Earnings results often give us a good indication what direction will the company will take in the months ahead. With Q2 now behind us, let’s have a look at Workiva (NYSE:WK) and its peers.

Organizations are constantly looking for improving organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 9 finance and HR software stocks we track reported a a strong Q2; on average, revenues beat analyst consensus estimates by 6.21%, while on average next quarter revenue guidance was 5.93% above consensus. The market rewarded the results with the average return the day after earnings coming in at 5.79%.

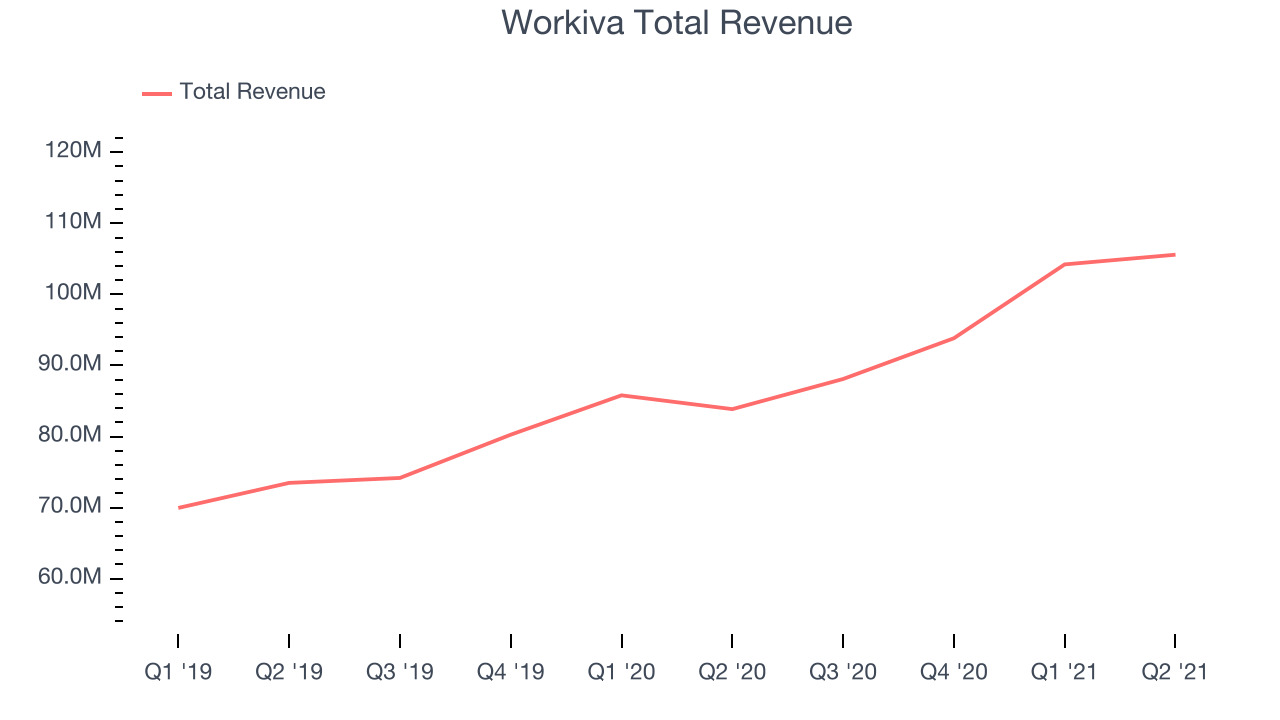

Workiva (NYSE:WK)

Founded in 2010, Workiva offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $105.5 million, up 25.9% year on year, beating analyst expectations by 3.85%. It was a strong quarter for the company, with accelerating customer growth and a very optimistic guidance for the next quarter.

"Our results continue to build on our market leadership and the increased demand for regulatory reporting and fit-for-purpose solutions to support digital transformations," said Marty Vanderploeg, Chief Executive Officer.

The stock is up 6.42% since the results and currently trades at $136.96.

Is now the time to buy Workiva? Access our full analysis of the earnings results here, it's free.

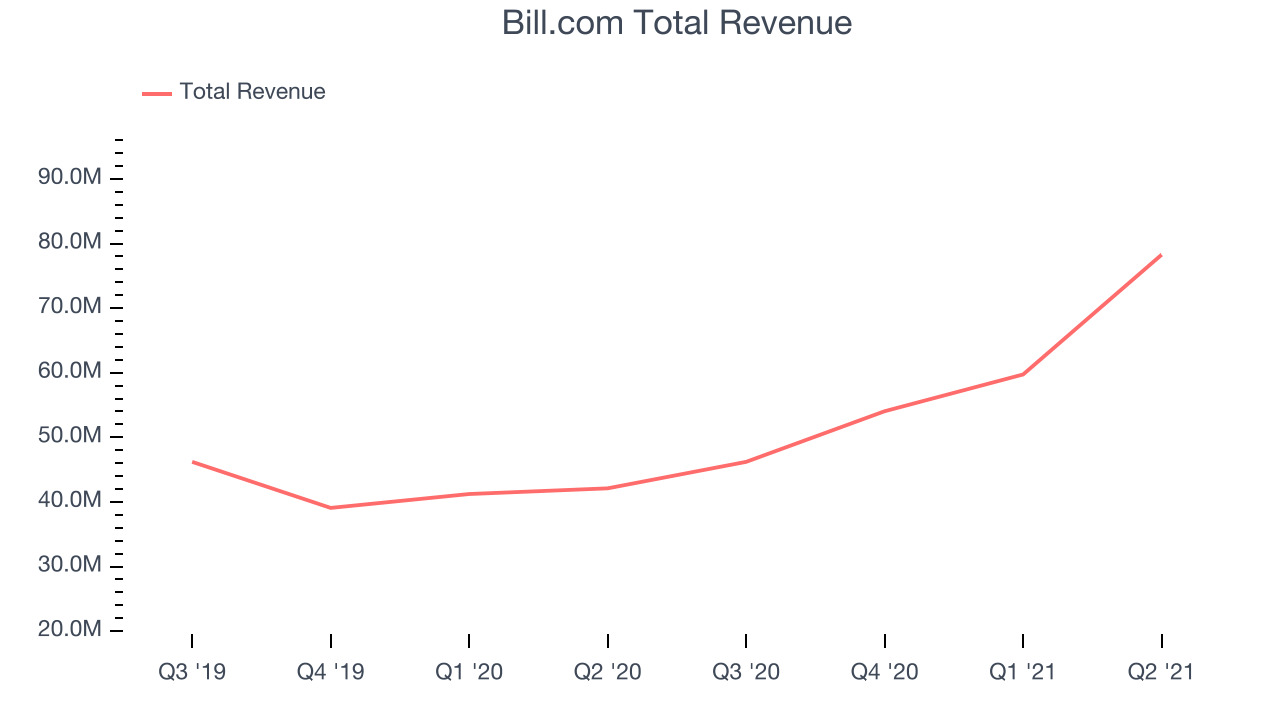

Best Q2: Bill.com (NYSE:BILL)

Started by René Lacerte in 2006 after selling his previous payroll and accounting software company PayCycle to Intuit, Bill.com (NYSE:BILL) is a software as a service platform that aims to make payments and billing processes easier for small and medium-sized businesses.

Bill.com reported revenues of $78.2 million, up 85.8% year on year, beating analyst expectations by 20.4%. It was a very strong quarter for the company, with an impressive beat of analyst estimates and an exceptional revenue growth.

Bill.com scored the strongest analyst estimates beat, fastest revenue growth, and highest full year guidance raise among its peers. The stock is up 28% since the results and currently trades at $279.99.

Is now the time to buy Bill.com? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.26 billion, up 18.6% year on year, beating analyst expectations by 1.61%. It was a decent quarter for the company, with a decent beat of analyst estimates.

The stock is up 5.34% since the results and currently trades at $260.

Read our full analysis of Workday's results here.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

Blackline reported revenues of $102.1 million, up 22.6% year on year, beating analyst expectations by 1.03%. It was a decent quarter for the company, with accelerating customer growth.

Blackline had the weakest full year guidance update among the peers. The stock is up 1.75% since the results and currently trades at $118.

Read our full, actionable report on Blackline here, it's free.

Coupa Software (NASDAQ:COUP)

Founded in 2006 by former Oracle executives, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spending across procurement, billing and business expenses and get a better visibility into how the money is spent.

Coupa Software reported revenues of $179.2 million, up 42.3% year on year, beating analyst expectations by 9.98%. It was an impressive quarter for the company, with a significant improvement in gross margin. The market however expected even more and the stock is down 12.3% since the results and currently trades at $231.24.

Read our full, actionable report on Coupa Software here, it's free.

The author has no position in any of the stocks mentioned