Earnings results often give us a good indication of what direction the company will take in the months ahead. With Q1 now behind us, let’s have a look at Yext (NYSE:YEXT) and its peers.

The Internet and the exploding amount of data have transformed how businesses interact with, market to, and transact with their customers. Personalization of offerings, e-commerce, targeted advertising and data-empowered sales teams are now table stakes for modern businesses, and sales and marketing software providers are becoming the tools of evolving customer interaction.

The 23 sales and marketing software stocks we track reported a weak Q1; on average, revenues beat analyst consensus estimates by 2.48%, while on average next quarter revenue guidance was 0.04% under consensus. The technology sell-off has been putting pressure on stocks since November, but sales and marketing software stocks held their ground better than others, with the share price up 1.15% since earnings, on average.

Yext (NYSE:YEXT)

Founded in 2006 by Howard Lerman, Yext (NYSE:YEXT) offers software as a service that helps their clients manage and monitor their online listings and customer reviews across all relevant databases, from Google Maps to Alexa or Siri.

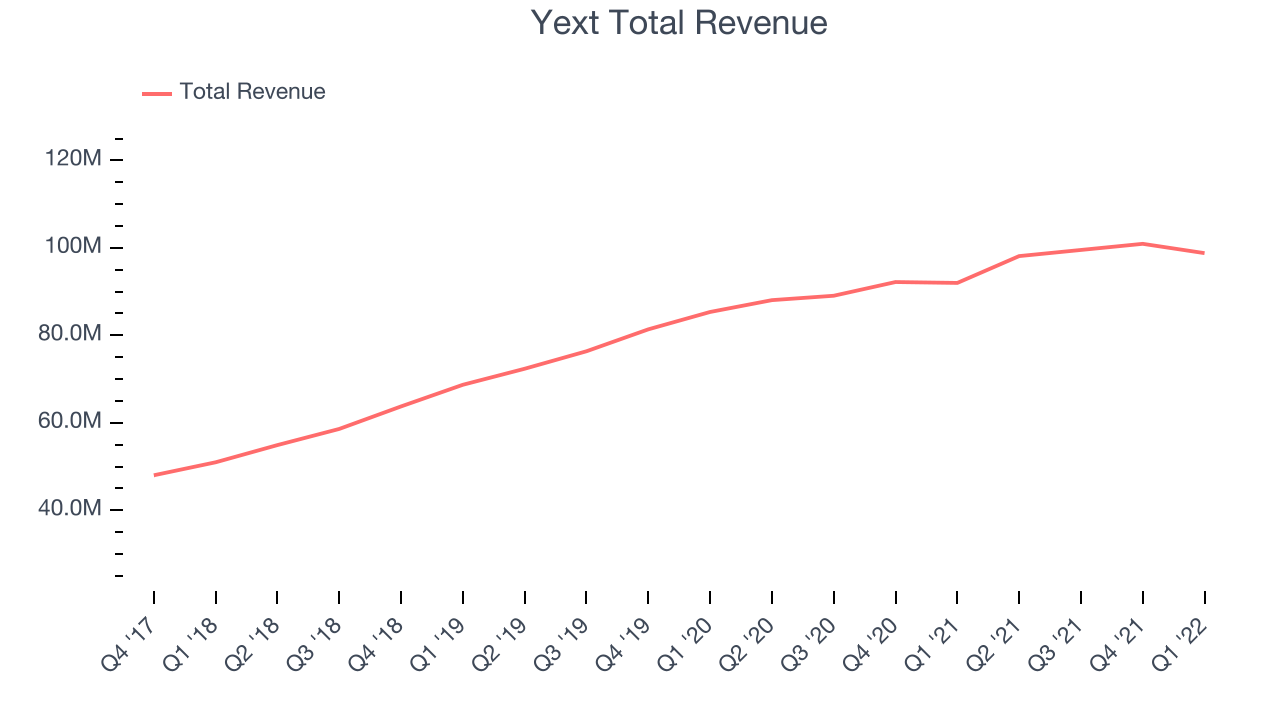

Yext reported revenues of $98.8 million, up 7.4% year on year, beating analyst expectations by 1.58%. It was a weaker quarter for the company, with a full year guidance missing analysts' expectations and a slow revenue growth.

The stock is down 6.01% since the results and currently trades at $5.08.

Read our full report on Yext here, it's free.

Best Q1: DoubleVerify (NYSE:DV)

When Oren Netzer saw a digital ad for US-based Target while sitting in his Tel Aviv apartment, he knew there was an unsolved problem, so he started DoubleVerify (NYSE: DV), a provider of advertising solutions to businesses that helps with ad verification, fraud prevention, and brand safety.

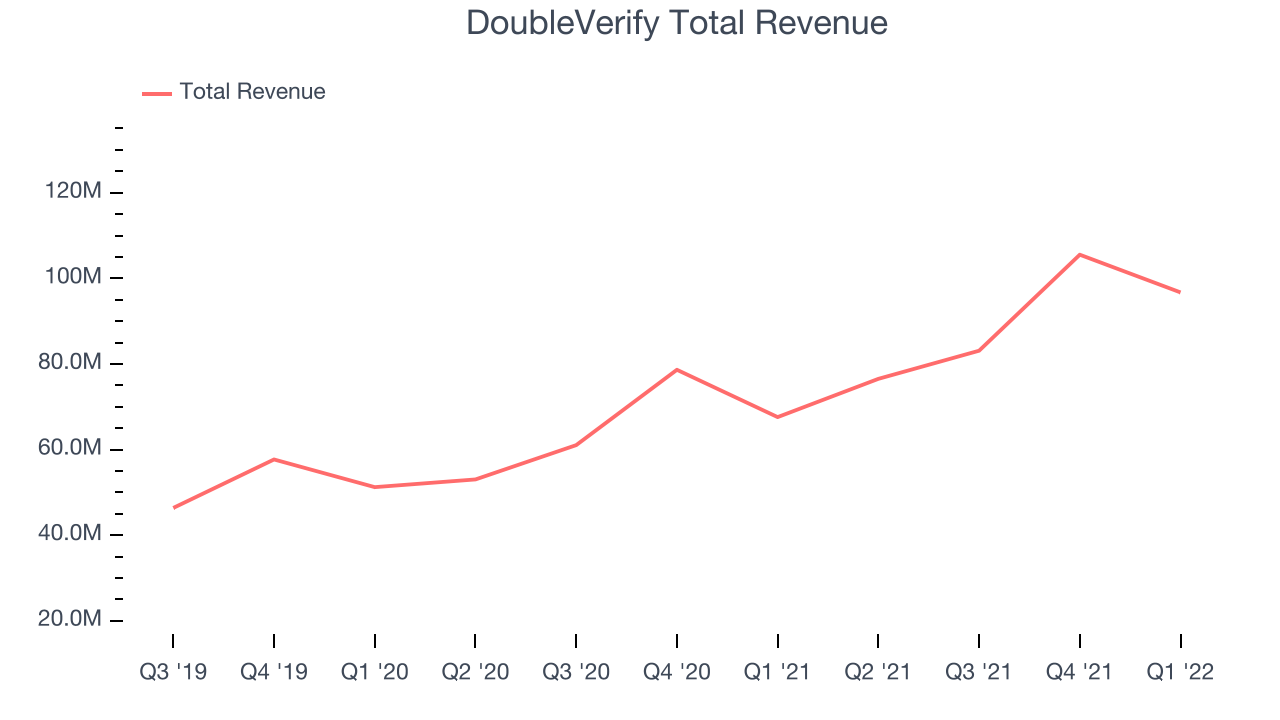

DoubleVerify reported revenues of $96.7 million, up 43.1% year on year, beating analyst expectations by 7.58%. It was a very strong quarter for the company, with an exceptional revenue growth and an impressive beat of analyst estimates.

DoubleVerify scored the strongest analyst estimates beat among its peers. The stock is up 34.1% since the results and currently trades at $24.51.

Is now the time to buy DoubleVerify? Access our full analysis of the earnings results here, it's free.

Weakest Q1: ON24 (NYSE:ONTF)

Started in 1998 as a platform to broadcast press conferences, ON24’s (NYSE:ONTF) software helps organizations organize online webinars and other virtual events and convert prospects into customers.

ON24 reported revenues of $48.4 million, down 3.21% year on year, beating analyst expectations by 1.88%. It was a weak quarter for the company, with a full year guidance missing analysts' expectations and a slow revenue growth.

ON24 had the slowest revenue growth and weakest full year guidance update in the group. The stock is down 3.71% since the results and currently trades at $10.37.

Read our full analysis of ON24's results here.

BigCommerce (NASDAQ:BIGC)

Founded in Sydney, Australia in 2009 by Mitchell Harper and Eddie Machaalani, BigCommerce (NASDAQ:BIGC) provides software for businesses to easily create online stores.

BigCommerce reported revenues of $66 million, up 41.5% year on year, beating analyst expectations by 3.46%. It was a mixed quarter for the company, with an exceptional revenue growth but decelerating growth in large customers.

The company added 218 enterprise customers paying more than $2,000 annually to a total of 12,972. The stock is down 0.63% since the results and currently trades at $18.67.

Read our full, actionable report on BigCommerce here, it's free.

ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

ZoomInfo reported revenues of $241.7 million, up 57.6% year on year, beating analyst expectations by 6.03%. It was a very strong quarter for the company, with an exceptional revenue growth.

ZoomInfo delivered the fastest revenue growth and highest full year guidance raise among the peers. The company added 171 enterprise customers paying more than $100,000 annually to a total of 1,623. The stock is down 25.5% since the results and currently trades at $36.64.

Read our full, actionable report on ZoomInfo here, it's free.

The author has no position in any of the stocks mentioned