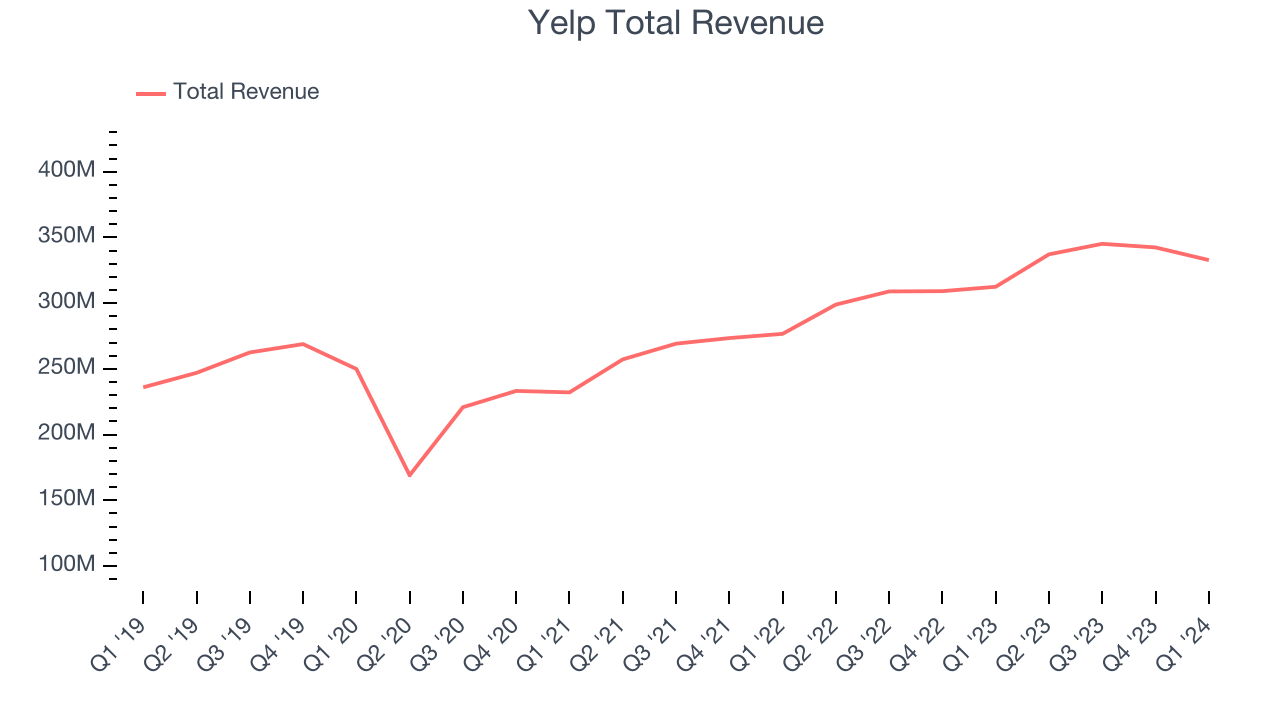

Local business platform Yelp (NYSE:YELP) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 6.5% year on year to $332.8 million. It made a GAAP profit of $0.20 per share, improving from its loss of $0.02 per share in the same quarter last year.

Yelp (YELP) Q1 CY2024 Highlights:

- Revenue: $332.8 million vs analyst estimates of $333.4 million (small miss)

- Adjusted EBITDA: $64.5 million vs analyst estimates of $50.5 million (big beat)

- EPS: $0.20 vs analyst estimates of $0.06 ($0.14 beat)

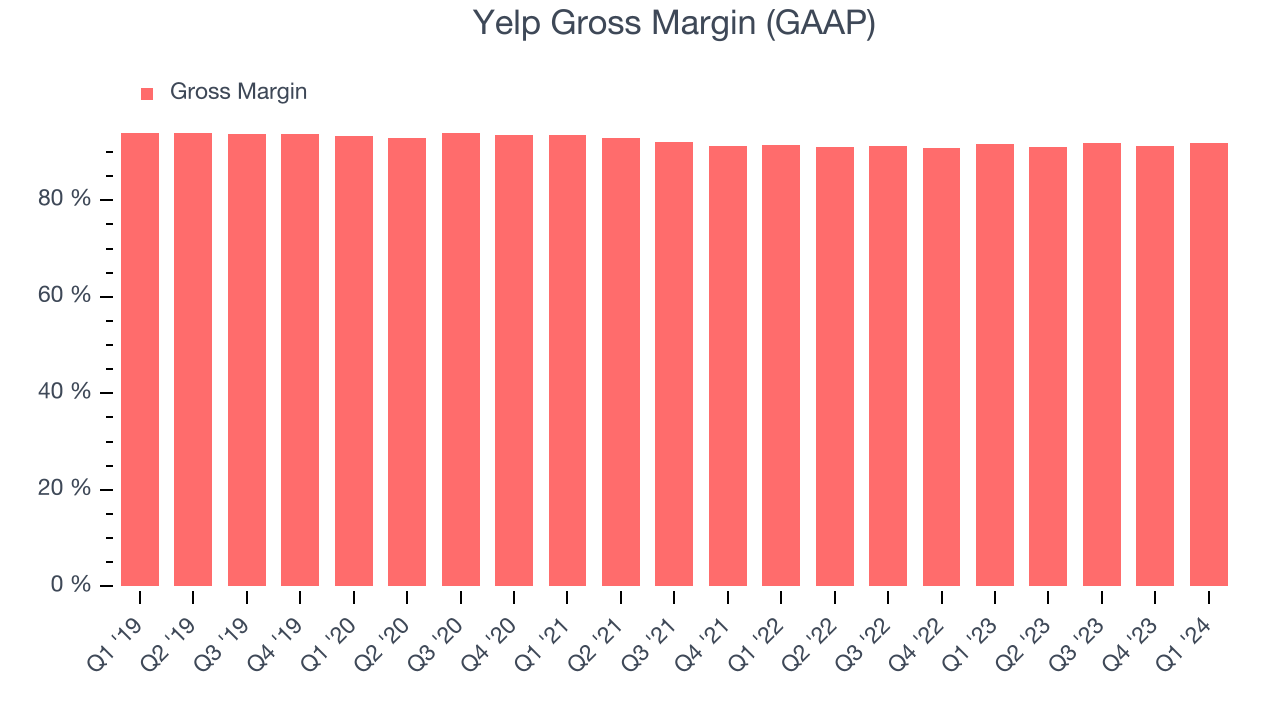

- Gross Margin (GAAP): 91.8%, in line with the same quarter last year

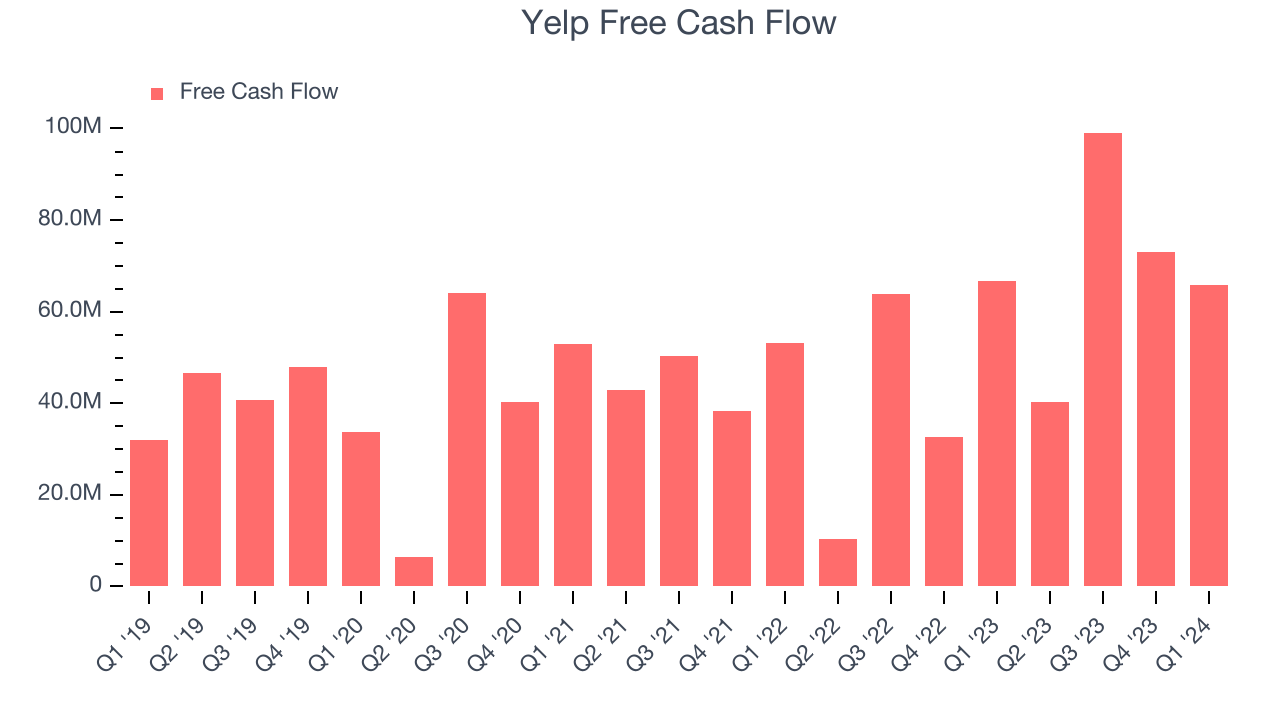

- Free Cash Flow of $65.87 million, similar to the previous quarter

- Market Capitalization: $2.66 billion

Founded by PayPal alumni Jeremy Stoppelman and Russel Simmons, Yelp (NYSE:YELP) is an online platform that helps people discover local businesses through crowd-sourced reviews.

Yelp is an online platform that provides consumer ratings, reviews, and photos of millions of local businesses. Consumers benefit from a network effect as the more users of the platform the more reviews get generated over time, improving the overall quality of Yelp’s platform.

For businesses, Yelp offers both free and paid products to engage with potential customers. Any business can register for a free account by claiming their businesses’ listing page and providing basic information. They can also respond to reviews (especially negative ones).

Yelp also offers paid advertising for businesses to promote themselves through premium services such as targeted search advertising and add-ons to their listing pages. Some examples include the ability to order food, make reservations at restaurants, and submit a “Request-A-Quote” for home and local services. Yelp also provides businesses with analytics regarding store-level visits through integrations with third-party data providers.

Social Networking

Businesses must meet their customers where they are, which over the past decade has come to mean on social networks. In 2020, users spent over 2.5 hours a day on social networks, a figure that has increased every year since measurement began. As a result, businesses continue to shift their advertising and marketing dollars online.

Yelp competes with online advertising platforms Google (NASDAQ:GOOGL) and Meta Platforms (NASDAQ:META), along with home services lead generation players like ANGI (NASDAQ:ANGI), and Porch Group (NASDAQ:PRCH).

Sales Growth

Yelp's revenue growth over the last three years has been mediocre, averaging 17.4% annually. This quarter, Yelp reported mediocre 6.5% year-on-year revenue growth, missing Wall Street's expectations.

Ahead of the earnings results, analysts were projecting sales to grow 7.3% over the next 12 months.

Pricing Power

A company's gross profit margin has a major impact on its ability to exert pricing power, develop new products, and invest in marketing. These factors may ultimately determine the winner in a competitive market, making it a critical metric to track for the long-term investor.

Yelp's gross profit margin, which tells us how much money the company gets to keep after covering the base cost of its products and services, came in at 91.8% this quarter, up 0.1 percentage points year on year.

For social network businesses like Yelp, these aforementioned costs typically include customer service, data center, and other infrastructure expenses. After paying for these expenses, Yelp had $0.92 for every $1 in revenue to invest in marketing, talent, and the development of new products and services.

Yelp's gross margins have been relatively stable over the last year, averaging 91.5%. Its margins are some of the highest in the consumer internet sector, enabling it to fund large investments in product and marketing during periods of rapid growth to stay one step ahead of the competition.

User Acquisition Efficiency

Unlike enterprise software that's typically sold by dedicated sales teams, consumer internet businesses like Yelp grow from a combination of product virality, paid advertisement, and incentives.

Yelp is efficient at acquiring new users, spending 44.9% of its gross profit on sales and marketing expenses over the last year. This level of efficiency indicates relatively solid competitive positioning, giving Yelp the freedom to invest its resources into new growth initiatives.

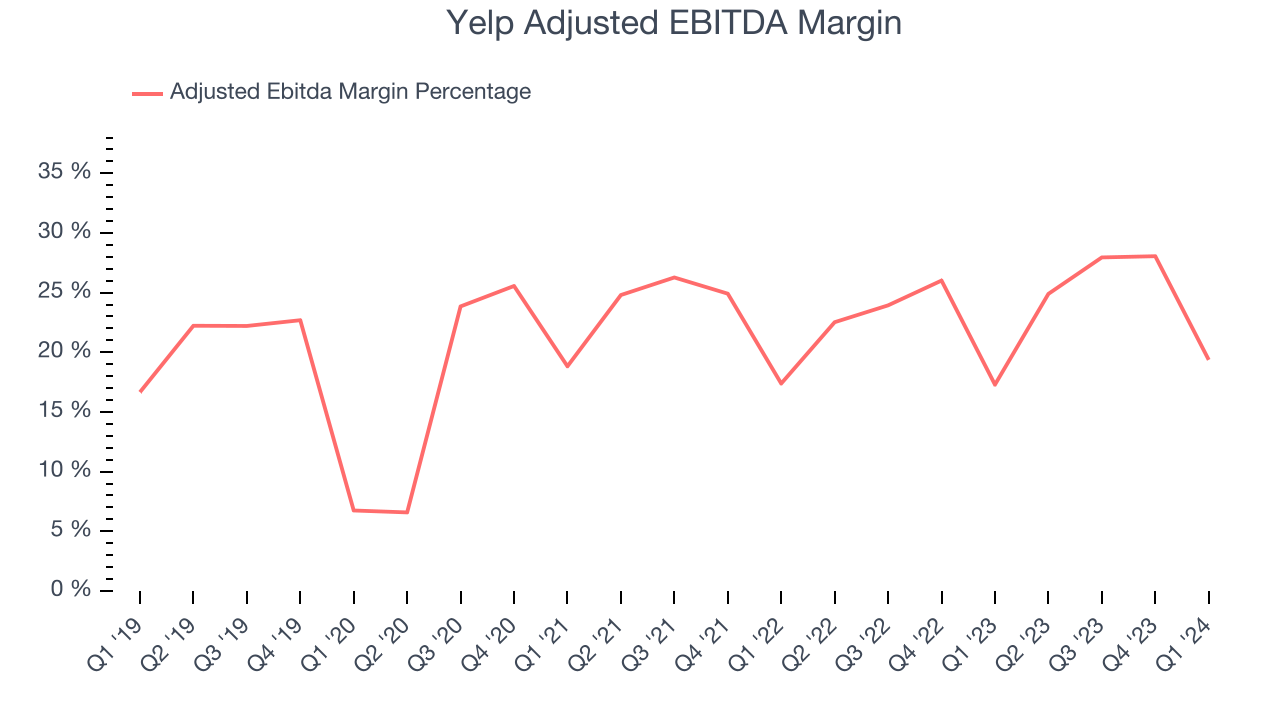

Profitability & Free Cash Flow

Investors frequently analyze operating income to understand a business's core profitability. Similar to operating income, adjusted EBITDA is the most common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of a company's profit potential.

Yelp reported EBITDA of $64.46 million this quarter, resulting in a 19.4% margin. Additionally, Yelp has demonstrated extremely high profitability over the last four quarters, with average EBITDA margins of 25.1%.

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills. Yelp's free cash flow came in at $65.87 million in Q1, roughly the same as last year.

Yelp has generated $278.6 million in free cash flow over the last 12 months, an eye-popping 20.5% of revenue. This robust FCF margin stems from its asset-lite business model, scale advantages, and strong competitive positioning, giving it the option to return capital to shareholders or reinvest in its business while maintaining a healthy cash balance.

Key Takeaways from Yelp's Q1 Results

Yelp's revenue growth regrettably slowed and its revenue missed Wall Street's estimates. On the other hand, adjusted EBITDA came in ahead. Overall, this was a mixed quarter for Yelp. The company is down 5.3% on the results and currently trades at $37.55 per share.

Is Now The Time?

Yelp may have had a mixed quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

There are several reasons why we think Yelp is a great business. While we'd expect growth rates to moderate from here, its revenue growth has been decent over the last three years. Additionally, its impressive gross margins are a wonderful starting point for the overall profitability of the business and its powerful free cash flow generation enables it to stay ahead of the competition through consistent reinvestment of profits.

At the moment, Yelp trades at 8.6x next 12 months EV-to-EBITDA. Looking at the consumer internet landscape today, Yelp's qualities stand out, and we like the stock at this price.

Wall Street analysts covering the company had a one-year price target of $46.43 per share right before these results (compared to the current share price of $37.55), implying they saw upside in buying Yelp in the short term.

To get the best start with StockStory check out our most recent Stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for the companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.