Educational publishing company John Wiley & Sons (NYSE:WLY) announced better-than-expected results in Q3 FY2024, with revenue down 6.2% year on year to $460.7 million. On the other hand, the company's full-year revenue guidance of $1.61 billion at the midpoint came in 9.3% below analysts' estimates. It made a GAAP loss of $2.08 per share, down from its loss of $1.29 per share in the same quarter last year.

John Wiley & Sons (WLY) Q3 FY2024 Highlights:

- Revenue: $460.7 million vs analyst estimates of $392.6 million (17.3% beat)

- EPS: -$2.08 vs analyst estimates of $0.26 (-$2.34 miss)

- Guidance for the full year misses on revenue but beats on EPS

- Gross Margin (GAAP): 68.8%, up from 64.6% in the same quarter last year

- Market Capitalization: $1.82 billion

Established in 1807, John Wiley & Sons (NYSE:WLY) is a global leader in academic publishing, providing educational materials, scholarly research, and professional development resources.

John Wiley & Sons was founded to support academic and professional communities by disseminating knowledge and learning. Originating as a small printing shop, it has evolved into a globally recognized academic publisher over its more than two-century history.

The company produces a diverse range of academic materials, including textbooks, scholarly journals, and online learning resources, catering to the needs of students, educators, researchers, and professionals. By providing high-quality, peer-reviewed content across various disciplines, John Wiley & Sons addresses the demand for reliable information in education and professional development.

John Wiley & Sons’s revenue streams include book sales, journal subscriptions, and digital content and services. Its business model combines traditional and digital publishing to serve a global audience.

Media

The advent of the internet changed how shows, films, music, and overall information flow. As a result, many media companies now face secular headwinds as attention shifts online. Some have made concerted efforts to adapt by introducing digital subscriptions, podcasts, and streaming platforms. Time will tell if their strategies succeed and which companies will emerge as the long-term winners.

Competitors in the educational and scholarly publishing industry include Scholastic (NASDAQ:SCHL), The New York Times (NYSE:NYT), and News Corp (NASDAQ:NWSA).

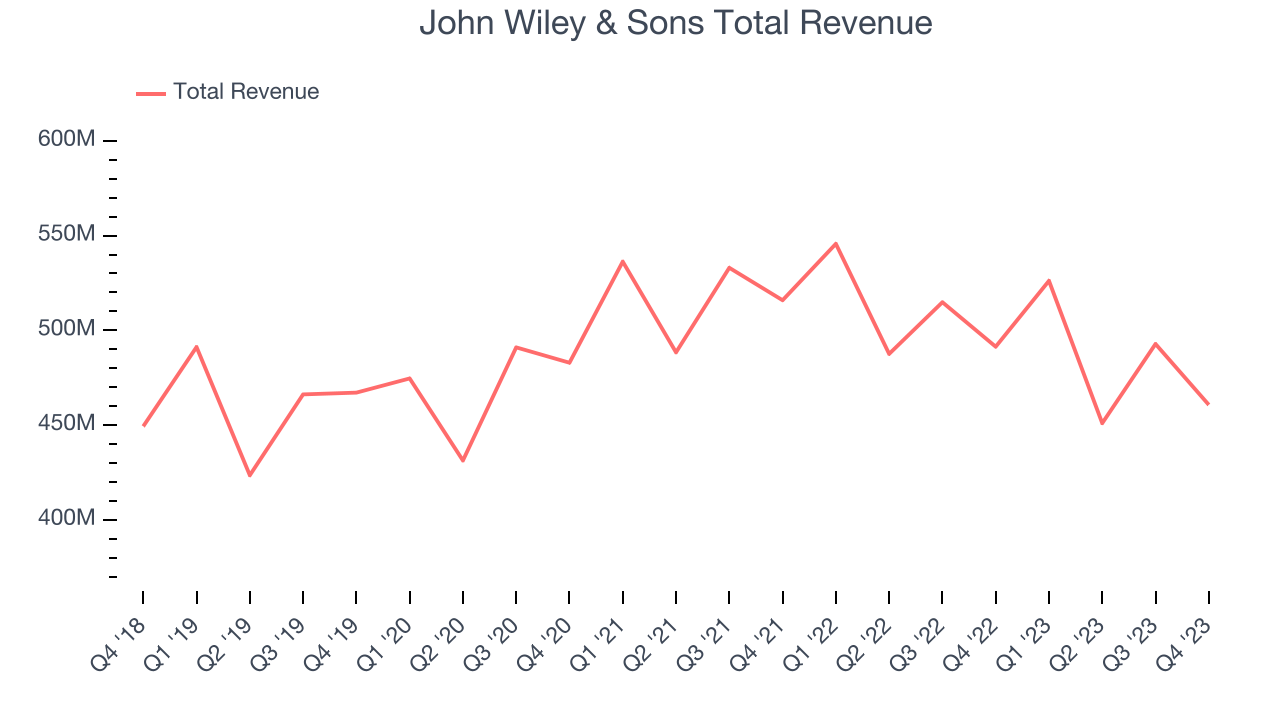

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. John Wiley & Sons's annualized revenue growth rate of 1.4% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. John Wiley & Sons's recent history shows a reversal from its already weak five-year trend as its revenue has shown annualized declines of 3.5% over the last two years.

This quarter, John Wiley & Sons's revenue fell 6.2% year on year to $460.7 million but beat Wall Street's estimates by 17.3%.

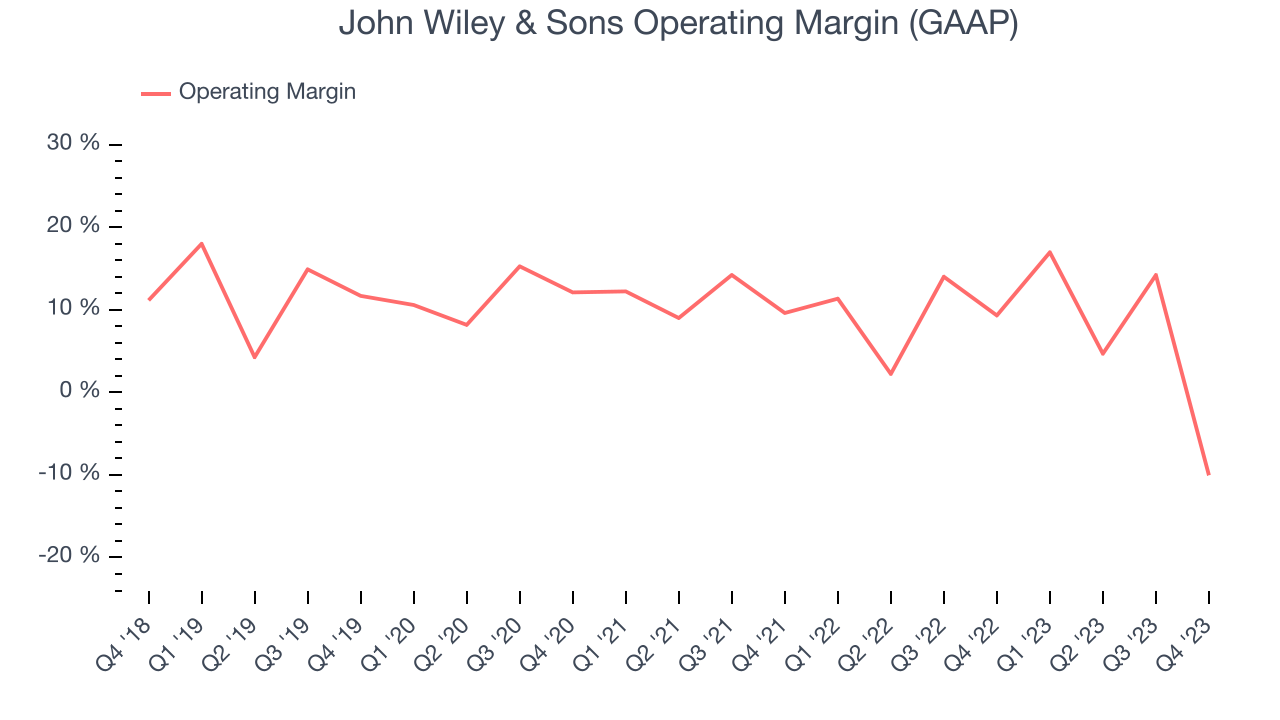

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

John Wiley & Sons was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer discretionary business, producing an average operating margin of 8.2%.

This quarter, John Wiley & Sons generated an operating profit margin of negative 10.1%, down 19.4 percentage points year on year. Note that GAAP results impacted by charges related to held for sale or sold assets, including goodwill and held for sale impairments of $82 million.

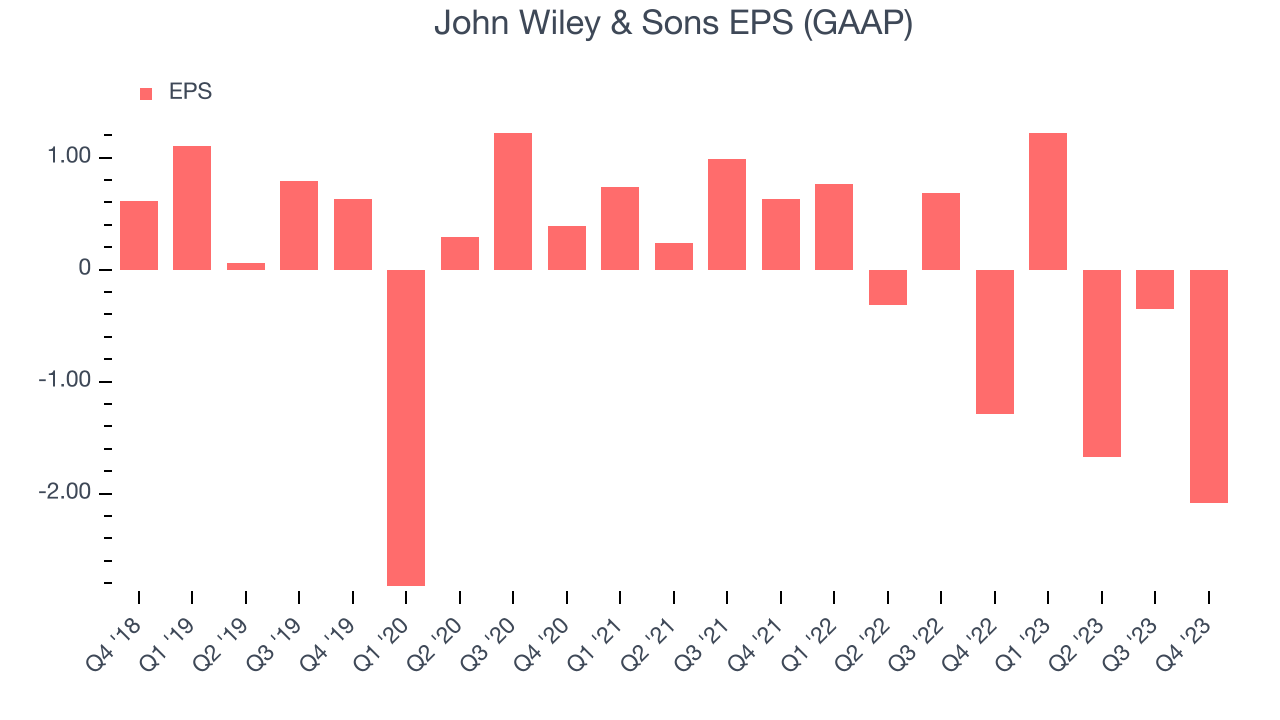

EPS

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, John Wiley & Sons's EPS dropped 325%, translating into 33.6% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q3, John Wiley & Sons reported EPS at negative $2.08, down from negative $1.29 in the same quarter a year ago. This print unfortunately missed analysts' estimates. Note that GAAP results impacted by charges related to held for sale or sold assets, including goodwill and held for sale impairments of $82 million that flowed through to EPS. We also like to analyze expected revenue growth based on Wall Street analysts' consensus projections, but unfortunately, there is insufficient data.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

John Wiley & Sons's five-year average return on invested capital was 9.8%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, John Wiley & Sons's ROIC over the last two years averaged 2.9 percentage point decreases each year. In conjunction with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Key Takeaways from John Wiley & Sons's Q3 Results

We were impressed by how significantly John Wiley & Sons blew past analysts' revenue expectations this quarter. EPS guidance for the full was also above expectations, another big positive. On the other hand, its full-year revenue guidance missed and its operating margin fell short of Wall Street's estimates. Overall, this was a mixed quarter for John Wiley & Sons. The stock is up 2.2% after reporting and currently trades at $33.86 per share.

Is Now The Time?

John Wiley & Sons may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of John Wiley & Sons, we'll be cheering from the sidelines. First off, its revenue growth has been weak over the last five years. On top of that, its declining EPS over the last five years makes it hard to trust, and its relatively low ROIC suggests it has historically struggled to find compelling business opportunities.

While we've no doubt one can find things to like about John Wiley & Sons, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $48 per share right before these results (compared to the current share price of $33.86).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.