Online reputation and search platform Yext (NYSE:YEXT) reported Q1 FY2022 results that beat analyst expectations, with revenue up 7.78% year on year to $91.9 million. Yext made a GAAP loss of $17.6 million, improving on its loss of $29.2 million, in the same quarter last year.

Is now the time to buy Yext? Get early access to our full analysis of the earnings results here

Yext (YEXT) Q1 FY2022 Highlights:

- Revenue: $91.9 million vs analyst estimates of $88.5 million (3.83% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.06 ($0.04 miss)

- Revenue guidance for Q2 2022 is $95 million at the midpoint, above analyst estimates of $93 million

- The company lifted revenue guidance for the full year, from $377.5 million to $383.5 million at the midpoint, a 1.58% increase

- Customers: 2,500, up from 2,400 in previous quarter

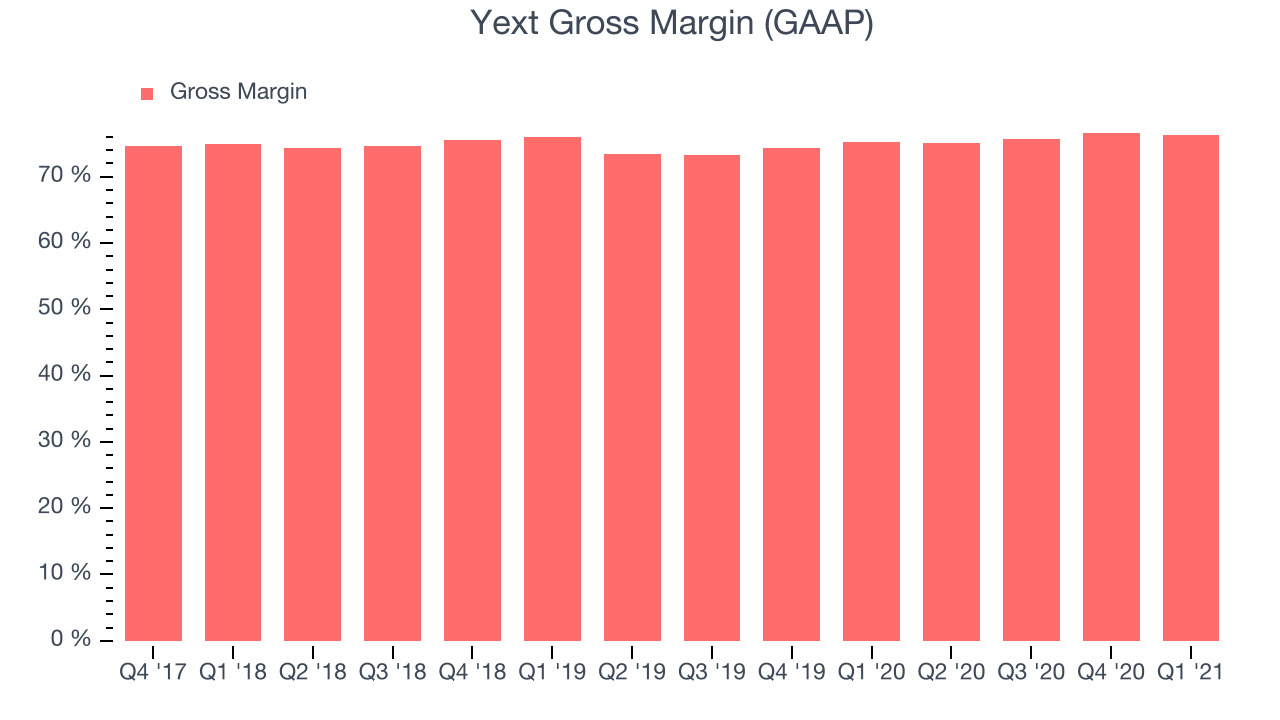

- Gross Margin (GAAP): 76.2%, in line with previous quarter

- Updated valuation: Yext is up at $13.67 and now trades at 4.3x price-to-sales (LTM)

"We are kicking off this year with a very strong first quarter," said Howard Lerman, Founder and CEO of Yext.

Online Brand Reputation Management

Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their listings and reviews across all relevant databases, from Google Maps to Alexa or Siri. It also helps companies automatically answer questions their customers have about their products or services.

As the number of places that keep business listings (such as addresses, opening hours and contact details) increase, the task of keeping all listings up-to-date becomes more significant, and increases demand for solutions like those offered by Yext and listing management competitor Uberall.

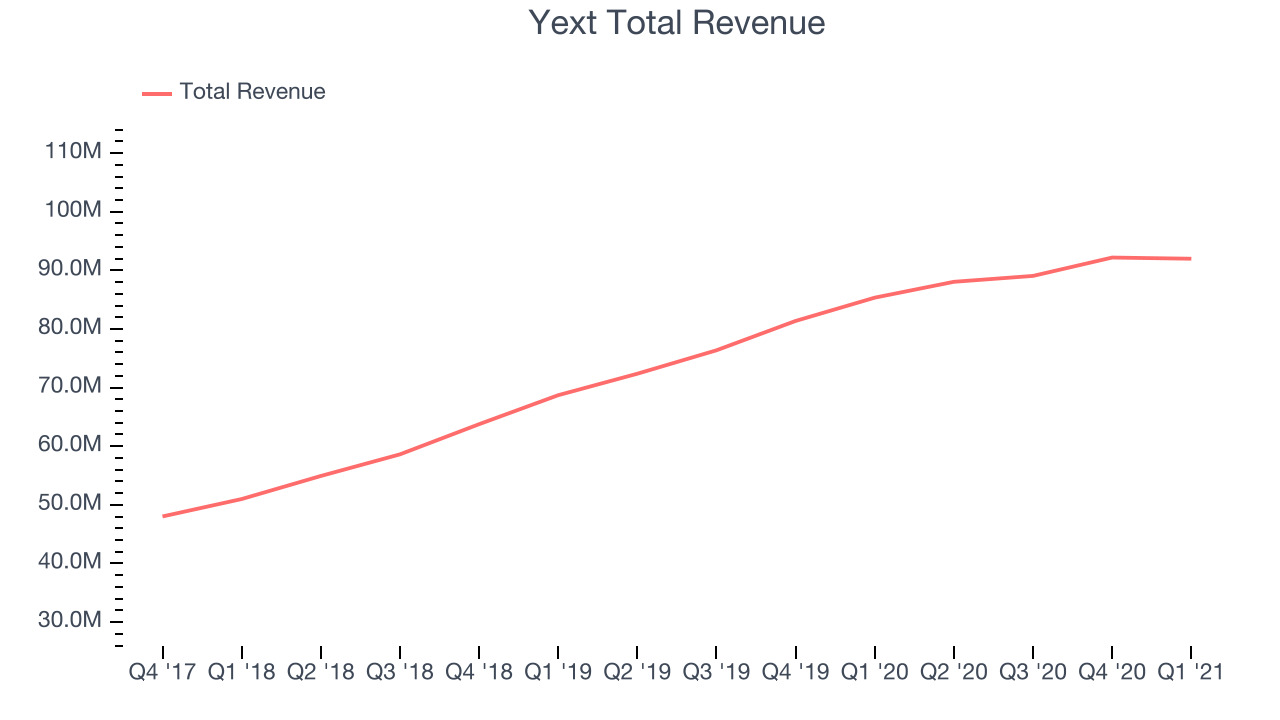

As you can see below, Yext's revenue growth has been strong over the last twelve months, growing from $85.3 million to $91.9 million.

Yext's quarterly revenue was only up 7.78% year on year, which might disappoint some shareholders. We can see that revenue decreased by$202 thousand in Q1, compared to increase of $3.13 million in Q4 2021. We've no doubt shareholders would probably like to see growth rates rebound from here.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Profitability With Scale

While Yext has been successful in linking millions of consumers with the brands they are looking for, those brands don't need Yext to manage their listings. If Yext pricing becomes too expensive, its clients can either manage their own listings one by one, or use a competitor. Rising gross margins could be seen as an indication that Yext continues to offer a strong value proposition.

Yext's gross profit margin, an important metric measuring how much money there is left after paying for servers, licences, technical support and other necessary running expenses was at 76.2% in Q1. That means that for every $1 in revenue the company had $0.76 left to spend on developing new products, marketing & sales and the general administrative overhead. This is a good gross margin that will allow Yext to fund large investments in product and sales during periods of rapid growth and be profitable when it reaches maturity. It is good to see that the gross margin is staying stable which indicates that Yext is doing a good job controlling costs and is not under a pressure from competition to lower prices.

Key Takeaways from Yext's Q1 Results

With market capitalisation of $1.58 billion and more than $272 million in cash, the company has the capacity to continue to prioritise growth.

It was good to see Yext outperform Wall St’s revenue expectations this quarter. And we were also glad that the revenue guidance for the next quarter exceeded analysts' expectations. On the other hand, the revenue growth overall was quite weak. Zooming out, we think this was still a decent quarter. While the market has high expectations of Yext, its track record makes it look like a good growth stock, and nothing we've seen today has meaningfully changed that.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.