.9% after reporting and currently trades at $55 per share.

Is Now The Time?

When considering an investment in Wayfair, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

We cheer for everyone who's making the lives of others easier through technology, but in the case of Wayfair, we'll be cheering from the sidelines. Its revenue has declined over the last three years, and analysts expect growth to deteriorate from here. On top of that, its active buyers have declined, and its gross margins make it extremely difficult to reach positive operating profits compared to other consumer internet businesses.

At the moment, Wayfair trades at 9.9x next 12 months EV-to-EBITDA. While we've no doubt one can find things to like about Wayfair, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $70.22 per share right before these results (compared to the current share price of $58.43).

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.