Boutique fitness studio franchisor Xponential Fitness (NYSE:XPOF) reported Q1 CY2024 results topping analysts' expectations, with revenue up 12.5% year on year to $79.52 million. The company expects the full year's revenue to be around $345 million, in line with analysts' estimates. It made a non-GAAP profit of $0.16 per share, improving from its loss of $0.01 per share in the same quarter last year.

Xponential Fitness (XPOF) Q1 CY2024 Highlights:

- Revenue: $79.52 million vs analyst estimates of $78.77 million (small beat)

- Adjusted EBITDA: $29.8 million vs analyst estimates of $29.5 million (small beat)

- The company reconfirmed its revenue guidance for the full year of $345 million at the midpoint (reconfirmed its full year adjusted EBITDA guidance as well)

- Gross Margin (GAAP): 75.5%, up from 74.4% in the same quarter last year

- Free Cash Flow of $1.84 million is up from -$4.05 million in the previous quarter

- Market Capitalization: $410.9 million

Owner of CycleBar, Rumble, and Club Pilates, Xponential Fitness (NYSE:XPOF) is a boutique fitness brand offering diverse and specialized exercise experiences.

Xponential Fitness was established to create a variety of boutique fitness studios catering to different exercise preferences and fitness goals. The company's brands fulfill the rising demand for specialized fitness regimes that move beyond the one-size-fits-all approach of traditional gyms.

Xponential Fitness developed its studio portfolio through numerous acquisitions, and its offerings range from pilates and boxing to rowing and cardio dance. Each of its acquired brands is chosen for its leadership potential in its specific fitness vertical.

The company primarily operates through a franchise model, and its franchisees are typically those seeking to benefit from the thriving health and wellness sector. Xponential Fitness generates revenue through franchise fees, subscriptions, and equipment and merchandise sales to franchisees. Its XPASS offering represents its subscription revenue and enables consumers to book classes across its umbrella of fitness studios.

Leisure Facilities

Leisure facilities companies often sell experiences rather than tangible products, and in the last decade-plus, consumers have slowly shifted their spending from "things" to "experiences". Leisure facilities seek to benefit but must innovate to do so because of the industry's high competition and capital intensity.

Competitors offering fitness experiences include private company Equinox, Life Time (NYSE:LTH), and Planet Fitness (NYSE:PLNT).Sales Growth

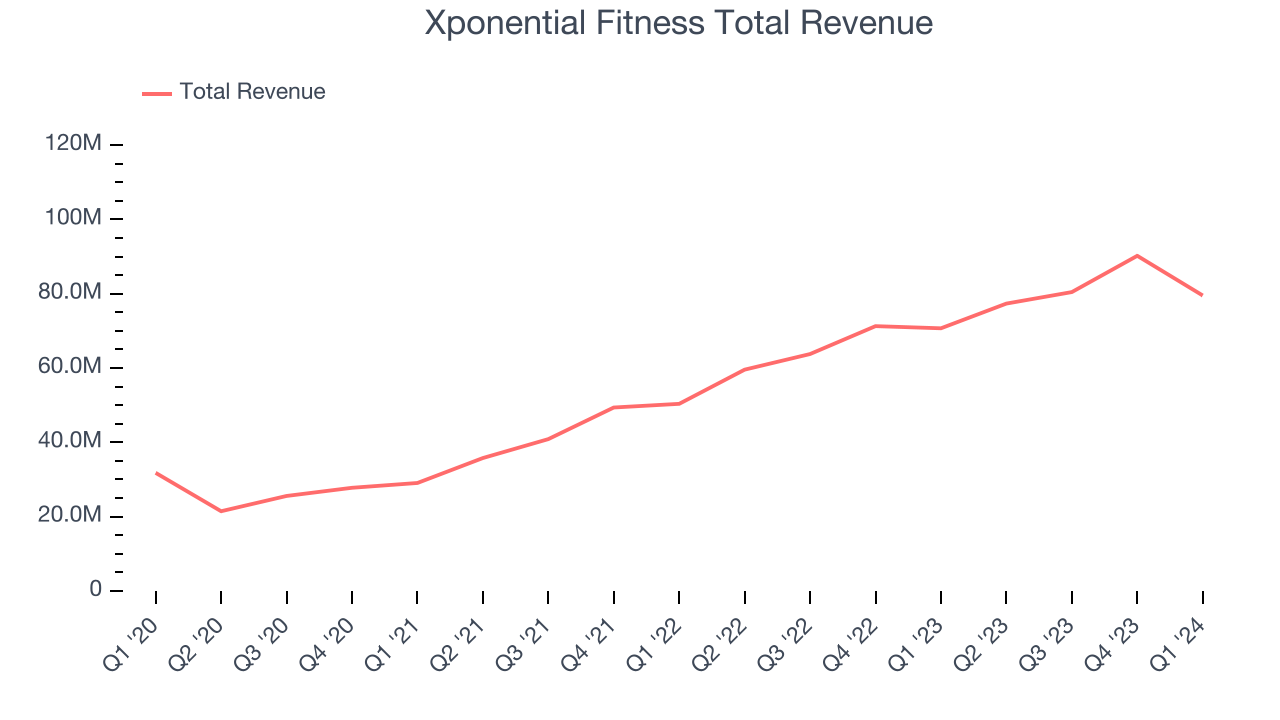

Reviewing a company's long-term performance can reveal insights into its business quality. Any business can have short-term success, but a top-tier one sustains growth for years. Xponential Fitness's annualized revenue growth rate of 46.6% over the last three years was incredible for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Xponential Fitness's recent history shows its momentum has slowed as its annualized revenue growth of 36.3% over the last two years is below its three-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Xponential Fitness's recent history shows its momentum has slowed as its annualized revenue growth of 36.3% over the last two years is below its three-year trend.

We can dig even further into the company's revenue dynamics by analyzing its three most important segments: Franchise, Equipment, and Merchandise, which are 52.5%, 0%, and 0% of revenue. Over the last two years, Xponential Fitness's revenues in all three segments increased.Franchise revenue (royalty fees) averaged year-on-year growth of 34% while Equipment (apparel sold to franchisees) and Merchandise (workout equipment sold to franchisees) averaged 41.6% and 13.1%.

This quarter, Xponential Fitness reported robust year-on-year revenue growth of 12.5%, and its $79.52 million of revenue exceeded Wall Street's estimates by 0.9%. Looking ahead, Wall Street expects sales to grow 8.4% over the next 12 months, a deceleration from this quarter.

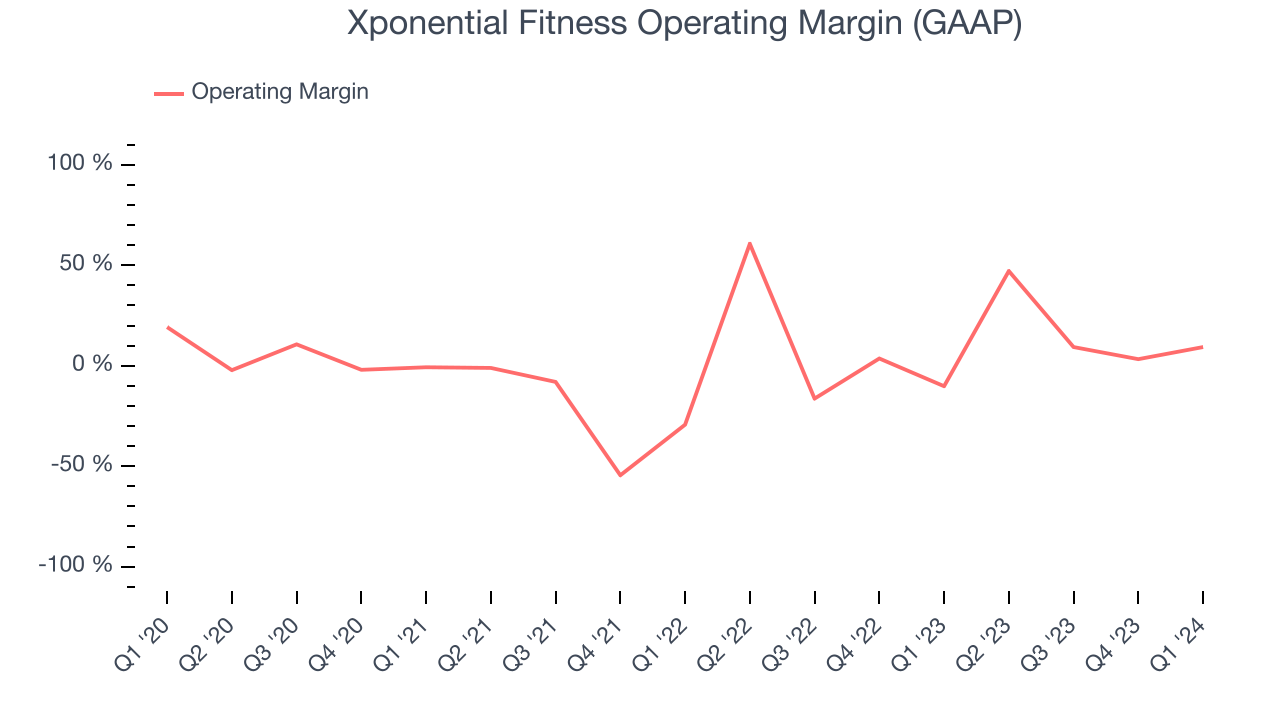

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

Xponential Fitness has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 12.7%, higher than the broader consumer discretionary sector.

In Q1, Xponential Fitness generated an operating profit margin of 9.3%, up 19.5 percentage points year on year.

Over the next 12 months, Wall Street expects Xponential Fitness to become more profitable. Analysts are expecting the company’s LTM operating margin of 16.6% to rise to 30%.EPS

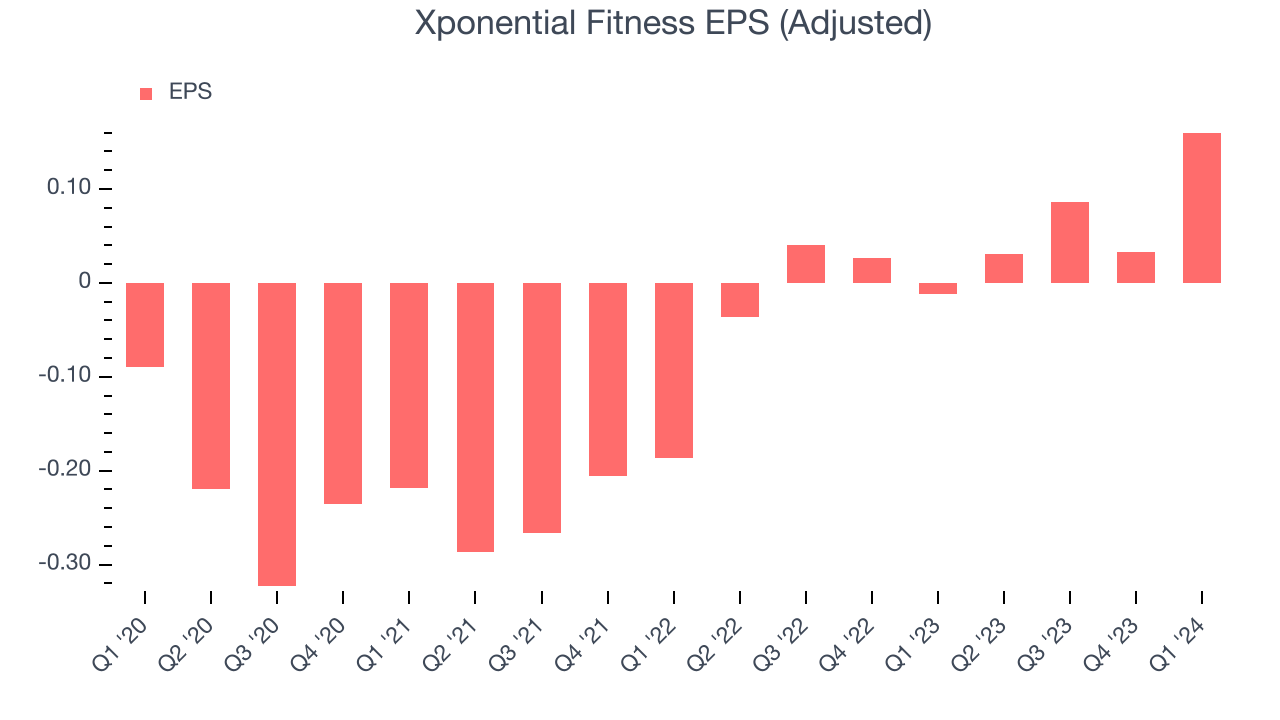

Analyzing long-term revenue trends tells us about a company's historical growth, but the long-term change in its earnings per share (EPS) points to the profitability and efficiency of that growth–for example, a company could inflate its sales through excessive spending on advertising and promotions.

Over the last three years, Xponential Fitness cut its earnings losses and improved its EPS by 32.2% each year.

In Q1, Xponential Fitness reported EPS at $0.16, up from negative $0.01 in the same quarter last year. Despite growing year on year, this print unfortunately missed analysts' estimates, but we care more about long-term EPS growth rather than short-term movements. Over the next 12 months, Wall Street expects Xponential Fitness to grow its earnings. Analysts are projecting its LTM EPS of $0.31 to climb by 347% to $1.38.

Cash Is King

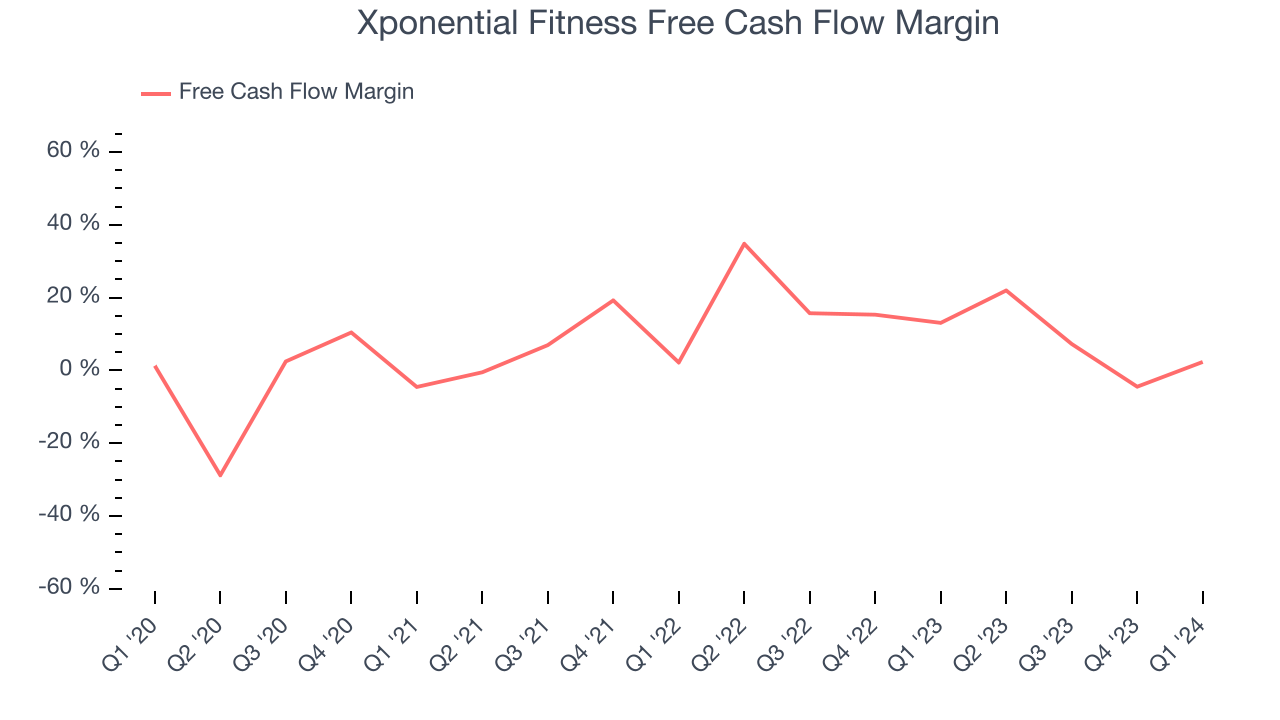

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, Xponential Fitness has shown decent cash profitability, giving it some reinvestment opportunities. The company's free cash flow margin has averaged 12.1%, slightly better than the broader consumer discretionary sector.

Xponential Fitness's free cash flow came in at $1.84 million in Q1, equivalent to a 2.3% margin and down 80.1% year on year.

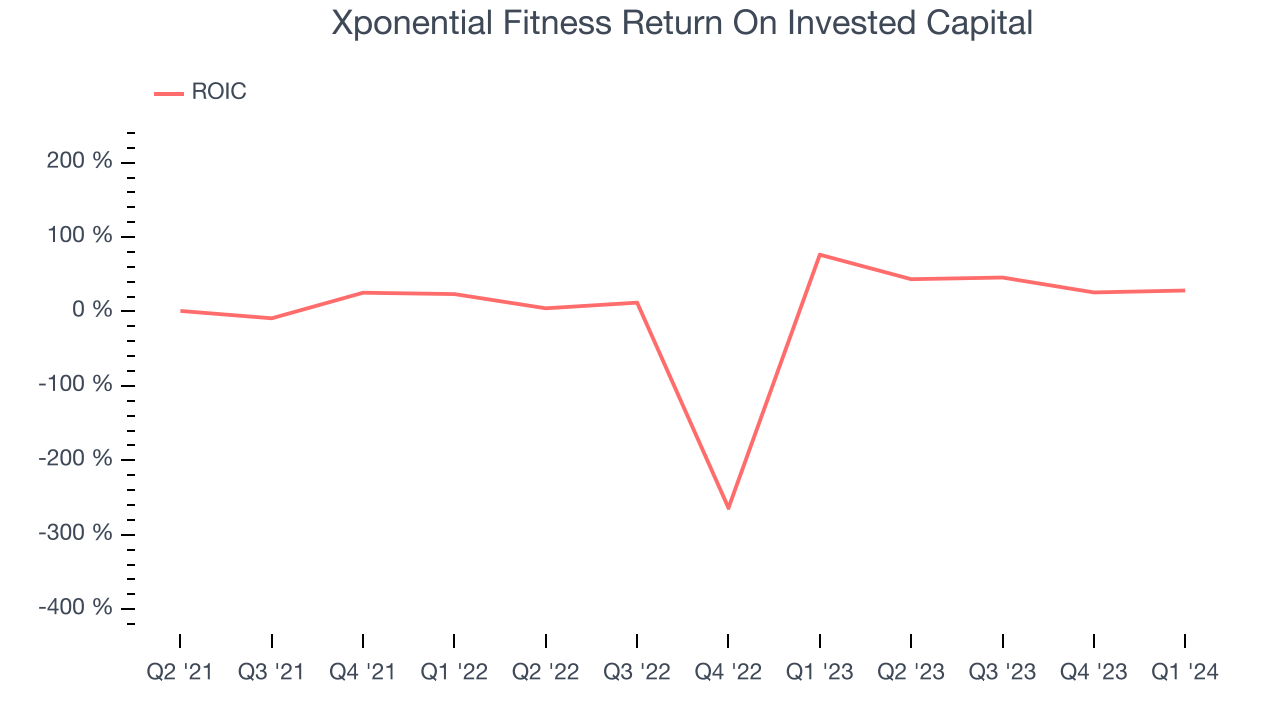

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit a company makes compared to how much money the business raised (debt and equity).

Xponential Fitness's five-year average ROIC was 42.6%, placing it among the best consumer discretionary companies. Just as you’d like your investment dollars to generate returns, Xponential Fitness's invested capital has produced excellent profits.

Balance Sheet Risk

As long-term investors, the risk we care most about is the permanent loss of capital. This can happen when a company goes bankrupt or raises money from a disadvantaged position and is separate from short-term stock price volatility, which we are much less bothered by.

Xponential Fitness reported $27.22 million of cash and $378.2 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $112.3 million of EBITDA over the last 12 months, we view Xponential Fitness's 3.1x net-debt-to-EBITDA ratio as safe. We also see its $18.6 million of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from Xponential Fitness's Q1 Results

It was encouraging to see Xponential Fitness narrowly top analysts' revenue and adjusted EBITDA expectations this quarter. Adjusted EBITDA also beat by a small amount, and the company reaffirmed full year guidance, showing that it's staying on track. Overall, this was a solid quarter for Xponential Fitness. The stock is up 17.2% after reporting and currently trades at $15.75 per share.

Is Now The Time?

Xponential Fitness may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Xponential Fitness is a great business. For starters, its revenue growth has been exceptional over the last three years. On top of that, its stellar ROIC suggests it has been a well-run company historically, and its projected EPS for the next year implies the company's fundamentals will improve.

Xponential Fitness's price-to-earnings ratio based on the next 12 months is 9.7x. Looking at the consumer discretionary landscape today, Xponential Fitness's qualities stand out and we like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $24.96 per share right before these results (compared to the current share price of $15.75), implying they saw upside in buying Xponential Fitness in the short term.

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.