Financial and compliance reporting software company Workiva (NYSE:WK) beat analysts' expectations in Q1 CY2024, with revenue up 17% year on year to $175.7 million. On the other hand, next quarter's revenue guidance of $175 million was less impressive, coming in 1.3% below analysts' estimates. It made a non-GAAP profit of $0.22 per share, improving from its loss of $0.12 per share in the same quarter last year.

Workiva (WK) Q1 CY2024 Highlights:

- Revenue: $175.7 million vs analyst estimates of $174.2 million (small beat)

- EPS (non-GAAP): $0.22 vs analyst estimates of $0.17 (29.1% beat)

- Revenue Guidance for Q2 CY2024 is $175 million at the midpoint, below analyst estimates of $177.3 million

- The company reconfirmed its revenue guidance for the full year of $721 million at the midpoint

- Gross Margin (GAAP): 76.4%, up from 74.4% in the same quarter last year

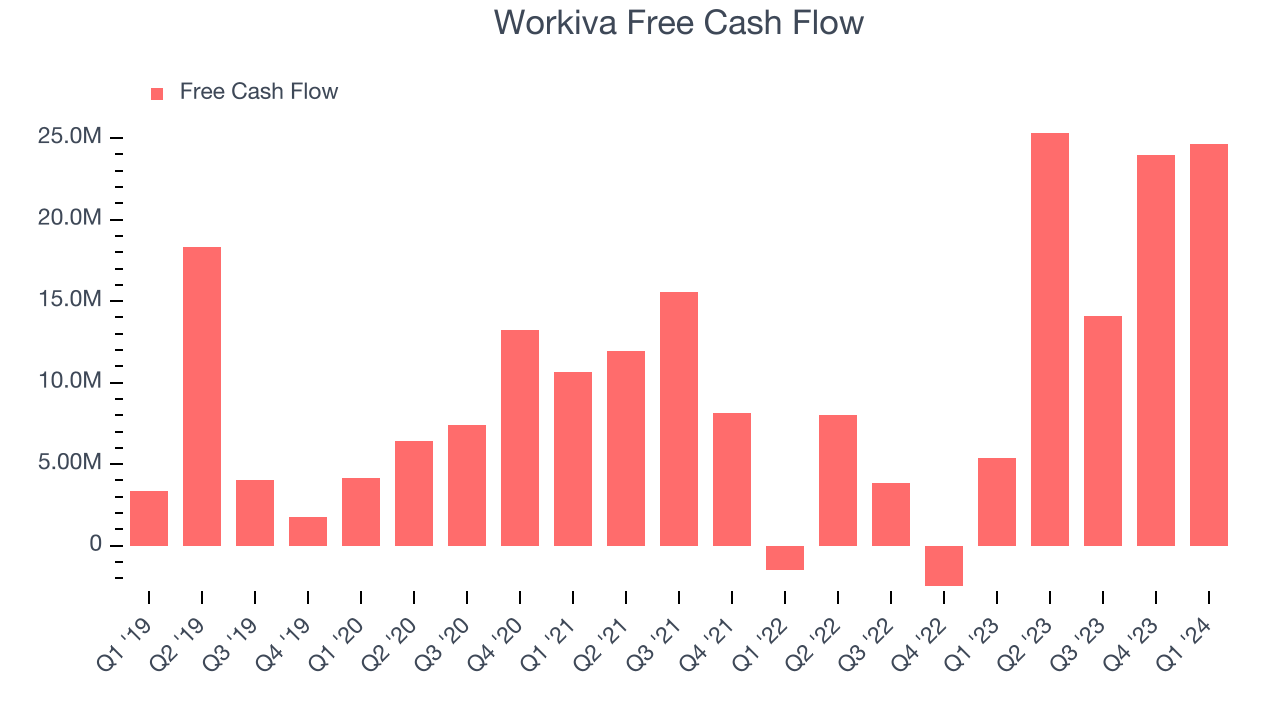

- Free Cash Flow of $24.64 million, similar to the previous quarter

- Net Revenue Retention Rate: 111%, in line with the previous quarter

- Customers: 6,074, up from 6,034 in the previous quarter

- Market Capitalization: $4.40 billion

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

The platform automatically gathers and updates data from various internal company sources like accounting software or spreadsheets and joins it together in the cloud, removing the need for accounting teams to do it manually. Workiva users can then connect the data directly to financial, regulatory, and performance reports and presentations and know that they are always using the correct, approved and most up-to-date, version of it. Workiva's target market is enterprises and big institutions that have large volumes of data distributed across various sources and a lot of reporting requirements at the same time.

Compliance Software

The demand for software platforms that automate compliances processes is rising as keeping up with the latest financial reporting regulations and standards is difficult and expensive, especially as companies increasingly operate across several geographical regions with varying rules.

Other providers of financial management software solutions include Blackline (NASDAQ:BL), and Oracle (NYSE:ORCL).

Sales Growth

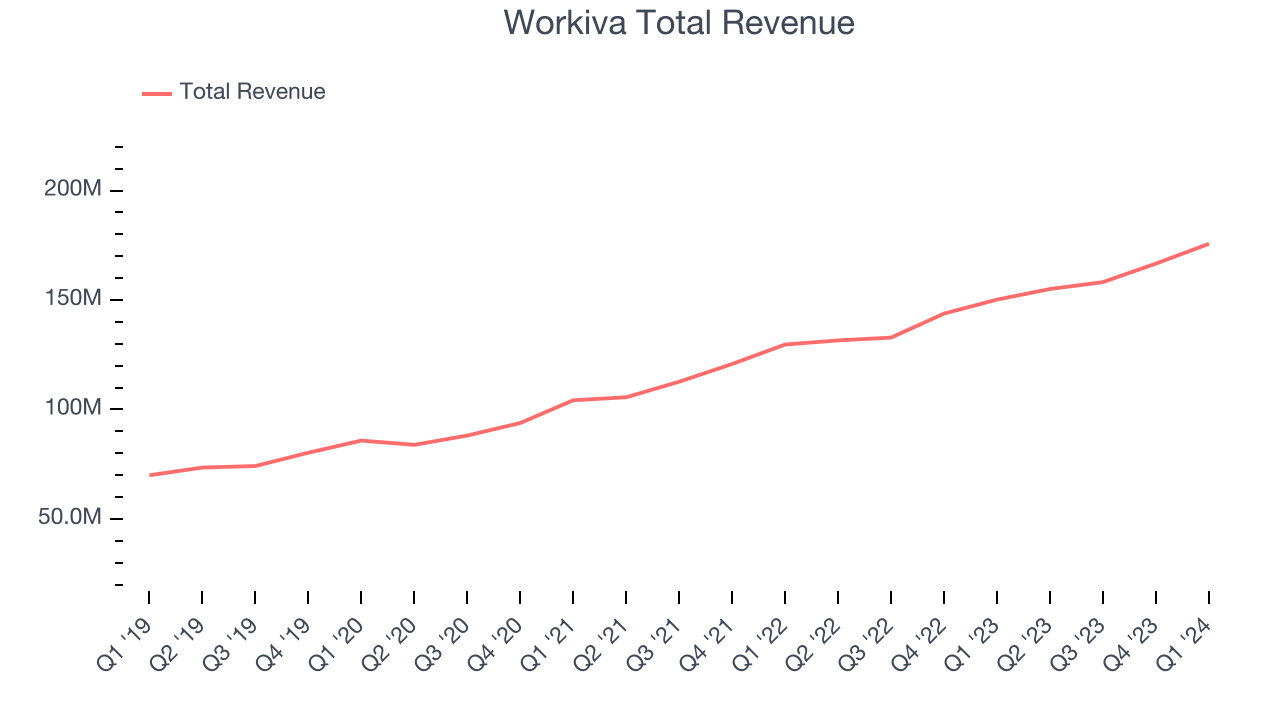

As you can see below, Workiva's revenue growth has been strong over the last three years, growing from $104.2 million in Q1 2021 to $175.7 million this quarter.

This quarter, Workiva's quarterly revenue was once again up 17% year on year. We can see that Workiva's revenue increased by $9.01 million in Q1, up from $8.48 million in Q4 CY2023. While we've no doubt some investors were looking for higher growth, it's good to see that quarterly revenue is re-accelerating.

Next quarter's guidance suggests that Workiva is expecting revenue to grow 12.9% year on year to $175 million, slowing down from the 17.8% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 13.4% over the next 12 months before the earnings results announcement.

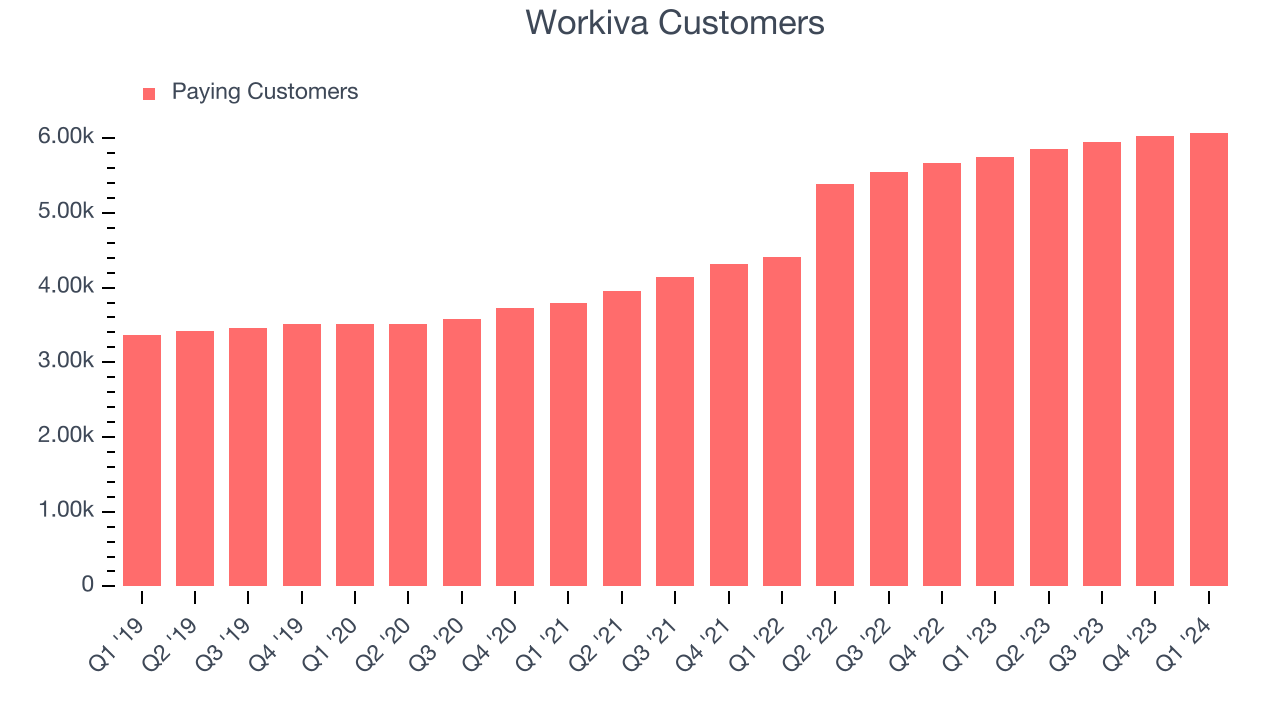

Customer Growth

Workiva reported 6,074 customers at the end of the quarter, an increase of 40 from the previous quarter. That's slower customer growth than we have seen previously, suggesting that the company's customer acquisition momentum is slowing.

Product Success

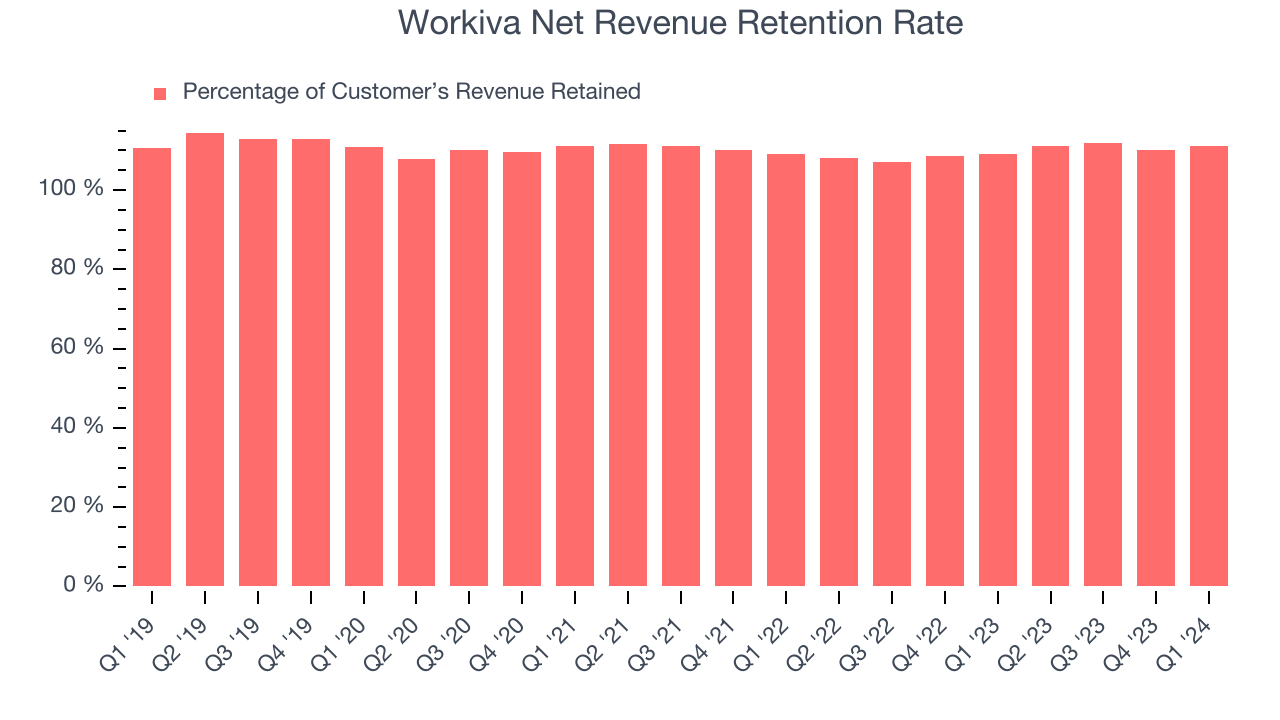

One of the best parts about the software-as-a-service business model (and a reason why SaaS companies trade at such high valuation multiples) is that customers typically spend more on a company's products and services over time.

Workiva's net revenue retention rate, a key performance metric measuring how much money existing customers from a year ago are spending today, was 111% in Q1. This means that even if Workiva didn't win any new customers over the last 12 months, it would've grown its revenue by 11%.

Workiva has a good net retention rate, proving that customers are satisfied with its software and getting more value from it over time, which is always great to see.

Profitability

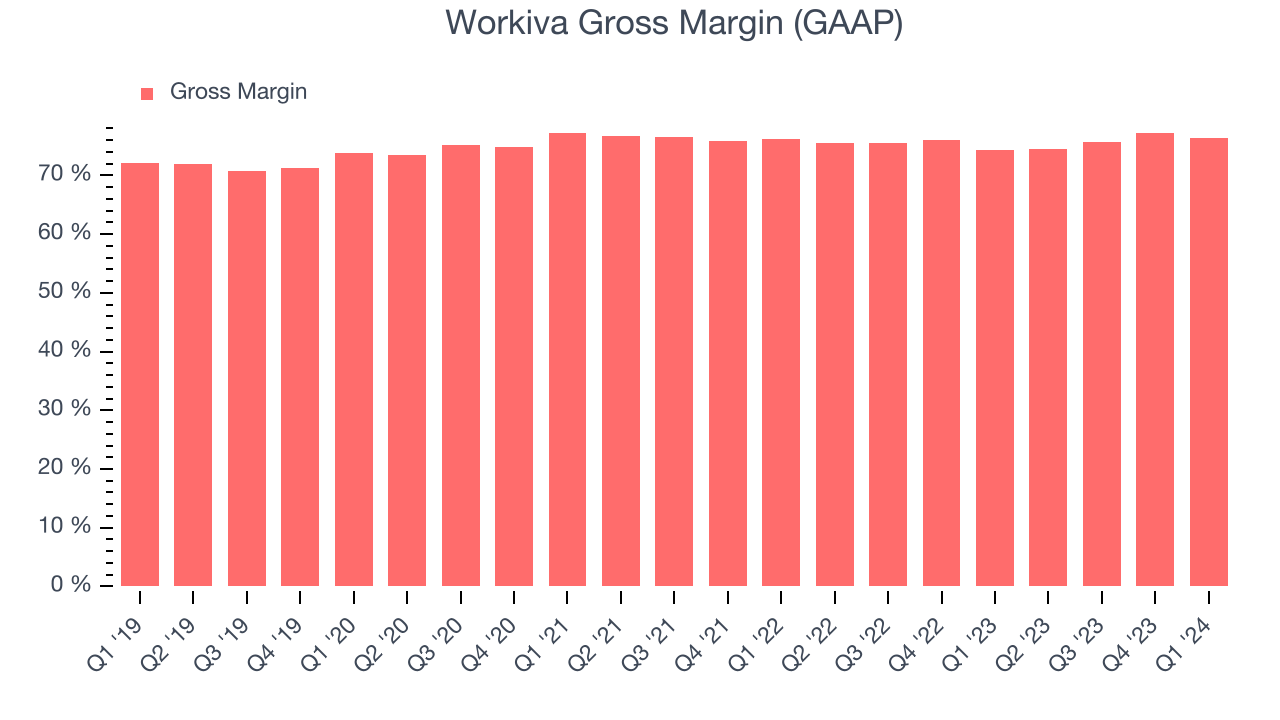

What makes the software as a service business so attractive is that once the software is developed, it typically shouldn't cost much to provide it as an ongoing service to customers. Workiva's gross profit margin, an important metric measuring how much money there's left after paying for servers, licenses, technical support, and other necessary running expenses, was 76.4% in Q1.

That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, sales and marketing, and general administrative overhead. Despite the recent drop, Workiva still has an excellent gross margin that allows it to fund large investments in product and sales during periods of rapid growth and achieve profitability when reaching maturity.

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Workiva's free cash flow came in at $24.64 million in Q1, up 359% year on year.

Workiva has generated $88.03 million in free cash flow over the last 12 months, a decent 13.4% of revenue. This FCF margin stems from its asset-lite business model and gives it a decent amount of cash to reinvest in its business.

Key Takeaways from Workiva's Q1 Results

Strong free cash flow was a highlight of Workiva's Q1, on the other hand its customer growth decelerated and guidance for Q2 was below estimates. Overall, this was a mixed quarter for Workiva. The stock is up 4.3% after reporting and currently trades at $83.5 per share.

Is Now The Time?

When considering an investment in Workiva, investors should take into account its valuation and business qualities as well as what's happened in the latest quarter.

Although we have other favorites, we understand the arguments that Workiva isn't a bad business. We'd expect growth rates to moderate from here, but its revenue growth has been solid over the last three years. On top of that, its customers are spending noticeably more each year, which is great to see.

Given its price-to-sales ratio of 5.9x based on the next 12 months, the market is certainly expecting long-term growth from Workiva. There are things to like about Workiva, and there's no doubt it's a bit of a market darling, at least for some. However, we think there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $104.50 right before these results (compared to the current share price of $83.50).

To get the best start with StockStory, check out our most recent Stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released. Especially for companies reporting pre-market, this often gives investors the chance to react to the results before everyone else has fully absorbed the information.