Broadband and telecommunications services provider WideOpenWest (NYSE:WOW) reported results in line with analysts' expectations in Q1 CY2024, with revenue down 6.2% year on year to $161.5 million. On the other hand, next quarter's revenue guidance of $159.5 million was less impressive, coming in 1.9% below analysts' estimates. It made a GAAP loss of $0.18 per share, improving from its loss of $0.46 per share in the same quarter last year.

WideOpenWest (WOW) Q1 CY2024 Highlights:

- Reminder that WOW received an acquisition offer from DigitalBridge Investments and Crestview $4.80 per share in cash on May 3, 2024; WOW's Board of Directors established a special committee to evaluate the proposal

- Revenue: $161.5 million vs analyst estimates of $161.4 million (small beat)

- EPS: -$0.18 vs analyst estimates of -$0.10 (-$0.08 miss)

- Revenue Guidance for Q2 CY2024 is $159.5 million at the midpoint, below analyst estimates of $162.6 million

- Gross Margin (GAAP): 58.2%, up from 54.6% in the same quarter last year

- Free Cash Flow was -$39.3 million compared to -$35.9 million in the previous quarter

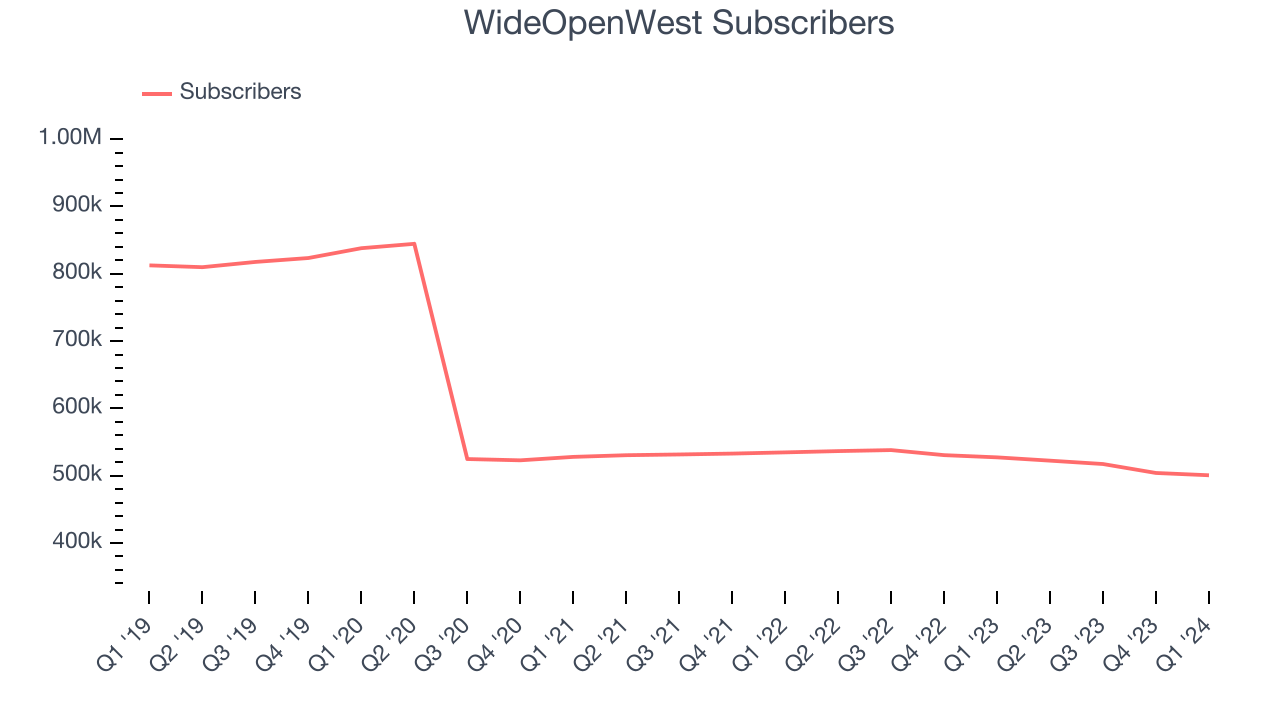

- Subscribers: 500,700

- Market Capitalization: $403.2 million

Initially started in Denver as a cable television provider, WideOpenWest (NYSE:WOW) provides high-speed internet, cable, and telephone services to the Midwest and Southeast regions of the U.S.

The company has grown through organic expansion, especially in its home market of the Midwest, but acquisitions of regional competitors have also contributed to its growth. Specifically, WideOpenWest acquired Knology in 2012 and NuLink in 2014, which established and expanded its footprint in the Southeastern US.

WideOpenWest principally serves residential customers who want some combination of high-speed broadband connectivity to access the internet, cable television for entertainment, and traditional telephony for voice calls. While broadband has been growing secularly, cable television and landline telephony have been challenged. In a milestone move that was a nod to traditional television’s decline, WideOpenWest announced on May 15, 2023 that it would discontinue its in-house TV services and migrate its television customers to YouTube TV, owned by Alphabet (NASDAQ:GOOGL).

The company's revenue is primarily derived from subscription packages. Prices vary based on a customer’s geographic location, the number of services the customer is buying in a bundle, and the broadband speeds or television channels desired. To grow its revenue over time, WideOpenWest has attempted to increase market share in existing markets, broaden its footprint to new geographies (which requires capital investment), and offer more services such as connected home subscription packages.

Cable and Satellite

The massive physical footprints of fiber in the ground or satellites in space make it challenging for companies in this industry to adjust to shifting consumer habits. Over the last decade-plus, consumers have ‘cut the cord’ to their traditional cable subscriptions in favor of streaming options. While that is a headwind, this affinity to streaming means more households need high-speed internet, and companies that successfully serve customers can enjoy high retention rates and pricing power since the options for internet connectivity in any geography is usually limited.

Competitors in the telecommunications sector include AT&T (NYSE:T), Verizon (NYSE:VZ), and Charter Communications (NASDAQ:CHTR).Sales Growth

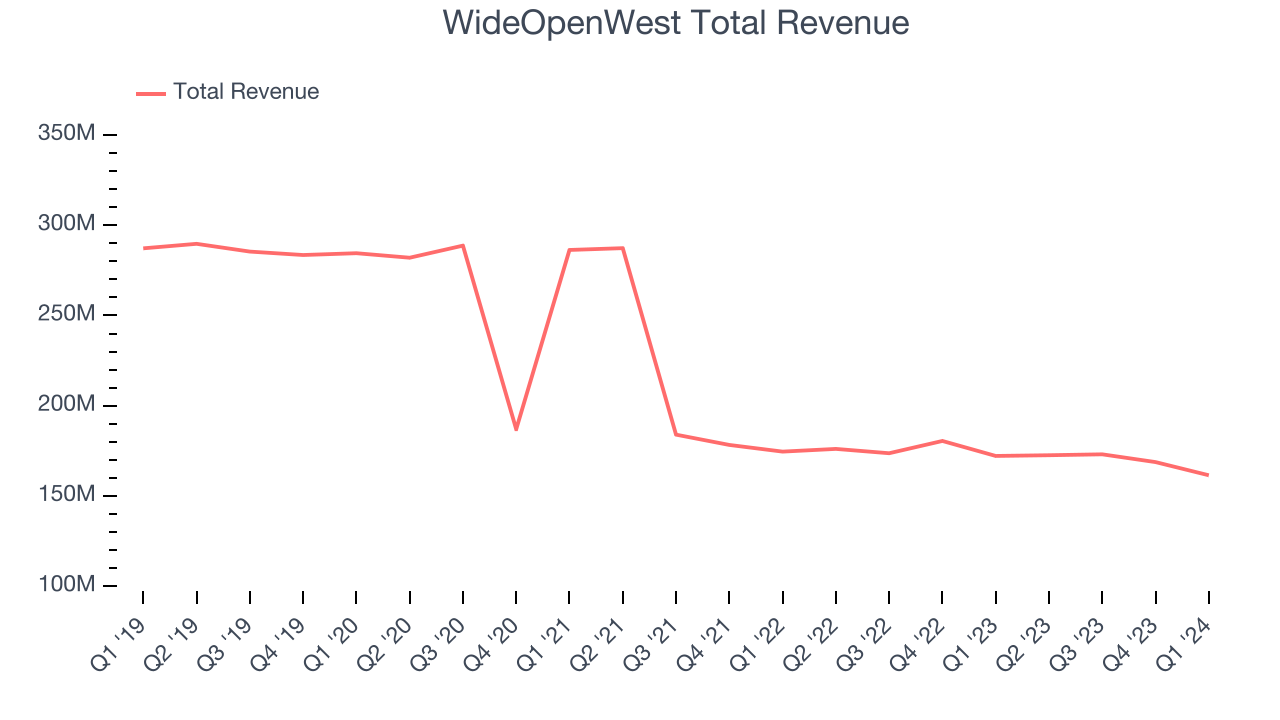

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. WideOpenWest's revenue declined over the last five years, dropping 10.2% annually.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. WideOpenWest's 2-year annualized revenue declines of 9.4% align with its five-year revenue declines, suggesting its demand is consistently shrinking.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. WideOpenWest's 2-year annualized revenue declines of 9.4% align with its five-year revenue declines, suggesting its demand is consistently shrinking.

We can dig even further into the company's revenue dynamics by analyzing its number of subscribers, which reached 500,700 in the latest quarter. Over the last two years, WideOpenWest's subscribers averaged 2% year-on-year declines. Because this number is higher than its revenue growth during the same period, we can see the company's monetization of its consumers has fallen.

This quarter, WideOpenWest reported a rather uninspiring 6.2% year-on-year revenue decline to $161.5 million of revenue, in line with Wall Street's estimates. The company is guiding for a 7.6% year-on-year revenue decline next quarter to $159.5 million, a deceleration from the 2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects revenue to decline 4.8% over the next 12 months.

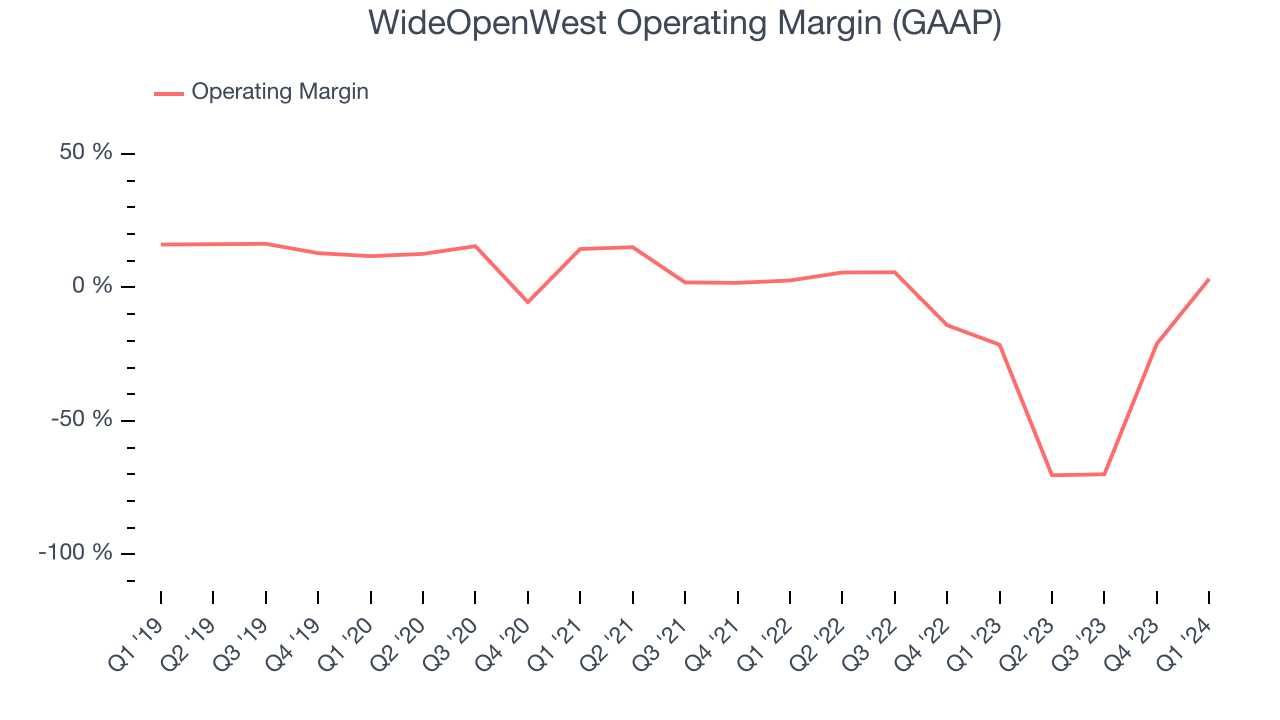

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Although WideOpenWest was profitable this quarter from an operational perspective, it's generally struggled when zooming out. Its high expenses have contributed to an average operating margin of negative 22.9% over the last two years. This performance isn't ideal as demand in the consumer discretionary sector is volatile. We prefer to invest in companies that can weather industry downturns through consistent profitability.

In Q1, WideOpenWest generated an operating profit margin of 3.2%, up 24.6 percentage points year on year.

Over the next 12 months, Wall Street expects WideOpenWest to become profitable. Analysts are expecting the company’s LTM operating margin of negative 40.4% to rise to positive 7.7%.EPS

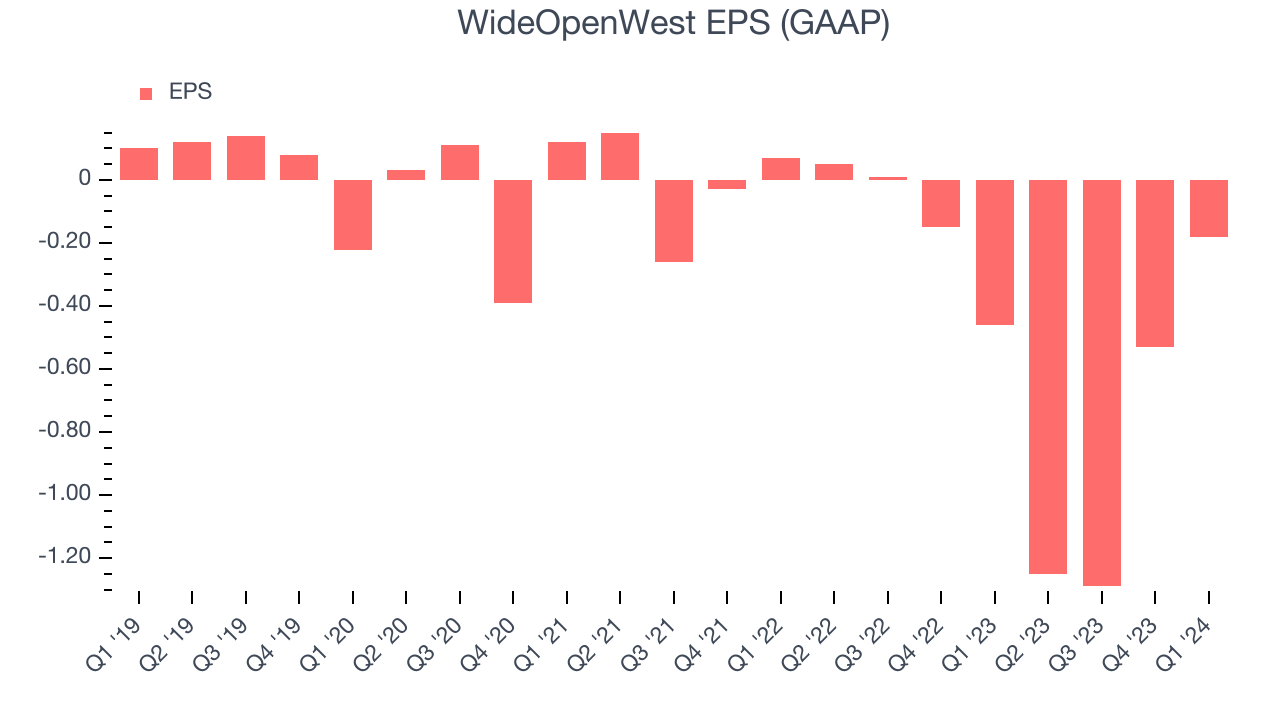

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last five years, WideOpenWest's EPS dropped 432%, translating into 39.7% annualized declines. We tend to steer our readers away from companies with falling EPS, where diminishing earnings could imply changing secular trends or consumer preferences. Consumer discretionary companies are particularly exposed to this, leaving a low margin of safety around the company (making the stock susceptible to large downward swings).

In Q1, WideOpenWest reported EPS at negative $0.18, up from negative $0.46 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates. Over the next 12 months, Wall Street is optimistic. Analysts are projecting WideOpenWest's LTM EPS of negative $3.25 to reach break even.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

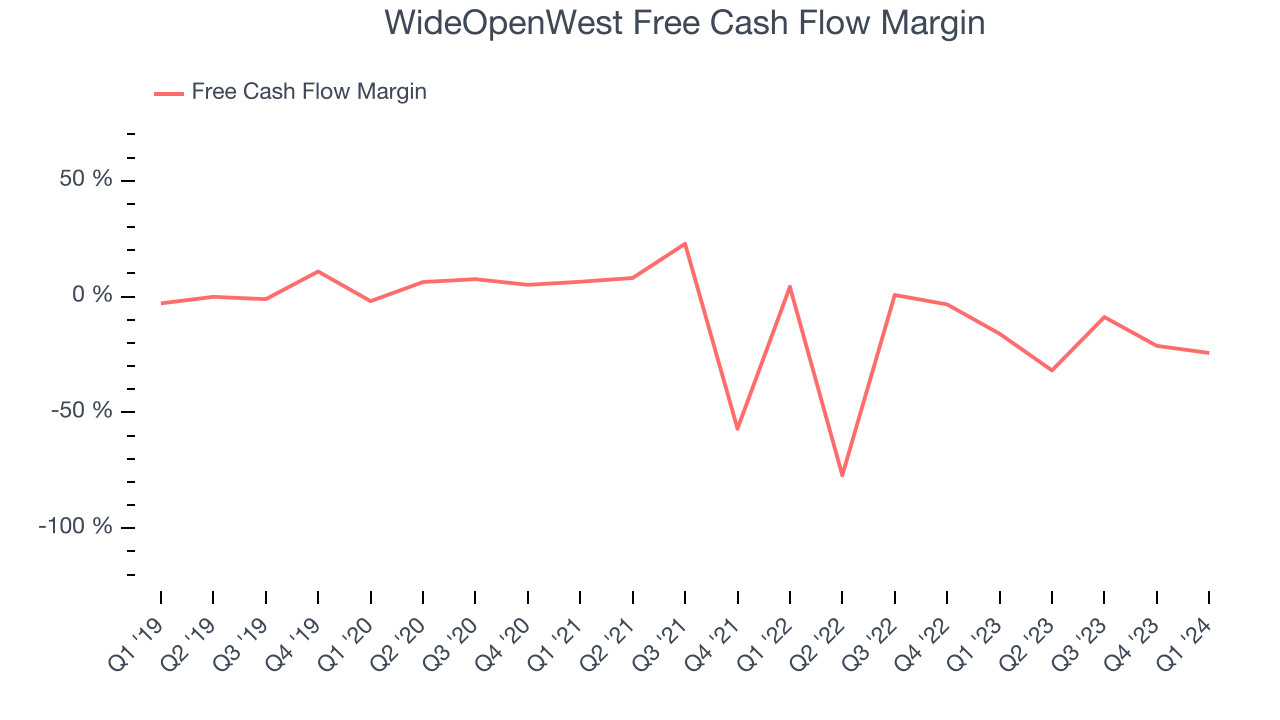

Over the last two years, WideOpenWest's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer discretionary sector, averaging negative 22.8%.

WideOpenWest burned through $39.3 million of cash in Q1, equivalent to a negative 24.3% margin, reducing its cash burn by 42.4% year on year.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

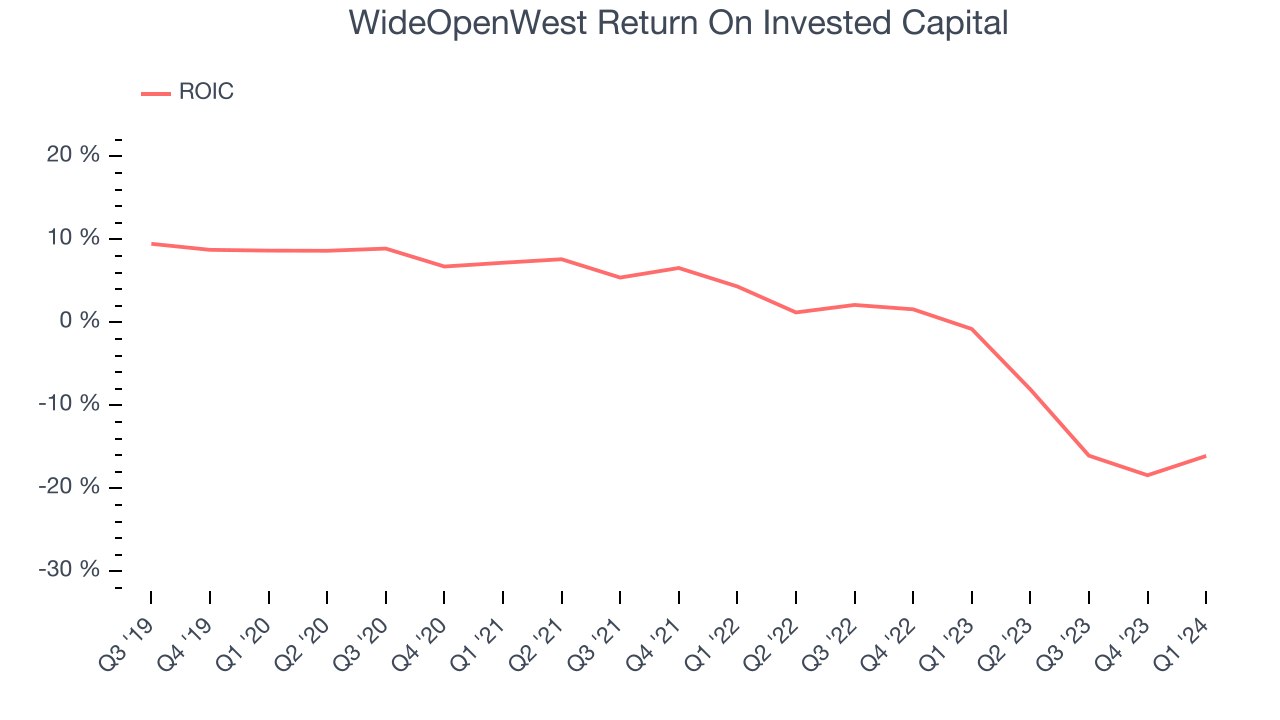

WideOpenWest's five-year average return on invested capital was 0.7%, somewhat low compared to the best consumer discretionary companies that pump out 25%+. Its returns suggest it historically did a subpar job investing in profitable business initiatives.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, WideOpenWest's ROIC significantly decreased over the last few years. Paired with its already low returns, these declines suggest the company's profitable business opportunities are few and far between.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

WideOpenWest, which has $19.2 million of cash and $993.8 million of debt on its balance sheet, was unprofitable over the last 12 months. It posted negative $72.5 million of EBITDA, and as investors in high-quality companies, we seek to avoid indebted loss-making companies.

We implore our readers to do the same because credit agencies could downgrade WideOpenWest if its unprofitable ways continue, making incremental borrowing more expensive and restricting growth prospects. The company could also be backed into a corner if the market turns unexpectedly. We hope WideOpenWest can improve its profitability and remain cautious until then.

Key Takeaways from WideOpenWest's Q1 Results

We struggled to find many strong positives in these results. Its operating margin missed and its EPS fell short of Wall Street's estimates. Overall, the results could have been better. The company is down 3.1% on the results and currently trades at $4.7 per share.

Is Now The Time?

WideOpenWest may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of WideOpenWest, we'll be cheering from the sidelines. Its revenue has declined over the last five years, but at least growth is expected to increase in the short term. And while its projected EPS for the next year implies the company's fundamentals will improve, the downside is its number of subscribers has been disappointing. On top of that, its declining EPS over the last five years makes it hard to trust.

While we've no doubt one can find things to like about WideOpenWest, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $5.67 per share right before these results (compared to the current share price of $4.70).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.