Beverage company Zevia (NYSE:ZVIA) fell short of analysts' expectations in Q1 CY2024, with revenue down 10.4% year on year to $38.8 million. Next quarter's revenue guidance of $39 million also underwhelmed, coming in 15.8% below analysts' estimates. It made a GAAP loss of $0.10 per share, down from its loss of $0.04 per share in the same quarter last year.

Zevia PBC (ZVIA) Q1 CY2024 Highlights:

- Revenue: $38.8 million vs analyst estimates of $39.43 million (1.6% miss)

- EPS: -$0.10 vs analyst expectations of -$0.10 (in line)

- Revenue Guidance for Q2 CY2024 is $39 million at the midpoint, below analyst estimates of $46.33 million

- Gross Margin (GAAP): 45.7%, down from 46.4% in the same quarter last year

- Free Cash Flow was -$3.24 million compared to -$6.67 million in the previous quarter

- Sales Volumes were down 10.4% year on year

- Market Capitalization: $60.51 million

With a primary focus on soda but also a presence in energy drinks and teas, Zevia (NYSE:ZVIA) is a better-for-you beverage company.

The company was founded in 2007 and launched with three flavors of zero-calorie, naturally-sweetened sodas. Zevia believed that consumers deserved a soda that was both healthy and great-tasting. Since its founding, more flavors have been launched and range from familiar favorites such as cola to innovative flavors such as grapefruit citrus. In addition to expanding the soda portfolio, Zevia has launched products in the energy drink, alcoholic mixer, tea, and kids’ beverage categories.

The Zevia core customer enjoys the taste of soda but has also soured on traditional sodas due to their sugar content and negative health impacts. This individual is also likely wary of artificial sweeteners that have flooded the market. Lastly, Zevia’s loyalists are likely educated and have the willingness and means to pay a premium for products that tout health benefits.

Zevia products don’t enjoy the widespread distribution of traditional sodas, but the company has made major strides since its founding. Zevia beverages can be found in major supermarkets and convenience stores. Over time, the company is hoping to follow in the footsteps of storied soda brands where brand recognition leads to higher demand, which then increasingly incentivizes retailers to carry the brand to satisfy consumers.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Competitors mainly include traditional soda companies such as Coca-Cola (NYSE:KO), PepsiCo (NASDAQ:PEP), Keurig Dr. Pepper (NASDAQ:KDP).Sales Growth

Zevia PBC is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale.

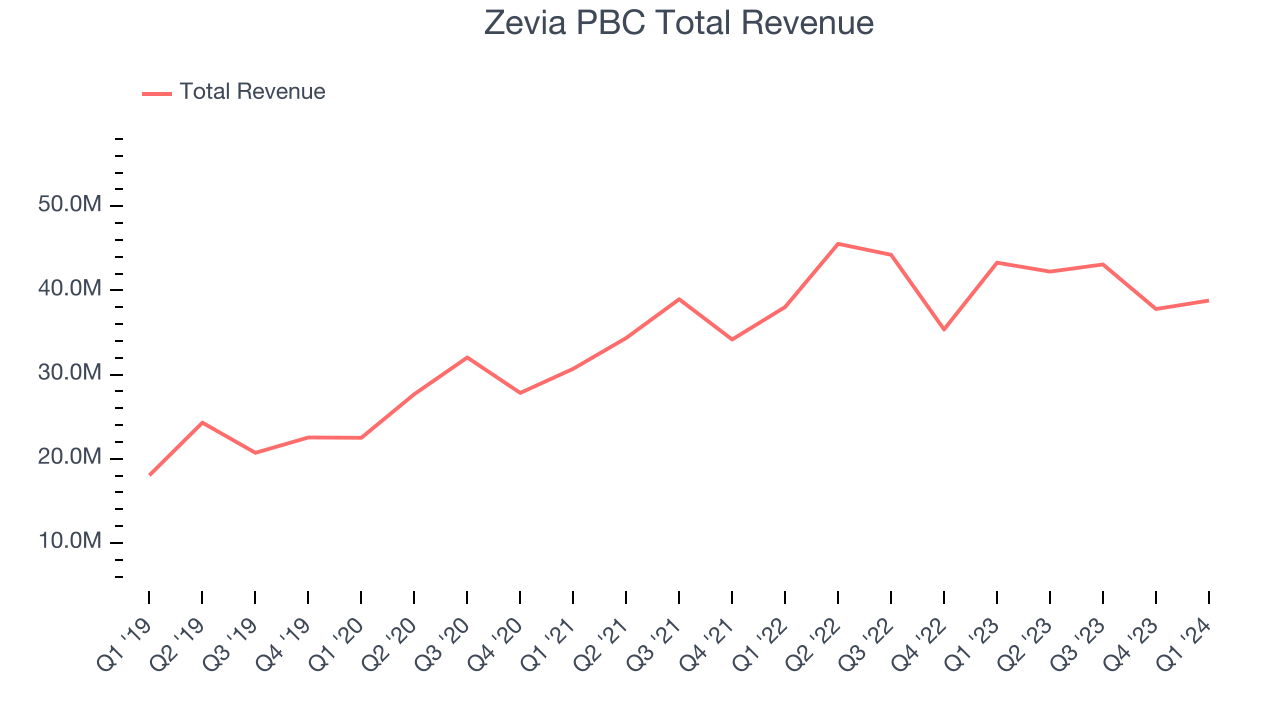

As you can see below, the company's annualized revenue growth rate of 11.1% over the last three years was decent for a consumer staples business.

This quarter, Zevia PBC missed Wall Street's estimates and reported a rather uninspiring 10.4% year-on-year revenue decline, generating $38.8 million in revenue. The company is guiding for a 7.7% year-on-year revenue decline next quarter to $39 million, a further deceleration from the 7.2% year-on-year decrease it recorded in the same quarter last year. Looking ahead, Wall Street expects sales to grow 11.3% over the next 12 months, an acceleration from this quarter.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

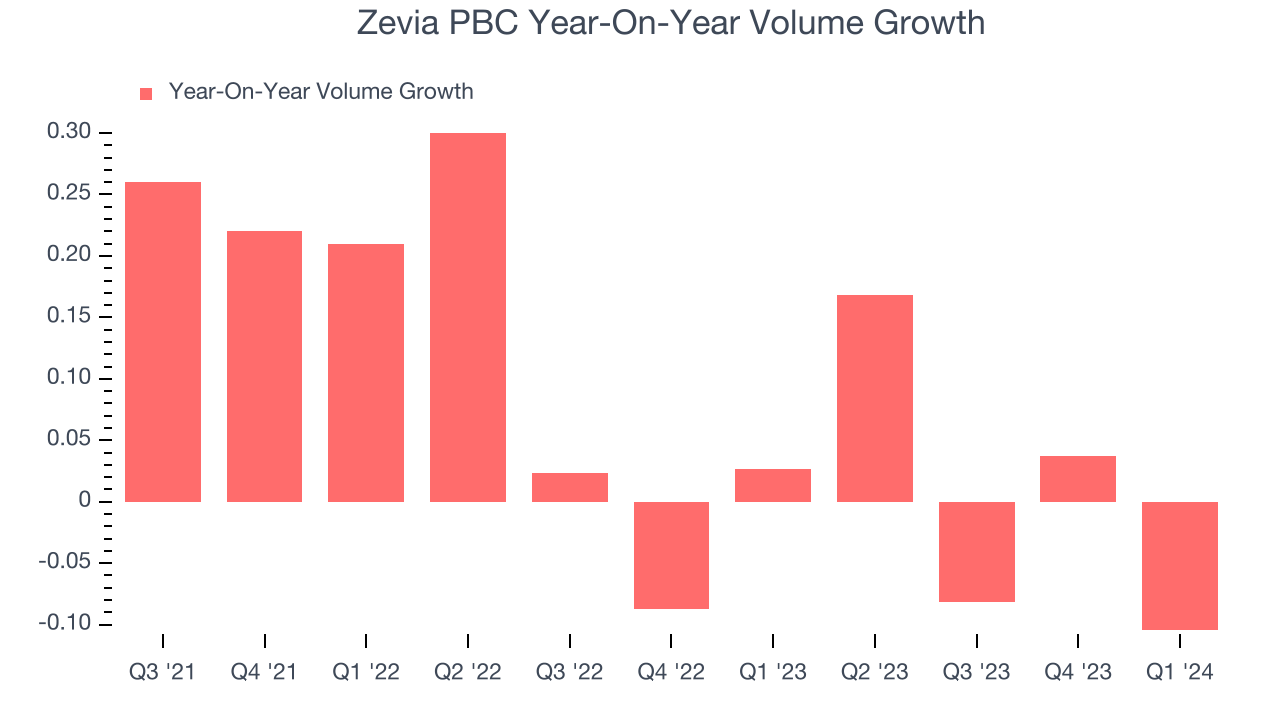

Zevia PBC's average quarterly volume growth was a healthy 3.5% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Zevia PBC's Q1 2024, sales volumes dropped 10.4% year on year. This result was a reversal from the 2.7% year-on-year increase it posted 12 months ago. A one quarter hiccup shouldn't deter you from investing in a business. We'll be monitoring the company to see how things progress.

Gross Margin & Pricing Power

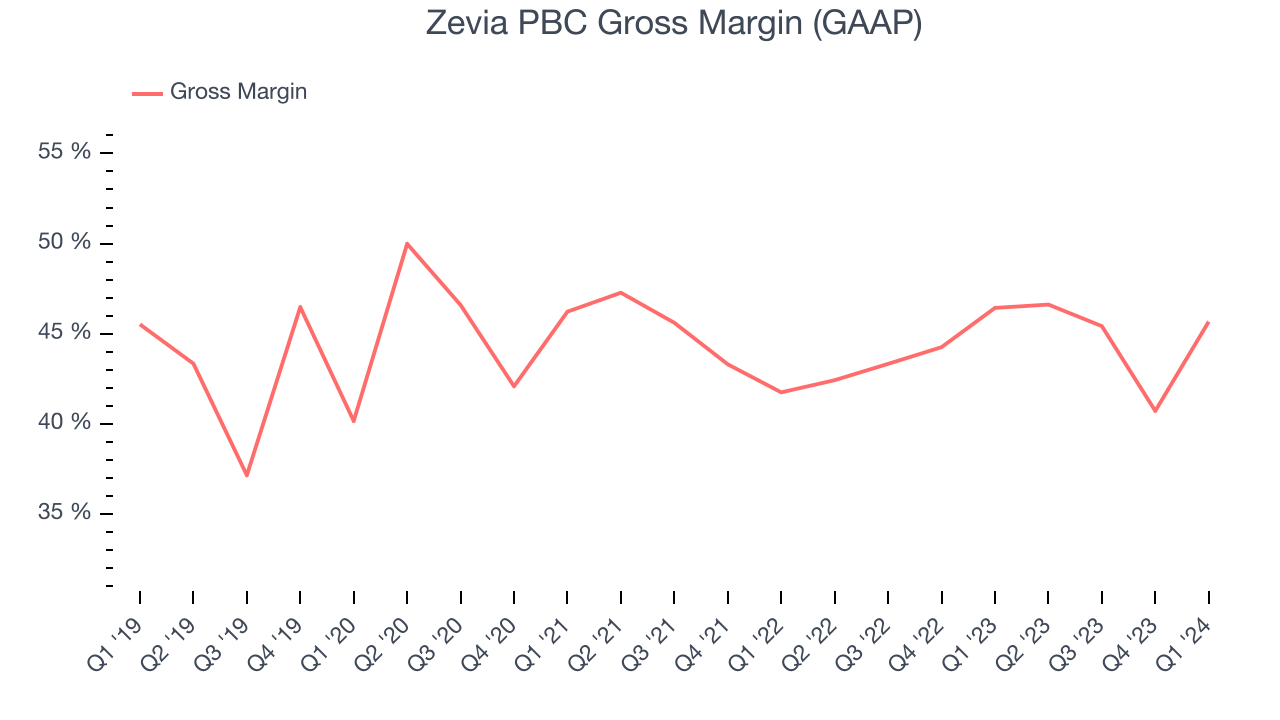

Zevia PBC's gross profit margin came in at 45.7% this quarter, in line with the same quarter last year. That means for every $1 in revenue, $0.54 went towards paying for raw materials, production of goods, and distribution expenses.

Zevia PBC has good unit economics for a consumer staples company, giving it the opportunity to invest in areas such as marketing and talent to stay competitive. As you can see above, it's averaged a healthy 44.4% gross margin over the last two years. Its margin has also been trending up over the last 12 months, averaging 1.3% year-on-year increases each quarter. If this trend continues, it could suggest a less competitive environment where the company has better pricing power and more favorable input costs (such as raw materials).

Operating Margin

Operating margin is an important measure of profitability accounting for key expenses such as marketing and advertising, IT systems, wages, and other administrative costs.

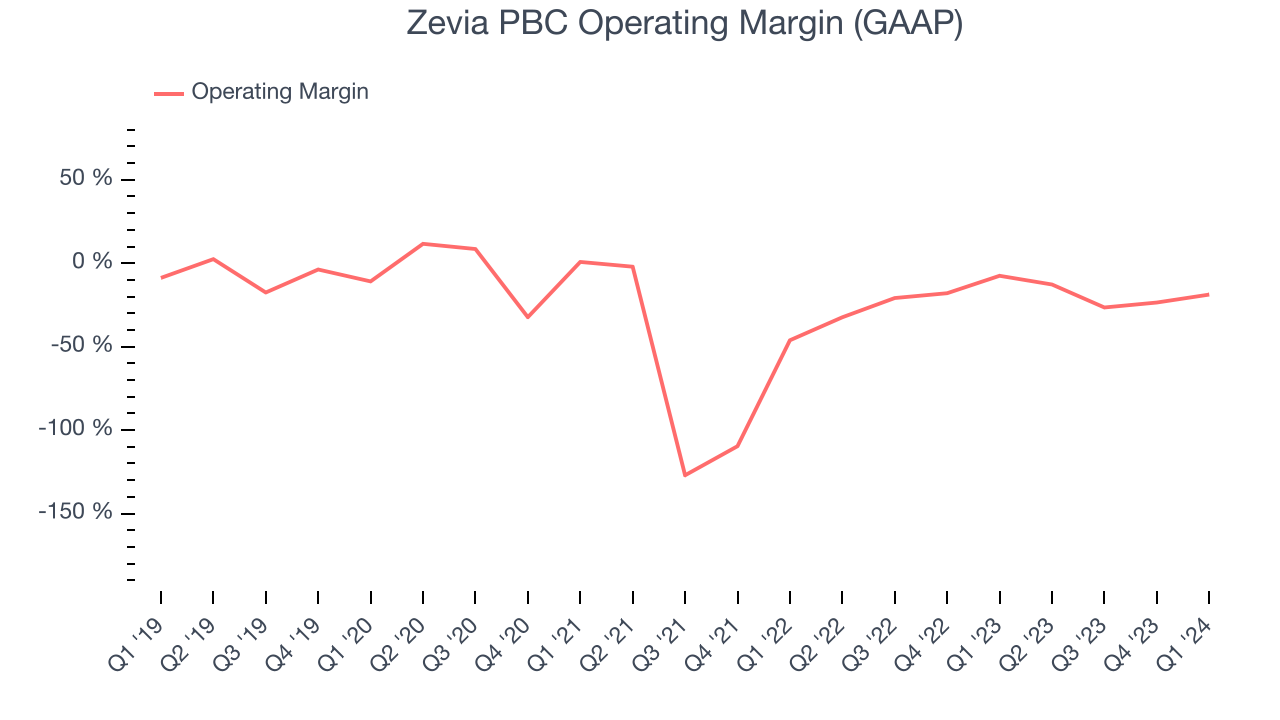

This quarter, Zevia PBC generated an operating profit margin of negative 18.8%, down 11.3 percentage points year on year. Because Zevia PBC's operating margin decreased more than its gross margin, we can infer the company was less efficient and increased spending in discretionary areas like corporate overhead and advertising.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, Zevia PBC has been one of them. Its high expenses have contributed to an average operating margin of negative 20.1%. On top of that, Zevia PBC's margin has remained more or less the same, showing the company needs to change something about its operating practices.

There are few unprofitable publicly traded consumer staples companies, and over the last two years, Zevia PBC has been one of them. Its high expenses have contributed to an average operating margin of negative 20.1%. On top of that, Zevia PBC's margin has remained more or less the same, showing the company needs to change something about its operating practices.EPS

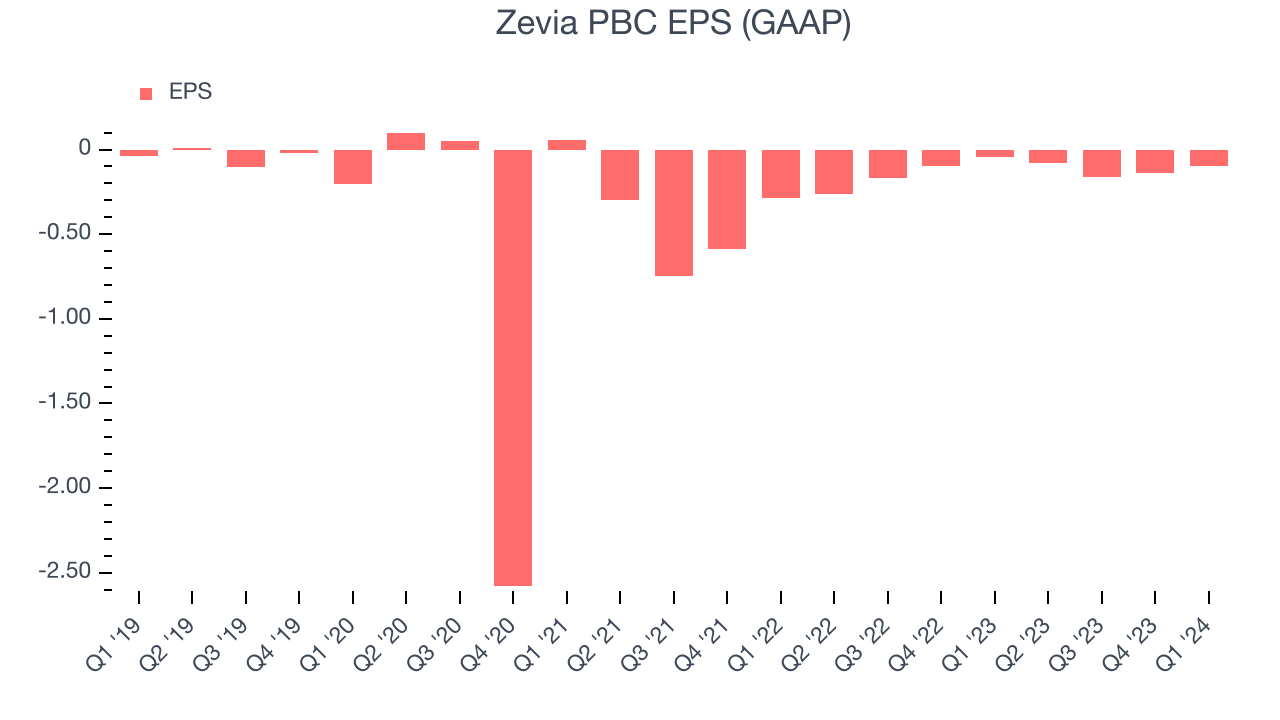

Earnings growth is a critical metric to track, but for long-term shareholders, earnings per share (EPS) is more telling because it accounts for dilution and share repurchases.

In Q1, Zevia PBC reported EPS at negative $0.10, down from negative $0.04 in the same quarter a year ago. This print beat Wall Street's estimates by 2%.

Between FY2021 and FY2024, Zevia PBC cut its earnings losses. Its EPS has improved by 41.3% on average each year.

Wall Street expects the company to continue growing earnings over the next 12 months, with analysts projecting an average 21.5% year-on-year increase in EPS.

Cash Is King

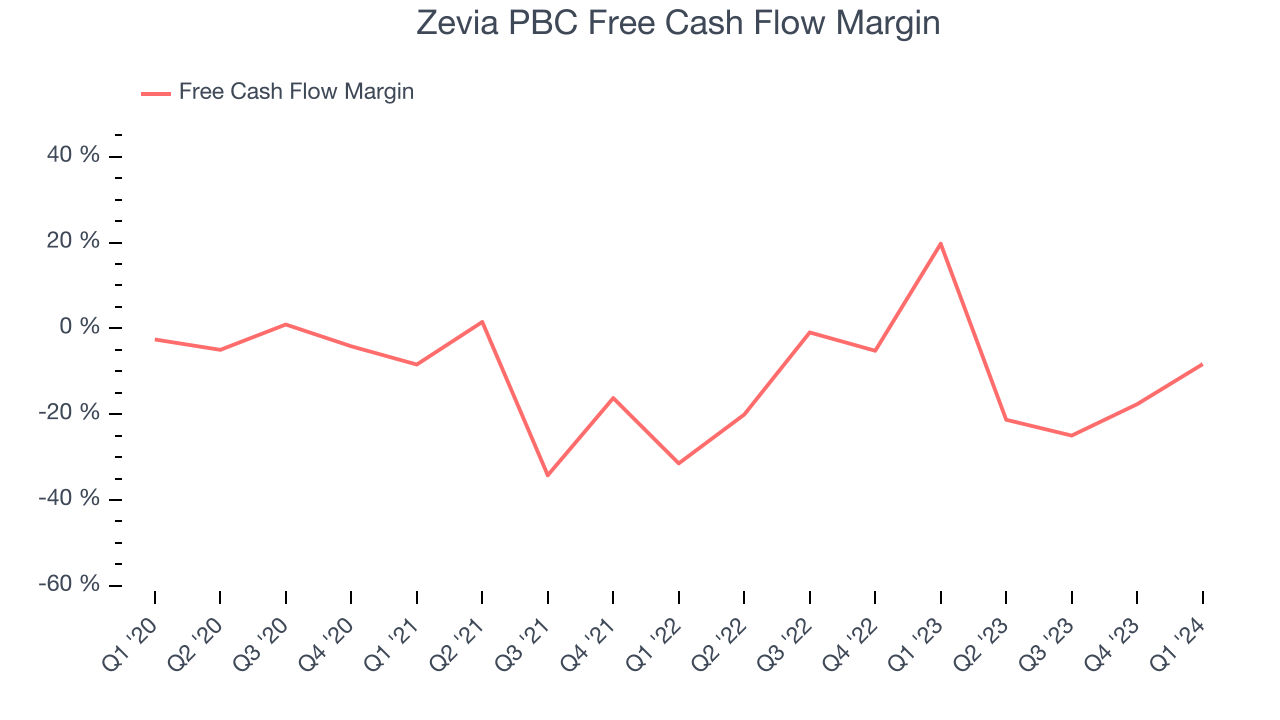

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can't use accounting profits to pay the bills.

Zevia PBC burned through $3.24 million of cash in Q1, representing a negative 8.3% free cash flow margin. The company shifted to cash flow negative from cash flow positive in the same quarter last year, which caught our eye as we'd like consumer staples companies to have more consistent performance.

Over the last two years, Zevia PBC's demanding reinvestments to stay relevant with consumers have drained company resources. Its free cash flow margin has been among the worst in the consumer staples sector, averaging negative 9.8%. Furthermore, its margin has averaged year-on-year declines of 16.6 percentage points over the last 12 months. We'll keep an eye on this as almost any movement in the wrong direction is undesirable given it's already burning cash. The company will need to improve its free cash flow conversion if it wants to survive (and ultimately thrive).

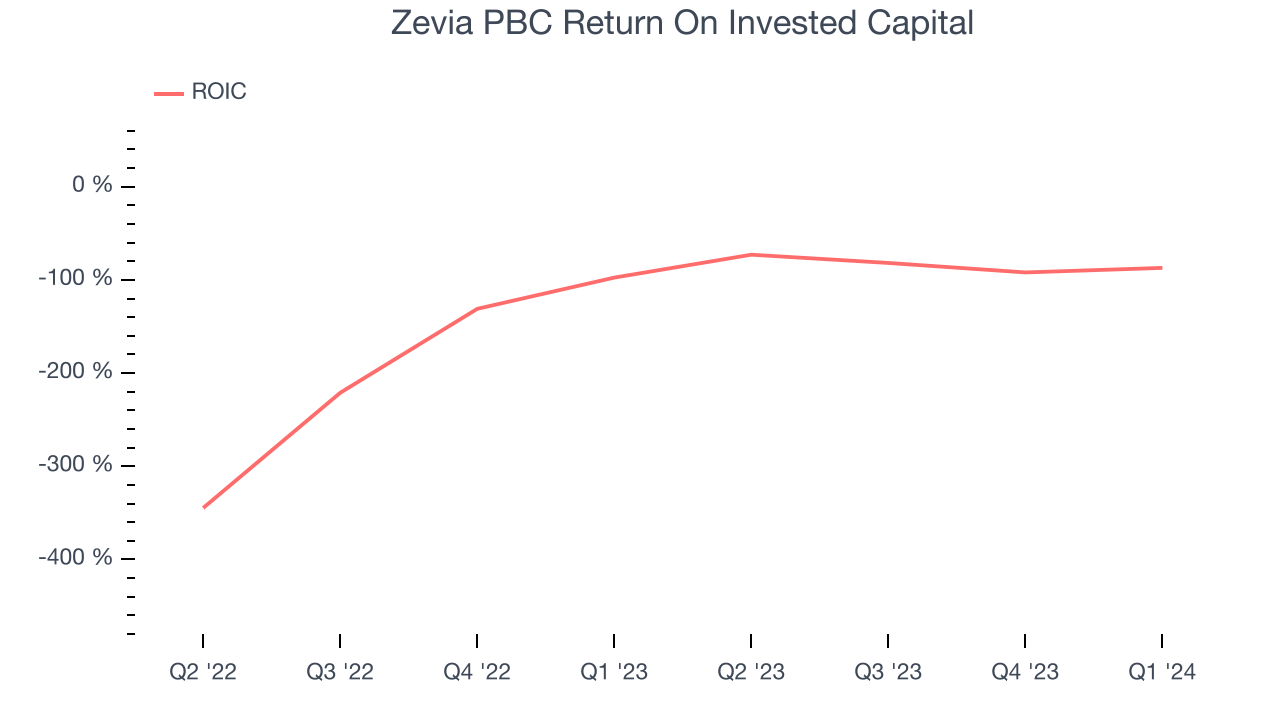

Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing revenue. But was it capital-efficient? Enter ROIC, a metric showing how much operating profit a company generates relative to how much money the business raised (debt and equity).

Zevia PBC's five-year average ROIC was negative 92.3%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer staples sector.

Balance Sheet Risk

Debt is a tool that can boost company returns but presents risks if used irresponsibly.

Zevia PBC is a well-capitalized company with $28.72 million of cash and $1.81 million of debt, meaning it could pay back all its debt tomorrow and still have $26.91 million of cash on its balance sheet. This net cash position gives Zevia PBC the freedom to raise more debt, return capital to shareholders, or invest in growth initiatives.

Key Takeaways from Zevia PBC's Q1 Results

It was good to see Zevia PBC beat analysts' gross margin expectations this quarter. On the other hand, its full-year revenue guidance missed analysts' expectations and its revenue guidance for next quarter missed Wall Street's estimates. Overall, this was a mediocre quarter for Zevia PBC. The company is down 9.1% on the results and currently trades at $0.95 per share.

Is Now The Time?

Zevia PBC may have had a tough quarter, but investors should also consider its valuation and business qualities when assessing the investment opportunity.

We cheer for all companies serving consumers, but in the case of Zevia PBC, we'll be cheering from the sidelines. Although its revenue growth has been solid over the last three years and its growth over the next 12 months is expected to be higher, its brand caters to a niche market. And while its EPS growth over the last three years has been fantastic, the downside is its relatively low ROIC suggests it has struggled to grow profits historically.

While we've no doubt one can find things to like about Zevia PBC, we think there are better opportunities elsewhere in the market. We don't see many reasons to get involved at the moment.

Wall Street analysts covering the company had a one-year price target of $3.18 per share right before these results (compared to the current share price of $0.95).

To get the best start with StockStory, check out our most recent stock picks, and then sign up to our earnings alerts by adding companies to your watchlist here. We typically have the quarterly earnings results analyzed within seconds of the data being released, and especially for companies reporting pre-market, this often gives investors the chance to react to the results before the market has fully absorbed the information.