Kitchenware and home goods retailer Williams-Sonoma (NYSE:WSM) reported Q4 FY2023 results exceeding Wall Street analysts' expectations, with revenue down 7.1% year on year to $2.28 billion. It made a non-GAAP profit of $5.44 per share, down from its profit of $5.50 per share in the same quarter last year.

Williams-Sonoma (WSM) Q4 FY2023 Highlights:

- Revenue: $2.28 billion vs analyst estimates of $2.23 billion (2.4% beat)

- EPS (non-GAAP): $5.44 vs analyst estimates of $5.16 (5.5% beat)

- Gross Margin (GAAP): 46%, up from 41.2% in the same quarter last year

- Same-Store Sales were down 6.8% year on year

- Store Locations: 518 at quarter end, decreasing by 12 over the last 12 months

- Market Capitalization: $15.46 billion

Started in 1956 as a store specializing in French cookware, Williams-Sonoma (NYSE:WSM) is a specialty retailer of higher-end kitchenware, home goods, and furniture.

Today, the company has expanded beyond its French cookware roots to offer everything from bedding and bath linens to gourmet food and specialty appliances. The unifying theme in a Williams-Sonoma store is products that are both beautiful and practical.

The core Williams-Sonoma customer is typically a higher-income, educated suburban consumer who values quality and design and isn’t afraid to pay a bit more for it. Some brands that a shopper can find in a Williams-Sonoma store include Le Creuset, KitchenAid, Nespresso, and the company’s own line of kitchenware.

Williams-Sonoma has been one of the more successful retailers to adapt to e-commerce. Before online shopping caught fire, the company was able to build a large database of customer information because of its catalog mailing list. This turned into an email marketing list and a relatively early e-commerce presence.

Home Furniture Retailer

Furniture retailers understand that ‘home is where the heart is’ but that no home is complete without that comfy sofa to kick back on or a dreamy bed to rest in. These stores focus on providing not only what is practically needed in a house but also aesthetics, style, and charm in the form of tables, lamps, and mirrors. Decades ago, it was thought that furniture would resist e-commerce because of the logistical challenges of shipping large furniture, but now you can buy a mattress online and get it in a box a few days later; so just like other retailers, furniture stores need to adapt to new realities and consumer behaviors.

Competitors that offer kitchenware and home goods include TJX (NYSE:TJX), Target (NYSE:TGT), and Walmart (NYSE:WMT).Sales Growth

Williams-Sonoma is larger than most consumer retail companies and benefits from economies of scale, giving it an edge over its competitors.

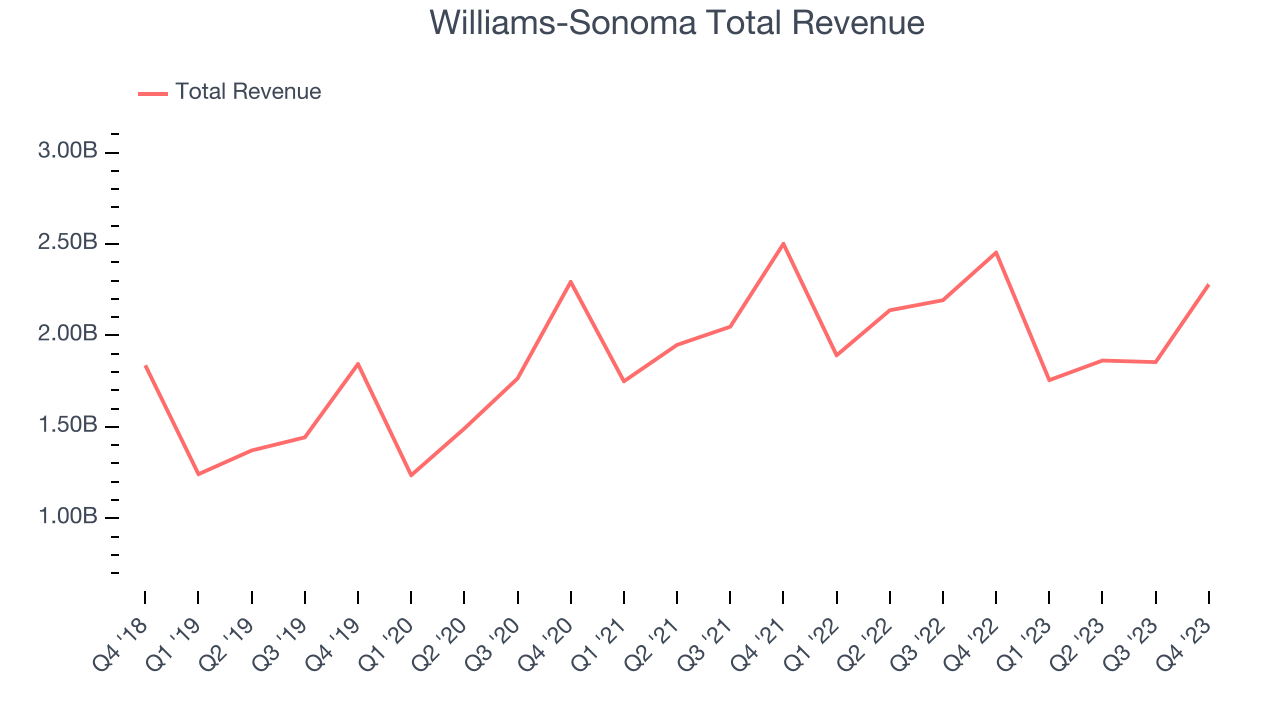

As you can see below, the company's annualized revenue growth rate of 7.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was weak despite closing stores.

This quarter, Williams-Sonoma's revenue fell 7.1% year on year to $2.28 billion but beat Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects revenue to decline 2.1% over the next 12 months.

Number of Stores

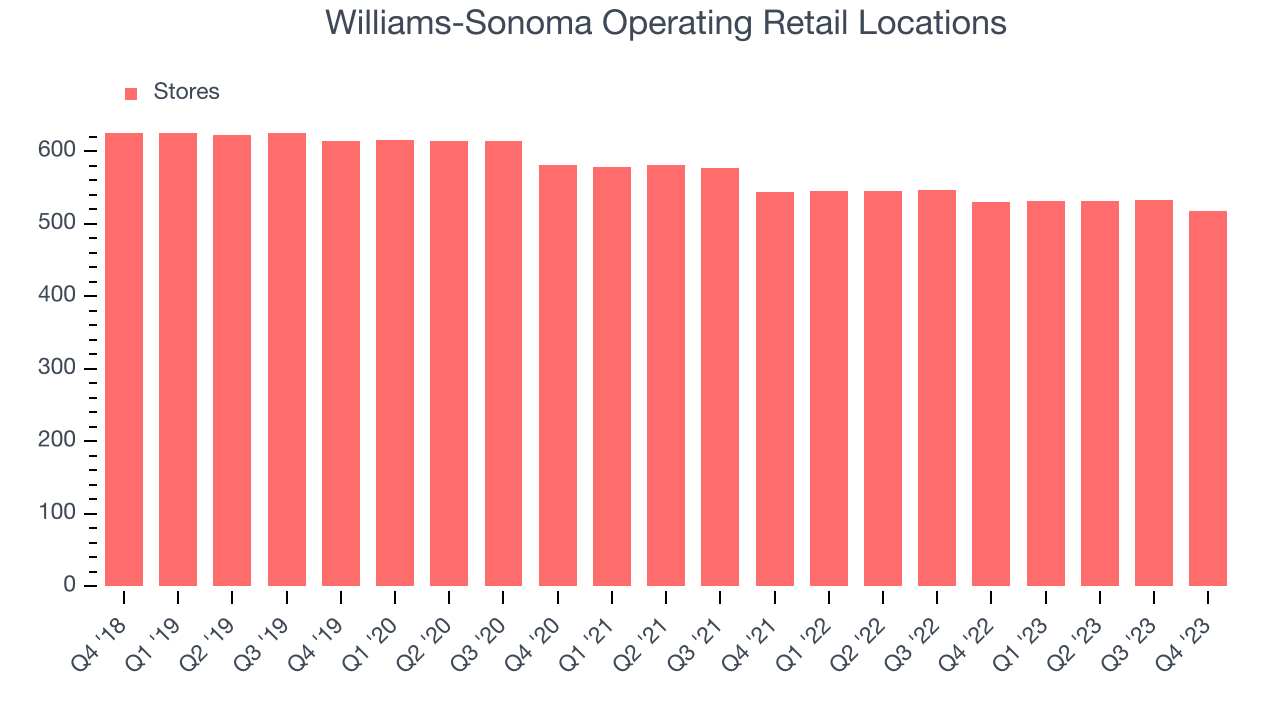

When a retailer like Williams-Sonoma is shuttering stores, it usually means that brick-and-mortar demand is less than supply, and the company is responding by closing underperforming locations and possibly shifting sales online. Williams-Sonoma's store count shrank by 12 locations, or 2.3%, over the last 12 months to 518 total retail locations in the most recently reported quarter.

Taking a step back, the company has generally closed its stores over the last two years, averaging a 3.7% annual decline in its physical footprint. A smaller store base means that the company must rely on higher foot traffic and sales per customer at its remaining stores as well as e-commerce sales to fuel revenue growth.

Same-Store Sales

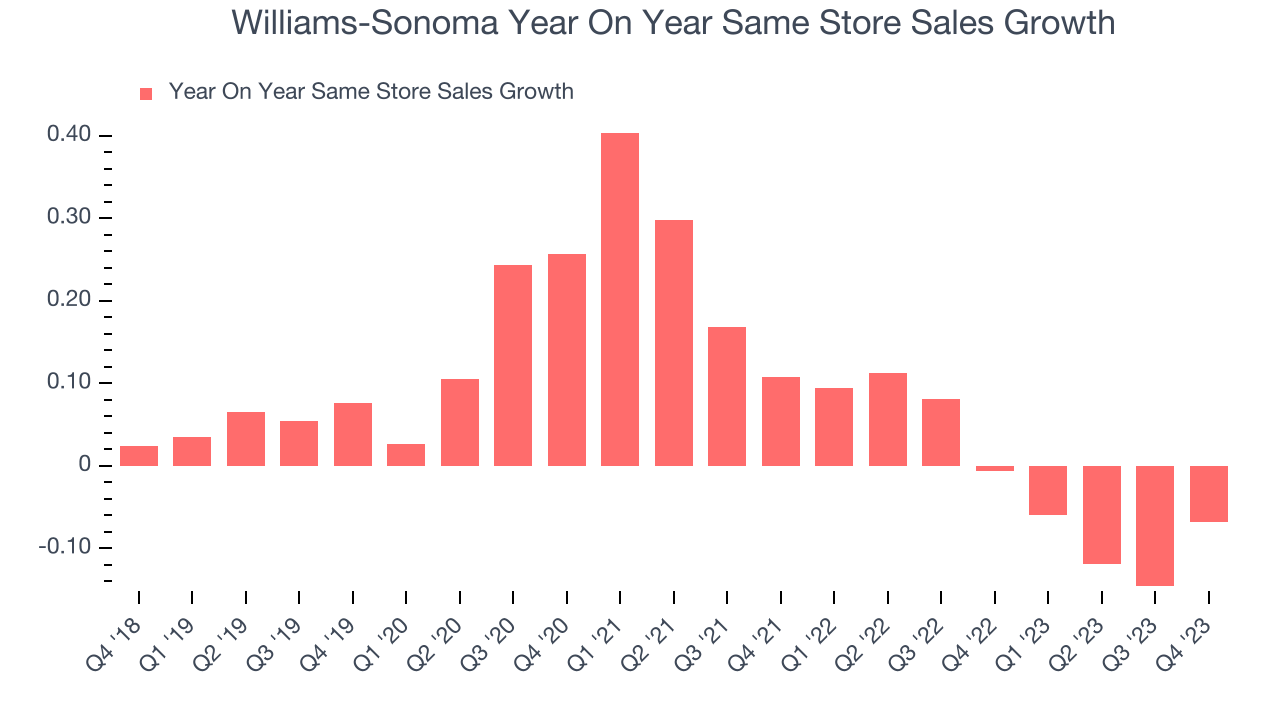

Williams-Sonoma's demand has been shrinking over the last eight quarters, and on average, its same-store sales have declined by 1.4% year on year. The company has been reducing its store count as fewer locations sometimes lead to higher same-store sales, but that hasn't been the case here.

In the latest quarter, Williams-Sonoma's same-store sales fell 6.8% year on year. This decrease was a further deceleration from the 0.6% year-on-year decline it posted 12 months ago. We hope the business can get back on track.

Gross Margin & Pricing Power

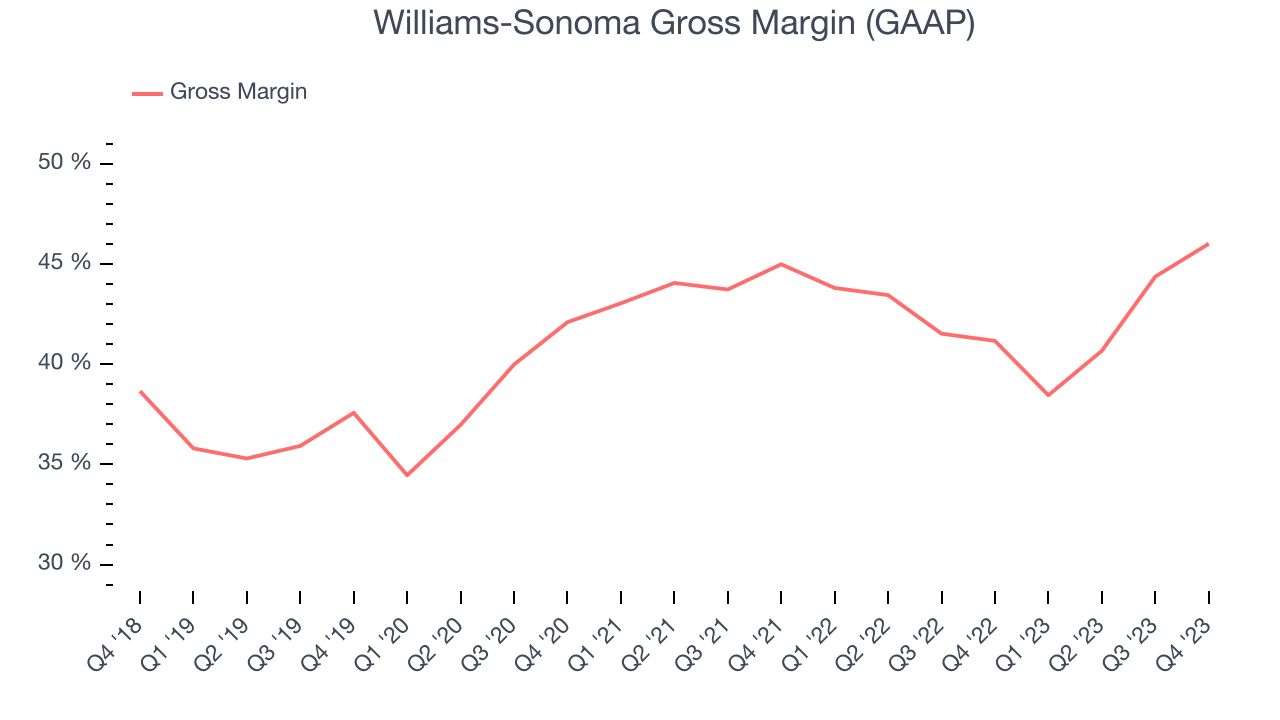

Williams-Sonoma has great unit economics for a retailer, giving it ample room to invest in areas such as marketing and talent to grow its brand. As you can see below, it's averaged an impressive 42.5% gross margin over the last eight quarters. This means the company makes $0.43 for every $1 in revenue before accounting for its operating expenses.

Williams-Sonoma produced a 46% gross profit margin in Q4, marking a 4.8 percentage point increase from 41.2% in the same quarter last year. This margin expansion is a good sign in the near term. It shows the company increased its pricing power, and if this trend continues, it could signal a less competitive environment where it has more negotiating leverage and stable input costs (such as distribution expenses to move goods).

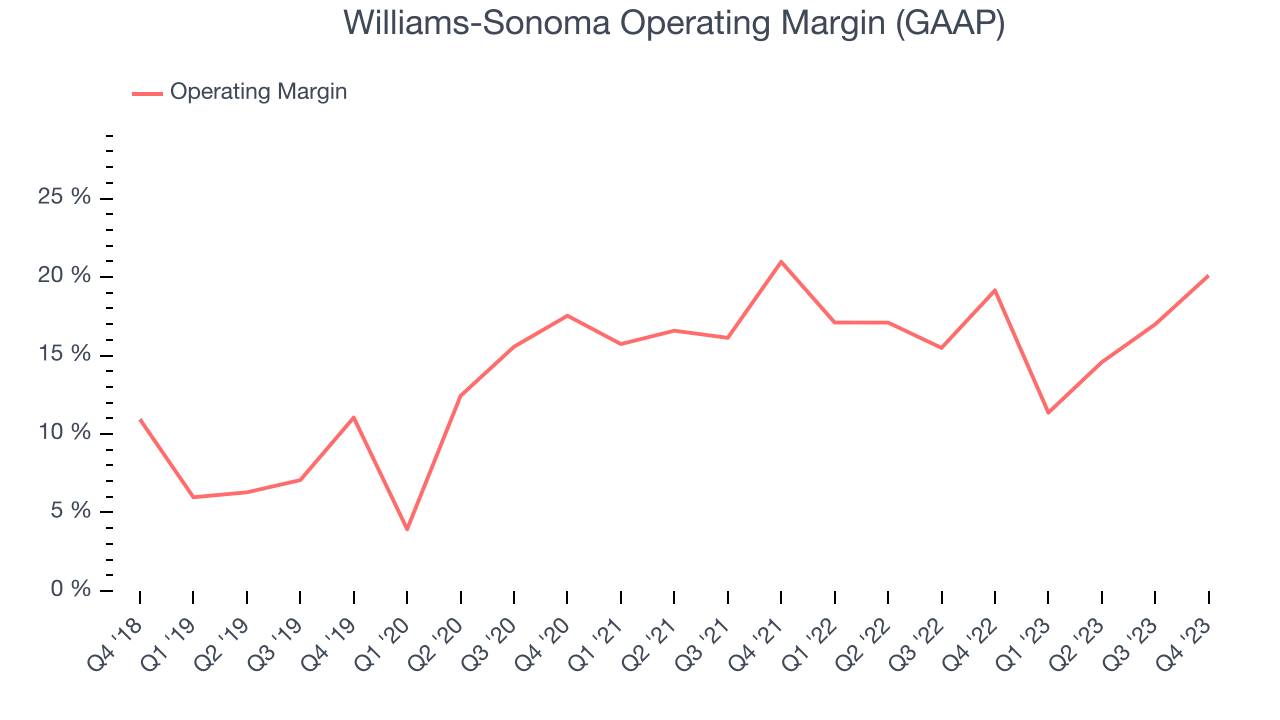

Operating Margin

Operating margin is a key profitability metric for retailers because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Williams-Sonoma generated an operating profit margin of 20.1%, in line with the same quarter last year. This indicates the company's costs have been relatively stable.

Zooming out, Williams-Sonoma has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 16.7%. However, Williams-Sonoma's margin has slightly declined by 1.2 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way.

Zooming out, Williams-Sonoma has been a well-managed company over the last two years. It's demonstrated elite profitability for a consumer retail business, boasting an average operating margin of 16.7%. However, Williams-Sonoma's margin has slightly declined by 1.2 percentage points year on year (on average). This shows the company has faced some small speed bumps along the way. EPS

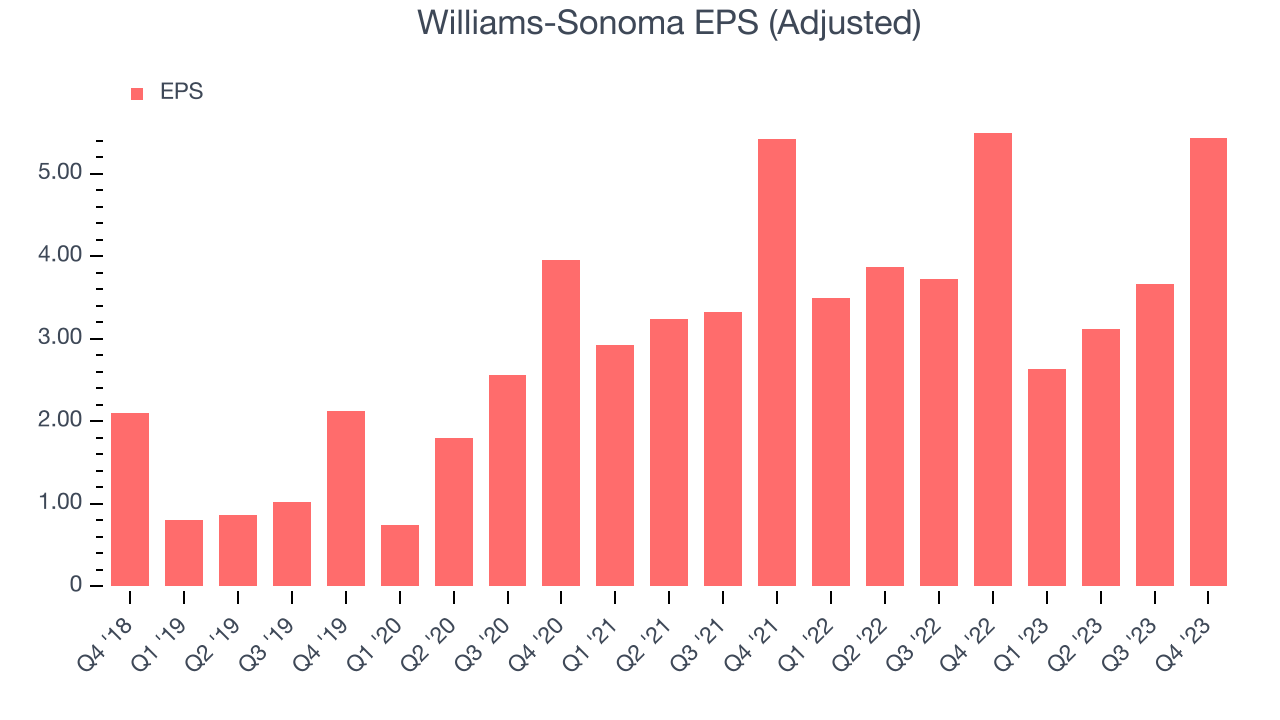

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q4, Williams-Sonoma reported EPS at $5.44, down from $5.50 in the same quarter a year ago. This print beat Wall Street's estimates by 5.5%.

Between FY2019 and FY2023, Williams-Sonoma's adjusted diluted EPS grew 208%, translating into a remarkable 32.4% compounded annual growth rate. This growth is materially higher than its revenue growth over the same period and was driven by excellent expense management (leading to higher profitability) and share repurchases (leading to higher PER share earnings).

Over the next 12 months, however, Wall Street is projecting an average 1.4% year-on-year decline in EPS.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Williams-Sonoma hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 36.2%, splendid for a retail business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Over the last two years, Williams-Sonoma's ROIC averaged 17.5 percentage point increases each year. This is a good sign, and if the company's returns keep rising, there's a chance it could evolve into an investable business.

Key Takeaways from Williams-Sonoma's Q4 Results

We enjoyed seeing Williams-Sonoma exceed analysts' gross margin expectations this quarter. Management noted that although 2023 was the slowest housing market in several decades, it avoided discounting, enabling it to deliver an operating margin ahead of its pre-pandemic profitability.

We were also excited the company's revenue outperformed Wall Street's estimates, driven by better-than-expected same-store sales at its flagship Williams Sonoma brand (1.6% growth vs estimates of negative 0.5%) and Pottery Barn (negative 9.6% vs estimates of negative 10.3%). The revenue and gross margin beats also led to an EPS beat, and management increased the company's quarterly dividend by 26% and share repurchase capacity to $1 billion. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 4.9% after reporting and currently trades at $253 per share.

Is Now The Time?

Williams-Sonoma may have had a good quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Williams-Sonoma isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last four years, and analysts expect growth to deteriorate from here. And while its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits, the downside is its declining physical locations suggests its demand is falling. On top of that, its shrinking same-store sales suggests it'll need to change its strategy to succeed.

Williams-Sonoma's price-to-earnings ratio based on the next 12 months is 16.5x. We can find things to like about Williams-Sonoma and there's no doubt it's a bit of a market darling, at least for some investors. But it seems there's a lot of optimism already priced in and we wonder if there are better opportunities elsewhere right now.

Wall Street analysts covering the company had a one-year price target of $207.32 per share right before these results (compared to the current share price of $253), implying they didn't see much short-term potential in Williams-Sonoma.

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.