As the Q3 earnings season wraps, let’s dig into this quarter’s best and worst performers in the consumer discretionary industry, including Apple (NASDAQ:AAPL) and its peers.

This sector includes everything from cable TV services to hotel stays to gym memberships. While diverse, the way people buy and experience these products is being upended by the internet and digitization. Consumer discretionary companies are working to adapt to secular trends such as streaming video, online marketplaces for lodging accommodations, and connected fitness. That discretionary purchases are, by definition, something consumers can give up makes it even more imperative for companies in the space to adapt.

The 152 consumer discretionary stocks we track reported a satisfactory Q3. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 0.6% above.

In light of this news, share prices of the companies have held steady as they are up 2% on average since the latest earnings results.

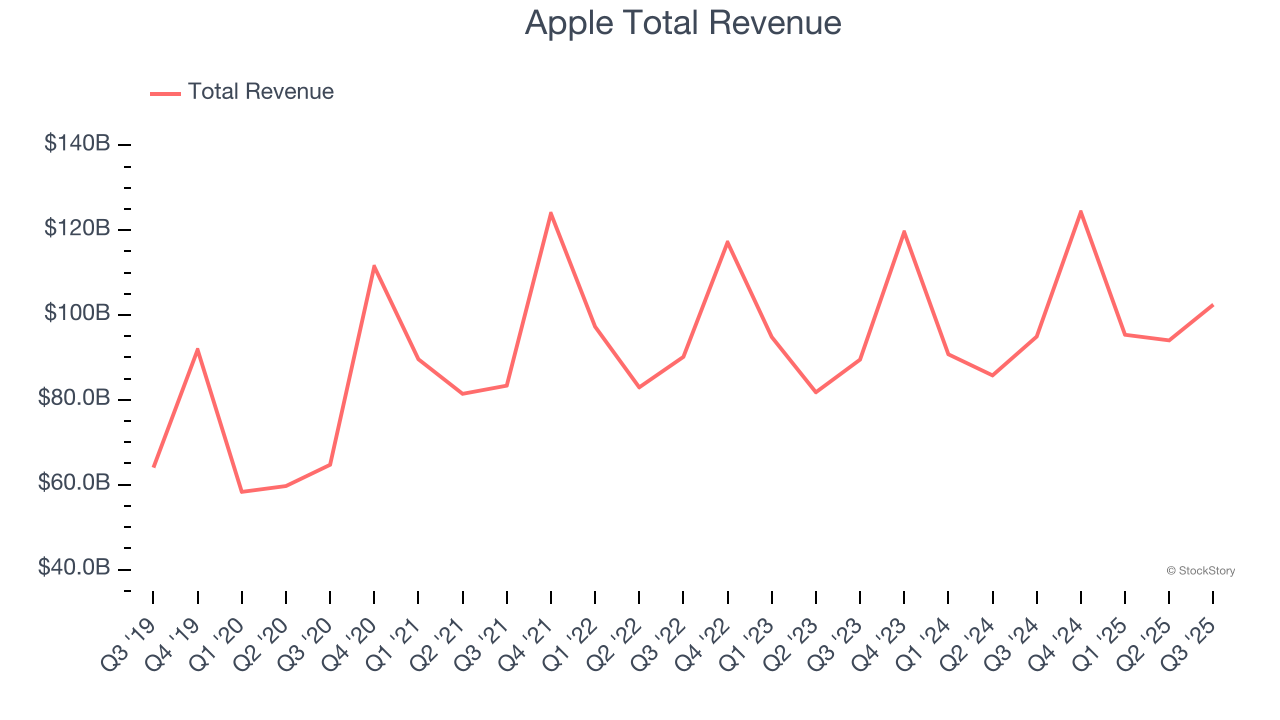

Apple (NASDAQ:AAPL)

Creator of the iPhone and App Store, Apple (NASDAQ:AAPL) is a legendary developer of consumer electronics and software.

Apple reported revenues of $102.5 billion, up 7.9% year on year. This print exceeded analysts’ expectations by 0.8%. Overall, it was a strong quarter for the company with We were also happy its revenue narrowly outperformed Wall Street’s estimates, and the beat in Services was a bright spot.

The market was likely pricing in the results, and the stock is flat since reporting. It currently trades at $271.01.

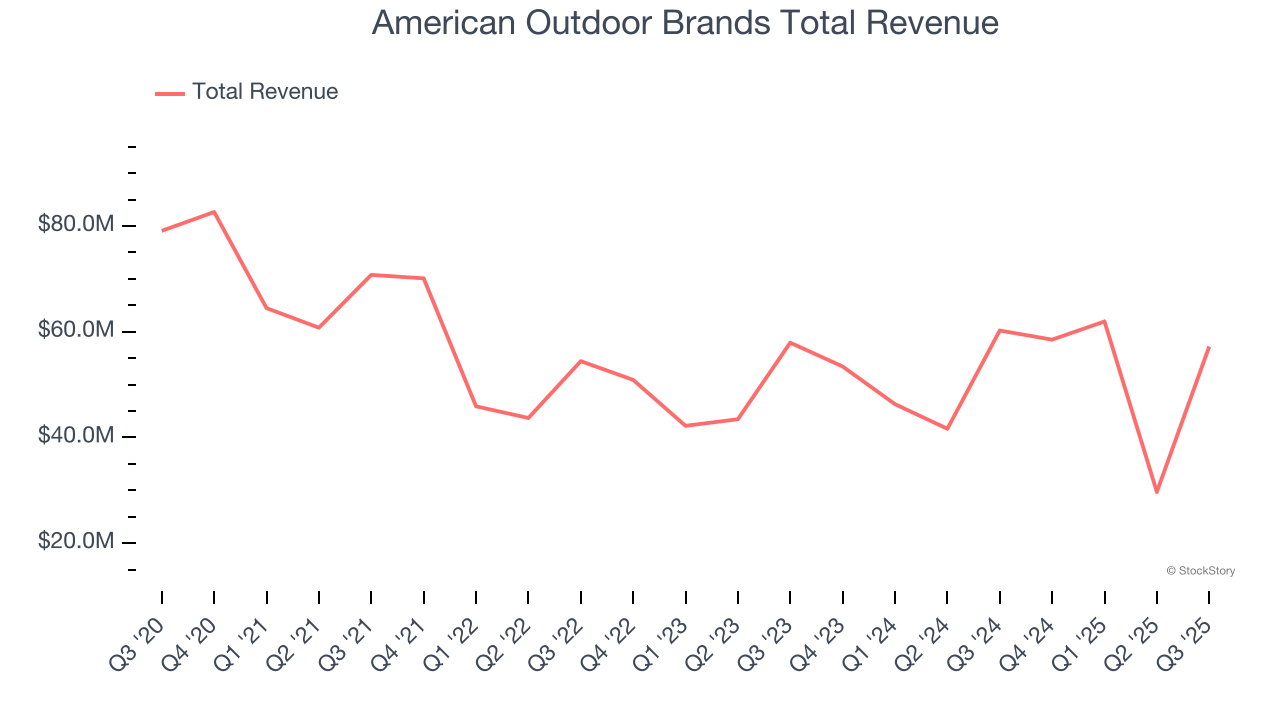

Best Q3: American Outdoor Brands (NASDAQ:AOUT)

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

American Outdoor Brands reported revenues of $57.2 million, down 5% year on year, outperforming analysts’ expectations by 12.3%. The business had an incredible quarter with a beat of analysts’ EPS and EBITDA estimates.

The market seems content with the results as the stock is up 2.6% since reporting. It currently trades at $7.92.

Is now the time to buy American Outdoor Brands? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: PlayStudios (NASDAQ:MYPS)

Founded by a team of former gaming industry executives, PlayStudios (NASDAQ:MYPS) offers free-to-play digital casino games.

PlayStudios reported revenues of $57.65 million, down 19.1% year on year, falling short of analysts’ expectations by 3%. It was a disappointing quarter as it posted a miss of analysts’ daily active users estimates and a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 26.6% since the results and currently trades at $0.67.

Read our full analysis of PlayStudios’s results here.

Funko (NASDAQ:FNKO)

Boasting partnerships with media franchises like Marvel and One Piece, Funko (NASDAQ:FNKO) is a company specializing in creating and distributing licensed pop culture collectibles.

Funko reported revenues of $250.9 million, down 14.3% year on year. This print came in 4.2% below analysts' expectations. Zooming out, it was actually a very strong quarter as it recorded a beat of analysts’ EPS and EBITDA estimates.

The stock is up 10.9% since reporting and currently trades at $3.35.

Read our full, actionable report on Funko here, it’s free for active Edge members.

Latham (NASDAQ:SWIM)

Started as a family business, Latham (NASDAQ:SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $161.9 million, up 7.6% year on year. This result missed analysts’ expectations by 1.8%. More broadly, it was a mixed quarter as it also recorded a solid beat of analysts’ adjusted operating income estimates but a significant miss of analysts’ EPS estimates.

The stock is down 12.1% since reporting and currently trades at $6.33.

Read our full, actionable report on Latham here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.