As we reflect back on the just completed Q2 sales software sector earnings season, we dig into the relative performance of Zendesk (NYSE:ZEN) and its peers.

As more of our commercial interactions take place over the internet, the need for online support is growing. Customers are expecting to be able to talk to brands on any channel, at any time and that drives the need for integrated sales and support platforms like Zendesk.

The 4 sales software stocks we track reported a solid Q2; on average, revenues beat analyst consensus estimates by 3.21%, while on average next quarter revenue guidance was 2.61% above consensus. The market rewarded the results with the average return the day after earnings coming in at 1.05%.

Weakest Q2: Zendesk (NYSE:ZEN)

Founded in 2006 by three Danish friends who got tired of implementing complex old-school solutions, Zendesk is a software as a service platform that makes it easier for companies to provide help and support to their customers.

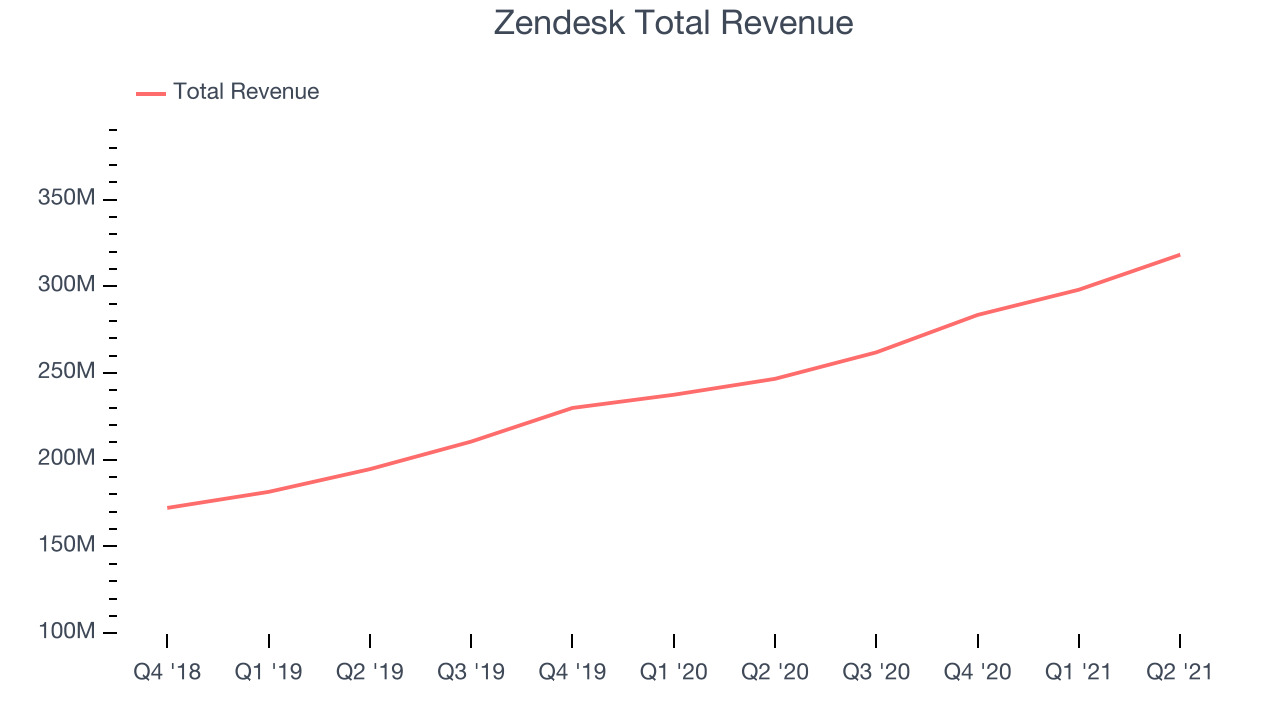

Zendesk reported revenues of $318.2 million, up 29% year on year, missing analyst expectations by 0.73%. It was a weaker quarter for the company, with a miss of the top line analyst estimates and an underwhelming revenue guidance for the next quarter.

Zendesk delivered the weakest performance against analyst estimates of the whole group. The stock is down 13.2% since the results and currently trades at $123.47.

Is now the time to buy Zendesk? Access our full analysis of the earnings results here, it's free.

Best Q2: ZoomInfo (NASDAQ:ZI)

Founded in 2007 as DiscoveryOrg and renamed after a merger in 2019, ZoomInfo (NASDAQ:ZI) is a software as a service product that provides sales departments with access to a database of prospective clients.

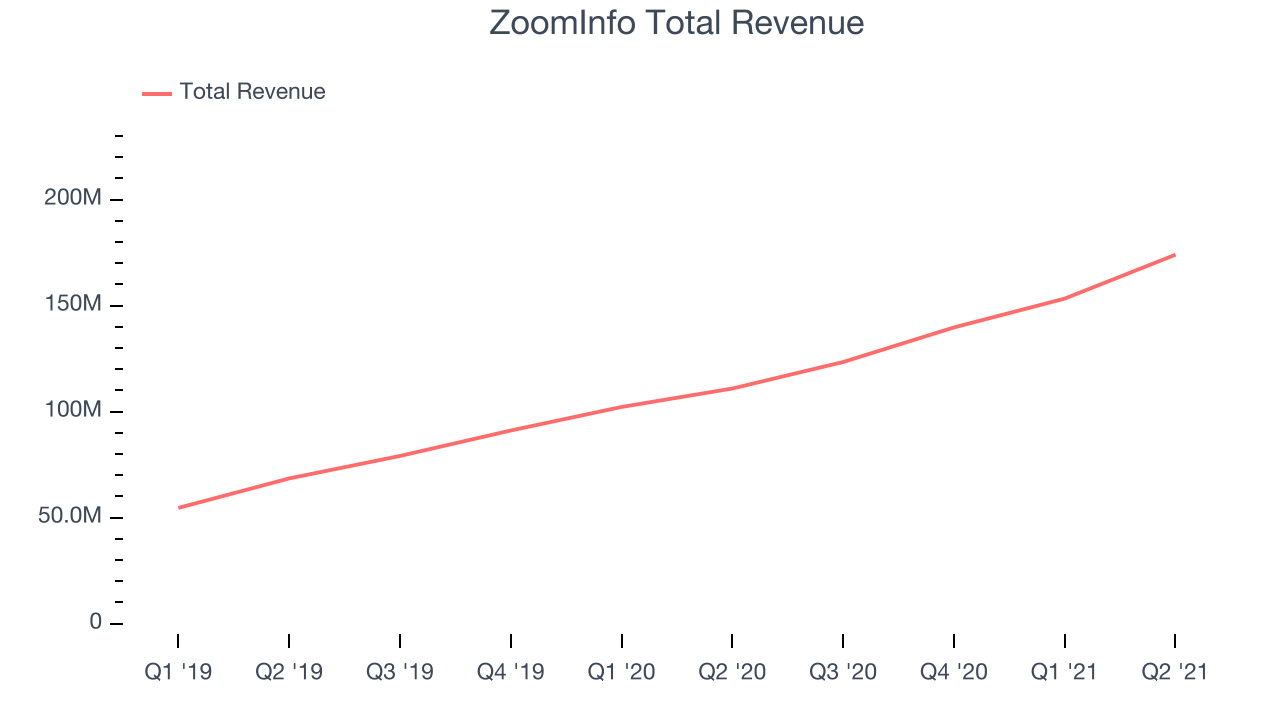

ZoomInfo reported revenues of $174 million, up 56.8% year on year, beating analyst expectations by 7.09%. It was a impressive quarter for the company, with an exceptional revenue growth and a very optimistic guidance for the next quarter.

ZoomInfo pulled off the fastest growth in large customers, strongest analyst estimates beat, and fastest revenue growth among its peers. The stock is up 3.21% since the results and currently trades at $68.

Is now the time to buy ZoomInfo? Access our full analysis of the earnings results here, it's free.

Salesforce (NYSE:CRM)

Launched in 1999 from a rented one-bedroom apartment in San Francisco by Marc Benioff and his three co-founders, Salesforce is a software as a service platform that helps companies access, manage and share sales information.

Salesforce reported revenues of $6.34 billion, up 23% year on year, beating analyst expectations by 1.51%. It was a decent quarter for the company, with a strong sales guidance for the next quarter.

Salesforce had the slowest revenue growth. The stock is up 2.45% since the results and currently trades at $280.20.

Read our full analysis of Salesforce's results here.

HubSpot (NYSE:HUBS)

Started in 2006 by two MIT grad students, HubSpot is a software as a service platform that helps small and medium-size businesses sell, market themselves, and get found on the internet.

HubSpot reported revenues of $310.7 million, up 52.6% year on year, beating analyst expectations by 4.99%. It was a solid quarter for the company, with an exceptional revenue growth.

The stock is up 11.8% since the results and currently trades at $735.50.

Read our full, actionable report on HubSpot here, it's free.

The author has no position in any of the stocks mentioned