As Q4 earnings season comes to a close, it’s time to take stock of this quarter's best and worst performers amongst the finance and HR software stocks, including Zuora (NYSE:ZUO) and its peers.

Organizations are constantly looking to improve organizational efficiencies, whether it is financial planning, tax management or payroll. Finance and HR software benefit from the SaaS-ification of businesses, large and small, who much prefer the flexibility of cloud-based, web-browser delivered software paid for on a subscription basis than the hassle and expense of purchasing and managing on-premise enterprise software.

The 14 finance and HR software stocks we track reported a decent Q4; on average, revenues beat analyst consensus estimates by 5.01%, while on average next quarter revenue guidance was 3.19% above consensus. Tech multiples have reverted to the historical mean after reaching all time levels in early 2021, but finance and HR software stocks held their ground better than others, with share prices down 1.14% since the previous earnings results, on average.

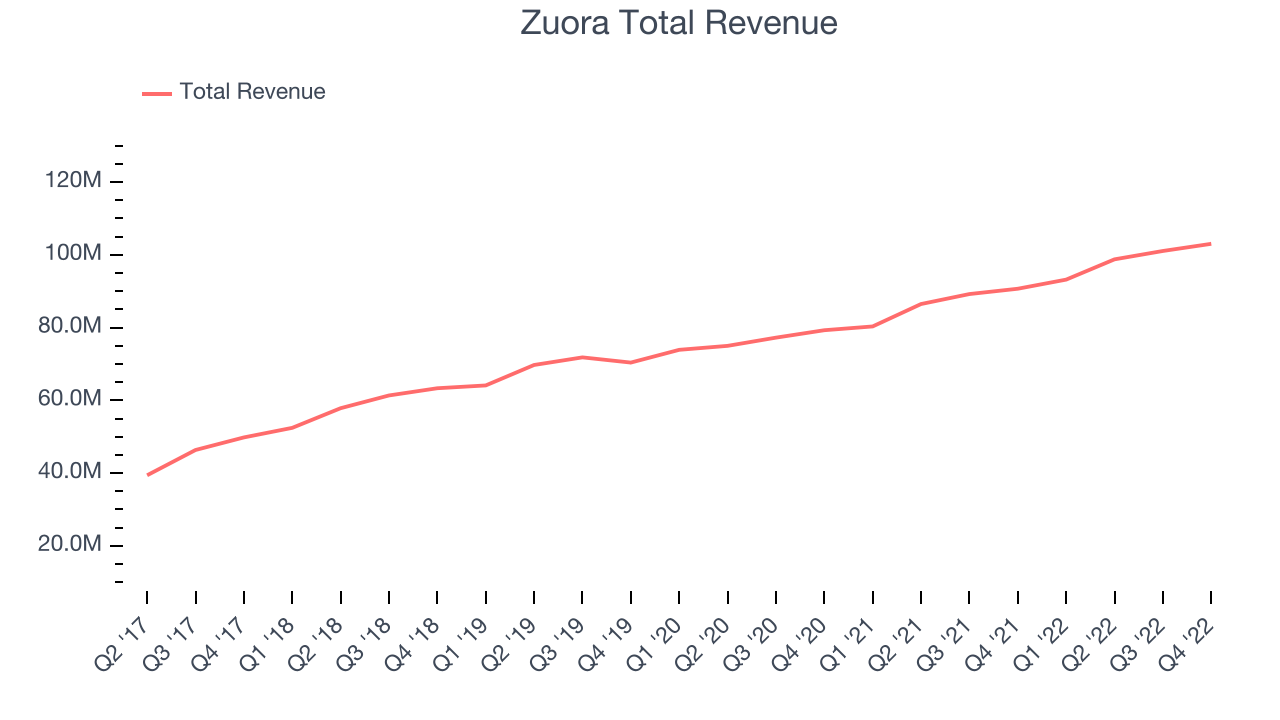

Zuora (NYSE:ZUO)

Founded in 2007, Zuora (NYSE:ZUO) offers software as a service platform that allows companies to bill and accept payments for recurring subscription products.

Zuora reported revenues of $103 million, up 13.6% year on year, beating analyst expectations by 2.8%. It was a slower quarter for the company, with decelerating growth in large customers and underwhelming guidance for the next year.

“Q4 was another solid quarter where we came in ahead of guidance across our operating metrics, including revenue, free cash flow, net dollar retention and non-GAAP operating income,” said Tien Tzuo, founder and CEO at Zuora.

The stock is up 14% since the results and currently trades at $9.34.

Read our full report on Zuora here, it's free.

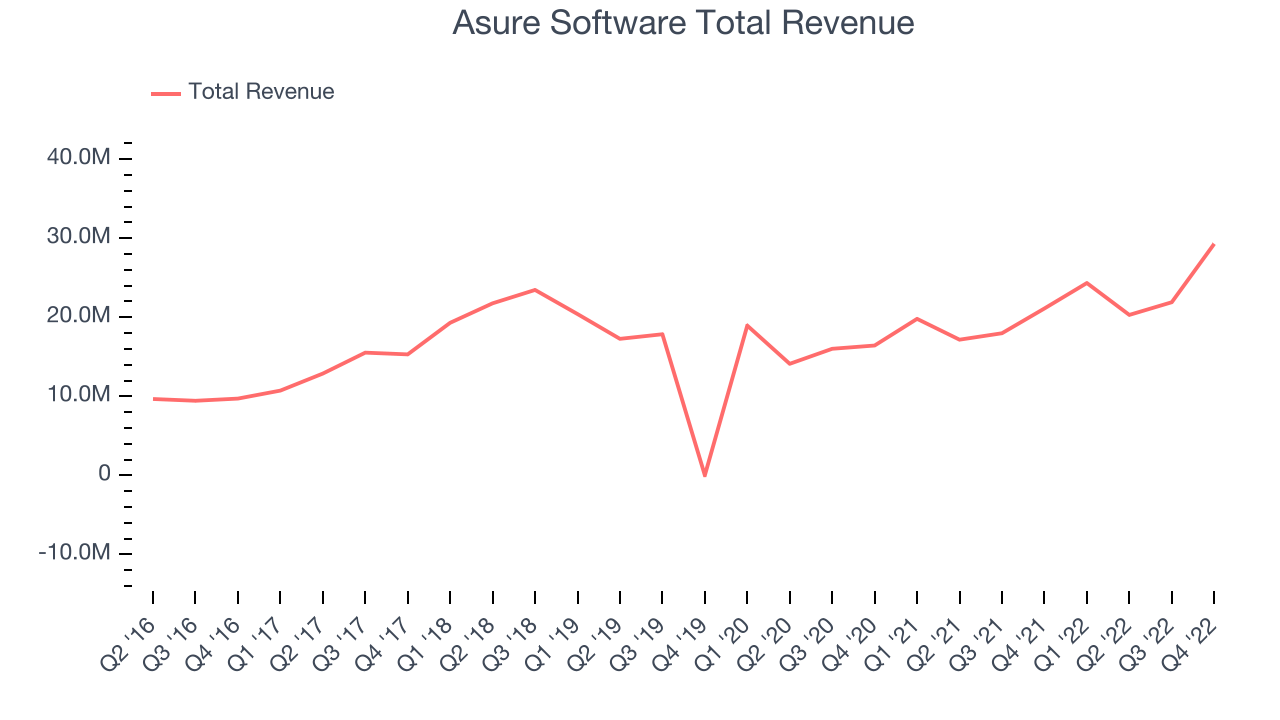

Best Q4: Asure Software (NASDAQ:ASUR)

Created from the merger of two small workforce management companies in 2007, Asure (NASDAQ:ASUR) provides cloud based payroll and HR software for small and medium-sized businesses (SMBs).

Asure Software reported revenues of $29.3 million, up 38.7% year on year, beating analyst expectations by 23.3%. It was an impressive quarter for the company, with a significant improvement in gross margin and a solid beat of analyst estimates.

Asure Software delivered the strongest analyst estimates beat among its peers. The stock is up 22.4% since the results and currently trades at $13.75.

Is now the time to buy Asure Software? Access our full analysis of the earnings results here, it's free.

BlackLine (NASDAQ:BL)

Started in 2001 by software engineer Therese Tucker, one of the very few women founders who took their companies public, BlackLine (NASDAQ:BL) provides software for organizations to automate accounting and finance tasks.

BlackLine reported revenues of $140 million, up 21.4% year on year, in line with analyst expectations. It was a weaker quarter for the company, with revenue guidance for the next quarter and the full year missing analysts' expectations.

BlackLine had the weakest performance against analyst estimates and weakest full year guidance update in the group. The company added 128 customers to a total of 4,188. The stock is down 13.3% since the results and currently trades at $62.91.

Read our full analysis of BlackLine's results here.

Ceridian (NYSE:CDAY)

Founded in 1992 as an outsourced payroll processor and transformed after the 2012 acquisition of Dayforce, Ceridian (NYSE:CDAY) is a provider of cloud based payroll and HR software targeted at mid-sized businesses.

Ceridian reported revenues of $336.1 million, up 19.1% year on year, beating analyst expectations by 3.39%. It was a decent quarter for the company, with very optimistic guidance for the next quarter but a decline in gross margin.

The company added 145,000 customers to a total of 5,993,000. The stock is down 2.92% since the results and currently trades at $72.51.

Read our full, actionable report on Ceridian here, it's free.

Paychex (NASDAQ:PAYX)

One of the oldest payroll service providers, Paychex provides payroll and human resource (HR) solutions.

Paychex reported revenues of $1.38 billion, up 8.23% year on year, beating analyst expectations by 2.4%. It was a solid quarter for the company, with a significant improvement in gross margin.

Paychex had the slowest revenue growth among the peers. The stock is up 1.98% since the results and currently trades at $111.1.

Read our full, actionable report on Paychex here, it's free.

The author has no position in any of the stocks mentioned