The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s have a look at how the finance and HR software stocks have fared in Q2, starting with Workiva (NYSE:WK).

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 16 finance and HR software stocks we track reported a decent Q2; on average, revenues beat analyst consensus estimates by 4.24%, while on average next quarter revenue guidance was 2.63% above consensus. There has been a stampede out of high valuation technology stocks as raising interest rates encourage investors to value profits over growth again and while some of the finance and HR software stocks have fared somewhat better than others, they have not been spared, with share prices declining 9.34% since the previous earnings results, on average.

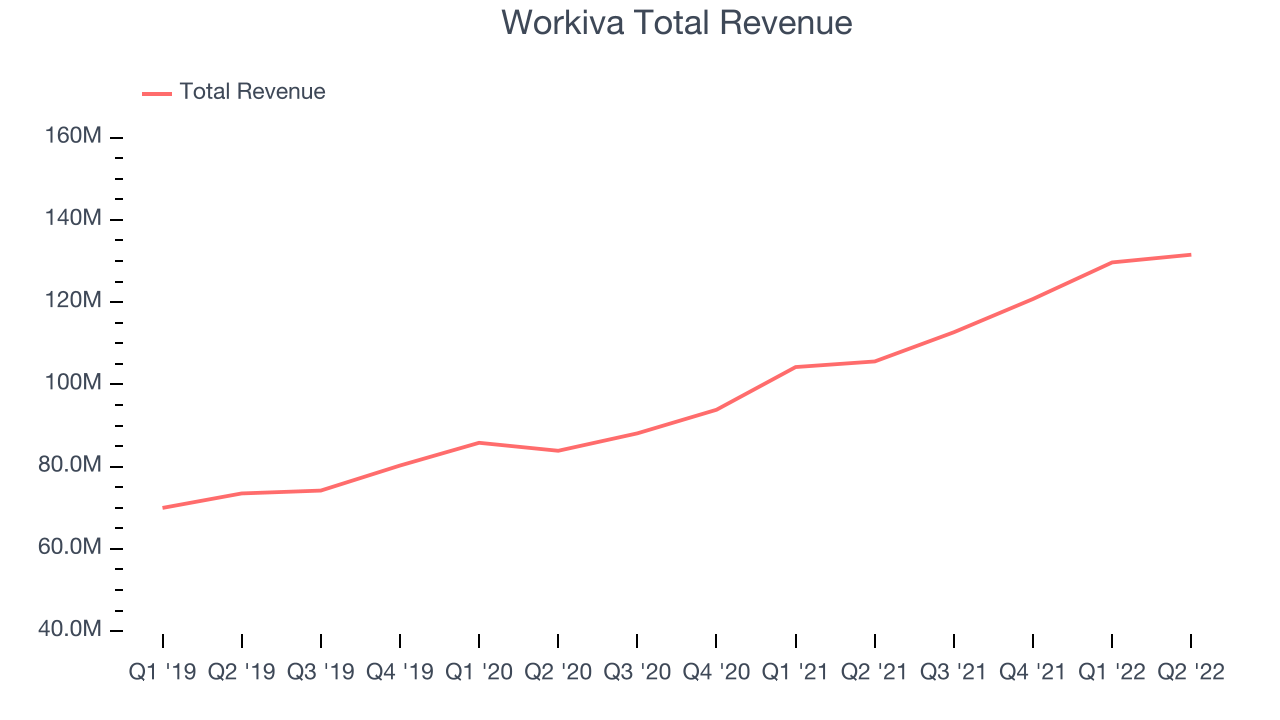

Workiva (NYSE:WK)

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $131.5 million, up 24.5% year on year, beating analyst expectations by 4.36%. It was a decent quarter for the company, with accelerating customer growth but an underwhelming revenue guidance for the next quarter.

"Our second quarter subscription & support and total revenue exceeded market expectations and we once again beat the high end of our guidance in revenue and operating results," said Marty Vanderploeg, Chief Executive Officer.

The stock is up 8.21% since the results and currently trades at $73.93.

Is now the time to buy Workiva? Access our full analysis of the earnings results here, it's free.

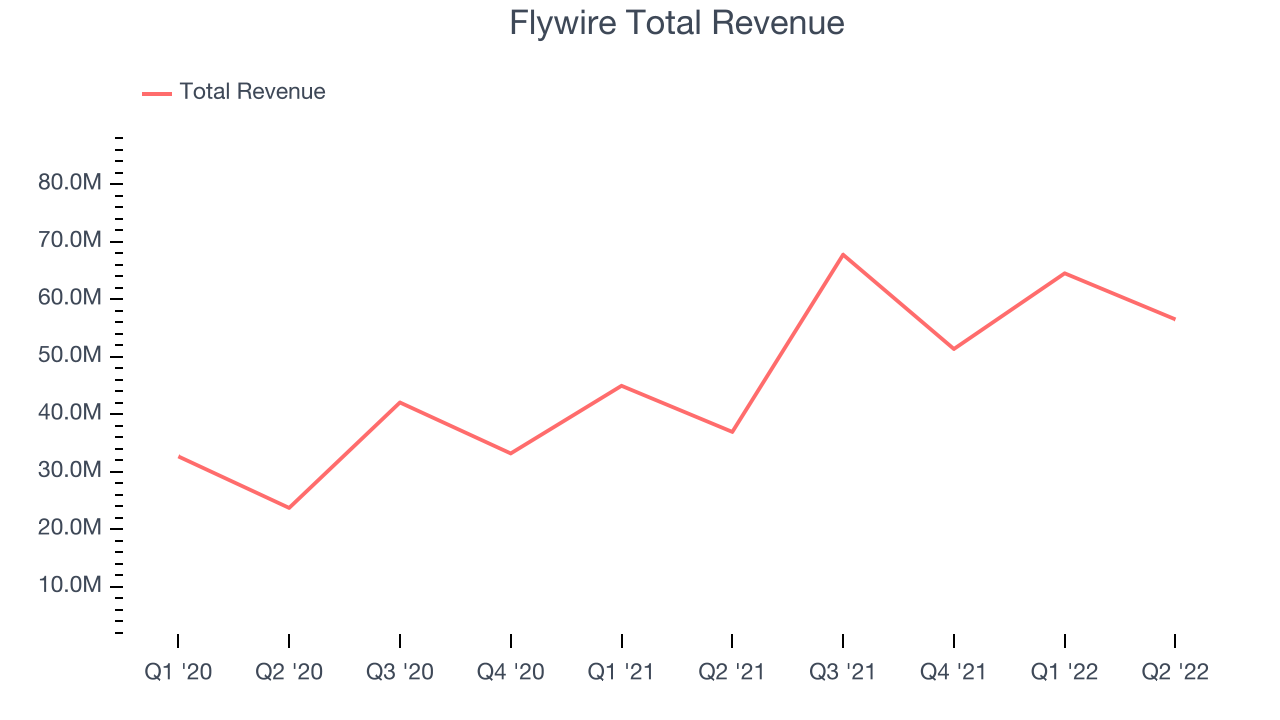

Best Q2: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $56.5 million, up 52.9% year on year, beating analyst expectations by 18.7%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Flywire pulled off the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 11.7% since the results and currently trades at $20.82.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $2.41 billion, down 5.74% year on year, beating analyst expectations by 3.61%. It was a weak quarter for the company, with underwhelming guidance for the next year and declining revenue.

The stock is down 13.4% since the results and currently trades at $388.84.

Read our full analysis of Intuit's results here.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $128.4 million, up 25.8% year on year, beating analyst expectations by 1.52%. It was a mixed quarter for the company, with accelerating customer growth but underwhelming revenue guidance for the next quarter.

The company added 106 customers to a total of 4,003. The stock is down 17.9% since the results and currently trades at $55.48.

Read our full, actionable report on BlackLine here, it's free.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio Paycor (NASDAQ: PYCR), provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $110.9 million, up 26.1% year on year, beating analyst expectations by 7.26%. It was a very strong quarter for the company, with full year guidance beating analysts' expectations.

The stock is down 7.27% since the results and currently trades at $28.67.

Read our full, actionable report on Paycor here, it's free.

The author has no position in any of the stocks mentioned