A Profitable Growth Stock Benefitting From The Rise of AI

Lattice Semiconductor (NASDAQ: LSCC) has long been one of the most exciting stocks on our watchlist because we think the company is benefitting from the rise of artificial intelligence.

As you can see from the chart below, the Lattice Semiconductor stock price dropped suddenly in October 2023. Just days later on 3 November 2023, we chose Lattice Semiconductor as the StockStory Edge stock of the month for November and emailed our detailed buy recommendation to members.

As our way of welcoming you aboard our free membership tier, we hope you enjoy this abridged version of our full recommendation, which is only available to members of StockStory Edge.

What Does Lattice Semiconductor Do?

Lattice is a leading designer of field-programmable gate arrays (FPGAs).

Field Programmable Gate Arrays, or FPGAs, are like a special kind of computer chip. You could think of them as like a LEGO set for building complex electronic systems. They are used for a variety of complex products like robots that work in distribution centers and cars with self-driving technology.

Normally, computer chips are set to do one job and can't be changed. But FPGAs are different. After you buy them, you can change how they work to do different jobs. It's like having a LEGO set where you can first build a tiger, then take it apart and build a red panda, then take it apart and build a goldfish, all using the same pieces.

FPGAs have emerged as a preferred solution for customers in rapidly evolving technological fields because their flexibility gives them significant cost and time advantages over legacy chips that can’t be changed once manufactured. In AI research, for example, FPGAs’ reprogrammable nature allows engineers to quickly change their algorithms without buying a new batch of chips that can cost millions of dollars.

Given its chips’ customization abilities, Lattice collaborates intimately with customers to implement designs. The company achieves this through its team of field applications engineers and proprietary software solutions that allow for more user-friendly experiences. We like that it has a software solution because essential software can often earn very high profit margins.

We believe the demand for LSCC’s FPGAs is durable. Its chips are critical components for dynamic, high-growth industries such as AI, industrial robotics, autonomous vehicles (i.e., self-driving technology), and 5G wireless infrastructure. We see a bigger role for these technologies in the future, and that means more demand for Lattice Semiconductor’s products.

Risks

The first risk is a potential semiconductor downturn. The industry is cyclical due to the interplay of global economic growth, inventories, and technological obsolescence. We believe Lattice is partially insulated from obsolescence because of the re-programmability of FPGAs, but there’s no denying it’s tethered to the macro, which is sometimes good, sometimes bad, and sometimes somewhere in between. Investing over the long term by holding high-quality companies over three to five years, however, can meaningfully negate this roller coaster.

Like many semiconductor companies, Lattice is a “fabless” chip designer, meaning it doesn’t manufacture, assemble, or test its chips in-house. Instead, it outsources these functions to partners like Taiwan Semiconductor (TSMC) so that the company can focus on innovation. This means LSCC’s supply chain could be disrupted if China blockaded Taiwan (or worse).

Finally, there is competition. The company has a strong grip over the small-range FPGA market. The mid-range market is currently up for grabs, and we think Avant is a strong contender. On the other hand, AMD and Intel could also attack the mid-range market by providing customers with more tailored solutions. Thus far, the two giants have mostly set their sights on large-range FPGAs, which are mostly used for the highest-intensity applications.

Why We Like Lattice Semiconductors

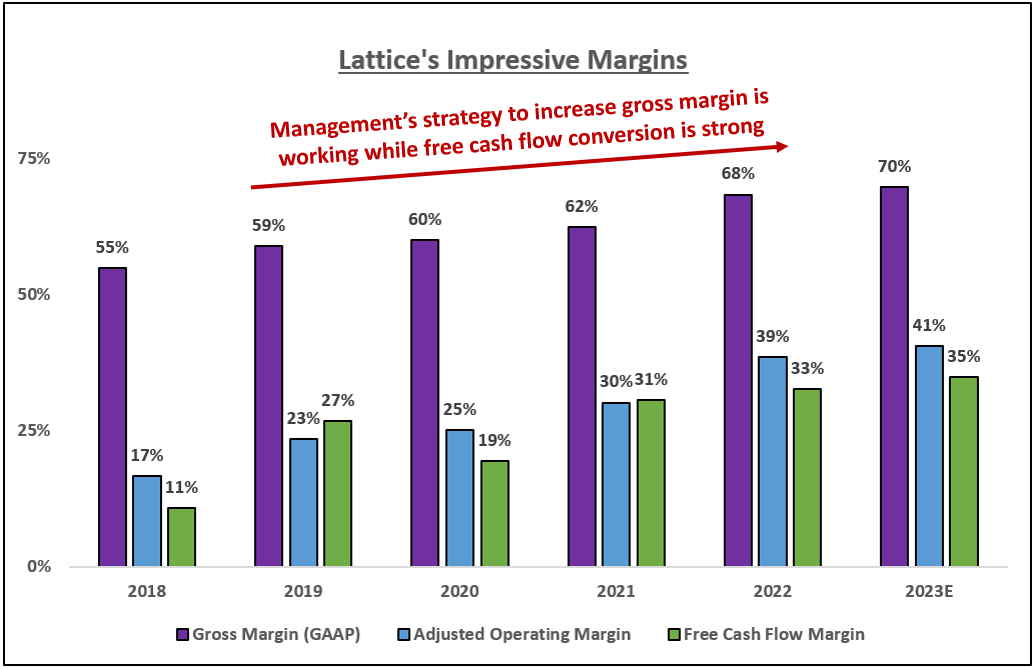

Lattice is an exceptionally high-quality business and its best-in-class profit margins have always kept it near the top of our list. Semiconductors are cyclical businesses, so demand fluctuations are normal and temporary. We think Lattice can easily outlast any lulls in demand, thanks to strong free cash flow margins.

Our view is that LSCC is the leader in a high-growth market, and its total addressable market is about to double.

1. Lattice is benefitting from the rise of AI

Lattice is well-positioned to benefit from the rise of AI because its silicon is on almost every new AI server shipped globally today. That rate should increase as servers steadily consume more chips and the total number of servers grows with more businesses, organizations, and people using generative AI and large language models (like ChatGPT).

AI will also bring an explosion in edge computing. Edge computing describes processing done on a server or device closer to the data source rather than in centralized data centers. Massive amounts of data must be analyzed at low latencies for AI to work at scale, and LSCC’s FPGAs–with their parallel processing capabilities that boost analytical speed and re-programmability that allows for easy adjustments to constantly changing AI algorithms–are must-haves.

2. Lattice has strong revenue and earnings per share growth

LSCC is a 40-year-old company that has consistently done one thing well: designing FPGAs. Over the last five years, its revenue has grown from about $400 million to what will be $740+ million this year (13% annualized growth rate), and its EPS rose by almost 500% over the same period.

Additionally, Lattice’s unique chips and intellectual property have enabled it to generate a robust 70% gross margin and 40% adjusted operating margin. This has led to heaps of free cash flow that the company has reinvested into product innovation. As of late, LSCC has even had excess cash to return to shareholders in the form of share buybacks. In 2022, it repurchased $110 million of stock, the highest annual total in its history.

3. New Product Platform

For most of its history, LSCC has focused on the small-range, power-efficient FPGA market for applications requiring simple logic functions. The company’s Nexus product line, released in late 2019, made Lattice the #1 player in the global FPGA market by volume. These chips were so popular because they featured the smallest chip sizes and lowest power consumption in the industry (75% less power consumption than comparable products from AMD and Intel).

Despite its success, Lattice is not standing still. Less than a year ago, the company entered the mid-range FPGA market with its Avant product line. These chips are leveraged in more rigorous use cases requiring edge computing (the “E” in Avant-E, see below) such as industrial robotics, autonomous vehicle networking, and machine vision (using cameras and computers to inspect and measure).

We think Avant is a game-changing development because its FPGAs boast 2x the bandwidth capabilities, 2.5x better power efficiency, and are up to 6x smaller than competing products from AMD and Intel. They are simply superior products.

4. Experienced Leadership

Lattice is led by CEO James Anderson, who joined the company in September 2018. Luckily for investors, his prior two roles were in key leadership positions at AMD and Intel. Anderson’s hiring was part of the complete turnover of Lattice’s old management team, and seven executives were recruited to join him.

Two individuals worth calling out are Stephen Douglass (Chief Technology Officer) and Mark Nelson (SVP of Sales). Douglass joined from Xilinx, which was the largest FPGA company before being acquired by AMD in 2022, while Nelson joined from Intel. We believe the management team’s deep knowledge of the industry and its closest competitors gives it an advantage.

Summing it all up, our research suggests that LSCC’s $660 million of revenue in 2022 can nearly double to about $1.2 billion in five years, a 13% annualized growth rate. With higher margins from Avant sales, efficiency from selling to existing customers, and continued share buybacks, that revenue growth can translate into nearly 20% EPS growth per annum. We believe this kind of growth should see the stock will reach $90 by the end of 2026.

With a bit of luck–and the optimism of a bull market–shareholders may well see a higher price.

If you enjoyed this abridged version of our Stock of the Month for November 2023 you’ll love the full version. Not only that, but when you become a member of StockStory Edge, you’ll get instant access to all our past recommendations; and you’ll be among the first to receive our next one!

Do you want know what moves the stocks you care about? When a stocks moves more than 5% on material news, we’ll drop an analysis explaining it right into your inbox. Similarly, our actionable earnings analysis is delivered within minutes of the results being released, giving you an edge over other investors. Set up your FREE watchlist now.