Retail behemoth Walmart (NYSE:WMT) reported Q4 FY2024 results beating Wall Street analysts' expectations, with revenue up 5.7% year on year to $173.4 billion. It made a non-GAAP profit of $1.80 per share, improving from its profit of $1.71 per share in the same quarter last year.

Is now the time to buy Walmart? Find out by accessing our full research report, it's free.

Walmart (WMT) Q4 FY2024 Highlights:

- Revenue: $173.4 billion vs analyst estimates of $169.3 billion (2.4% beat)

- EPS (non-GAAP): $1.80 vs analyst estimates of $1.65 (9.4% beat)

- EPS (non-GAAP) Guidance for Q1 2025 is $1.52 at the midpoint, below analyst estimates of $1.60

- Free Cash Flow of $10.78 billion, up 29.1% from the same quarter last year

- Gross Margin (GAAP): 24%, up from 23.5% in the same quarter last year

- Same-Store Sales were up 4% year on year

- Number of Stores: ~10,500

- Market Capitalization: $458.6 billion

Known for its large-format Supercenters, Walmart (NYSE:WMT) is a retail pioneer that serves a budget-conscious consumer who is looking for a wide range of products under one roof.

Large-format Grocery & General Merchandise Retailer

Big-box retailers operate large stores that sell groceries and general merchandise at highly competitive prices. Because of their scale and resulting purchasing power, these big-box retailers–with annual sales in the tens to hundreds of billions of dollars–are able to get attractive volume discounts and sell at often the lowest prices. While e-commerce is a threat, these retailers have been able to weather the storm by either providing a unique in-store shopping experience or by reinvesting their hefty profits into omnichannel investments.

Sales Growth

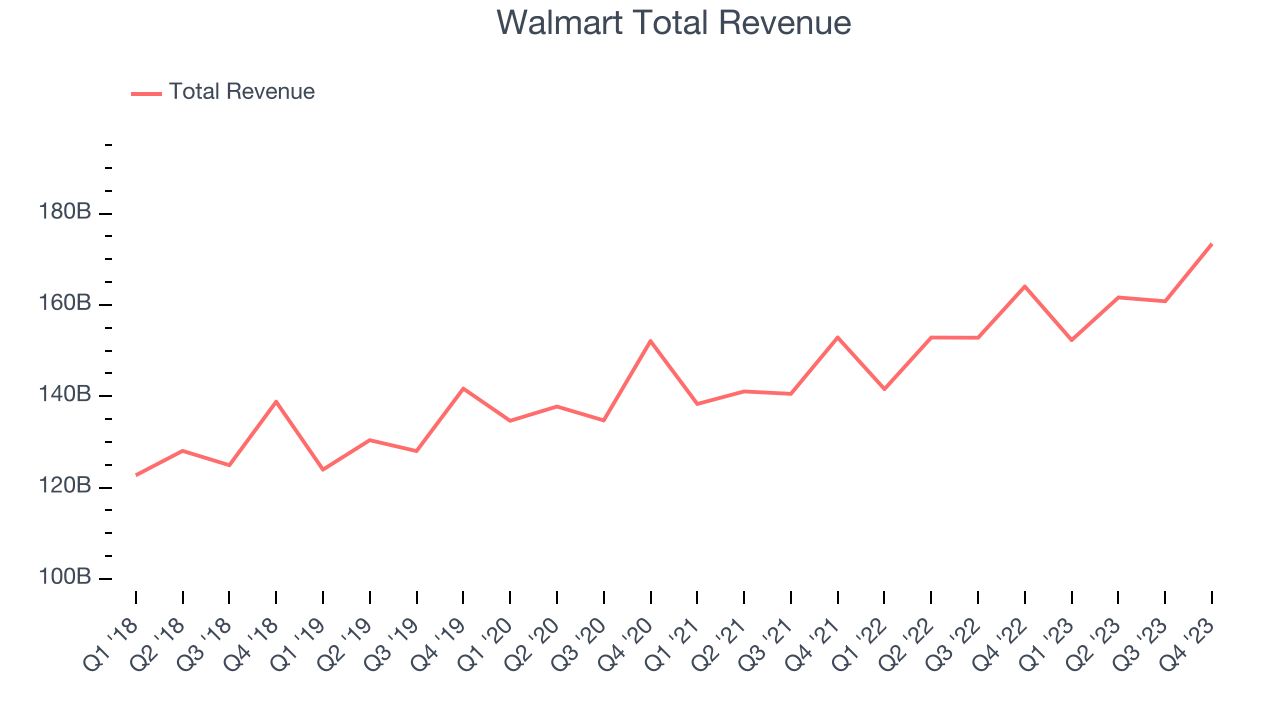

Walmart is a behemoth in the consumer retail sector and benefits from economies of scale, an important advantage giving the business an edge in distribution and more negotiating power with suppliers.

As you can see below, the company's annualized revenue growth rate of 5.5% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak as its store count was flat, signaling that growth was driven by more sales at existing, established stores.

This quarter, Walmart reported solid year-on-year revenue growth of 5.7%, and its $173.4 billion in revenue outperformed Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 2.2% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Same-Store Sales

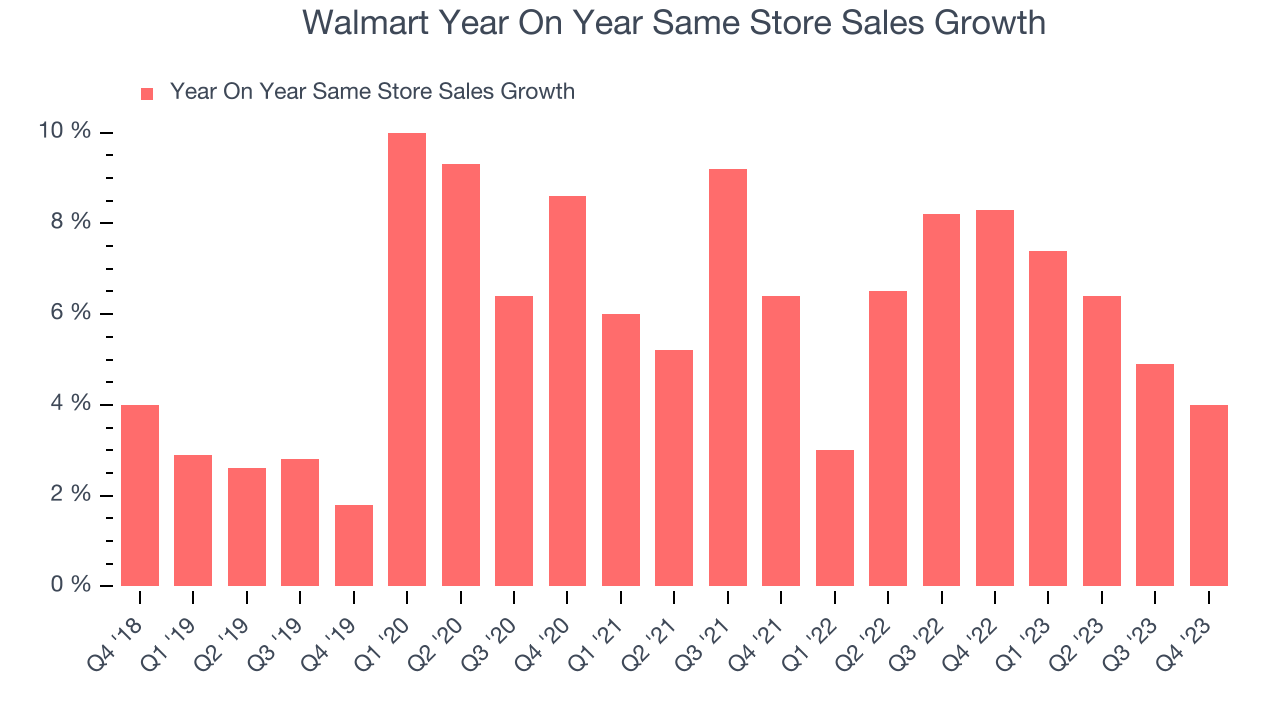

Same-store sales growth is an important metric that tracks demand for a retailer's established brick-and-mortar stores and e-commerce platform.

Walmart's demand within its existing stores has generally risen over the last two years but lagged behind the broader consumer retail sector. On average, the company's same-store sales have grown by 6.3% year on year. Given its flat store count over the same period, this performance stems from higher e-commerce sales or increased foot traffic at existing stores.

In the latest quarter, Walmart's same-store sales rose 4% year on year. By the company's standards, this growth was a meaningful deceleration from the 8.8% year-on-year increase it posted 12 months ago. We'll be watching Walmart closely to see if it can reaccelerate growth.

Key Takeaways from Walmart's Q4 Results

We enjoyed seeing Walmart exceed analysts' revenue, gross margin, and EPS expectations this quarter. That performance was driven by beats in its U.S. and International Walmart operations. On the other hand, Walmart's Sam's Club division lagged Wall Street's projections, and its earnings forecast for the full year 2024 missed analysts' expectations. The company also bought TV maker Vizio for just over $2 billion in February to support Walmart Connect, its media business. Zooming out, we think the company had a decent quarter, but its guidance was underwhelming. The stock is up 2% after reporting and currently trades at $173.84 per share.

So should you invest in Walmart right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.