Advertising and marketing company Zeta Global (NYSE:ZETA) beat analysts' expectations in Q1 CY2024, with revenue up 23.7% year on year to $194.9 million. On top of that, next quarter's revenue guidance ($212 million at the midpoint) was surprisingly good and 3.9% above what analysts were expecting. It made a GAAP loss of $0.23 per share, improving from its loss of $0.27 per share in the same quarter last year.

Is now the time to buy Zeta? Find out by accessing our full research report, it's free.

Zeta (ZETA) Q1 CY2024 Highlights:

- Revenue: $194.9 million vs analyst estimates of $187.2 million (4.2% beat)

- EPS: -$0.23 vs analyst estimates of -$0.25 (7.3% beat)

- Revenue Guidance for Q2 CY2024 is $212 million at the midpoint, above analyst estimates of $204.1 million (adjusted EBITDA guidance also ahead)

- The company lifted its revenue guidance for the full year from $875 million to $900 million at the midpoint, a 2.9% increase (adjusted EBITDA guidance for the period also raised)

- Gross Margin (GAAP): 60.6%, down from 65.5% in the same quarter last year

- Free Cash Flow of $15.21 million, down 16.3% from the previous quarter

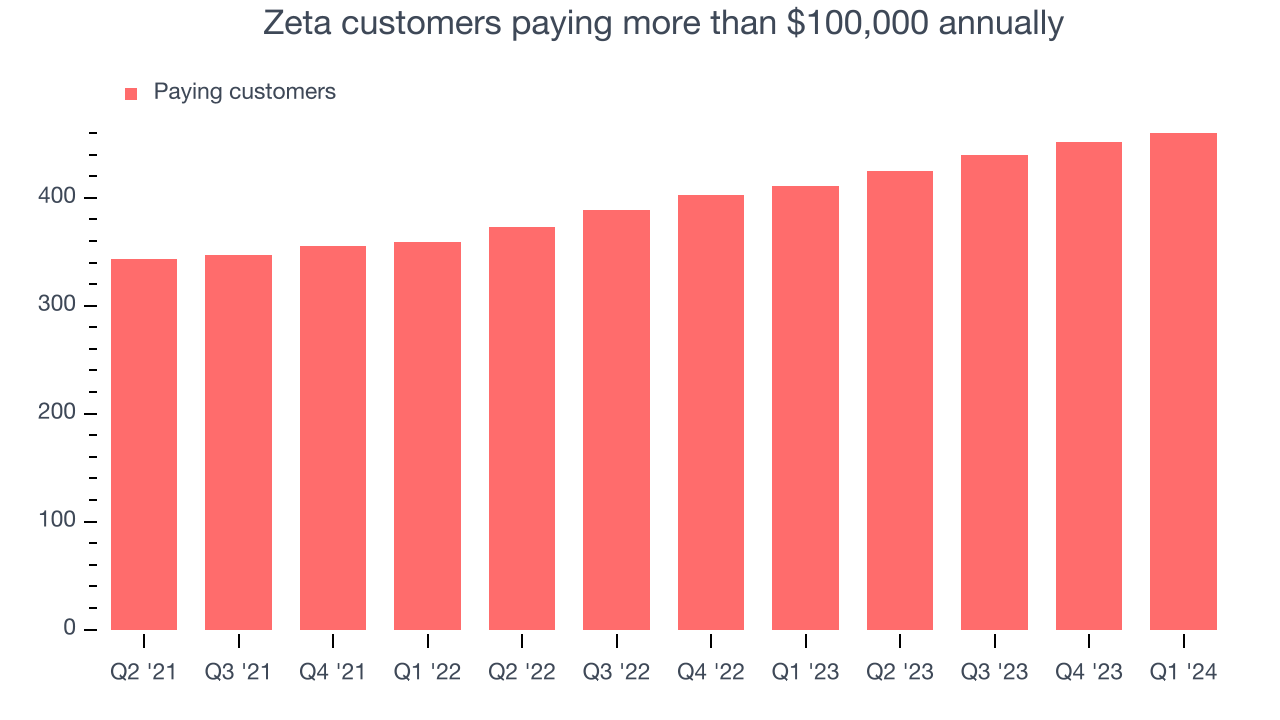

- Customers: 460 customers paying more than $100,000 annually

- Market Capitalization: $2.8 billion

Co-founded by former Apple CEO John Scully, Zeta Global (NYSE:ZETA) provides software and data analytics tools that help companies market their products to billions of customers.

Advertising Software

The digital advertising market is large, growing, and becoming more diverse, both in terms of audiences and media. As a result, there is a growing need for software that enables advertisers to use data to automate and optimize ad placements.

Sales Growth

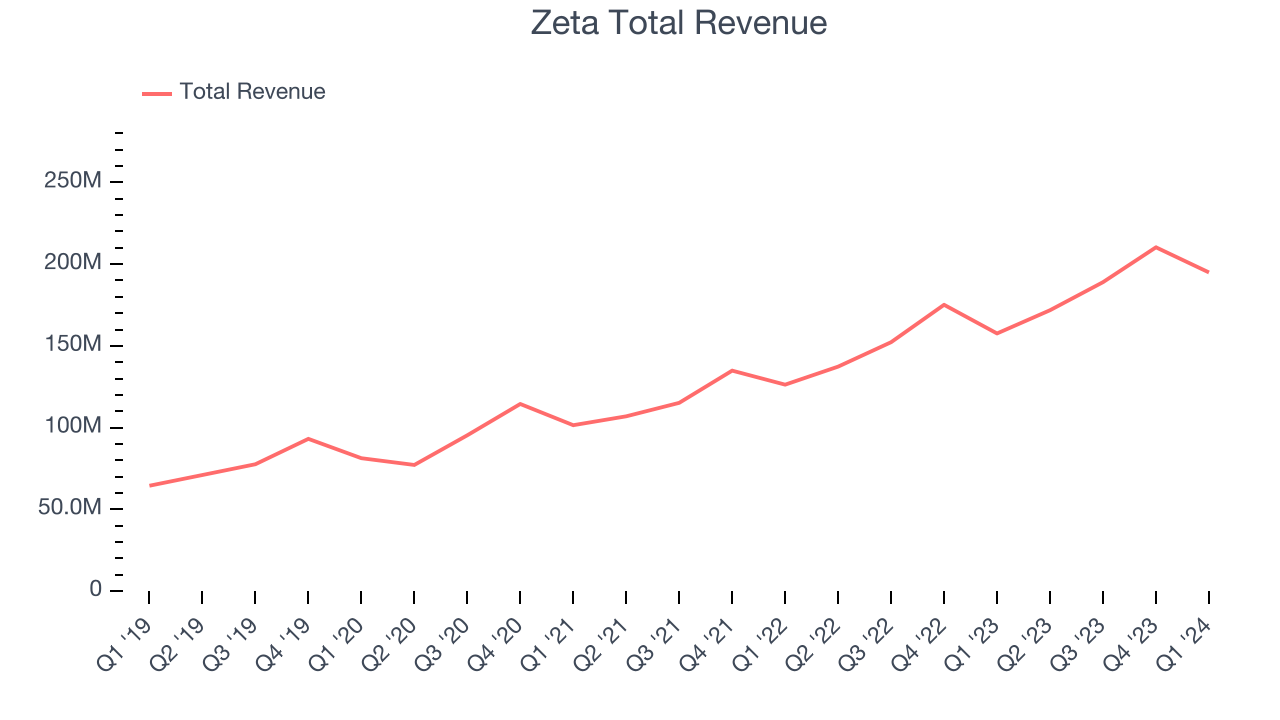

As you can see below, Zeta's revenue growth has been strong over the last three years, growing from $101.5 million in Q1 2021 to $194.9 million this quarter.

This quarter, Zeta's quarterly revenue was once again up a very solid 23.7% year on year. However, the company's revenue actually decreased by $15.37 million in Q1 compared to the $21.34 million increase in Q4 CY2023. Regardless, we aren't too concerned because Zeta's sales seem to follow a seasonal pattern and management is guiding for revenue to rebound in the coming quarter.

Next quarter's guidance suggests that Zeta is expecting revenue to grow 23.4% year on year to $212 million, in line with the 25.1% year-on-year increase it recorded in the same quarter last year. Looking ahead, analysts covering the company were expecting sales to grow 18.3% over the next 12 months before the earnings results announcement.

When a company has more cash than it knows what to do with, buying back its own shares can make a lot of sense–as long as the price is right. Luckily, we’ve found one, a low-priced stock that is gushing free cash flow AND buying back shares. Click here to claim your Special Free Report on a fallen angel growth story that is already recovering from a setback.

Large Customers Growth

This quarter, Zeta reported 460 enterprise customers paying more than $100,000 annually, an increase of 8 from the previous quarter. That's a bit fewer contract wins than last quarter and quite a bit below what we've typically observed over the past four quarters, suggesting that its sales momentum with large customers is slowing.

Key Takeaways from Zeta's Q1 Results

We were impressed by how strongly Zeta blew past analysts' billings expectations this quarter. We were also glad next quarter's revenue guidance came in higher than Wall Street's estimates. On the other hand, its new large contract wins slowed. Overall, we think this was a really good quarter that should please shareholders. The stock is flat after reporting and currently trades at $13.05 per share.

Zeta may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.