High-Quality Businesses Win

ServiceNow (NYSE: NOW) is an exciting stock because it offers exposure to the multi-decade mega-trend of automation. On top of that, its role in automating IT Service management puts it in a prime position to benefit from the introduction of generative AI.

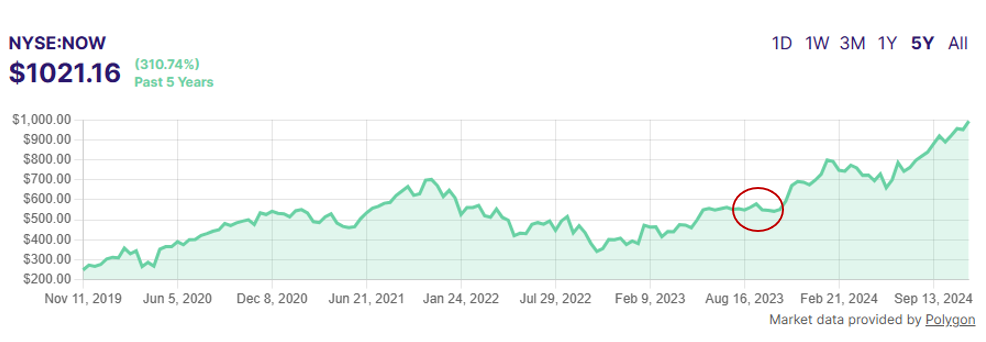

We are long-term investors, not speculators, so we don’t celebrate the short-term wins. Nonetheless, we are grateful and fortunate that Lead Analyst Anthony Lee chose a good time (August 17, 2023) to issue our ServiceNow buy recommendation exclusively to paying members of StockStory Edge. The stock was roughly $540 a share then.

Despite the 85+% share price increase since then, we still have ServiceNow in our portfolio. Note that we (the StockStory team) only bought shares in ServiceNow days after recommending it to members of StockStory Edge. And if in the future we no longer consider ServiceNow compelling, StockStory Edge members will be the first to know. We never trade personally until after informing our members and giving them 5 trading days to act.

As our way of welcoming you aboard our free membership tier, we hope you enjoy this abridged version of our full recommendation, which is only available to members of StockStory Edge.

ServiceNow (NOW): StockStory Edge Stock Of The Month For August 2023

ServiceNow (NYSE:NOW) has been a stock market winner ever since its summer 2012 IPO. It priced at $18, closed its first day of trading at $24.60, and hasn’t looked back. The shares now trade at around $1,000. Since its IPO, this is not just one of the best-performing stocks in enterprise software but in the whole market.

Just because the stock is up big, however, doesn’t mean the opportunity is gone.

In this case? Quite the opposite.

That’s because ServiceNow offers sticky mission-critical products across IT, HR, and customer service that reduce manual work, eliminate human error, and keep large corporations functioning. The company generates reliable subscription revenue from its happy customers and because of attractive unit economics, that revenue turns into high profits and free cash margins. The excess cash churned out by the business can be used to continually widen ServiceNow's lead over the competition competition from a brand, product, and customer service standpoint.

The kicker is that ServiceNow is now very much a Generative AI beneficiary due to its partnership with NVIDIA.

What Does ServiceNow Do?

ServiceNow’s software platform helps businesses automate workflows and gives them a birds-eye view of their operations, unifying what has become an increasingly complex technology stack for many companies.

ServiceNow was founded in 2003 when current Chairman of the Board Fred Luddy recognized the inefficiencies of traditional IT Service Management (ITSM) at a time when employees might have to jump through multiple hoops to request help and then sit on standby for hours until someone from the IT department fixed their problem.

Luddy envisioned a world where technology could speed up these slow, cumbersome processes and launched the company’s first product in 2006.

Today, corporations of all sizes rely on ServiceNow to not only streamline IT but also manage their entire organization through a simple yet comprehensive online portal. For example, onboarding a new employee involves HR for payroll, IT for device needs, and whatever is specific to that person’s department.

ServiceNow brings these disparate systems together and automates the onboarding process, which will inevitably happen over and over again.

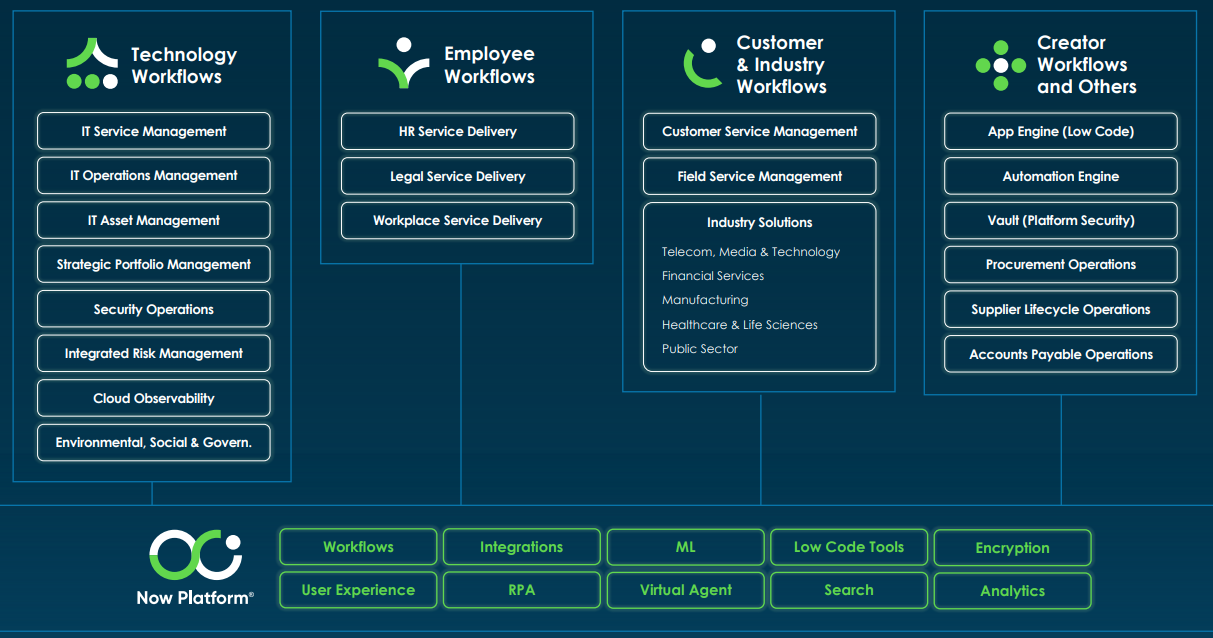

ServiceNow’s all-in-one platform gives customers numerous products to choose from, as shown in the graphic below. These software programs allow administrators to execute repetitive, labor-intensive tasks with the click of a button. On top of that, each product is wrapped in analytics, artificial intelligence, and machine learning capabilities, allowing customers to extract powerful insights from their data.

The company’s ambition doesn’t end there. ServiceNow has a strong track record of releasing new products to boost its customers’ productivity, the latest being a low-code platform that enables non-technical employees to build custom software applications. ServiceNow constantly surprises its customers (and investors) with innovation, granting it huge upside potential.

Why We Love An Investment In ServiceNow

For starters, we love the software subscription business model. If you sell sneakers, for instance, customers who bought from you last quarter may not come back again this quarter. On the other hand, software customers often sign multi-year contracts, resulting in recurring, predictable revenues and lower customer acquisition costs.

Within software, we believe ServiceNow has a very strong brand. “Nobody ever got fired for buying IBM” was a common phrase in IT circles in the 1980s and early 1990s, and we argue that NOW is heading in the same direction. 85% of Fortune 500 companies are ServiceNow customers and those controlling IT budgets view the company as trustworthy, reliable, and safe because of how many happy, loyal, and influential customers it has.

Furthermore, ServiceNow’s customers rarely cancel their subscriptions because its products are deeply intertwined with company operations. ServiceNow is capable of replacing a multitude of legacy software systems–everything from technical support to managing downtime. That means switching to ServiceNow can make life easier for employees, and once it’s there, switching away is very disruptive. This results in a sky-high renewal rate of around 98%.

Turning to profit, ServiceNow stands out with its gross margin of around 85% on its subscription revenue. From there, its adjusted operating margin and free cash flow margin will both hover around 30% when 2024 is all said and done. This makes ServiceNow a money-printing machine with the capital to grow its competitive position by improving existing products, adding new products, and promoting its brand.

What Does ServiceNow’s Future Hold?

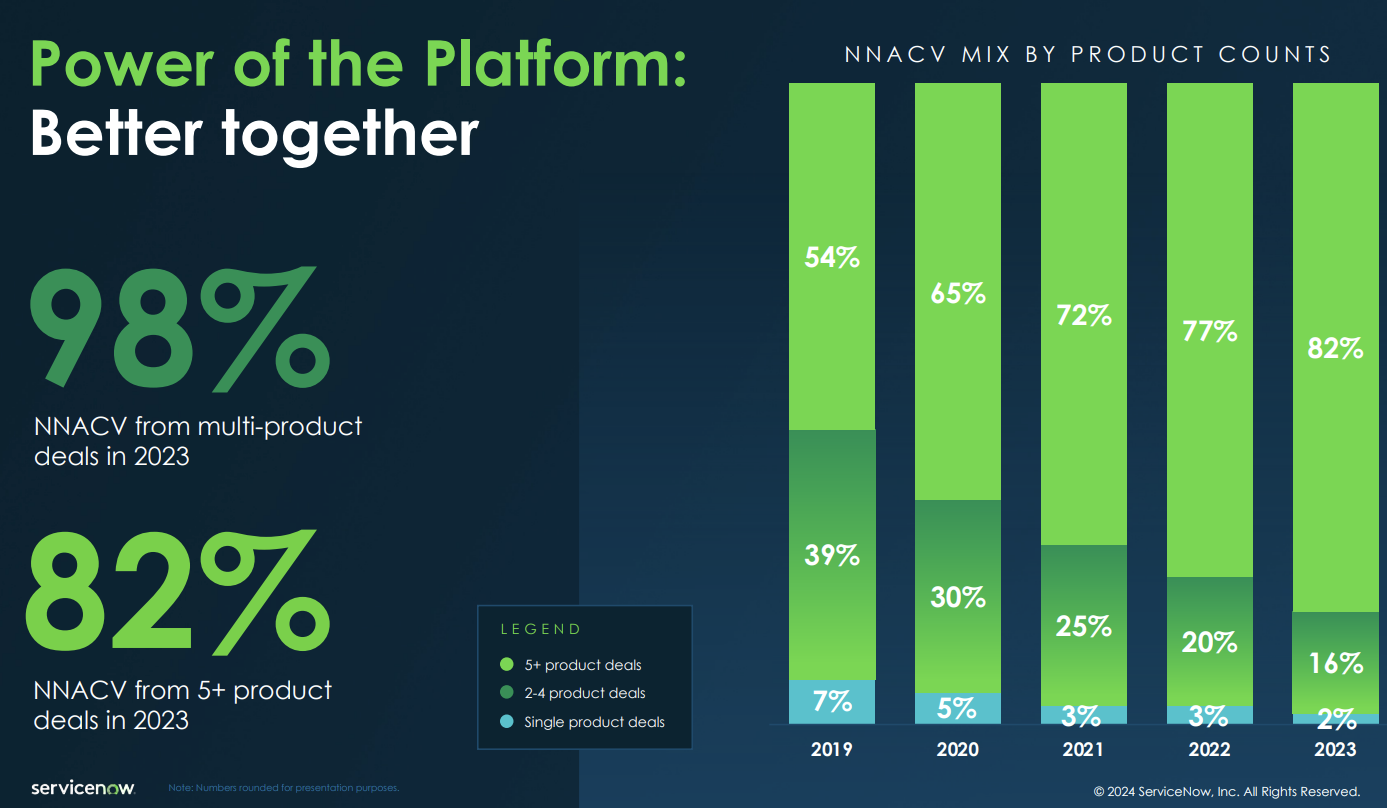

We think much of ServiceNow’s future growth will stem from selling more products to existing customers. The chart below shows how its “land and expand” strategy has developed over time. ServiceNow has successfully upsold its customers as 82% of contracts in 2023 featured five or more products purchased, up from 54% in 2019 (note that NNACV is 'net new annual contract value', a proxy for incremental revenue). We expect this number to be around 85% when the company reports 2024 results.

Another underappreciated growth lever is ServiceNow’s pricing power. Before 2018, the company had one pricing tier for all products. That changed in 2018 when NOW introduced a ‘Pro’ tier for IT service management, whereby customers could upgrade their packages to get more analytical and AI functionality. What’s next? Pro Plus, of course. It boasts “greater AI capabilities”, and we expect it to contribute to future growth.

We think as more of ServiceNow’s growth comes from existing customers, marketing expenses will moderate as a percentage of revenue, and thus we believe ServiceNow can earn higher profit margins as it grows.

Why Is Now The Right Time to Buy?

ServiceNow’s price-to-forward-sales (next 12 months) multiple is currently over 15x, higher than most companies and higher than when we recommended it back in August 2023.

Nonetheless, we think ServiceNow can justify its valuation due to its long-term demand tailwinds, predictable subscription model, best-in-class customer retention, and robust profit margins. We'd also add that our extensive backtest research and analysis has shown that when it comes to outperforming the market, business quality matters much more than entry price--you get what you pay for. Said differently, valuation may seem daunting in the near term, but companies showing robust growth up and down the P&L "grow into" their premium multiples over time.

The cherry on top is that the company is increasingly showing that it will be a Generative AI beneficiary for years--even decades--to come. In May 2023, ServiceNow and NVIDIA announced a partnership. The principal goal for ServiceNow was to develop custom large language models (LLMs) using NVIDIA’s technology.

The result includes intelligent virtual assistants and AI chatbots that can better resolve user issues and support requests. The secret sauce involves two parts: the GenAI’s capability to pull knowledge from unstructured data such as source code, internal documents, or videos to answer questions combined with the LLMs’ ability to summarize the information, eliminate the technical jargon, and give conversational responses.

In February 2024, ServiceNow unveiled an industry-specific solution for the telecom sector. ‘Now Assist for Telecommunications Service Management’ is for an industry where consumers are particularly frustrated with their customer service interactions (have you ever called customer service about your smartphone bill or tried to change plans??). Surely, similar solutions for other consumer-facing industries will roll out soon.

We really like that these GenAI and LLM-driven offerings are easy for customers to understand and provide straightforward, quantifiable benefits (the cost of a customer service agent). Combined with ServiceNow’s large customer base that already trusts the company in IT, Customer Service, and Human Resources, we think the company can start reaping the needle-moving benefits of GenAI in the near term.

With its product portfolio that is mission-critical for most customers, the expansion of this portfolio, and the GenAI tailwind, we think ServiceNow's revenue can sustain 20+% growth for a number of years.

With efficiency on expenses, especially the sales and marketing leverage, that revenue growth can translate into roughly 35% adjusted operating profit growth over time. It's had a big run in a short period and could take a breather in the near term, but we’re convinced the stock could approach $1,550 by the end of 2027. If that occurs, it would still generate a return that likely beats the market despite the big jump in the share price since we first pitched the stock.

Looking beyond 2026, we love a number of things about ServiceNow: the secular tailwinds it enjoys, the company's continually strengthening brand, and its products that bring customers great value and efficiency. This combination will drive stronger-for-longer revenue growth than the market anticipates.

This is a stock for investors looking for a high-quality business to hold over the long term.

What Are The Key Risks And How Do We Feel About Them?

Those stocks that are ‘“sure things”? They don’t exist. Every investment has its risks.

For ServiceNow, we’ve boiled them down into the three most important: competition, margins, and valuation.

ServiceNow has a tight grip on the IT service management market, but future returns will need to come from selling adjacent products where it faces stiffer competition. This means squaring off against Salesforce in customer service management, Microsoft in low-code/AI applications, and younger upstarts like Rippling in HR solutions. More competition means that ServiceNow may have to spend more on product development or accept lower gross margins to maintain its growth rate.

That leads us to our next risk–margins. Our thesis holds that ServiceNow can reduce its expenses as a percentage of revenue as it grows. There’s a chance this doesn’t happen. For example, new products may gain less traction than expected or cost more than anticipated to develop.

Turning to valuation, ServiceNow isn’t conventionally cheap based on current earnings. It has a lofty P/E ratio, implying the market expects many years of growth ahead. That makes it vulnerable to interest rate fluctuations and sentiment around high-growth businesses.

Ultimately, we’re comfortable with these risks because of ServiceNow’s dominance, reputation, products, financial strength. We expect many years of healthy growth in revenue, profits, and free cash flow.

Closing Thoughts

We’re excited about ServiceNow at this stage in its evolution. Software is still eating the world, and within software, ServiceNow is an elite asset in terms of its products and financials. Please note that members of StockStory hold shares in ServiceNow. Our money is where our mouth is.

If you enjoyed this abridged version of our Stock of the Month for August 2023 you’ll love the full version. Not only that, but when you become a member of StockStory Edge, you’ll get instant access to all our past recommendations; and you’ll be among the first to receive our next one!

Please note that we’re recommending ServiceNow (NYSE:NOW). If you decide to buy shares, please double-check the ticker and company name before you purchase as there’s another public company with a similar name–oilfield equipment manufacturer NOW (NYSE: DNOW).

Do you want know what moves the stocks you care about? When a stocks moves more than 5% on material news, we’ll drop an analysis explaining it right into your inbox. Similarly, our actionable earnings analysis is delivered within minutes of the results being released, giving you an edge over other investors. Set up your FREE watchlist now.

Publication Date: November, 2024