Educational publishing company John Wiley & Sons (NYSE:WLY) reported Q2 CY2024 results beating Wall Street analysts’ expectations, with revenue down 10.5% year on year to $403.8 million. The company expects the full year’s revenue to be around $1.67 billion, in line with analysts’ estimates. It made a GAAP loss of $0.03 per share, improving from its loss of $1.67 per share in the same quarter last year.

Is now the time to buy John Wiley & Sons? Find out by accessing our full research report, it’s free.

John Wiley & Sons (WLY) Q2 CY2024 Highlights:

- Revenue: $403.8 million vs analyst estimates of $387.4 million (4.2% beat)

- EPS: -$0.03 vs analyst estimates of $0.37 (-$0.40 miss)

- The company reconfirmed its revenue guidance for the full year of $1.67 billion at the midpoint

- EBITDA guidance for the full year is $397.5 million at the midpoint, in line with analyst expectations

- Gross Margin (GAAP): 73%, up from 65.2% in the same quarter last year

- EBITDA Margin: 18%, up from 13.2% in the same quarter last year

- Free Cash Flow was -$103.2 million compared to -$102.4 million in the same quarter last year

- Market Capitalization: $2.59 billion

“The Wiley leadership team and I are pleased with how we started the year, as measured by both our performance indicators and financial results ,” said Matthew Kissner, Wiley President and CEO.

Established in 1807, John Wiley & Sons (NYSE:WLY) is a global leader in academic publishing, providing educational materials, scholarly research, and professional development resources.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Sales Growth

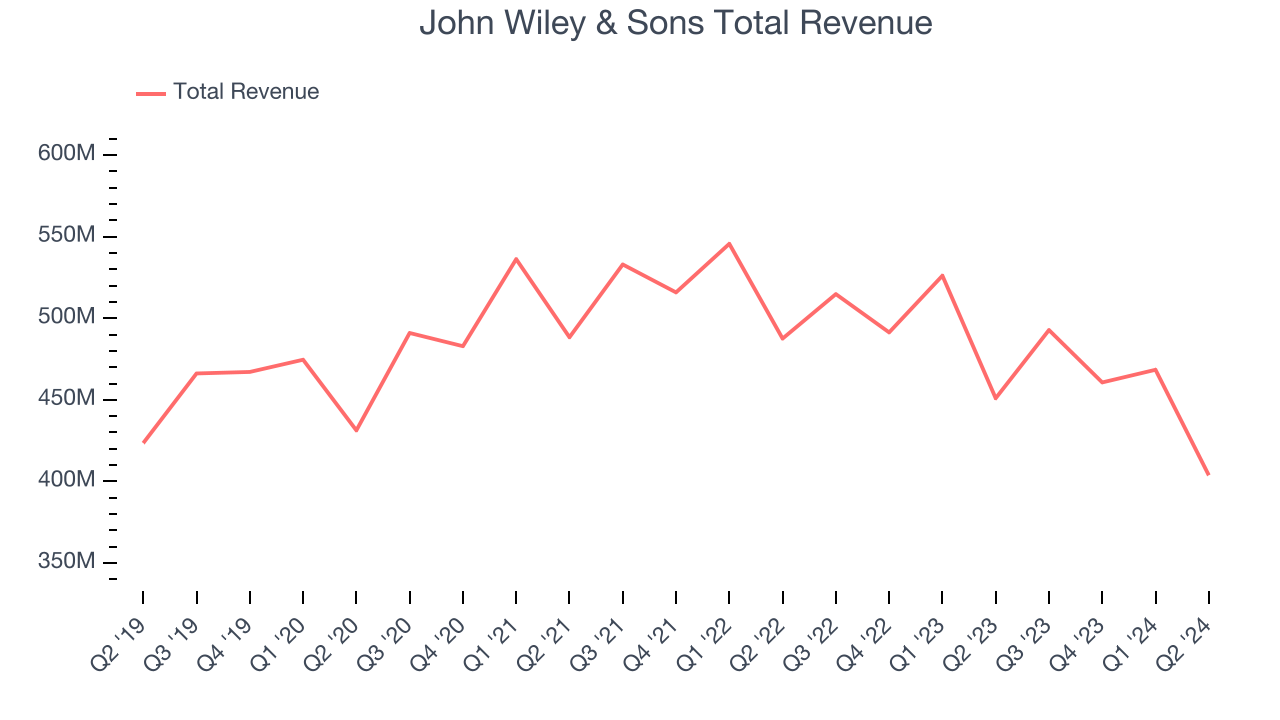

Reviewing a company’s long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one tends to sustain growth for years. John Wiley & Sons’s demand was weak over the last five years as its sales were flat, a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or emerging trend. John Wiley & Sons’s recent history shows its demand has stayed suppressed as its revenue has declined by 6.4% annually over the last two years.

This quarter, John Wiley & Sons’s revenue fell 10.5% year on year to $403.8 million but beat Wall Street’s estimates by 4.2%. We also like to judge companies based on their projected revenue growth, but not enough Wall Street analysts cover the company for it to have reliable consensus estimates.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) semiconductor stock benefitting from the rise of AI. Click here to access our free report on our favorite semiconductor growth story.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

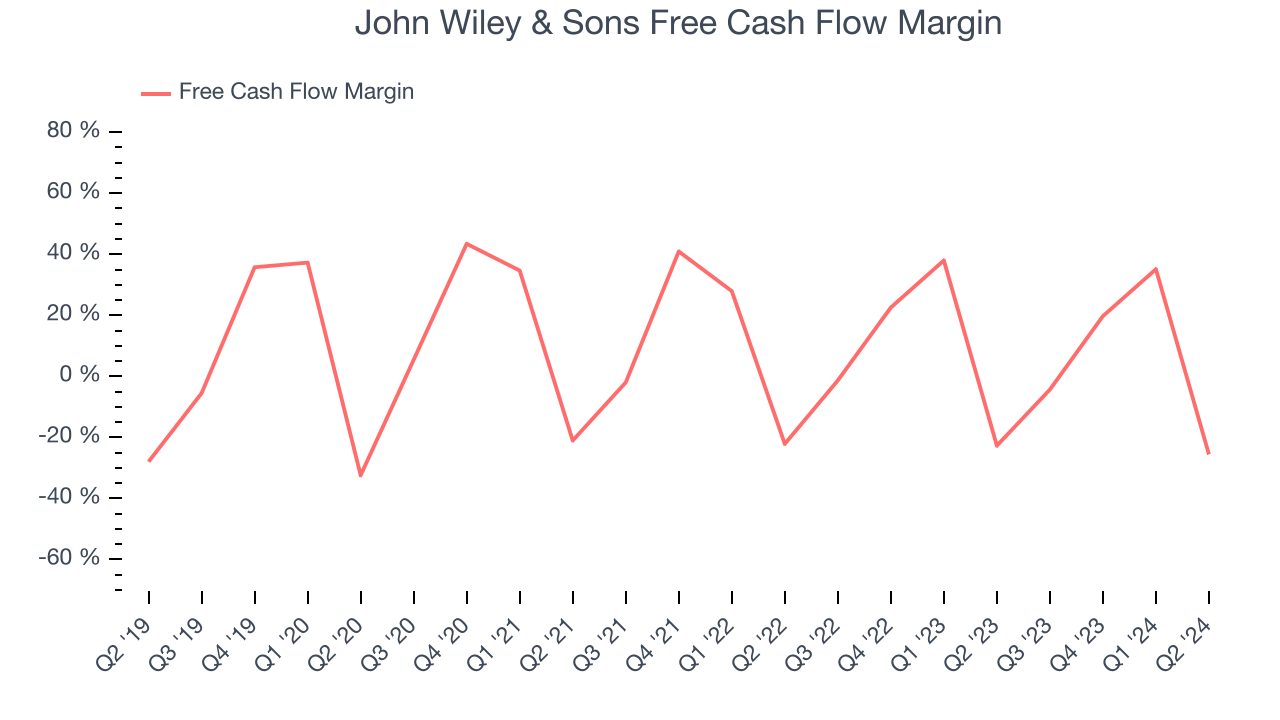

John Wiley & Sons has shown mediocre cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 8.7%, subpar for a consumer discretionary business.

John Wiley & Sons burned through $103.2 million of cash in Q2, equivalent to a negative 25.6% margin. The company’s cash burn was in line with the same quarter last year and is a deviation from its longer-term margin, raising some eyebrows.

Key Takeaways from John Wiley & Sons’s Q2 Results

We enjoyed seeing John Wiley & Sons exceed analysts’ revenue expectations this quarter. On the other hand, its EPS missed. The company reconfirmed full year revenue guidance and full year EBITDA guidance was in line with expectations, showing no major surprises. Overall, this seemed like a fine quarter. The stock remained flat at $47.65 immediately following the results.

So should you invest in John Wiley & Sons right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.