Outdoor lifestyle products brand (NYSE:YETI) reported Q1 CY2024 results beating Wall Street analysts' expectations, with revenue up 12.7% year on year to $341.4 million. It made a non-GAAP profit of $0.34 per share, improving from its profit of $0.18 per share in the same quarter last year.

YETI (YETI) Q1 CY2024 Highlights:

- Revenue: $341.4 million vs analyst estimates of $333.3 million (2.4% beat)

- EPS (non-GAAP): $0.34 vs analyst estimates of $0.24 (39.1% beat)

- Maintained full year revenue guidance, increased full year EPS guidance

- Gross Margin (GAAP): 57.1%, up from 53.5% in the same quarter last year

- Free Cash Flow was -$114.3 million, down from $159.5 million in the previous quarter

- Market Capitalization: $2.97 billion

Founded by two brothers from Texas, YETI (NYSE:YETI) specializes in durable outdoor goods including coolers, drinkware, and other gear tailored to adventure enthusiasts.

YETI was born out of frustration with the fragility of standard coolers that failed to meet the rigorous demands of outdoor activities. The founders, two avid outdoorsmen, established the company in 2006 to craft a cooler that could keep food and drinks cool for extended periods of time, withstand harsh conditions, and generally outlast the competition through better durability.

YETI's products command premium prices, which are made possible by its loyal customer base that is willing to pay more for quality and durability. The company's business model involves direct-to-consumer sales through its website and select retail partnerships. It also sponsors various sporting events to market itself to consumers.

Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Competitors in the outdoor and recreation goods industry include Vista Outdoor (NYSE:VSTO), Johnson Outdoors (NASDAQ:JOUT), and Clarus Corporation (NASDAQ:CLAR).Sales Growth

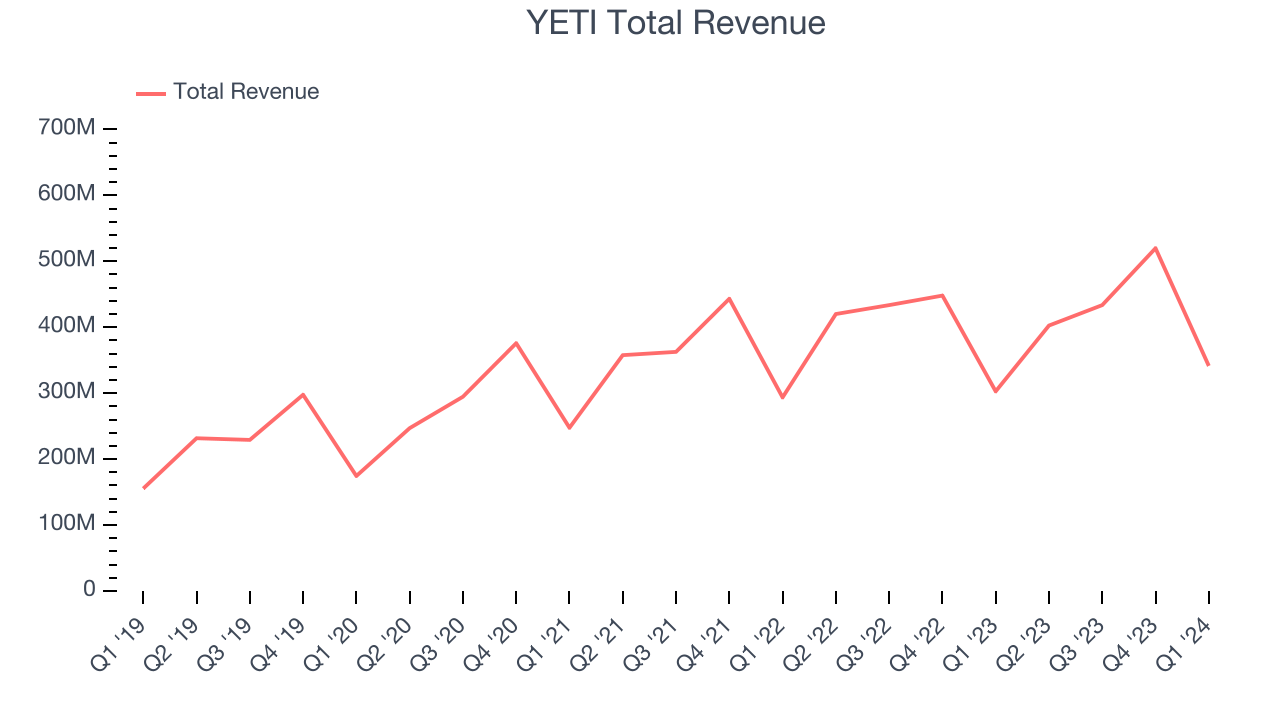

A company’s long-term performance can give signals about its business quality. Any business can put up a good quarter or two, but many enduring ones muster years of growth. YETI's annualized revenue growth rate of 16.3% over the last five years was decent for a consumer discretionary business.  Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. YETI's recent history shows the business has slowed as its annualized revenue growth of 7.9% over the last two years is below its five-year trend.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. YETI's recent history shows the business has slowed as its annualized revenue growth of 7.9% over the last two years is below its five-year trend.

This quarter, YETI reported robust year-on-year revenue growth of 12.7%, and its $341.4 million of revenue exceeded Wall Street's estimates by 2.4%. Looking ahead, Wall Street expects sales to grow 8% over the next 12 months, a deceleration from this quarter.

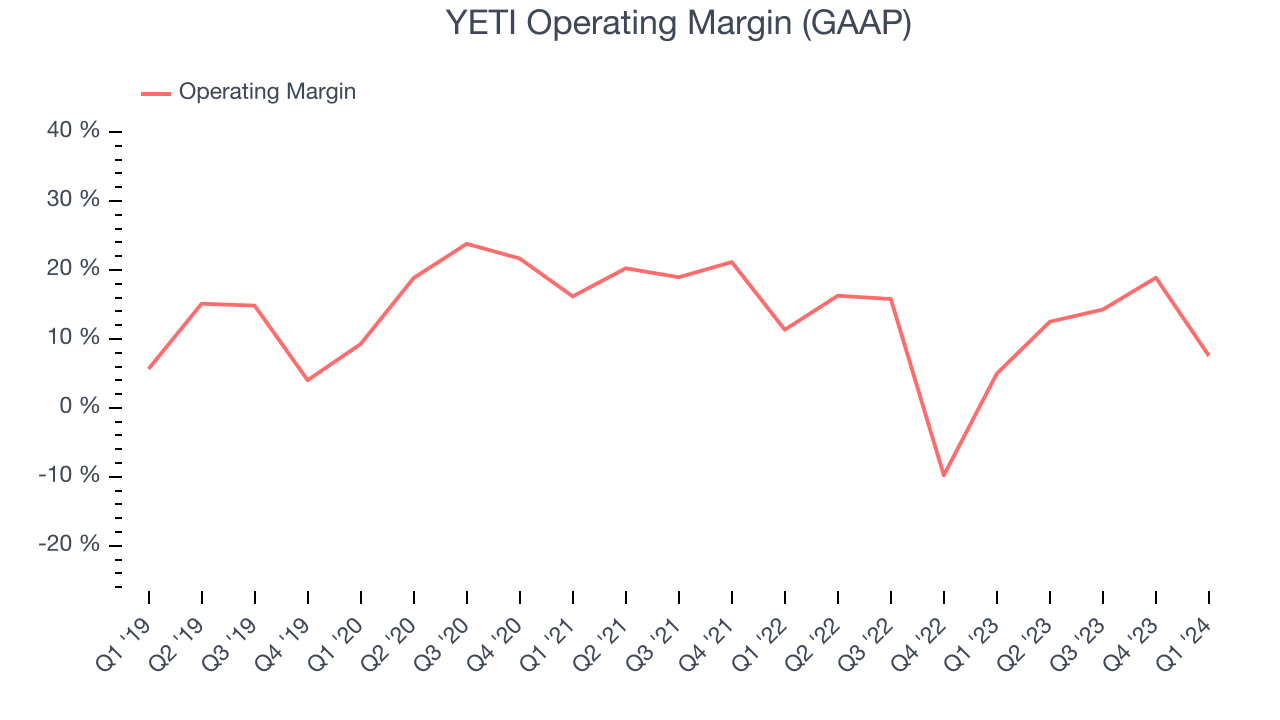

Operating Margin

Operating margin is an important measure of profitability. It’s the portion of revenue left after accounting for all core expenses–everything from the cost of goods sold to advertising and wages. Operating margin is also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

YETI has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 10.4%, higher than the broader consumer discretionary sector.

This quarter, YETI generated an operating profit margin of 7.6%, up 2.6 percentage points year on year.

Over the next 12 months, Wall Street expects YETI to become more profitable. Analysts are expecting the company’s LTM operating margin of 13.9% to rise to 16%.EPS

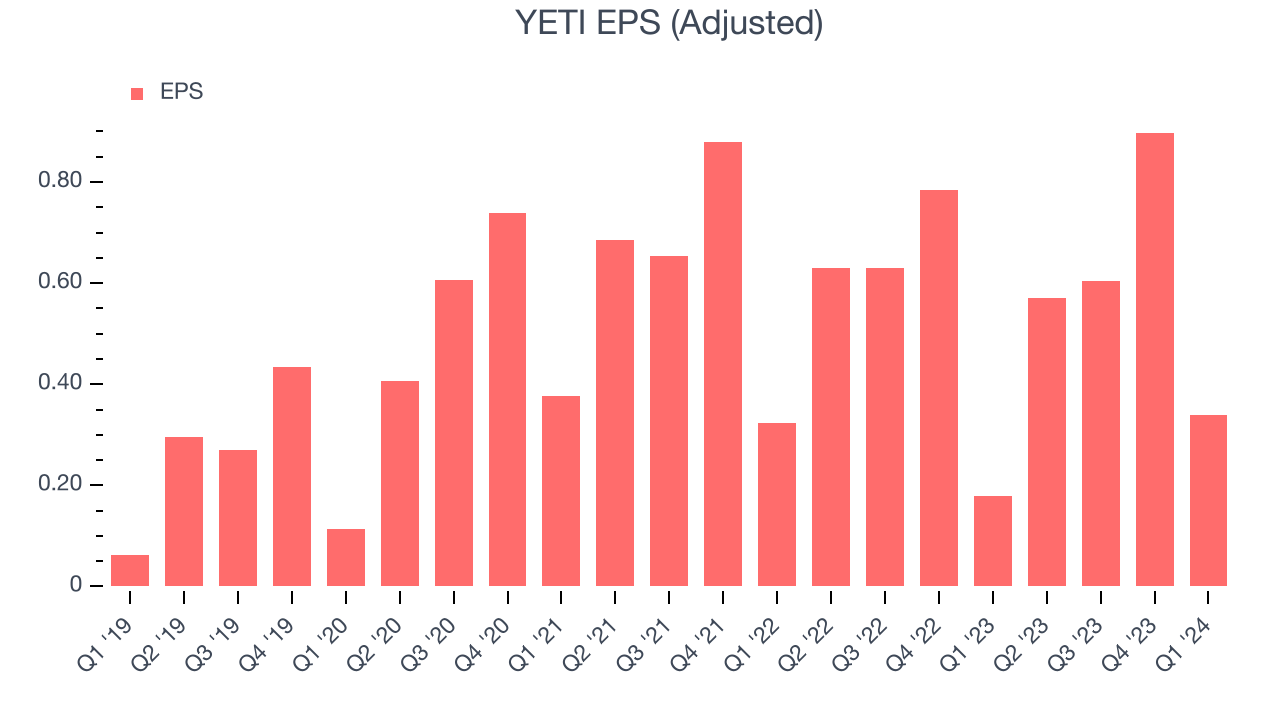

We track long-term historical earnings per share (EPS) growth for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company's growth was profitable.

Over the last five years, YETI's EPS grew 151%, translating into a remarkable 20.2% compounded annual growth rate. This performance is higher than its 16.3% annualized revenue growth over the same period. Let's dig into why.

YETI's operating margin has expanded 1.9 percentage points over the last five years, leading to higher profitability and earnings. Taxes and interest expenses can also affect EPS growth, but they don't tell us as much about a company's fundamentals.In Q1, YETI reported EPS at $0.34, up from $0.18 in the same quarter last year. This print beat analysts' estimates by 39.1%. Over the next 12 months, Wall Street expects YETI to grow its earnings. Analysts are projecting its LTM EPS of $2.41 to climb by 4.6% to $2.52.

Cash Is King

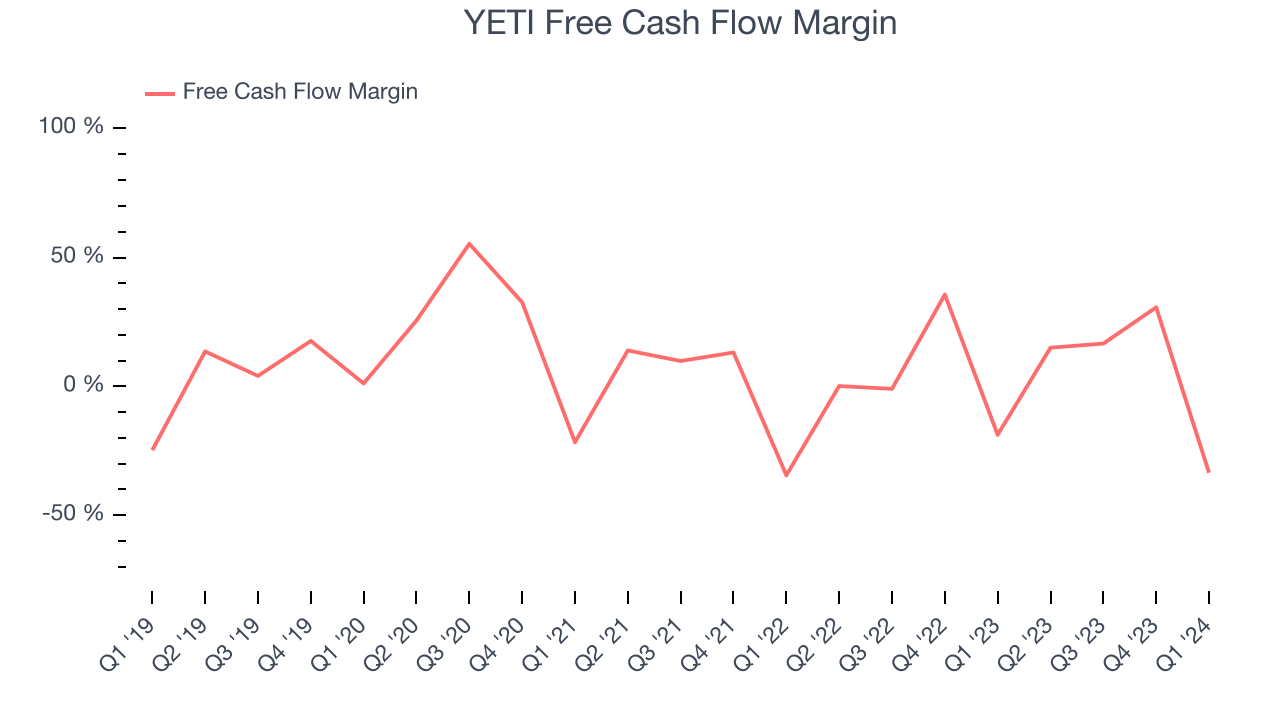

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Over the last two years, YETI has shown mediocre cash profitability, putting it in a pinch as it gives the company limited opportunities to reinvest, pay down debt, or return capital to shareholders. Its free cash flow margin has averaged 8.4%, subpar for a consumer discretionary business.

YETI burned through $114.3 million of cash in Q1, equivalent to a negative 33.5% margin, reducing its cash burn by 101% year on year. Over the next year, analysts predict YETI's cash profitability will fall. Their consensus estimates imply its LTM free cash flow margin of 10.5% will decrease to 7.9%.

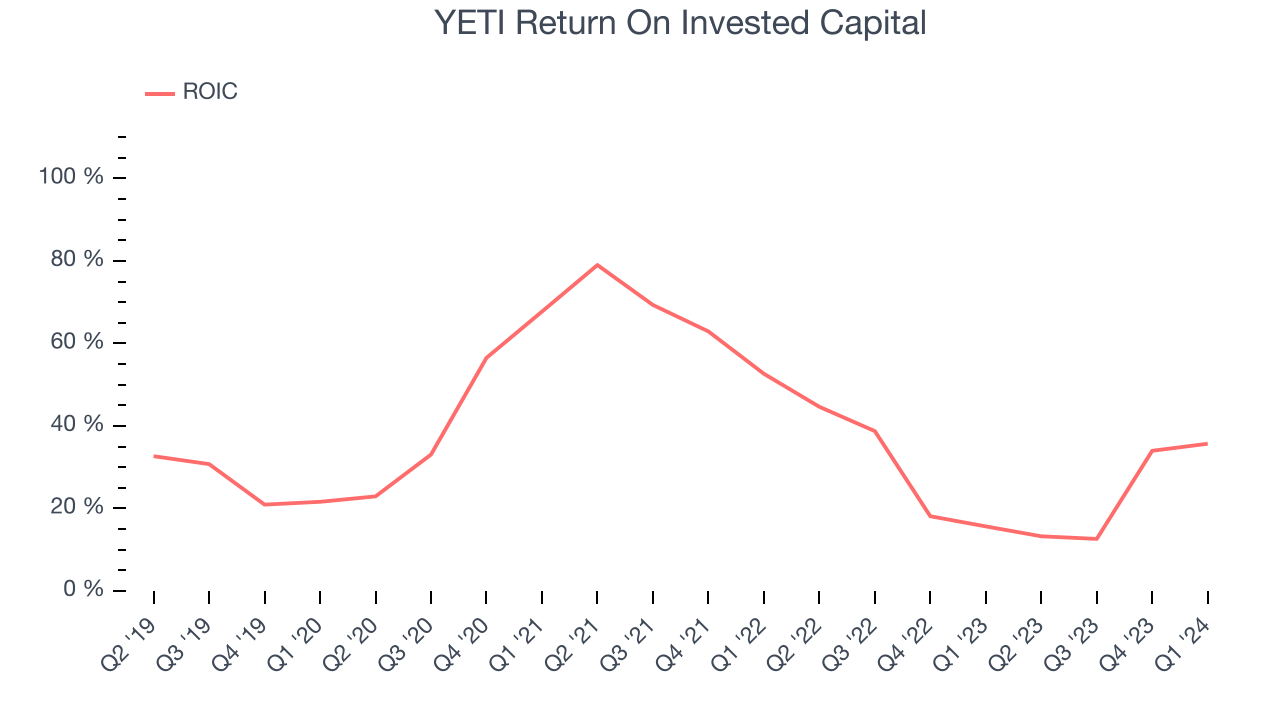

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although YETI hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable business initiatives. Its five-year average return on invested capital was 38.7%, splendid for a consumer discretionary business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, YETI's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

YETI reported $173.9 million of cash and $174.8 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company's debt level isn't too high and 2) that its interest payments are not excessively burdening the business.

With $313.4 million of EBITDA over the last 12 months, we view YETI's 0.0x net-debt-to-EBITDA ratio as safe. We also see its $311,000 of annual interest expenses as appropriate. The company's profits give it plenty of breathing room, allowing it to continue investing in new initiatives.

Key Takeaways from YETI's Q1 Results

We were impressed by how significantly YETI blew past analysts' EPS expectations this quarter. We were also glad its revenue outperformed Wall Street's estimates. While full year revenue guidance was maintained, EPS guidance was raised. Overall, we think this was a really good quarter that should please shareholders. The stock is up 9% after reporting and currently trades at $38 per share.

Is Now The Time?

YETI may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of YETI, we'll be cheering from the sidelines. Although its revenue growth has been decent over the last five years, its projected EPS for the next year is lacking. And while its stellar ROIC suggests it has been a well-run company historically, the downside is its low free cash flow margins give it little breathing room.

YETI's price-to-earnings ratio based on the next 12 months is 13.8x. While there are some things to like about YETI and its valuation is reasonable, we think there are better opportunities elsewhere in the market right now.

Wall Street analysts covering the company had a one-year price target of $43.81 per share right before these results (compared to the current share price of $38).

To get the best start with StockStory, check out our most recent stock picks, and then sign up for our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.