Fast-food company Yum China (NYSE:YUMC) missed analysts' expectations in Q2 CY2024, with revenue flat year on year at $2.68 billion. It made a non-GAAP profit of $0.55 per share, improving from its profit of $0.47 per share in the same quarter last year.

Is now the time to buy Yum China? Find out by accessing our full research report, it's free.

Yum China (YUMC) Q2 CY2024 Highlights:

- Revenue: $2.68 billion vs analyst estimates of $2.76 billion (2.9% miss)

- EPS (non-GAAP): $0.55 vs analyst estimates of $0.46 (19.4% beat)

- Gross Margin (GAAP): 19.9%, up from 16.8% in the same quarter last year

- Adjusted EBITDA Margin: 14.9%, in line with the same quarter last year

- Free Cash Flow of $232 million, similar to the previous quarter

- Locations: 15,423 at quarter end, up from 13,602 in the same quarter last year

- Same-Store Sales fell 4% year on year (15% in the same quarter last year)

- Market Capitalization: $11.36 billion

Joey Wat, CEO of Yum China, commented, "We achieved our most profitable second quarter since the spin-off, with core operating profit growing by 12% despite challenging industry dynamics. Our sharp focus on value-for-money and innovative new products worked well, driving robust same-store transaction growth. We took proactive actions to improve operational efficiency, stabilizing restaurant margin and expanding OP margin year over year."

One of China’s largest restaurant companies, Yum China (NYSE:YUMC) is an independent entity spun off from Yum! Brands in 2016.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

Sales Growth

Yum China is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

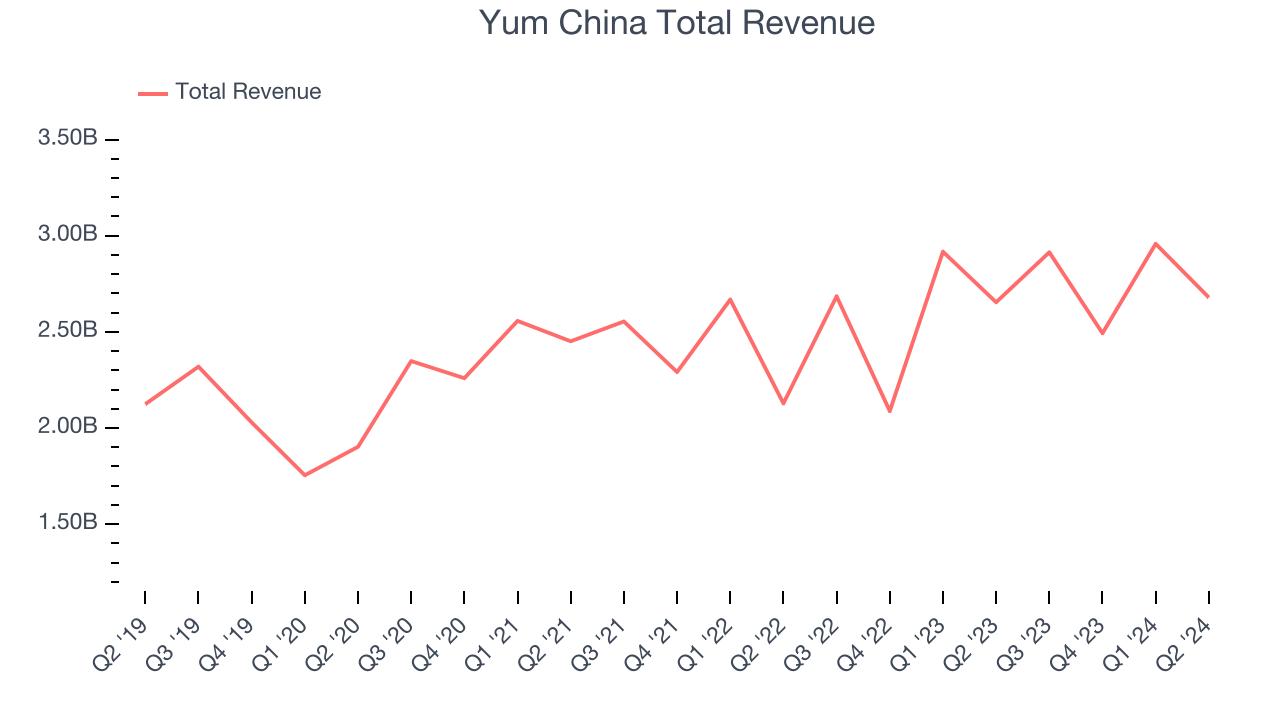

As you can see below, the company's annualized revenue growth rate of 5.2% over the last five years was sluggish, but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Yum China's revenue grew 0.9% year on year to $2.68 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 10.2% over the next 12 months, an acceleration from this quarter.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Same-Store Sales

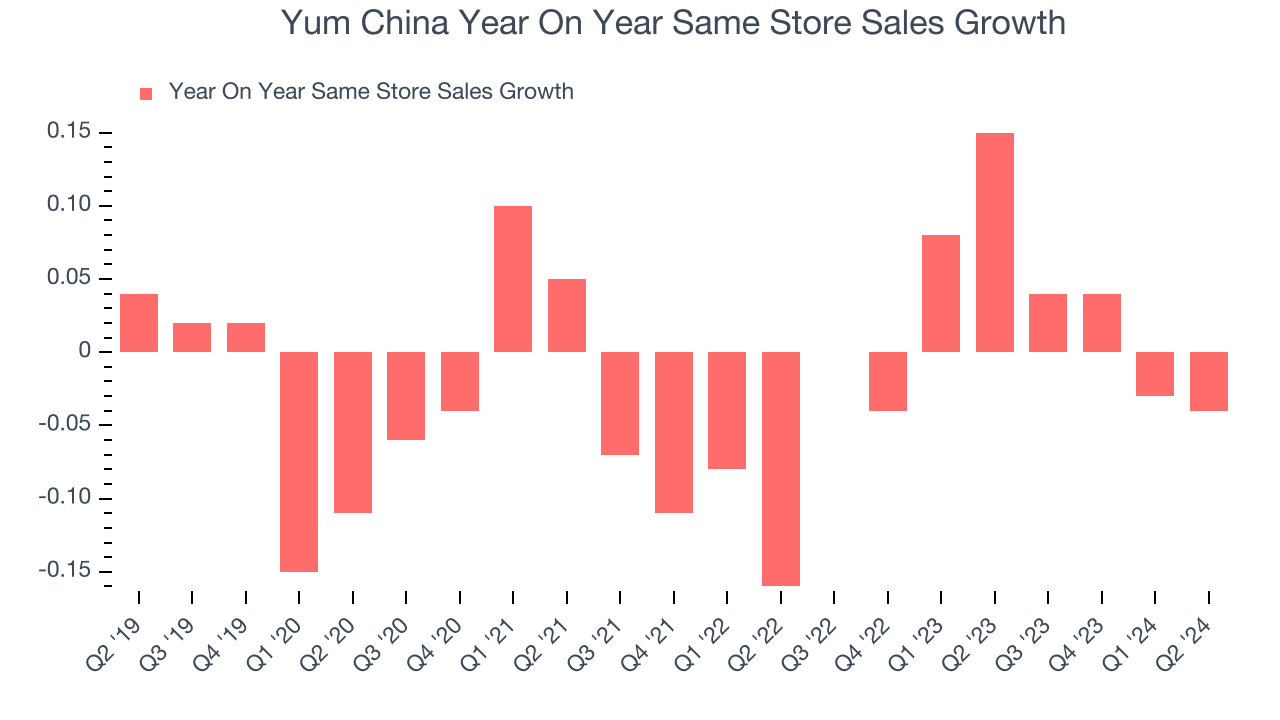

Same-store sales growth is an important metric that tracks organic growth and demand for a restaurant's established locations.

Yum China's demand within its existing restaurants has been relatively stable over the last eight quarters but fell behind the broader sector. On average, the company's same-store sales have grown by 2.5% year on year. With positive same-store sales growth amid an increasing number of restaurants, Yum China is reaching more diners and growing sales.

In the latest quarter, Yum China's same-store sales fell 4% year on year. This decline was a reversal from the 15% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Yum China's Q2 Results

We were impressed by how significantly Yum China blew past analysts' gross margin expectations this quarter. We were also glad its EPS outperformed Wall Street's estimates. On the other hand, its revenue unfortunately missed analysts' expectations. Zooming out, we think this was still a decent, albeit mixed, quarter, showing the company is staying on track. The stock traded up 1.2% to $30.18 immediately after reporting.

So should you invest in Yum China right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.