American Outdoor Brands (AOUT)

We wouldn’t recommend American Outdoor Brands. Not only has its sales growth been weak but also its negative returns on capital show it destroyed value.― StockStory Analyst Team

1. News

2. Summary

Why We Think American Outdoor Brands Will Underperform

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

- Muted 2.6% annual revenue growth over the last five years shows its demand lagged behind its consumer discretionary peers

- Falling earnings per share over the last four years has some investors worried as stock prices ultimately follow EPS over the long term

- Sales are projected to tank by 4.2% over the next 12 months as demand evaporates

American Outdoor Brands is in the penalty box. There are superior stocks for sale in the market.

Why There Are Better Opportunities Than American Outdoor Brands

High Quality

Investable

Underperform

Why There Are Better Opportunities Than American Outdoor Brands

American Outdoor Brands’s stock price of $7.20 implies a valuation ratio of 67.7x forward P/E. We consider this valuation aggressive considering the weaker revenue growth profile.

We prefer to invest in similarly-priced but higher-quality companies with superior earnings growth.

3. American Outdoor Brands (AOUT) Research Report: Q3 CY2025 Update

Recreational products manufacturer American Outdoor Brands (NASDAQ:AOUT) reported Q3 CY2025 results exceeding the market’s revenue expectations, but sales fell by 5% year on year to $57.2 million. Its non-GAAP profit of $0.29 per share was 48.7% above analysts’ consensus estimates.

American Outdoor Brands (AOUT) Q3 CY2025 Highlights:

- Revenue: $57.2 million vs analyst estimates of $50.92 million (5% year-on-year decline, 12.3% beat)

- Adjusted EPS: $0.29 vs analyst estimates of $0.20 (48.7% beat)

- Adjusted EBITDA: $6.48 million vs analyst estimates of $4.01 million (11.3% margin, 61.5% beat)

- Operating Margin: 3.7%, down from 5.1% in the same quarter last year

- Free Cash Flow was -$14.37 million compared to -$8.00 million in the same quarter last year

- Market Capitalization: $91.13 million

Company Overview

Spun off from Smith and Wesson in 2020, American Outdoor Brands (NASDAQ:AOUT) is an outdoor and recreational products company that offers outdoor and shooting sports products but does not sell firearms themselves.

The company is a manufacturer and marketer of outdoor lifestyle, shooting sports, and rugged adventure products. The company operates through two major segments: Shooting Sports and Outdoor Lifestyle, each catering to enthusiasts, professionals, and outdoor adventurers.

The Shooting Sports segment includes firearm-related accessories such as gun cleaning kits, reloading supplies, and optics, with brands like Tipton and Caldwell. The Outdoor Lifestyle segment offers hunting, camping, fishing, and survival gear, including knives, cooking equipment, and backpacks, sold under brands like BUBBA and Schrade.

Customers range from hunters, recreational shooters, and law enforcement to outdoor adventurers and anglers. Notable products include BUBBA fillet knives, Frankford Arsenal reloading tools, and Hooyman tree saws.

4. Leisure Products

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

Other companies offering shooting sports and outdoor products include Ruger (NYSE:RGR) and private companies O.F. Mossberg & Sons and the Remington Arms Company.

5. Revenue Growth

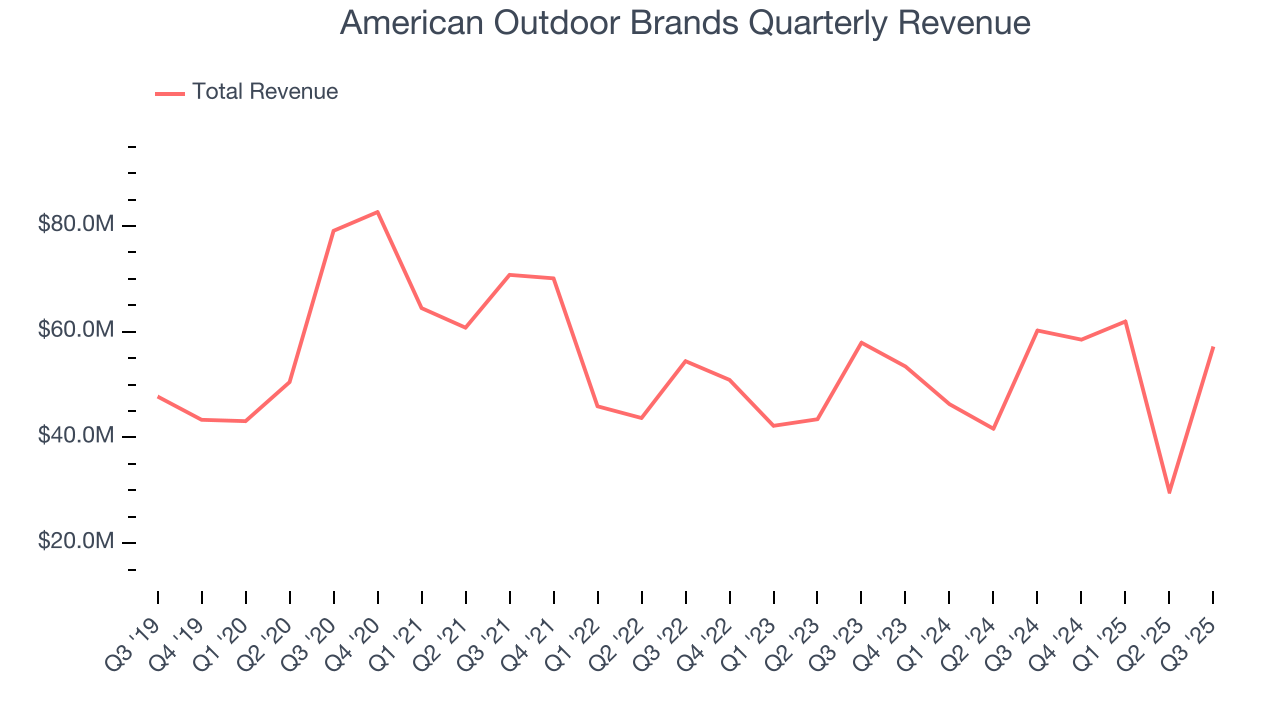

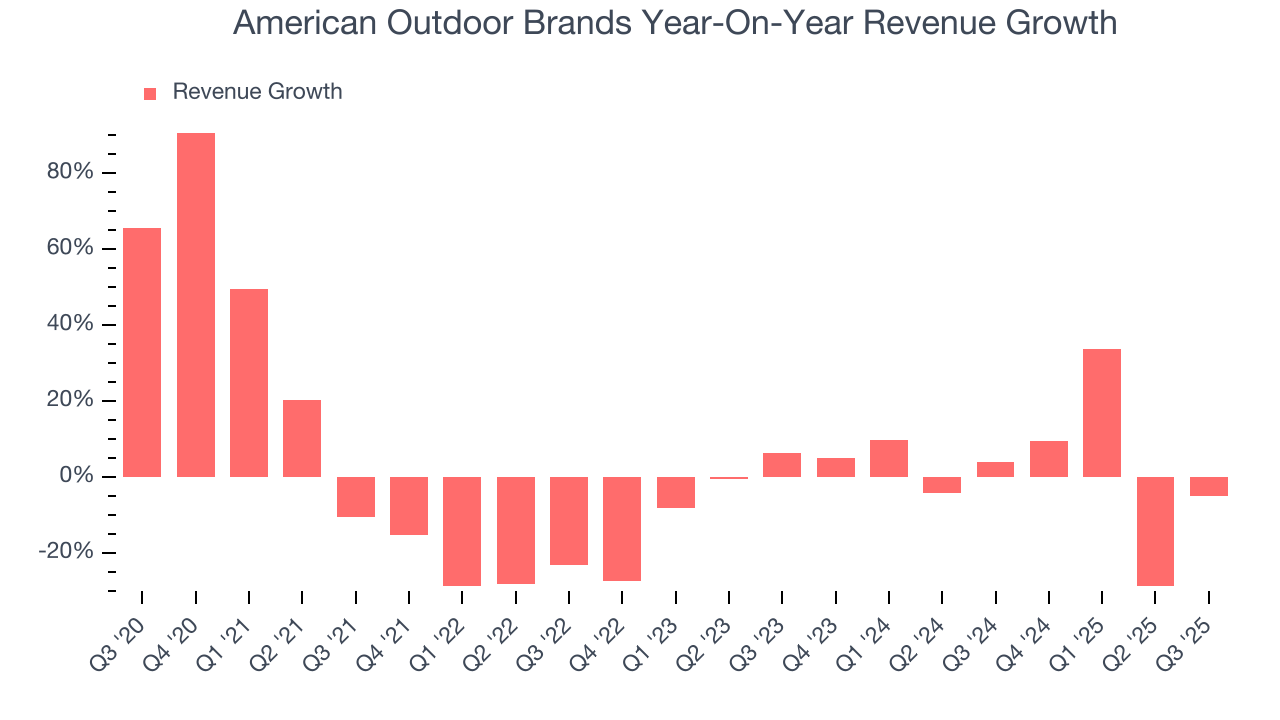

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but many enduring ones grow for years. Unfortunately, American Outdoor Brands struggled to consistently increase demand as its $207.3 million of sales for the trailing 12 months was close to its revenue five years ago. This wasn’t a great result and is a sign of poor business quality.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. American Outdoor Brands’s annualized revenue growth of 3.3% over the last two years is above its five-year trend, but we were still disappointed by the results.

This quarter, American Outdoor Brands’s revenue fell by 5% year on year to $57.2 million but beat Wall Street’s estimates by 12.3%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a deceleration versus the last two years. This projection is underwhelming and indicates its products and services will face some demand challenges.

6. Operating Margin

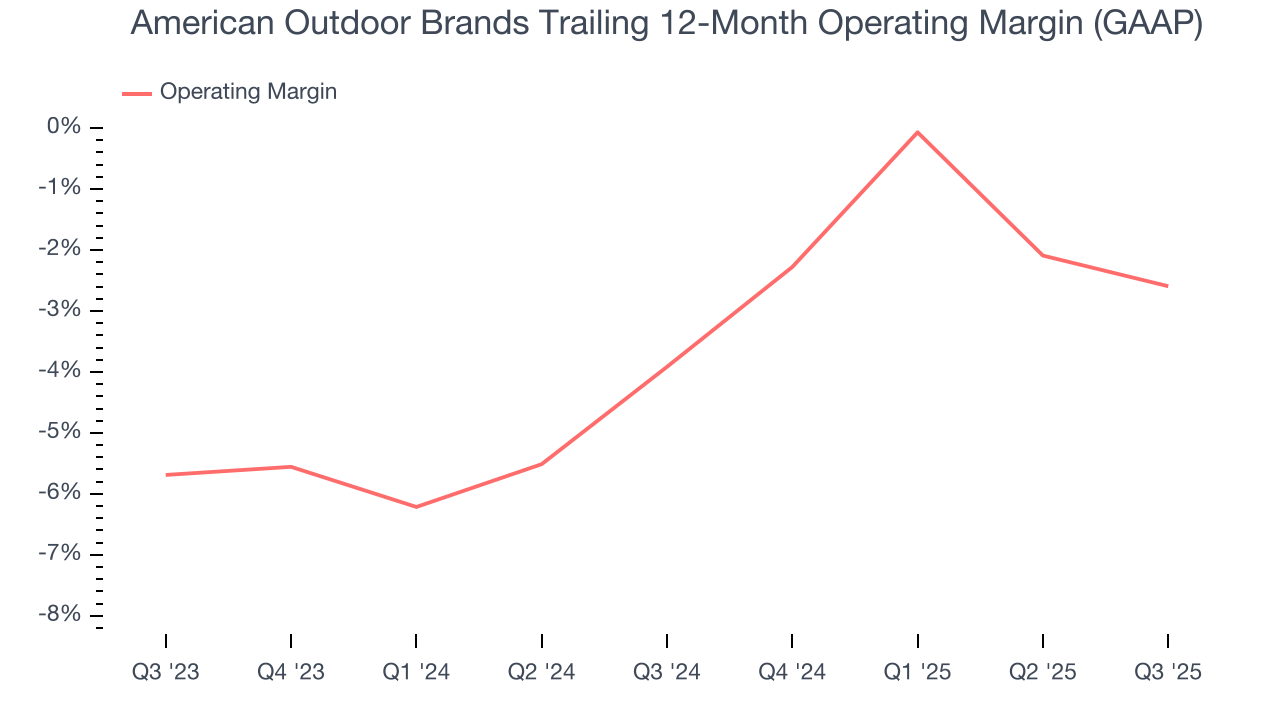

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

American Outdoor Brands’s operating margin has risen over the last 12 months, but it still averaged negative 3.2% over the last two years. This is due to its large expense base and inefficient cost structure.

This quarter, American Outdoor Brands generated an operating margin profit margin of 3.7%, down 1.4 percentage points year on year. This reduction is quite minuscule and indicates the company’s overall cost structure has been relatively stable.

7. Earnings Per Share

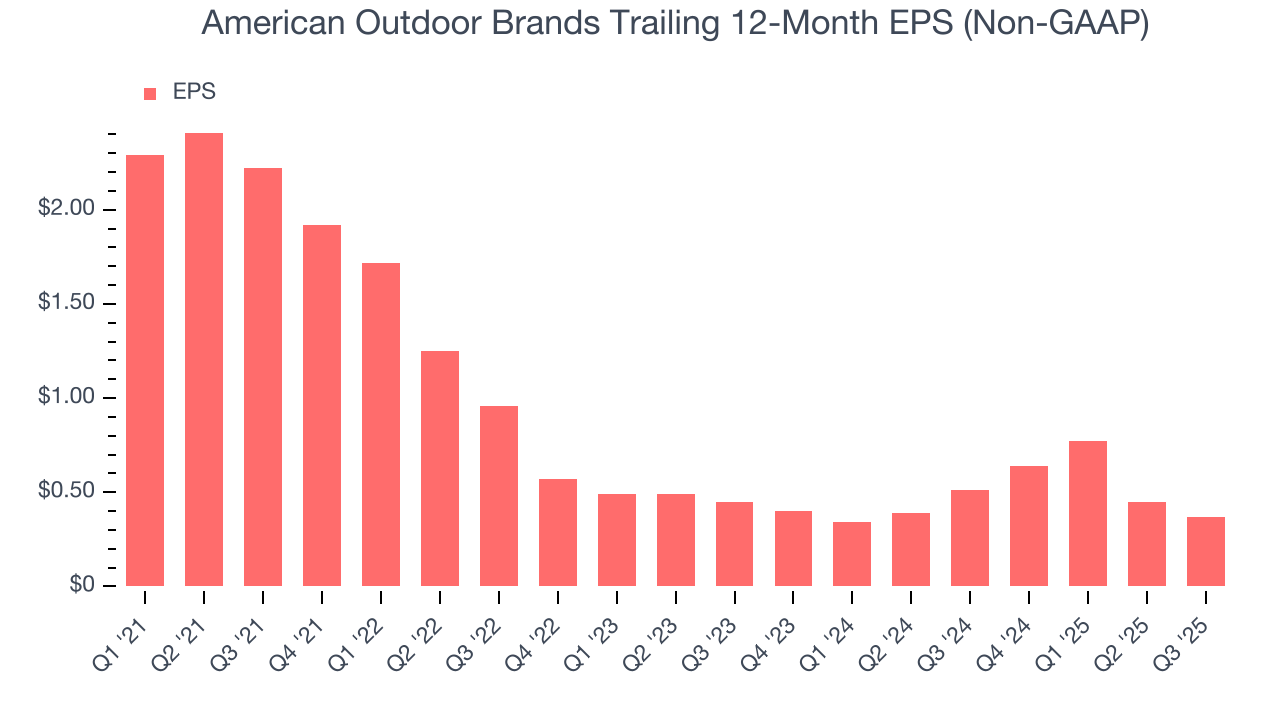

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Sadly for American Outdoor Brands, its EPS declined by 51.6% annually over the last five years while its revenue was flat. This tells us the company struggled because its fixed cost base made it difficult to adjust to choppy demand.

In Q3, American Outdoor Brands reported adjusted EPS of $0.29, down from $0.37 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects American Outdoor Brands’s full-year EPS of $0.37 to shrink by 32.4%.

8. Cash Is King

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

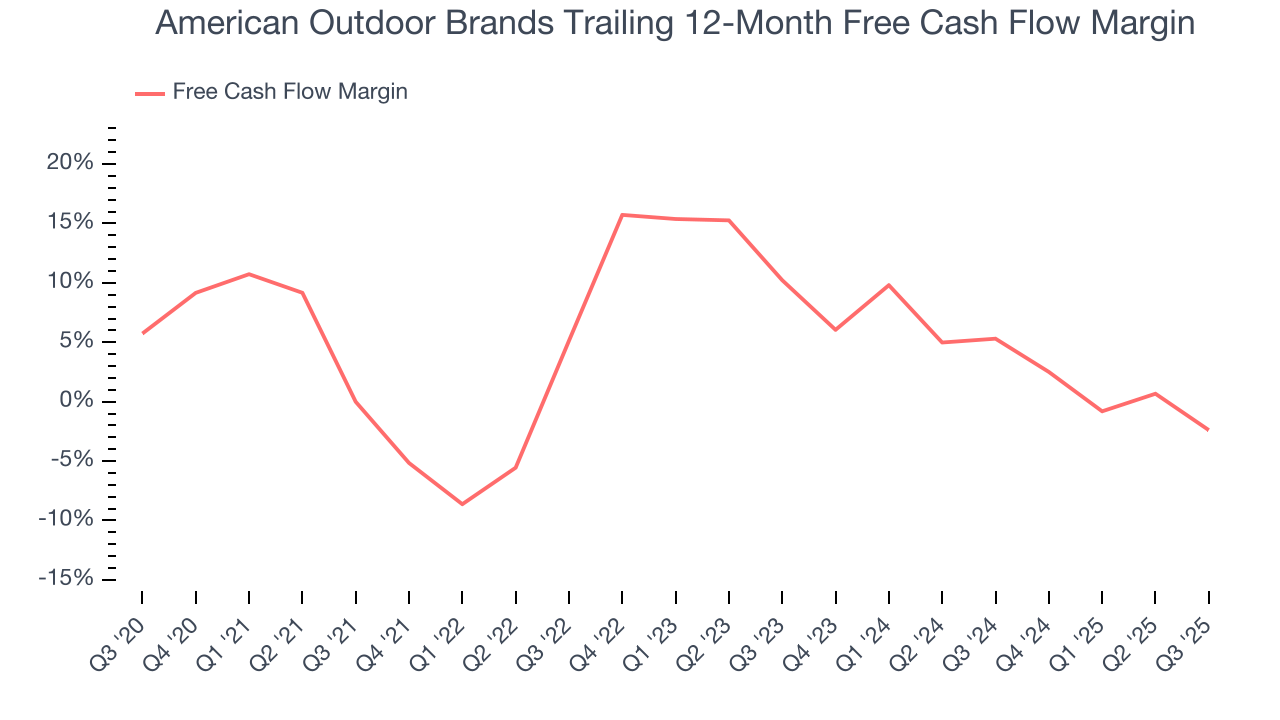

American Outdoor Brands has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.4%, lousy for a consumer discretionary business.

American Outdoor Brands burned through $14.37 million of cash in Q3, equivalent to a negative 25.1% margin. The company’s cash burn was similar to its $8.00 million of lost cash in the same quarter last year. These numbers deviate from its longer-term margin, indicating it is a seasonal business that must build up inventory during certain quarters.

9. Return on Invested Capital (ROIC)

EPS and free cash flow tell us whether a company was profitable while growing its revenue. But was it capital-efficient? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

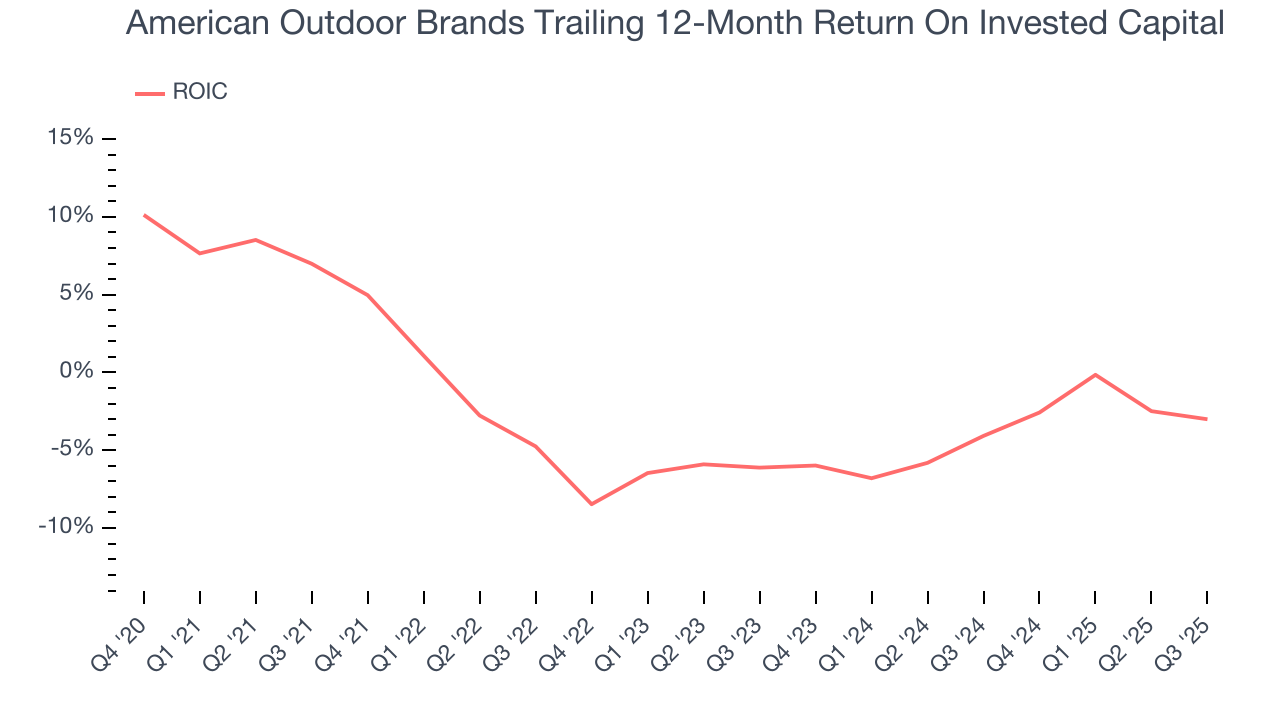

American Outdoor Brands’s five-year average ROIC was negative 2.2%, meaning management lost money while trying to expand the business. Its returns were among the worst in the consumer discretionary sector.

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, American Outdoor Brands’s ROIC averaged 4.7 percentage point decreases each year. Paired with its already low returns, these declines suggest its profitable growth opportunities are few and far between.

10. Balance Sheet Assessment

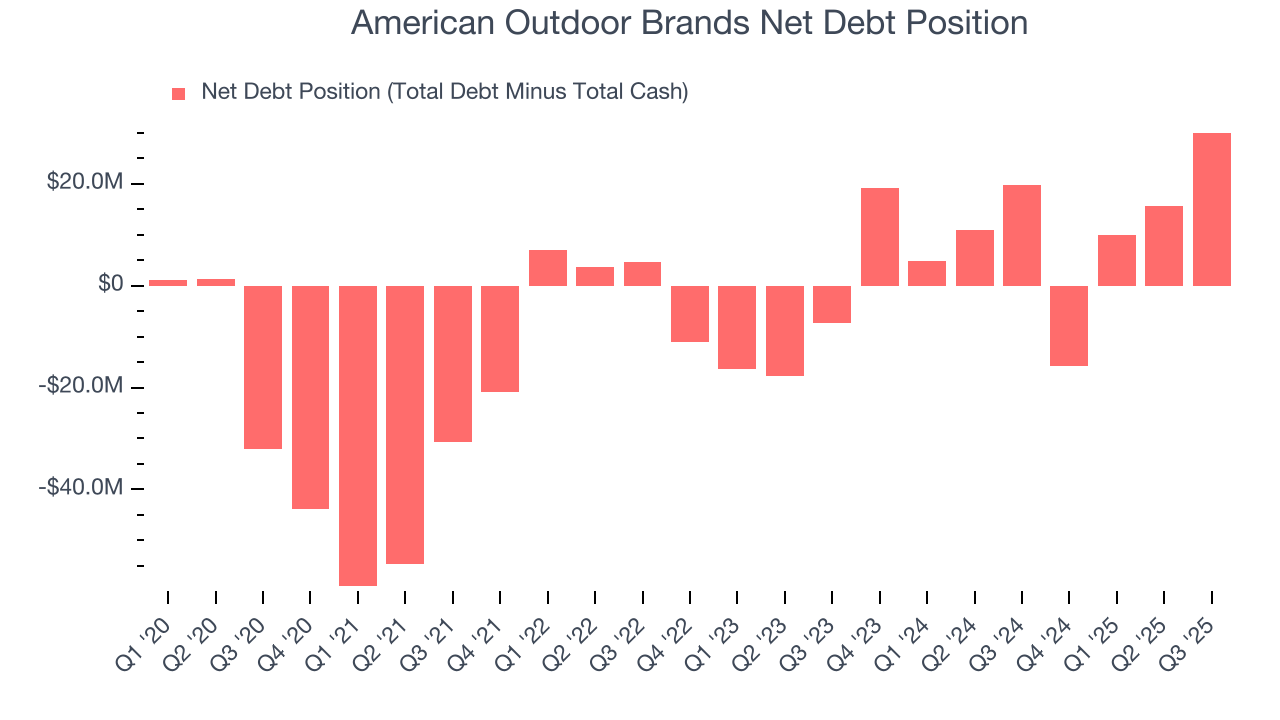

American Outdoor Brands reported $3.11 million of cash and $33.13 million of debt on its balance sheet in the most recent quarter. As investors in high-quality companies, we primarily focus on two things: 1) that a company’s debt level isn’t too high and 2) that its interest payments are not excessively burdening the business.

With $11.56 million of EBITDA over the last 12 months, we view American Outdoor Brands’s 2.6× net-debt-to-EBITDA ratio as safe. We also see its $150,000 of annual interest expenses as appropriate. The company’s profits give it plenty of breathing room, allowing it to continue investing in growth initiatives.

11. Key Takeaways from American Outdoor Brands’s Q3 Results

It was good to see American Outdoor Brands beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this quarter featured some important positives. The stock traded up 3% to $7.98 immediately following the results.

12. Is Now The Time To Buy American Outdoor Brands?

Updated: December 9, 2025 at 4:14 PM EST

We think that the latest earnings result is only one piece of the bigger puzzle. If you’re deciding whether to own American Outdoor Brands, you should also grasp the company’s longer-term business quality and valuation.

American Outdoor Brands falls short of our quality standards. For starters, its revenue growth was weak over the last five years, and analysts don’t see anything changing over the next 12 months. On top of that, American Outdoor Brands’s declining EPS over the last five years makes it a less attractive asset to the public markets, and its projected EPS for the next year is lacking.

American Outdoor Brands’s P/E ratio based on the next 12 months is 31.9x. This multiple tells us a lot of good news is priced in - we think there are better opportunities elsewhere.

Wall Street analysts have a consensus one-year price target of $15.25 on the company (compared to the current share price of $7.98).

Although the price target is bullish, readers should exercise caution because analysts tend to be overly optimistic. The firms they work for, often big banks, have relationships with companies that extend into fundraising, M&A advisory, and other rewarding business lines. As a result, they typically hesitate to say bad things for fear they will lose out. We at StockStory do not suffer from such conflicts of interest, so we’ll always tell it like it is.