Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q3 now behind us, let’s have a look at Workiva (NYSE:WK) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a mixed Q3; on average, revenues beat analyst consensus estimates by 3.22%, while on average next quarter revenue guidance was 1.54% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but finance and HR software stocks held their ground better than others, with the share prices up 9.91% since the previous earnings results, on average.

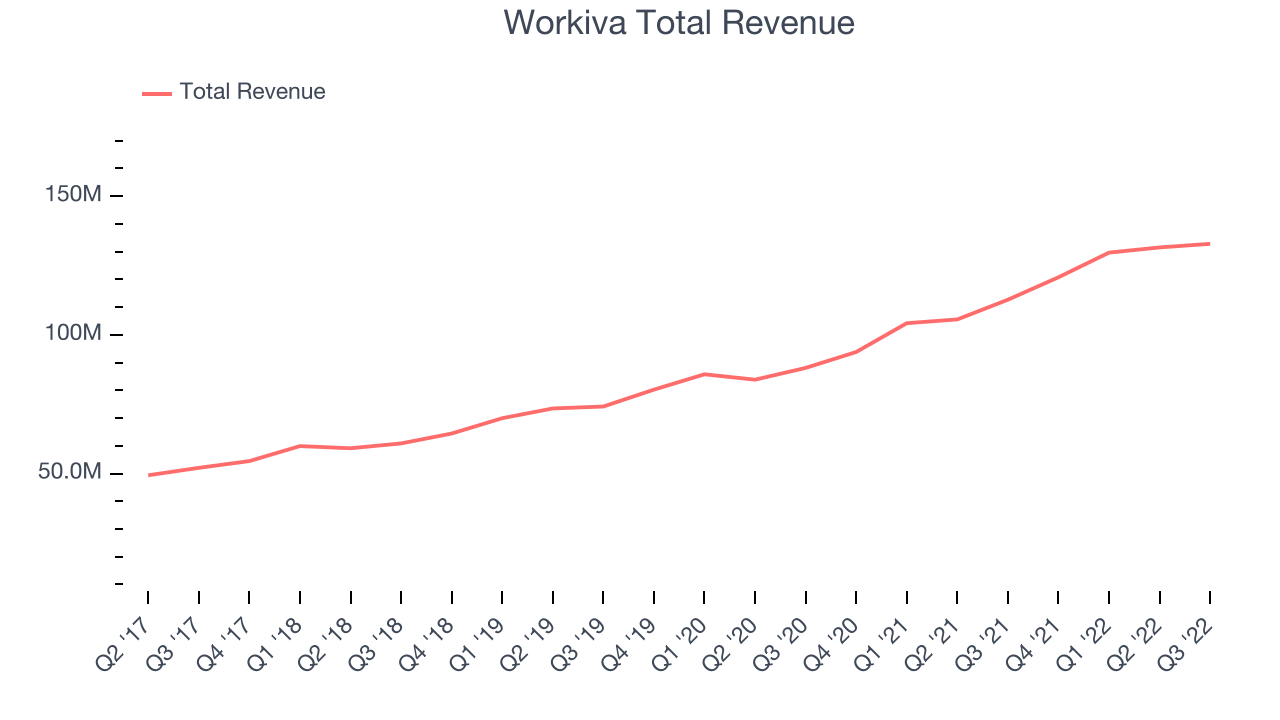

Workiva (NYSE:WK)

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $132.8 million, up 17.8% year on year, in line with analyst expectations. It was a weak quarter for the company, with underwhelming revenue guidance for the next quarter and decelerating customer growth.

"We are pleased with our third quarter 2022 results, delivering revenue growth near the high end of our quarterly guidance," said Marty Vanderploeg, chief executive officer.

The stock is up 28.4% since the results and currently trades at $87.13.

Read our full report on Workiva here, it's free.

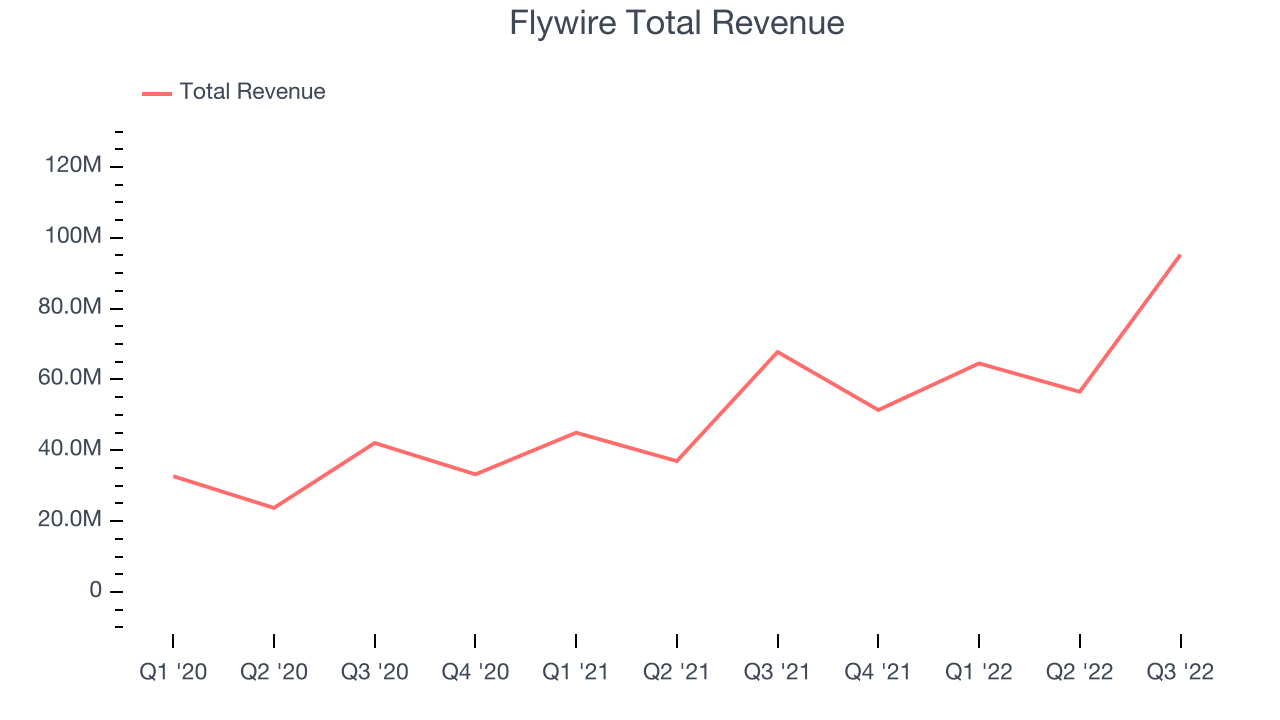

Best Q3: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $95.2 million, up 40.4% year on year, beating analyst expectations by 8.39%. It was a stunning quarter for the company, with a significant improvement in gross margin and very optimistic guidance for the next quarter.

Flywire delivered the highest full year guidance raise among its peers. The stock is up 38.3% since the results and currently trades at $25.02.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q3: Workday (NASDAQ:WDAY)

Founded by industry veterans Aneel Bushri and Dave Duffield after their former company PeopleSoft was acquired by Oracle in a hostile takeover, Workday (NASDAQ:WDAY) provides cloud-based software for organizations to manage and plan finance and human resources.

Workday reported revenues of $1.59 billion, up 16.2% year on year, beating analyst expectations by 0.85%. It was a decent quarter for the company, with topline results beating analyst expectations.

Workday had the weakest performance against analyst estimates in the group. The stock is up 13.9% since the results and currently trades at $163.34.

Read our full analysis of Workday's results here.

Paylocity (NASDAQ:PCTY)

Founded by payroll software veteran Steve Sarowitz in 1997, Paylocity (NASDAQ:PCTY) is a provider of payroll and human resources software for small and medium-sized enterprises.

Paylocity reported revenues of $253.2 million, up 39.3% year on year, beating analyst expectations by 5.65%. It was a very strong quarter for the company, with exceptional revenue growth and guidance for the next quarter above analyst estimates.

The stock is down 6.41% since the results and currently trades at $197.42.

Read our full, actionable report on Paylocity here, it's free.

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $101 million, up 13.2% year on year, in line with analyst expectations. It was a weaker quarter for the company, with underwhelming revenue guidance for the next quarter and slow revenue growth.

The company added 25 enterprise customers paying more than $100,000 annually to a total of 770. The stock is down 4.17% since the results and currently trades at $6.89.

Read our full, actionable report on Zuora here, it's free.

The author has no position in any of the stocks mentioned