Outdoor lifestyle products brand (NYSE:YETI) announced better-than-expected results in Q1 CY2024, with revenue up 12.7% year on year to $341.4 million. It made a non-GAAP profit of $0.34 per share, improving from its profit of $0.18 per share in the same quarter last year.

Is now the time to buy YETI? Find out by accessing our full research report, it's free.

YETI (YETI) Q1 CY2024 Highlights:

- Revenue: $341.4 million vs analyst estimates of $333.3 million (2.4% beat)

- EPS (non-GAAP): $0.34 vs analyst estimates of $0.24 (39.1% beat)

- Gross Margin (GAAP): 57.1%, up from 53.5% in the same quarter last year

- Free Cash Flow was -$114.3 million, down from $159.5 million in the previous quarter

- Market Capitalization: $2.97 billion

Matt Reintjes, President and Chief Executive Officer, commented, “First quarter results were highlighted by balanced, double-digit growth across both our wholesale and direct-to-consumer channels, as well as our Drinkware and Coolers & Equipment categories. This performance was punctuated by our international sales mix reaching a record 19% coupled with re-acceleration in domestic growth. Profitability continued to show strength with both adjusted gross margin and adjusted operating margin expanding nearly 450 basis points during the period. Additionally, we completed our previously announced acquisitions, and entered into a $100 million accelerated share repurchase agreement.”

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

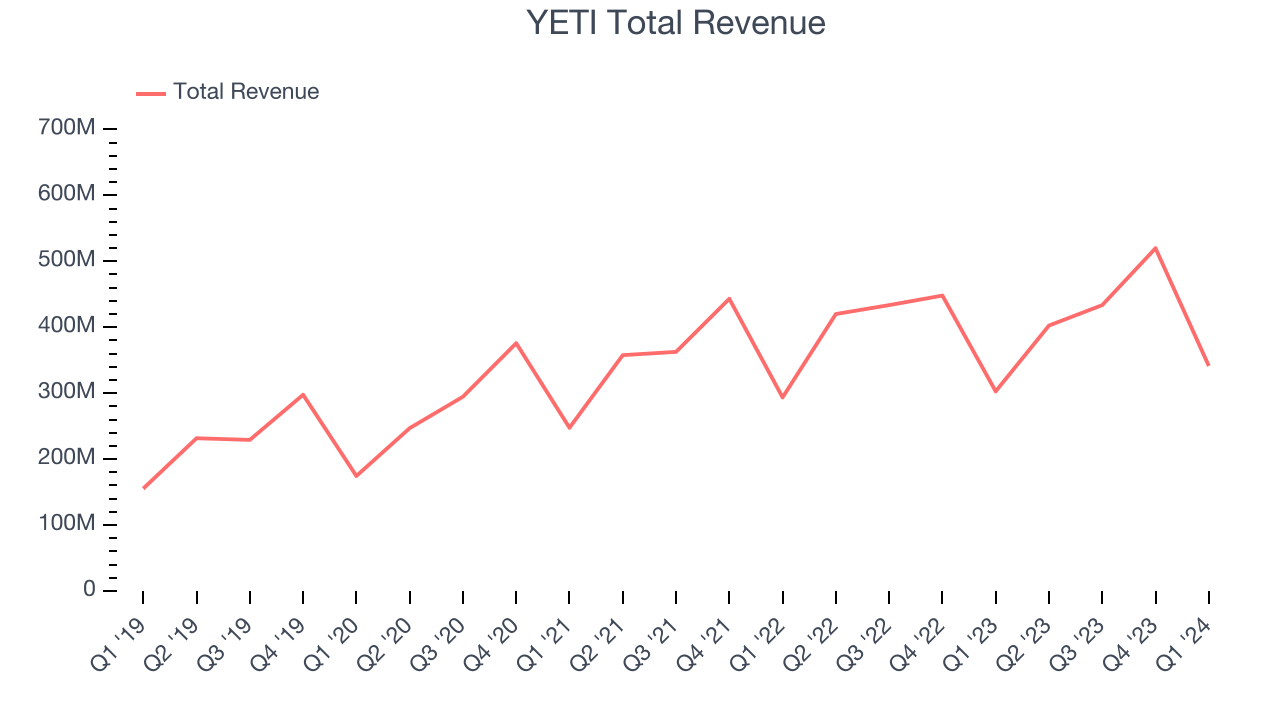

Sales Growth

A company’s long-term performance can give signals about its business quality. Even a bad business can shine for one or two quarters, but a top-tier one may grow for years. YETI's annualized revenue growth rate of 16.3% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. YETI's recent history shows the business has slowed as its annualized revenue growth of 7.9% over the last two years is below its five-year trend.

Within consumer discretionary, a long-term historical view may miss a company riding a successful new product or emerging trend. That's why we also follow short-term performance. YETI's recent history shows the business has slowed as its annualized revenue growth of 7.9% over the last two years is below its five-year trend.

This quarter, YETI reported robust year-on-year revenue growth of 12.7%, and its $341.4 million of revenue exceeded Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 8% over the next 12 months, a deceleration from this quarter.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

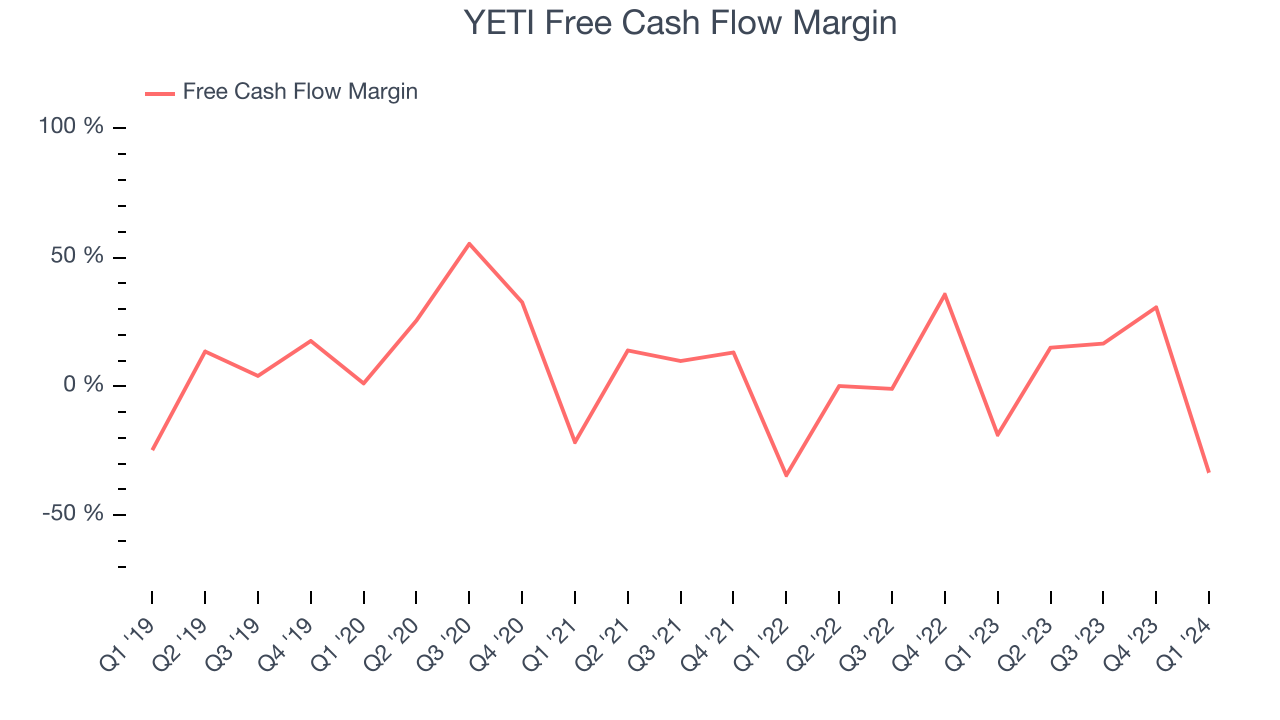

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, YETI has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.4%, subpar for a consumer discretionary business.

YETI burned through $114.3 million of cash in Q1, equivalent to a negative 33.5% margin, reducing its cash burn by 101% year on year. Over the next year, analysts predict YETI's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 10.5% will decrease to 7.9%.

Key Takeaways from YETI's Q1 Results

We were impressed by how significantly YETI blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. While full year revenue guidance was maintained, EPS guidance was raised. Overall, we think this was a really good quarter that should please shareholders. The stock is up 9% after reporting and currently trades at $38 per share.

YETI may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.