As finance and HR software stocks’ Q2 earnings season wraps, let's dig into this quarter’s best and worst performers, including Zuora (NYSE:ZUO) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 16 finance and HR software stocks we track reported a decent Q2; on average, revenues beat analyst consensus estimates by 4.24%, while on average next quarter revenue guidance was 2.63% above consensus. Technology stocks have been hit hard on fears of higher interest rates as investors search for near-term cash flows, but finance and hr software stocks held their ground better than others, with share prices down 4.31% since the previous earnings results, on average.

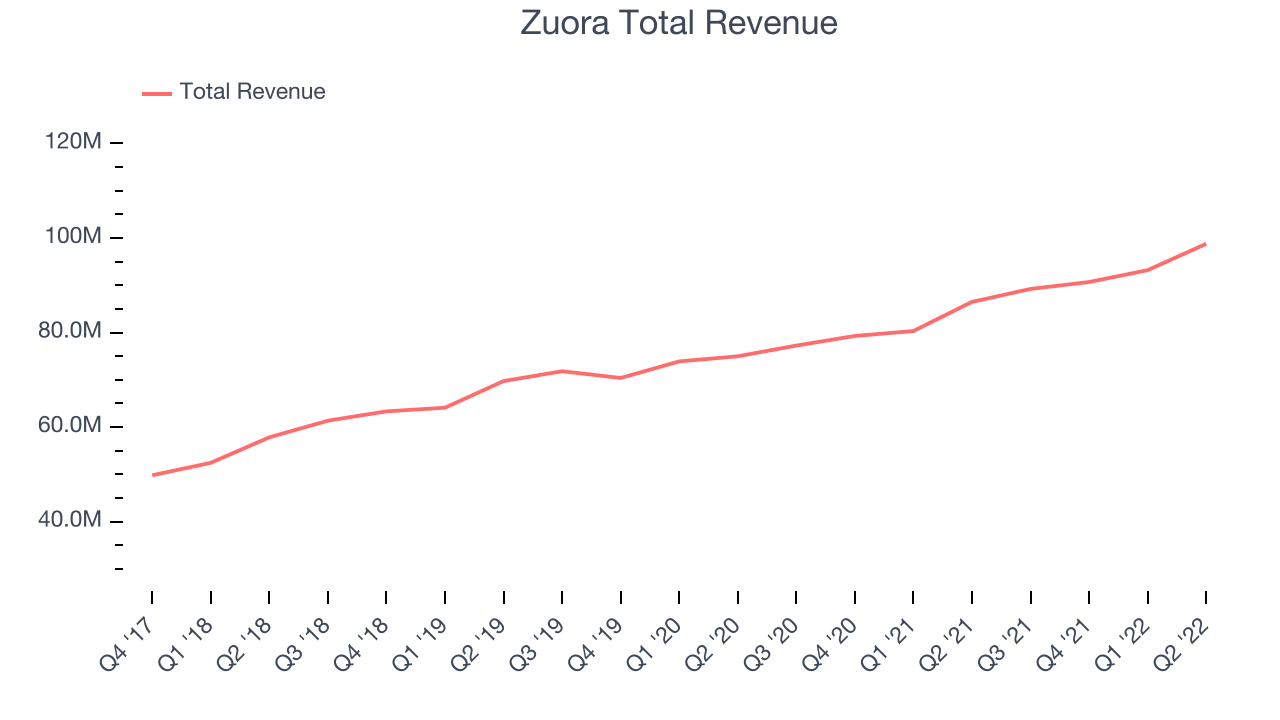

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $98.7 million, up 14.2% year on year, beating analyst expectations by 1.26%. It was a weaker quarter for the company, with revenue guidance for both the next quarter and full-year guidance missing analysts' expectations.

“It was another solid quarter where we exceeded guidance across all of our key financial metrics. We are benefiting from our incredible customer base, our land and expand strategy, as well as our resilient recurring revenue business model, and today’s acquisition of Zephr only expands our suite, giving us further opportunities to grow,” said Tien Tzuo, founder and CEO of Zuora.

Zuora delivered the weakest full year guidance update of the whole group. The company lost a net of 1 enterprise customer paying more than $100,000 annually and ended up with a total of 745. The stock is down 17.5% since the results and currently trades at $7.38.

Read our full report on Zuora here, it's free.

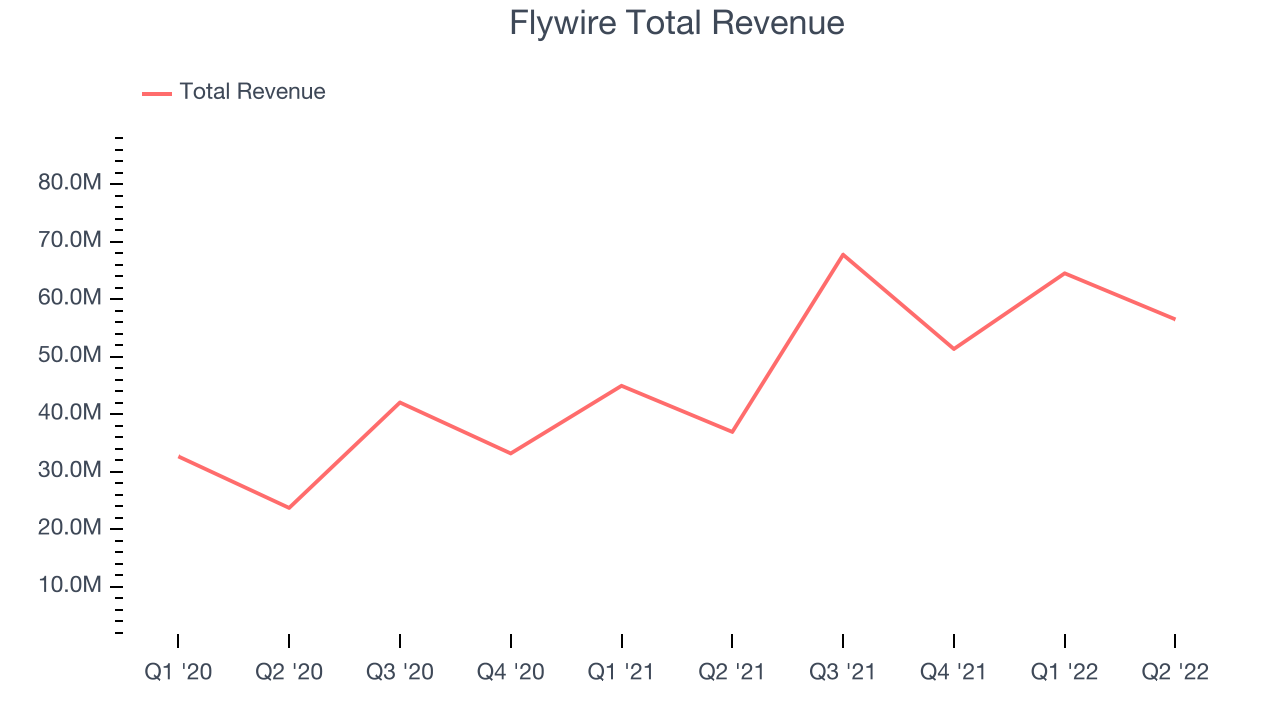

Best Q2: Flywire (NASDAQ:FLYW)

Originally created to process international tuition payments for universities, Flywire (NASDAQ:FLYW) is a cross border payments processor and software platform focusing on complex, high-value transactions like education, healthcare and B2B payments.

Flywire reported revenues of $56.5 million, up 52.9% year on year, beating analyst expectations by 18.7%. It was an exceptional quarter for the company, with an impressive beat of analyst estimates and a very optimistic guidance for the next quarter.

Flywire achieved the strongest analyst estimates beat and highest full year guidance raise among its peers. The stock is down 3.77% since the results and currently trades at $22.71.

Is now the time to buy Flywire? Access our full analysis of the earnings results here, it's free.

Slowest Q2: Intuit (NASDAQ:INTU)

Created in 1983 when founder Scott Cook watched his wife struggle to reconcile the family's checkbook, Intuit provides tax and accounting software for small and medium-sized businesses.

Intuit reported revenues of $2.41 billion, down 5.74% year on year, beating analyst expectations by 3.61%. It was a weak quarter for the company, with an underwhelming guidance for the next year and a slow revenue growth.

Intuit had the slowest revenue growth in the group. The stock is down 12.9% since the results and currently trades at $391.

Read our full analysis of Intuit's results here.

Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $301.2 million, up 20.2% year on year, beating analyst expectations by 2.27%. It was a decent quarter for the company, with a significant improvement in gross margin but decelerating customer growth.

The company added 119 customers to a total of 5,728. The stock is up 1.58% since the results and currently trades at $59.64.

Read our full, actionable report on Ceridian here, it's free.

Workiva (NYSE:WK)

Founded in 2010, Workiva (NYSE:WK) offers software as a service product that makes financial and compliance reporting easier, especially for publicly traded corporations.

Workiva reported revenues of $131.5 million, up 24.5% year on year, beating analyst expectations by 4.36%. It was a decent quarter for the company, with accelerating customer growth but an underwhelming revenue guidance for the next quarter.

The company added 62 enterprise customers paying more than $100,000 annually to a total of 1,186. The stock is up 10.4% since the results and currently trades at $75.49.

Read our full, actionable report on Workiva here, it's free.

The author has no position in any of the stocks mentioned