Cloudflare (NYSE:NET) isn’t just a high-quality company. It is a truly special company that could be a “ten bagger”. That means $10,000 invested today could be $100,000–a tenfold increase–years down the line.

There are three reasons why Cloudflare is so special: the intellectual horsepower of its team, the company’s go-to-market strategy, and the megatrends it is riding.

A Brief History of the Cloudflare

To understand the talent of its team–especially on the technical and engineering side–we must understand Cloudflare’s origin story. Lee Holloway built an elegant system that allowed website owners to track how spammers harvested email addresses. Holloway and co-founder Matthew Prince named this solution Project Honey Pot. Tracking bad guys eventually turned into stopping them as well.

Bringing on Prince’s Harvard Business School classmate Michelle Zatlyn, the three founded Cloudflare in 2009. Once again displaying engineering wizardry, Holloway created a “firewall in the cloud” (hence the Cloudflare name) that not only secured websites but made them load faster and perform better as well. The company’s mission of helping to build a better internet resonated, and some of Holloway’s first engineering hires were top minds from Yahoo, Google, and Paypal.

Cloudflare's Special Sauce

To this day, Cloudflare’s team is made up of the best technical minds in the world. In 2023, for example, just under 1.2 million bright minds applied for a job at the company. Offers were extended to less than 0.1% of these applicants according to a tweet from CEO Matthew Prince. Of those who received offers, over 90% accepted, showing that Cloudflare was their top choice destination.

That’s right, 0.1%, not 1%. It’s about 35x easier to get into Harvard than to get a job at Cloudflare.

The go-to-market strategy–how Cloudflare sells, upsells, and cross-sells its broad product portfolio–is another part of the secret sauce. The company’s engineering team initially built its street cred preventing large DDoS attacks. This is where attackers compromise multiple computers with malware then use them to target and overwhelm a web server with traffic that can crash a system.

In June 2011 when Cloudflare was still scrappy, small, and largely unknown, for example, it mitigated a major DDoS attack for the website of LulzSec, a black hat hacking group. According to a news story at the time, “LulzSec has for now supplanted both Anonymous and Wikileaks as the Internet’s public enemy number one, both for the sheer boldness of their attacks and for their comically arrogant manner.” “We love Cloudflare,” LulzSec tweeted shortly thereafter.

In the decade that followed, Cloudflare continued to mitigate larger and larger DDoS attacks–many of which set records at the time–with its automated detection capabilities and ability to deftly distribute traffic across global datacenters. It came to the rescue of much more legitimate businesses like financial institutions and electoral infrastructure overseas.

Predictably, the on-ramp for many of the company’s customers is security (DDoS protection, web application firewall) or performance (content delivery, load balancing that distributes traffic to optimize site performance). Cloudflare smartly goes after these customers with a freemium model that encourages self-serve sign-ups and activation. Since a meaningful volume of new business comes from organic inbounds, this carries little to no customer acquisition cost.

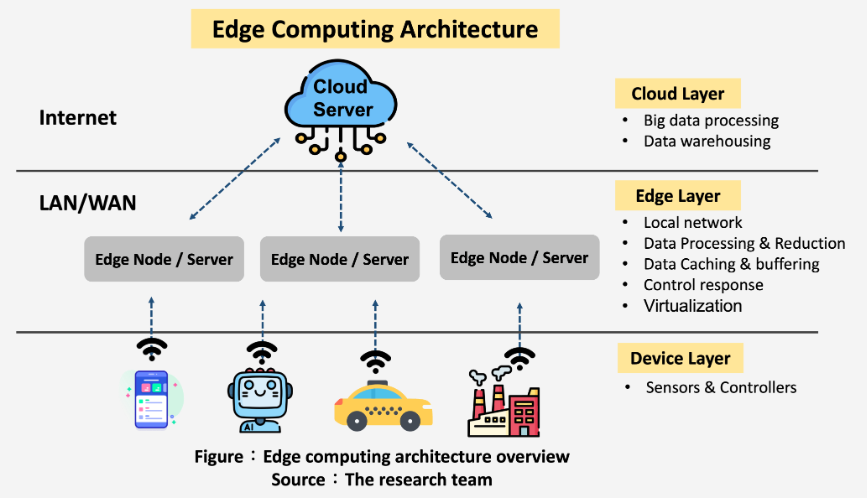

From there, Cloudflare converts users to loyal, paying customers that rely on multiple products by introducing products such as Cloudflare One, a Secure Access Service Edge (SASE) cybersecurity platform that is tailor-built for a cloud-first, distributed-workforce world. There are also developer tools such as Cloudflare Workers, a serverless computing platform (serverless because Cloudflare, rather than the customer, owns and manages the servers). It allows developers to run code close to connected devices such as EVs or industrial robots to minimize latency where hitting the brakes or swinging a two-ton robotic arm half a second too late could be catastrophic.

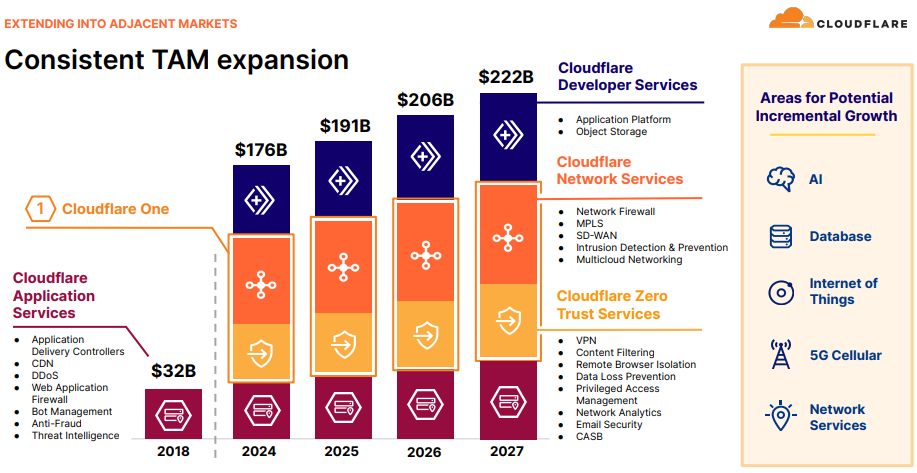

Innovation is in Cloudflare’s DNA, so new product velocity is unmatched, and as such, the company’s TAM continually expands.

Financials - The Proof is in the Pudding

This approach has worked. Over the last five years, Cloudflare’s revenue has increased nearly 7x, growing at an astounding 46% annualized rate. Both customer count and revenue per customer have increased at healthy rates, showing two powerful vectors for continued topline strength.

And it’s been profitable growth as well. During that same five year period, Cloudflare’s adjusted operating margin has gone from an eyesore at -30% to an encouraging nearly 10%, a massive swing. Its free cash flow margin has also followed a similar trend, going from massively negative five years ago to a nearly 10% margin in the latest year. We think both adjusted operating and free cash flow margin could approach 20% in the next five years as the company continues to grow rapidly and achieve meaningful operating leverage.

What the Future Could Hold

The future seems even brighter than a past that’s been highly encouraging. A major reason is Cloudflare Workers, that serverless platform we mentioned earlier. Edge computing, which could be integral for use cases where low latency is key (industrial and factory automation, augmented and virtual reality, autonomous vehicles), is estimated to be a $15 to $20 billion market today. It is projected to grow at a remarkable 30+% annualized rate over the next decade.

Cloudflare’s Workers product takes advantage of the company’s existing network that was established for its content delivery and website performance services. Its 115 datacenters span more than 310 cities in over 120 countries. This network importantly interconnects with over 13,000 networks globally, including major ISPs (internet service providers such as Verizon), cloud services, and enterprises, keeping Cloudflare’s network costs low, which it can pass onto its customers.

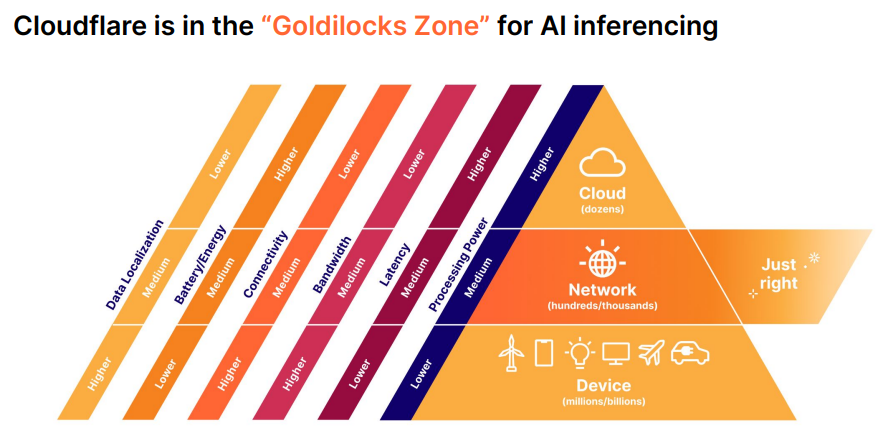

There is already strong traction despite Workers general availability (GA) only happening in April of this year. It is now used by 2 million developers, >70% of AI startups, and >20% of Cloudflare’s customer base. We think that going forward, Cloudflare’s distributed edge network will play a major role in AI inferencing models, which ingest data and train models for decision making and predictions, due to the reasons laid out below. This will be a huge tailwind for Cloudflare’s revenue growth.

Closing Thoughts

Cloudflare is a cream-of-the-crop company with potential for explosive growth and therefore, explosive returns. The engineering and talent is there, as is an effective way to sell the company’s broad product portfolio. Add in a big thematic tailwind, and this is a stock that can be owned for the better part of a decade, potentially longer.

Click here to read our full, regularly updated research report on NET.

We hope you enjoyed this abridged version of our research.

You can get so much value from StockStory!

AI-enabled research is revolutionizing stock investing, but so far only large institutions and funds have benefitted from it. But we believe everyday investors deserve to have access to the same tools as the Wall St bigwigs.

StockStory is a new service that uses AI to help individual investors like you grow your wealth and beat the market. Since launching in 2020, some of our top picks have returned 259%, 436%, and even 794% to date –crushing the S&P 500 by 3x, 5x, and nearly 9x. We recommended Nvidia to our users already in November 2022 – well BEFORE the generative AI burst onto the scene.

And now we’re on a hunt to add to those winners.

Harnessing the power of AI, the StockStory team has identified 6 top stocks that we believe everyday investors should buy right now.

And you can get the name of these stocks with full research reports for FREE by clicking here!