As finance and HR software stocks’ Q4 earnings season wraps, let's dig into this quarters’ best and worst performers, including Zuora (NYSE:ZUO) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 17 finance and HR software stocks we track reported a solid Q4; on average, revenues beat analyst consensus estimates by 5.66%, while on average next quarter revenue guidance was 2.56% above consensus. There has been a stampede out of high valuation technology stocks, but finance and HR software stocks held their ground better than others, with the share price up 1.06% since earnings, on average.

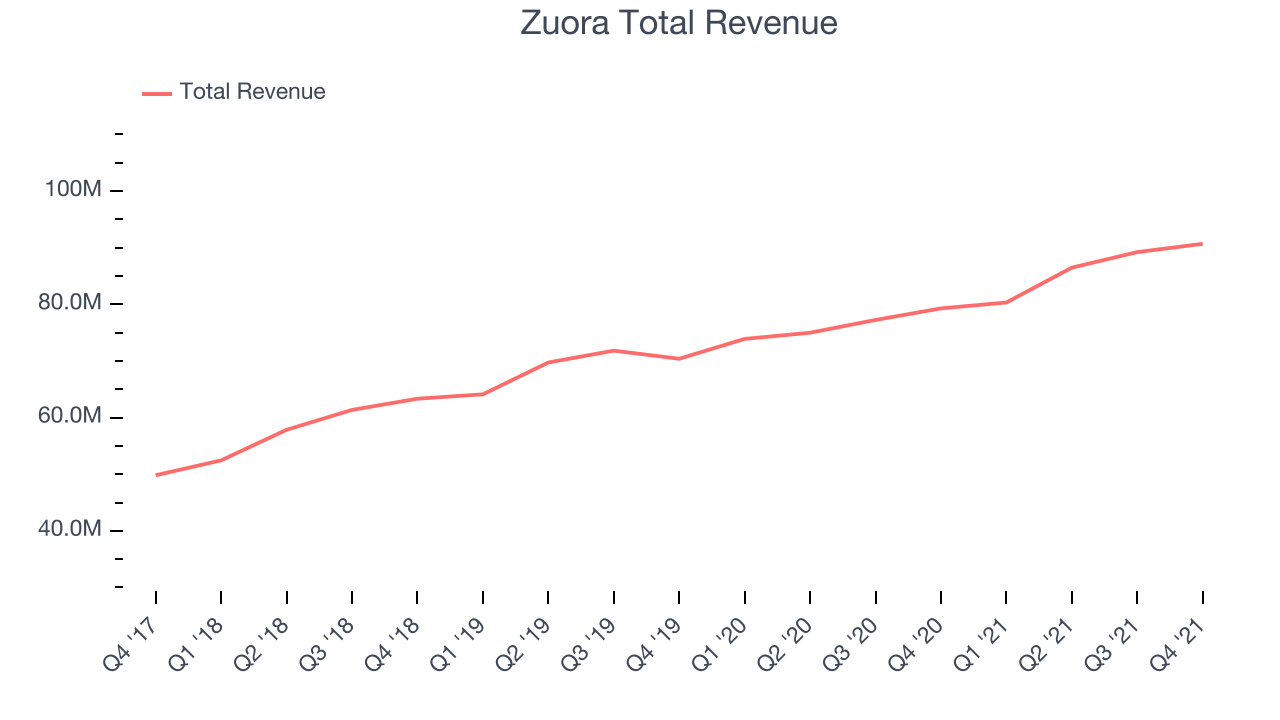

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $90.6 million, up 14.3% year on year, in line with analyst expectations. It was a mixed quarter for the company, with an increase in net revenue retention rate compared to the previous year but underwhelming revenue guidance for the next quarter.

"After a transformational year at Zuora, we closed out Fiscal 2022 meeting or exceeding expectations across our operating results," said Tien Tzuo, founder and CEO of Zuora.

Zuora delivered the slowest revenue growth of the whole group. The company added 27 enterprise customers paying more than $100,000 annually to a total of 747. The stock is down 11.6% since the results and currently trades at $13.59.

Is now the time to buy Zuora? Access our full analysis of the earnings results here, it's free.

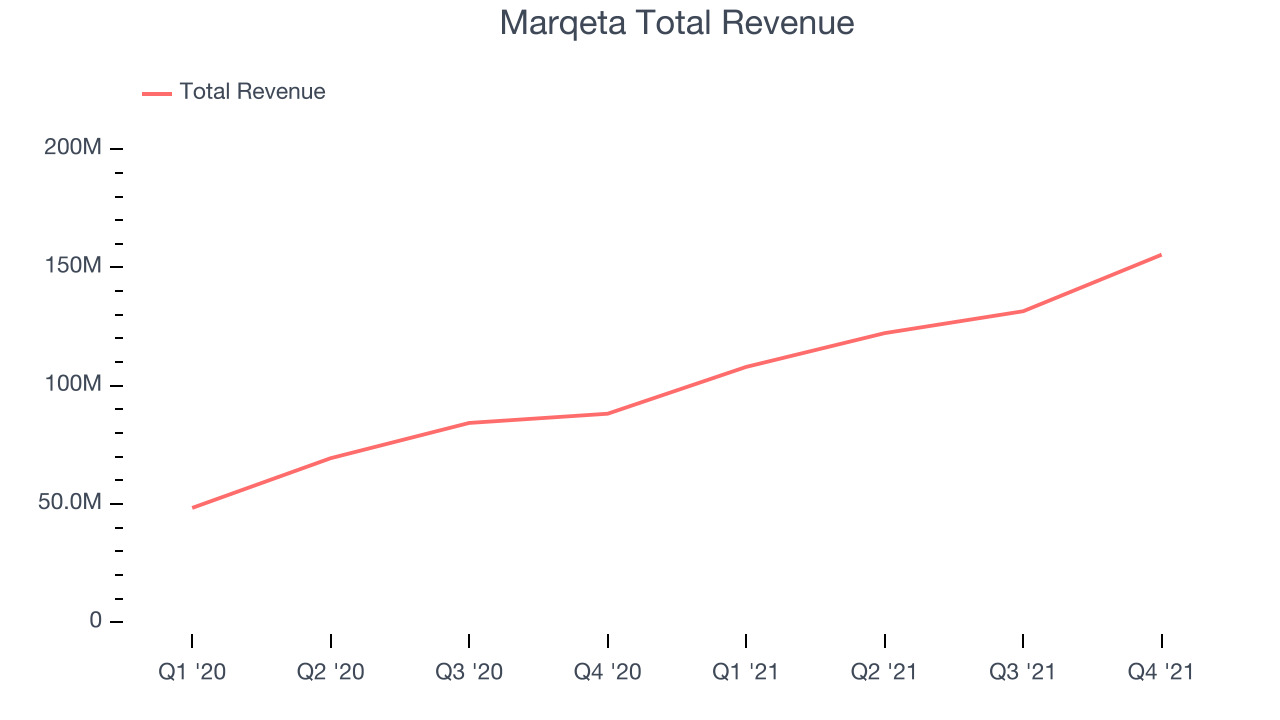

Best Q4: Marqeta (NASDAQ:MQ)

Founded by CEO Jason Gardner in 2009, Marqeta (NASDAQ: MQ) is an innovative card issuer that provides companies with the ability to issue and process virtual, physical, and tokenized credit and debit cards.

Marqeta reported revenues of $155.4 million, up 76.2% year on year, beating analyst expectations by 12.7%. It was an incredible quarter for the company, with a significant improvement in gross margin and an impressive beat of analysts' estimates.

The stock is up 2.7% since the results and currently trades at $11.

Is now the time to buy Marqeta? Access our full analysis of the earnings results here, it's free.

Weakest Q4: Coupa (NASDAQ:COUP)

Founded in 2006 by former Oracle executives, Coupa Software (COUP) is a software as a service platform that helps enterprises manage their spending across procurement, billing and business expenses and get a better visibility into how the money is spent.

Coupa reported revenues of $193.2 million, up 18.1% year on year, beating analyst expectations by 3.82%. It was a mixed quarter for the company, with an improvement in gross margin but full-year guidance missing analysts' expectations.

Coupa had the weakest full year guidance update in the group. The stock is up 15.6% since the results and currently trades at $104.

Read our full analysis of Coupa's results here.

Anaplan (NYSE:PLAN)

Founded by Michael Gould in 2006 in a stone barn in Yorkshire, England, Anaplan (NYSE:PLAN) is a financial modelling software that helps large enterprises with complex decision-making around budgets and financial forecasts.

Anaplan reported revenues of $162.6 million, up 32.7% year on year, beating analyst expectations by 5.09%. It was a decent quarter for the company, with strong topline growth and a solid beat of analyst estimates.

The stock is up 39.5% since the results and currently trades at $65.23.

Read our full, actionable report on Anaplan here, it's free.

Avalara (NYSE:AVLR)

Founded by Scott McFarlane in 2004, Avalara (NYSE:AVLR) offers software as a service that provides companies with real-time information on how much tax to charge and automates tax compliance.

Avalara reported revenues of $195.1 million, up 34.8% year on year, beating analyst expectations by 5.84%. It was a strong quarter for the company, with a solid beat of analyst estimates and revenue guidance for the next year above expectations.

The company added 870 customers to a total of 18,270. The stock is down 15.1% since the results and currently trades at $95.50.

Read our full, actionable report on Avalara here, it's free.

The author has no position in any of the stocks mentioned