Fast-food company Yum China (NYSE:YUMC) fell short of analysts' expectations in Q1 CY2024, with revenue up 1.4% year on year to $2.96 billion. It made a non-GAAP profit of $0.71 per share, improving from its profit of $0.69 per share in the same quarter last year.

Yum China (YUMC) Q1 CY2024 Highlights:

- Revenue: $2.96 billion vs analyst estimates of $3.04 billion (2.7% miss)

- EPS (non-GAAP): $0.71 vs analyst estimates of $0.65 (8.6% beat)

- Gross Margin (GAAP): 21.9%, up from 20.8% in the same quarter last year

- Free Cash Flow of $253 million is up from -$72 million in the previous quarter

- Same-Store Sales were down 3% year on year (miss)

- Store Locations: 15,022 at quarter end, increasing by 1,842 over the last 12 months

- Market Capitalization: $15.48 billion

One of China’s largest restaurant companies, Yum China (NYSE:YUMC) is an independent entity spun off from Yum! Brands in 2016.

It was strategically separated from its parent company to focus on the Chinese restaurant market, which has vast potential and different dynamics than the United States. Today, the company mainly operates KFC (fried chicken), Pizza Hut (pizza), and Taco Bell (Mexican) fast-food chains in China.

Yum China has carved itself a niche in the country as the predominant destination for traditional American flavors with an Asian twist. Its success can be attributed to localization, and through its deep understanding of Chinese consumers, has revamped its menu items to include innovative dishes such as KFC’s fried chicken meal, which comes with rice, soup, and mushroom salad, Pizza Hut’s jumbo bacon-wrapped shrimp basil pesto pizza and escargot, and Taco Bell’s beef bulgogi and kimchi burrito.

Additionally, unlike its United States counterparts, Yum China’s fast-food locations are perceived as premium dining options due to their cleanliness, price point, and inclusion of technology like self-service digital kiosks. Generally, its stores’ layouts are similar to those in the United States with a counter where customers can place orders and seating areas with a mix of booths and tables. Some of its locations, however, also offer table service, which is unheard of in typical fast-food joints.

Traditional Fast Food

Traditional fast-food restaurants are renowned for their speed and convenience, boasting menus filled with familiar and budget-friendly items. Their reputations for on-the-go consumption make them favored destinations for individuals and families needing a quick meal. This class of restaurants, however, is fighting the perception that their meals are unhealthy and made with inferior ingredients, a battle that's especially relevant today given the consumers increasing focus on health and wellness.

American competitors include Burger King (owned by Restaurant Brands, NYSE:QSR), McDonald’s (NYSE:MCD), and Starbucks (NASDAQ:SBUX) while Chinese competitors comprise of Dicos, Home Original Chicken, and Real Kungfu.Sales Growth

Yum China is one of the most widely recognized restaurant chains in the world and benefits from brand equity, giving it customer loyalty and more influence over purchasing decisions.

As you can see below, the company's annualized revenue growth rate of 5.3% over the last five years was weak , but to its credit, it opened new restaurants and grew sales at existing, established dining locations.

This quarter, Yum China's revenue grew 1.4% year on year to $2.96 billion, falling short of Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 14.4% over the next 12 months, an acceleration from this quarter.

Same-Store Sales

Yum China's demand within its existing restaurants has been relatively stable over the last eight quarters but fallen behind the broader sector. On average, the company's same-store sales have grown by 1% year on year. With positive same-store sales growth amid an increasing number of restaurants, Yum China is reaching more diners and growing sales.

In the latest quarter, Yum China's same-store sales fell 3% year on year. This decline was a reversal from the 8% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Number of Stores

A restaurant chain's total number of dining locations often determines how much revenue it can generate.

When a chain like Yum China is opening new restaurants, it usually means it's investing for growth because there's healthy demand for its meals and there are markets where the concept has few or no locations. Yum China's restaurant count increased by 1,842, or 14%, over the last 12 months to 15,022 locations in the most recently reported quarter.

Taking a step back, Yum China has rapidly opened new restaurants over the last eight quarters, averaging 11.3% annual increases in new locations. This growth is much higher than other restaurant businesses. Analyzing a restaurant's location growth is important because expansion means Yum China has more opportunities to feed customers and generate sales.

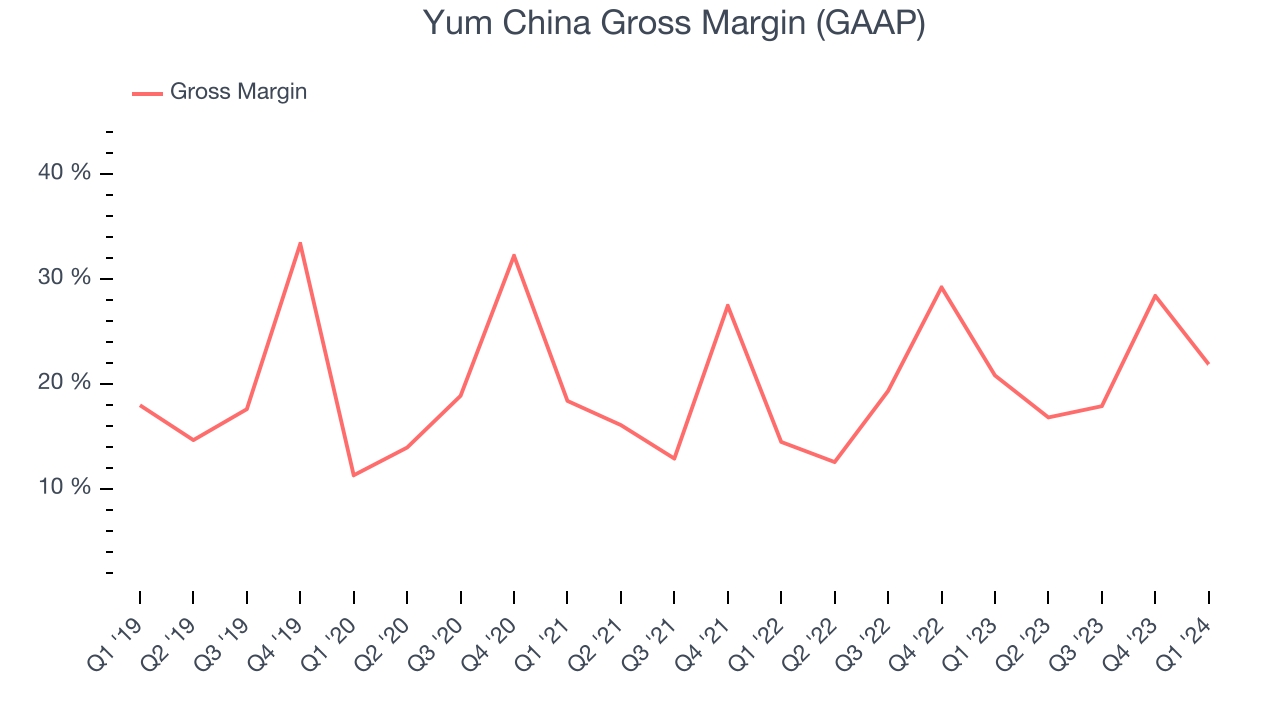

Gross Margin & Pricing Power

Gross profit margins are an important measure of a restaurant's pricing power and differentiation, whether it be the dining experience or quality and taste of food.

Yum China's gross profit margin came in at 21.9% this quarter. up 1.1 percentage points year on year. This means the company makes $0.21 for every $1 in revenue before accounting for its operating expenses.

Yum China has weak unit economics for a restaurant company, making it difficult to reinvest in the business. As you can see above, it's averaged a 20.8% gross margin over the last eight quarters. Its margin, however, has been trending up over the last 12 months, averaging 7.2% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment.

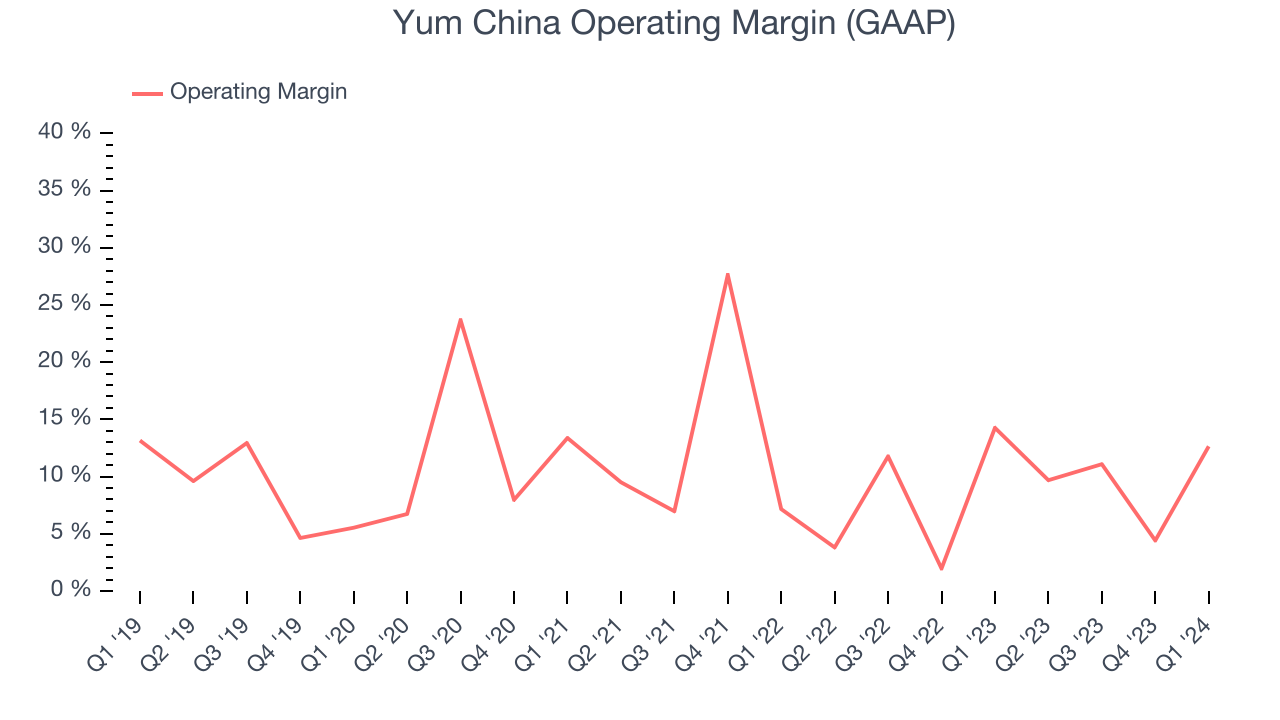

Operating Margin

Operating margin is a key profitability metric for restaurants because it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

In Q1, Yum China generated an operating profit margin of 12.6%, down 1.6 percentage points year on year. Conversely, the company's gross margin actually increased, so we can assume the reduction was driven by poor cost controls or weaker leverage on fixed costs.

Zooming out, Yum China has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9.2%, higher than the broader restaurant sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Yum China).

Zooming out, Yum China has done a decent job managing its expenses over the last eight quarters. The company has produced an average operating margin of 9.2%, higher than the broader restaurant sector. On top of that, its margin has remained more or less the same, highlighting the consistency of its business. The company's operating profitability was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes tectonic shifts to move meaningfully. Companies have more control over their operating margins, and it signals strength if they're high when gross margins are low (like for Yum China).EPS

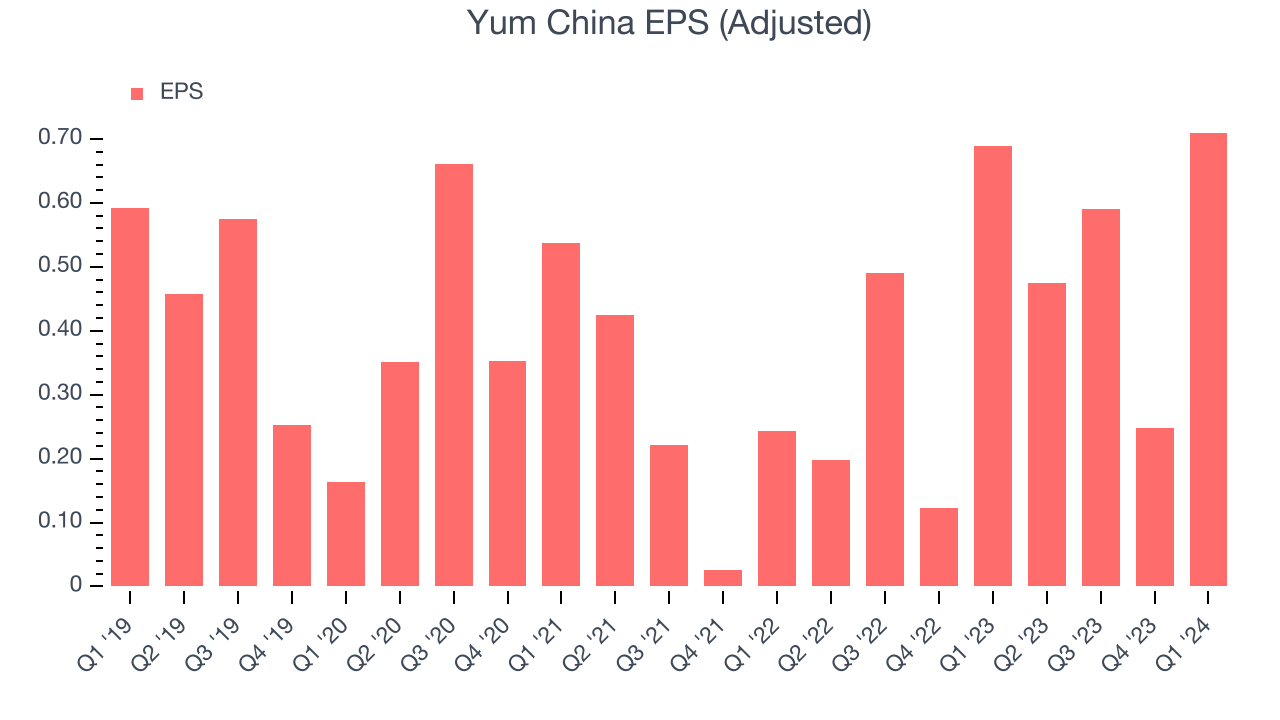

These days, some companies issue new shares like there's no tomorrow. That's why we like to track earnings per share (EPS) because it accounts for shareholder dilution and share buybacks.

In Q1, Yum China reported EPS at $0.71, up from $0.69 in the same quarter a year ago. This print beat Wall Street's estimates by 8.6%.

On the bright side, Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 13.6% year-on-year increase in EPS.

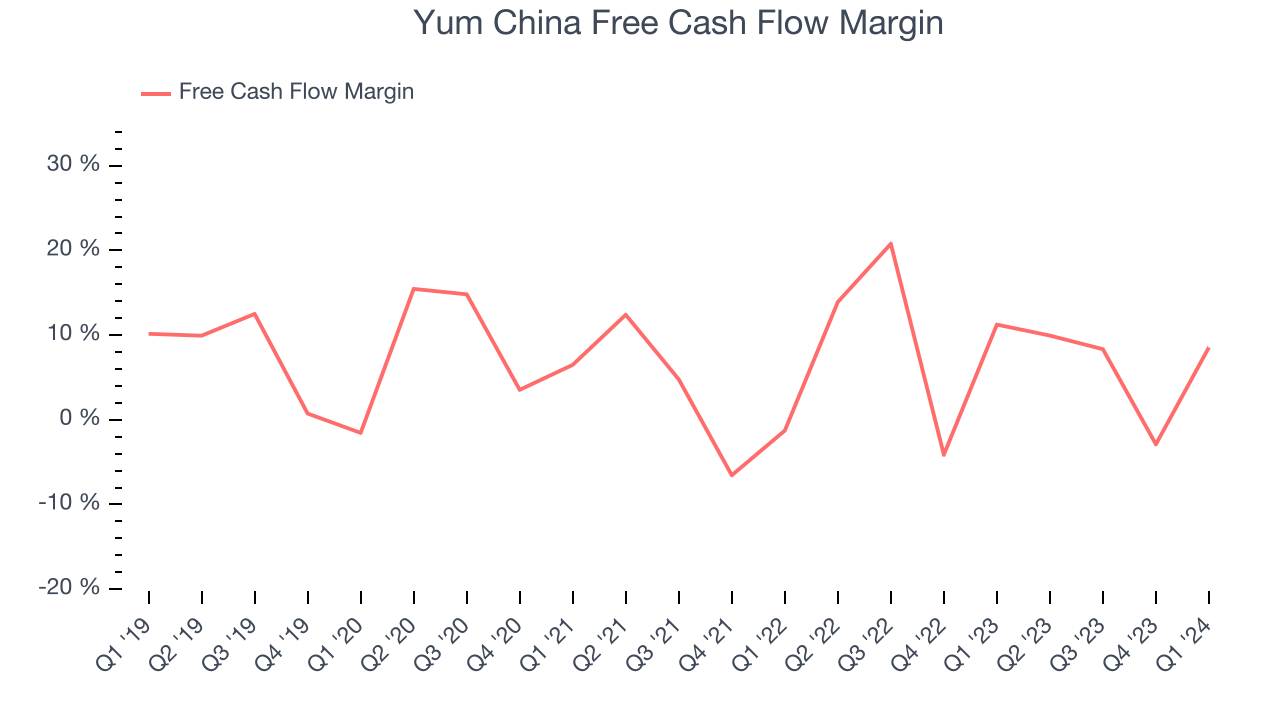

Cash Is King

If you've followed StockStory for a while, you know that we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

Yum China's free cash flow came in at $253 million in Q1, down 22.9% year on year. This result represents a 8.6% margin.

Over the last eight quarters, Yum China has shown solid cash profitability, giving it the flexibility to reinvest or return capital to investors. The company's free cash flow margin has averaged 8.6%, well above the broader restaurant sector. However, its margin has averaged year-on-year declines of 4.9 percentage points. If this trend continues, it could signal that the business is becoming slightly more capital-intensive.

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Although Yum China hasn't been the highest-quality company lately, it historically did a wonderful job investing in profitable business initiatives. Its five-year average ROIC was 31.5%, splendid for a restaurant business.

The trend in its ROIC, however, is often what surprises the market and drives the stock price. Unfortunately, Yum China's ROIC significantly decreased over the last few years. We like what management has done historically but are concerned its ROIC is declining, perhaps a symptom of waning business opportunities to invest profitably.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Yum China is a profitable, well-capitalized company with $2.40 billion of cash and $165 million of debt, meaning it could pay back all its debt tomorrow and still have $2.23 billion of cash on its balance sheet. This net cash position gives Yum China the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Yum China's Q1 Results

We were impressed by how significantly Yum China blew past analysts' gross margin expectations this quarter. We were also happy its EPS narrowly outperformed Wall Street's estimates. On the other hand, its same store sales missed and led to revenue below expectations. Zooming out, we are disappointed with the topline performance. The stock is flat after reporting and currently trades at $40 per share.

Is Now The Time?

Yum China may have had a favorable quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

Yum China isn't a bad business, but it probably wouldn't be one of our picks. Its revenue growth has been a little slower over the last five years, but at least growth is expected to increase in the short term. And while its new restaurant openings have increased its brand equity, the downside is its poor same-store sales performance has been a headwind. On top of that, its gross margins make it more difficult to reach positive operating profits compared to other restaurant businesses.

In the end, beauty is in the eye of the beholder. While Yum China wouldn't be our first pick, if you like the business, the shares are trading at a pretty interesting price right now.

Wall Street analysts covering the company had a one-year price target of $56.11 per share right before these results (compared to the current share price of $40).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.