Subscription management platform Zuora (NYSE:ZUO) reported Q1 FY2022 results topping analyst expectations, with revenue up 8.7% year on year to $80.3 million. Zuora made a GAAP loss of $17.6 million, down on its loss of $17.4 million, in the same quarter last year.

Is now the time to buy Zuora? Get early access to our full analysis of the earnings results here

Zuora (NYSE:ZUO) Q1 FY2022 Highlights:

- Revenue: $80.3 million vs analyst estimates of $79 million (1.68% beat)

- EPS (non-GAAP): -$0.02 vs analyst estimates of -$0.04

- Revenue guidance for Q2 2022 is $83.5 million at the midpoint, above analyst estimates of $81.8 million

- The company reconfirmed revenue guidance for the full year, at $338 million at the midpoint

- Free cash flow of $8.63 million, up from $2.06 million in previous quarter

- Net Revenue Retention Rate: 103%, up from 100% previous quarter

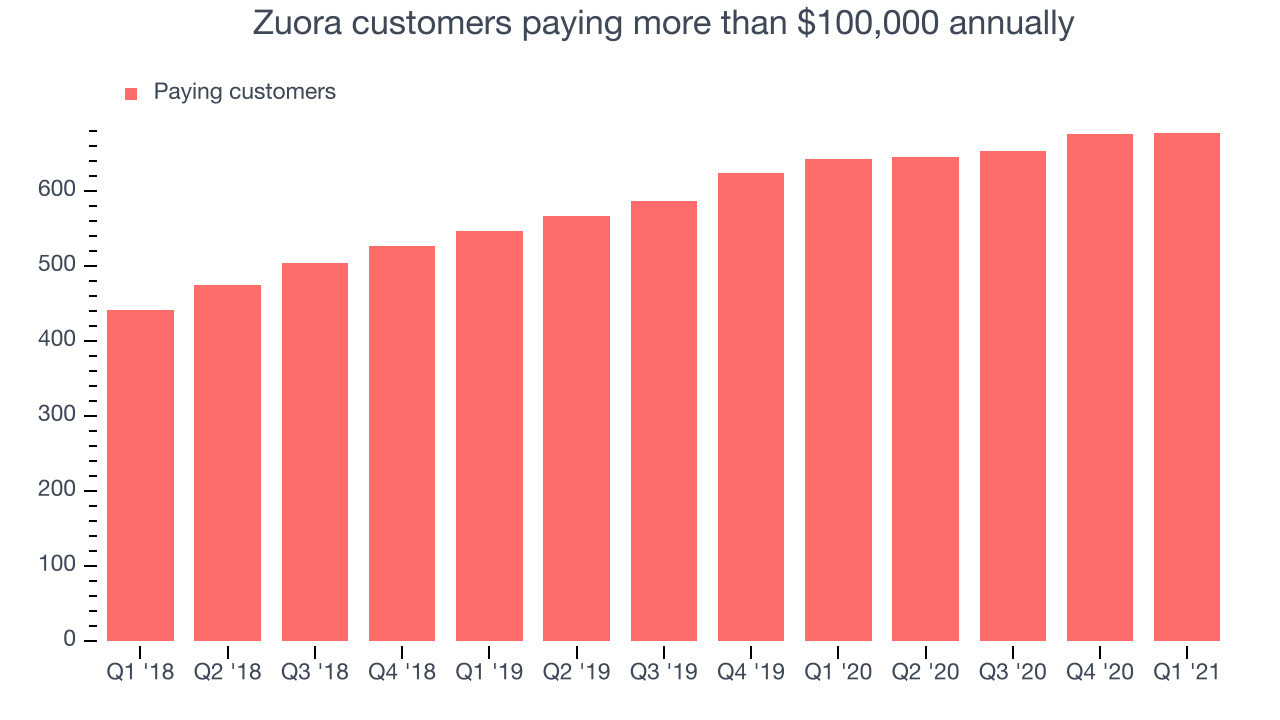

- Customers: 677 customers paying more than $100,000 annually

- Gross Margin (GAAP): 59.2%, in line with previous quarter

- Updated valuation: Zuora is flat at $15.06 and now trades at 5.9x price-to-sales (LTM)

“The first quarter was a solid start to the year, as we executed on the strategy we laid out at last month’s Investor Day. We exceeded expectations across our key operating metrics, drove significant improvement on net dollar retention, and believe that we have built a solid foundation for Zuora's long-term growth,” said Tien Tzuo, founder and CEO of Zuora.

A Platform For The Subscription Economy

Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products. Subscription products are on the rise and so is the demand for platforms to manage them. Zuora is competing in this space with products like Stripe or Salesforce Billing (NYSE:CRM).

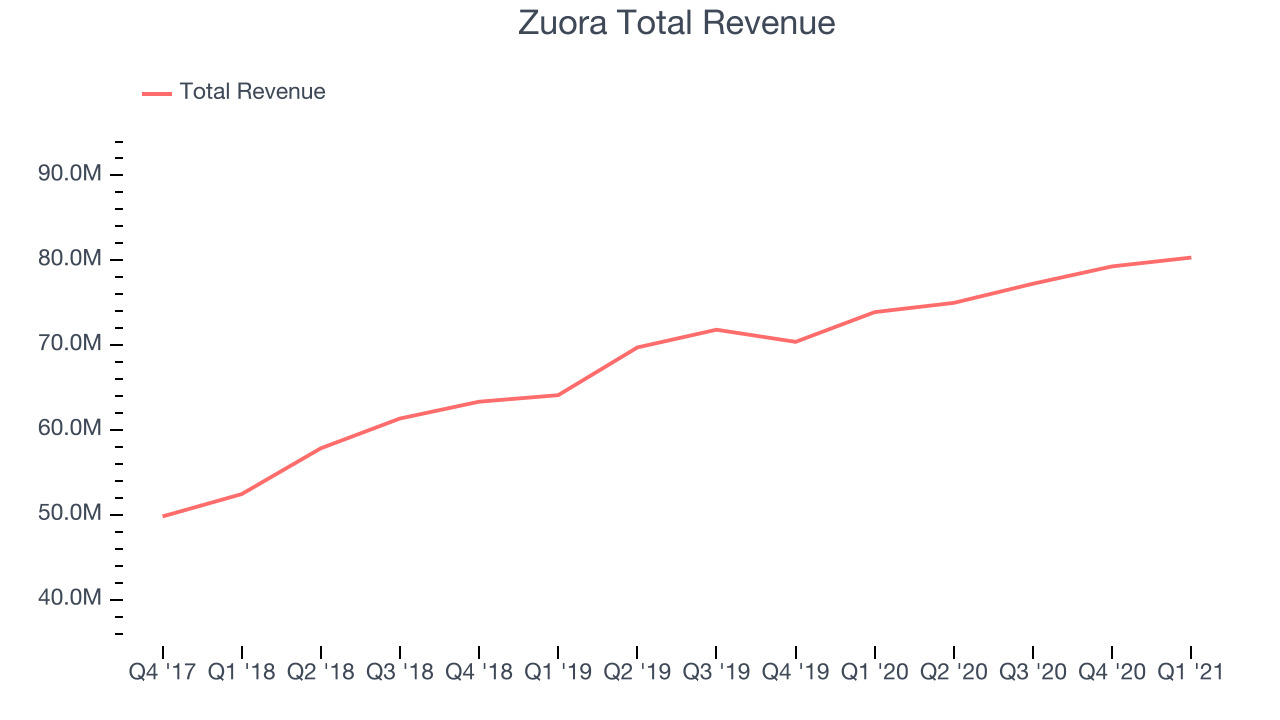

As you can see below, Zuora's revenue growth has been solid over the last twelve months, growing from $73.8 million to $80.3 million.

Zuora's revenue in Q1 was only up 8.7% year on year. We can see that revenue increased by just $1.04 million in Q1, compared to $2.04 million in Q4 2021. We've no doubt shareholders would probably like to see growth rates rebound from here.

There are others doing even better. Founded by ex-Google engineers, a small company making software for banks has been growing revenue 90% year on year and is already up more than 400% since the IPO in December. You can find it on our platform for free.

Customers

Zuora is focused on serving the enterprise market, offering a complex product that takes a significant amount of time to implement, but once adopted, is difficult to leave.

You can see below that at the end of the quarter Zuora reported 677 enterprise customers paying more than $100,000 annually, an increase of 1 on last quarter. That is a bit less contract wins than last quarter and also below what we have typically seen over the past couple of quarters, suggesting that the sales momentum with large customers is slowing down.

Key Takeaways from Zuora's Q1 Results

With market capitalisation of $1.8 billion Zuora is among smaller companies, but its more than $197.3 million in cash and positive free cash flow over the last twelve months give us confidence that Zuora has the resources it needs to pursue a high growth business strategy.

Zuora' revenue guidance for the next quarter looks quite a bit better than what the analysts were expecting. And we were also excited to see it that it outperformed analysts' revenue expectations this quarter. On the other hand, it was disappointing to see the slowdown in new contract wins and the revenue growth overall was quite weak. Taking a step back, it seems to us that this was a complicated quarter for Zuora. Zuora wasn't our first pick when looking for growth stocks going into these results, and nothing we have seen today has changed that.

PS. If you found this analysis useful, you will love our earnings alerts! We publish so fast, you often have the opportunity to buy or sell before the market has fully absorbed the information. Never miss out on the right time to invest again. Signup here for free early access.

The author has no position in any of the stocks mentioned.