Online reputation and search platform Yext (NYSE:YEXT) reported results in line with analysts’ expectations in Q2 CY2024, with revenue down 4.6% year on year to $97.89 million. The company’s full-year revenue guidance of $420.5 million at the midpoint came in 6.3% above analysts’ estimates. It made a non-GAAP profit of $0.05 per share, down from its profit of $0.06 per share in the same quarter last year.

Is now the time to buy Yext? Find out by accessing our full research report, it’s free.

Yext (YEXT) Q2 CY2024 Highlights:

- Revenue: $97.89 million vs analyst estimates of $98.14 million (small miss)

- EPS (non-GAAP): $0.05 vs analyst estimates of $0.03 ($0.03 beat)

- The company lifted its revenue guidance for the full year to $420.5 million at the midpoint from $395 million, a 6.5% increase

- EBITDA guidance for the full year is $66.5 million at the midpoint, above analyst estimates of $65.68 million

- Gross Margin (GAAP): 77.2%, in line with the same quarter last year

- EBITDA Margin: 10%, down from 11.5% in the same quarter last year

- Free Cash Flow was -$11.19 million, down from $37.66 million in the previous quarter

- Billings: $68.21 million at quarter end, down 9.1% year on year

- Market Capitalization: $606.7 million

"Our second quarter results delivered significant margin expansion due to our continued focus on operating efficiency, positioning us for growing profitability," said Yext CEO and Chair of the Board, Michael Walrath.

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

Listing Management Software

As the number of places that keep business listings (such as addresses, opening hours and contact details) increases, the task of keeping all listings up-to-date becomes more difficult and that drives demand for centralized solutions that update all touchpoints.

Sales Growth

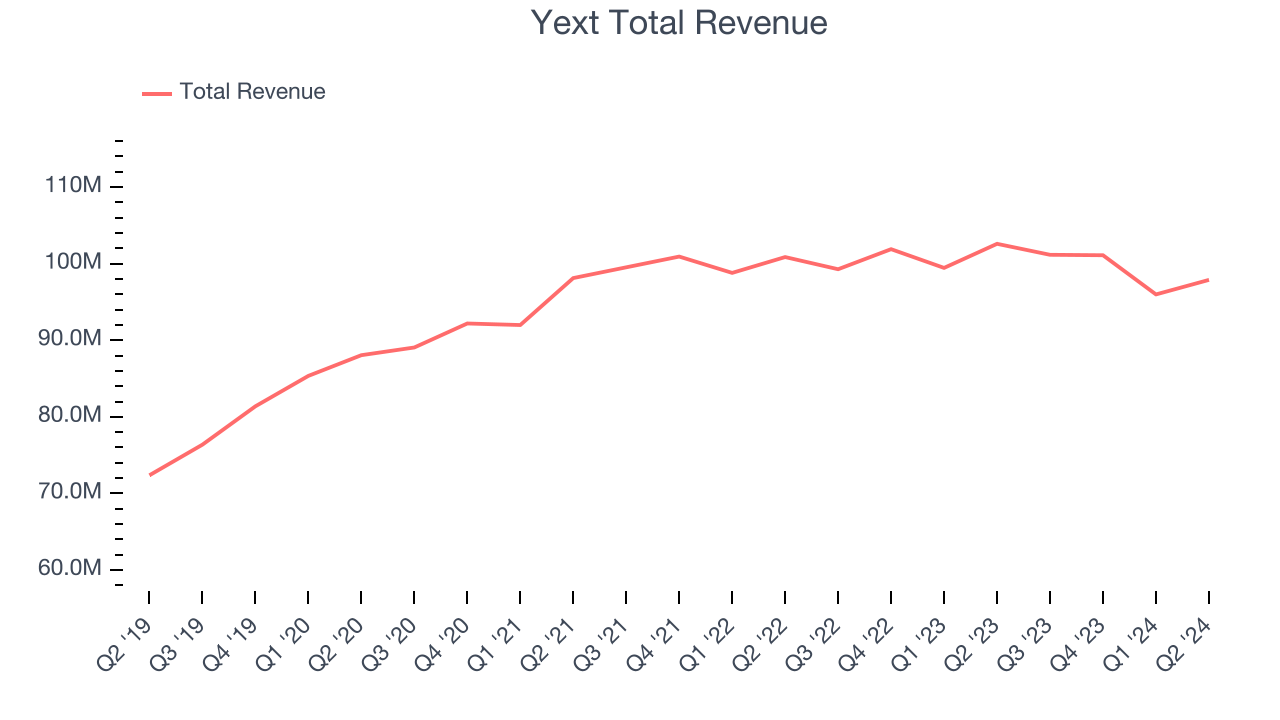

As you can see below, Yext’s 2.2% annualized revenue growth over the last three years has been weak, and its sales came in at $97.89 million this quarter.

This quarter, Yext’s revenue was down 4.6% year on year, which might disappointment some shareholders.

Looking ahead, analysts covering the company were expecting sales to grow 2.8% over the next 12 months before the earnings results announcement.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Cash Is King

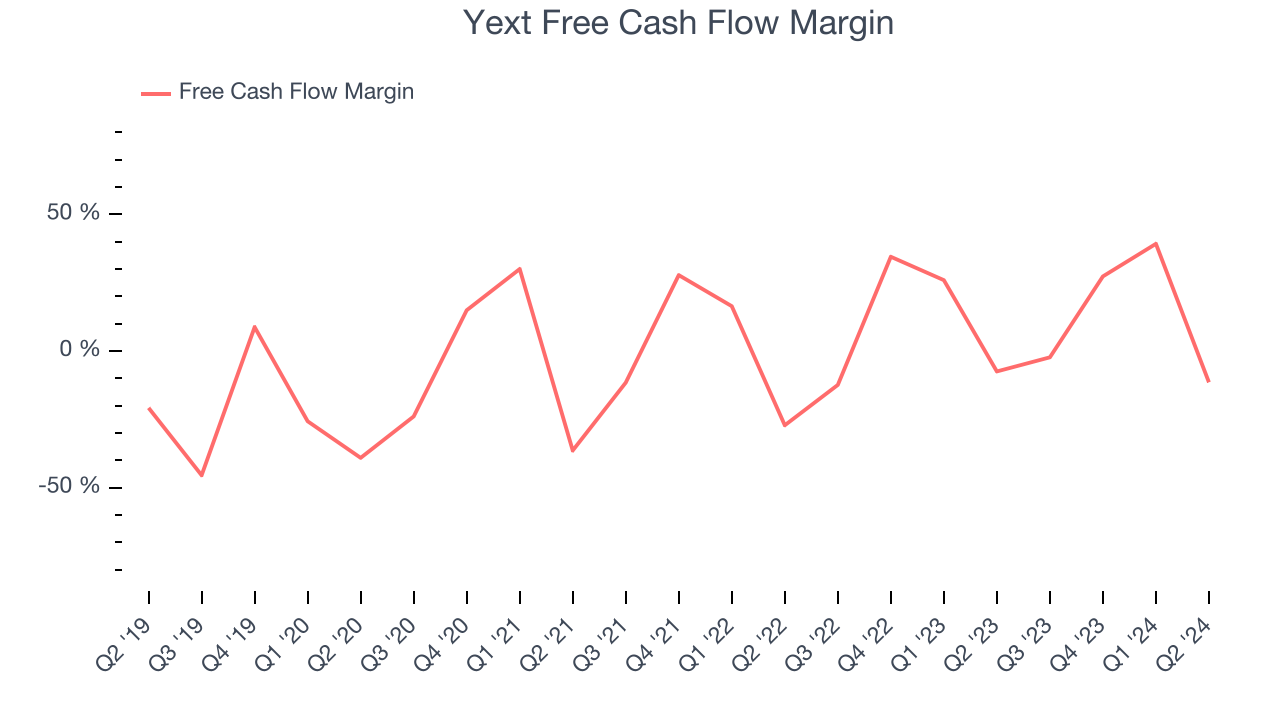

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

Yext has shown decent cash profitability, giving it some flexibility to reinvest or return capital to investors. The company’s free cash flow margin averaged 13.1% over the last year, slightly better than the broader software sector.

Yext burned through $11.19 million of cash in Q2, equivalent to a negative 11.4% margin. The company’s cash burn increased by 46.2% year on year and is a deviation from its longer-term margin, raising some eyebrows.

Key Takeaways from Yext’s Q2 Results

Revenue missed slightly but EPS managed to beat. We were especially impressed by Yext’s optimistic full-year revenue guidance, which blew past analysts’ expectations. Full-year EBITDA guidance also exceeded expectations. Overall, this was a solid quarter. The stock traded up 12% to $5.50 immediately after reporting.

Yext may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.