Finance and HR Software Stocks Q3 In Review: Zuora (NYSE:ZUO) Vs Peers

Jabin Bastian 2022/01/12 6:09 am EST

Quarterly earnings results are a good time to check in on a company’s progress, especially compared to other peers in the same sector. Today we are looking at Zuora (NYSE:ZUO), and the best and worst performers in the finance and HR software group.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a strong Q3; on average, revenues beat analyst consensus estimates by 6.37%, while on average next quarter revenue guidance was 4.1% above consensus. There has been a stampede out of high valuation technology stocks and finance and HR software stocks have not been spared, with share price down 22.8% since earnings, on average.

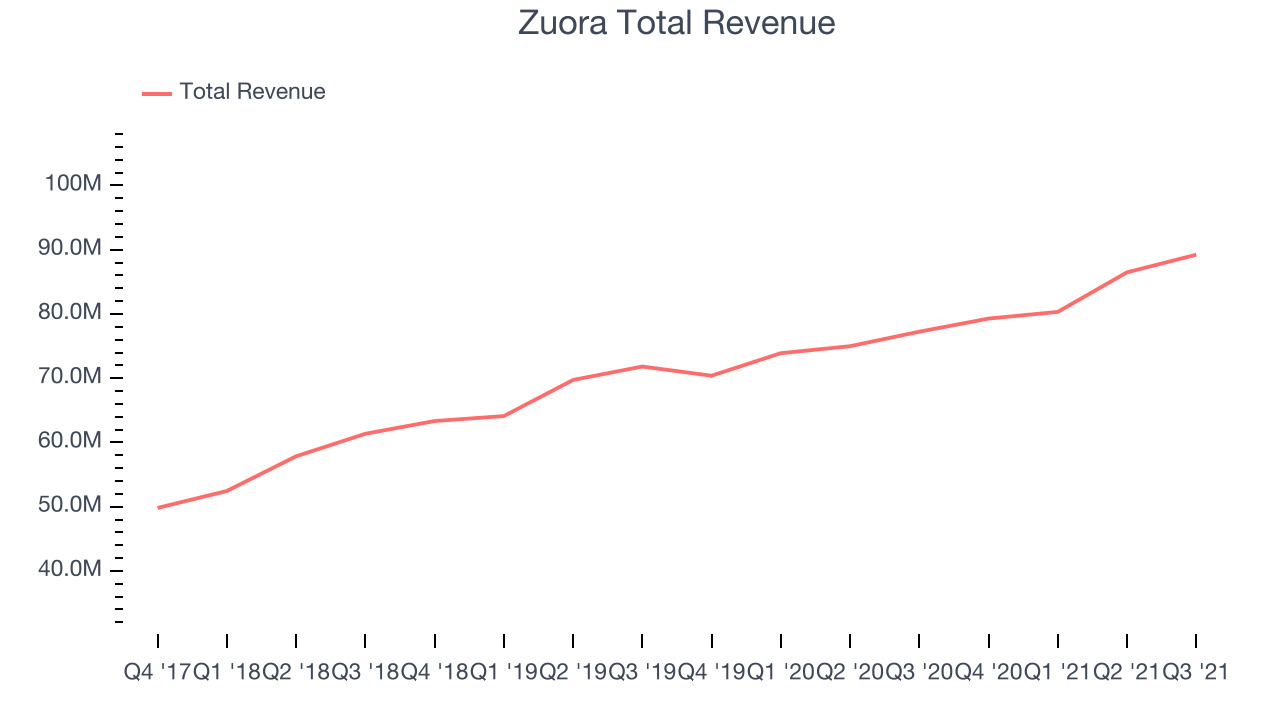

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $89.2 million, up 15.5% year on year, beating analyst expectations by 3.1%. It was a strong quarter for the company, with accelerating growth in large customers and a very optimistic guidance for the next quarter.

“Q3 was another solid quarter. We continued to deliver strong performance, exceeding our guidance for operating metrics including total revenue, subscription revenue, and non-GAAP loss from operations. It was also the highest upsell quarter in Zuora’s history. Based on our overall results, our dollar-based retention rate, and ARR growth, we are confident in our strategy and believe our opportunity in the Subscription Economy continues to expand,” said Tien Tzuo, founder and CEO of Zuora.

The stock is down 10.6% since the results and currently trades at $16.47.

Is now the time to buy Zuora? Access our full analysis of the earnings results here, it's free.

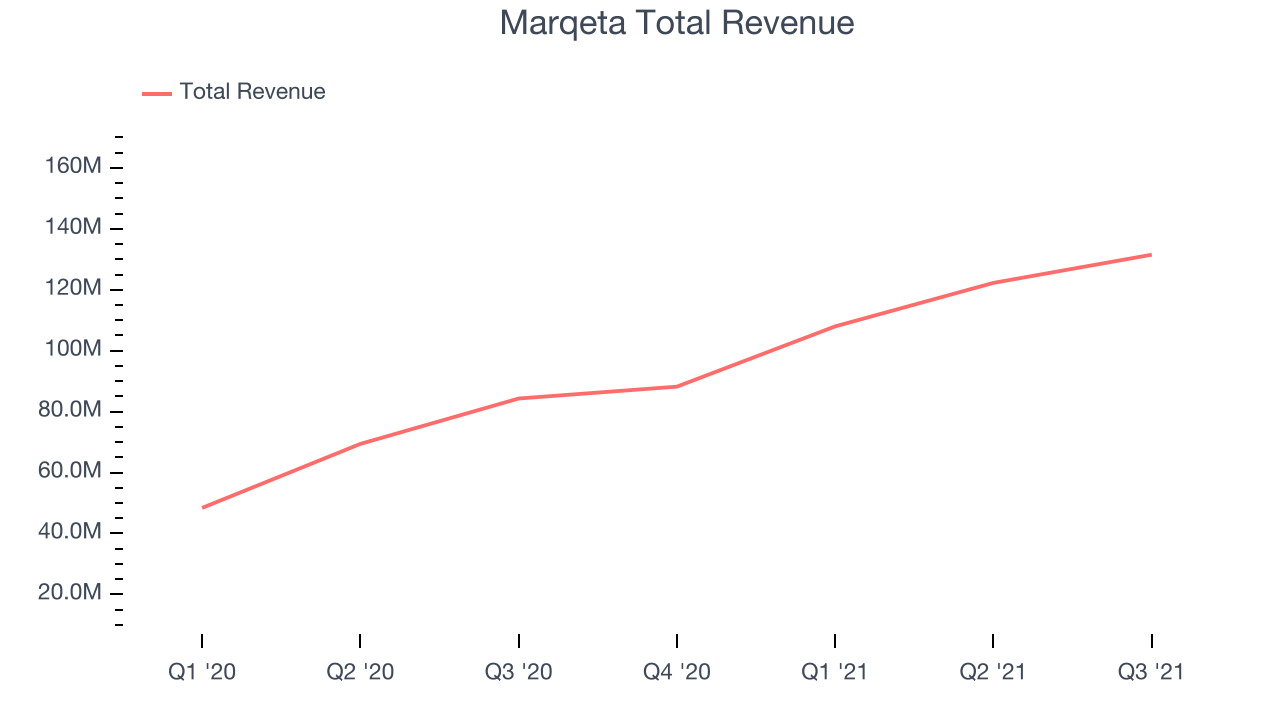

Best Q3: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $131.5 million, up 56% year on year, beating analyst expectations by 10.3%. It was an incredible quarter for the company, with a significant improvement in gross margin and an impressive beat of analyst estimates.

The stock is down 41.6% since the results and currently trades at $15.72.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q3: Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NASDAQ:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $257.2 million, up 25.8% year on year, beating analyst expectations by 1.19%. It was a weaker quarter for the company, with a decline in gross margin and decelerating customer growth.

Ceridian had the weakest full year guidance update in the group. The company added 63 customers to a total of 5,227. The stock is down 30% since the results and currently trades at $92.50.

Read our full analysis of Ceridian's results here.

Paycor (NASDAQ:PYCR)

Found in 1990 in Cincinnati, Ohio Paycor (NASDAQ: PYCR), provides software for small businesses to manage their payroll and HR needs in one place.

Paycor reported revenues of $92.7 million, up 17.2% year on year, beating analyst expectations by 2.93%. It was a decent quarter for the company, with a strong sales guidance for the next quarter.

The stock is down 25.9% since the results and currently trades at $26.70.

Read our full, actionable report on Paycor here, it's free.

Anaplan (NYSE:PLAN)

Founded by Michael Gould in 2006 in a stone barn in Yorkshire, England, Anaplan (NYSE:PLAN) is a financial modelling software that helps large enterprises with complex decision-making around budgets and financial forecasts.

Anaplan reported revenues of $155.3 million, up 35.2% year on year, beating analyst expectations by 6.17%. It was a decent quarter for the company, with a solid beat of analyst estimates but a decline in gross margin.

The stock is down 10.6% since the results and currently trades at $47.

Read our full, actionable report on Anaplan here, it's free.

The author has no position in any of the stocks mentioned