Astec trades at $46.13 and has moved in lockstep with the market. Its shares have returned 14.2% over the last six months while the S&P 500 has gained 13.6%.

Is now the time to buy Astec, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free for active Edge members.

Why Is Astec Not Exciting?

We don't have much confidence in Astec. Here are three reasons why ASTE doesn't excite us and a stock we'd rather own.

1. Backlog Declines as Orders Drop

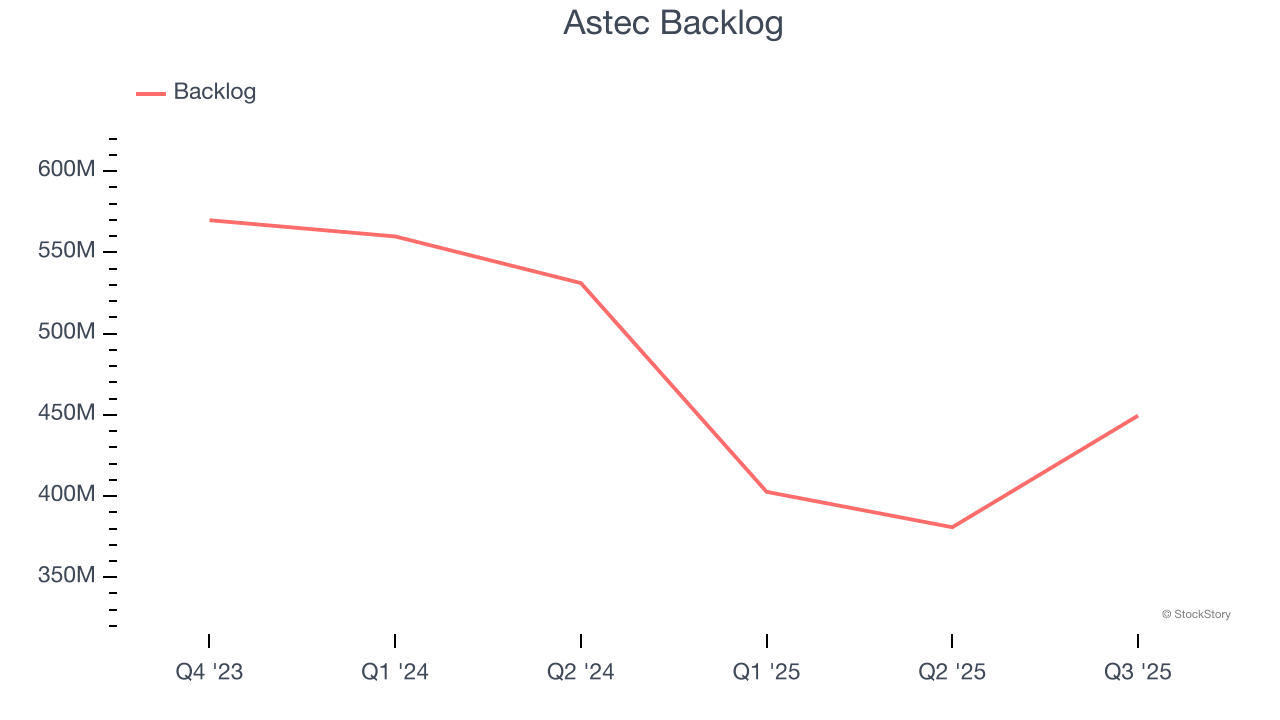

Investors interested in Construction Machinery companies should track backlog in addition to reported revenue. This metric shows the value of outstanding orders that have not yet been executed or delivered, giving visibility into Astec’s future revenue streams.

Astec’s backlog came in at $449.5 million in the latest quarter, and it averaged 28.2% year-on-year declines over the last two years. This performance was underwhelming and shows the company is not winning new orders. It also suggests there may be increasing competition or market saturation.

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Astec has bad unit economics for an industrials company, giving it less room to reinvest and develop new offerings. As you can see below, it averaged a 23.9% gross margin over the last five years. Said differently, Astec had to pay a chunky $76.06 to its suppliers for every $100 in revenue.

3. Cash Burn Ignites Concerns

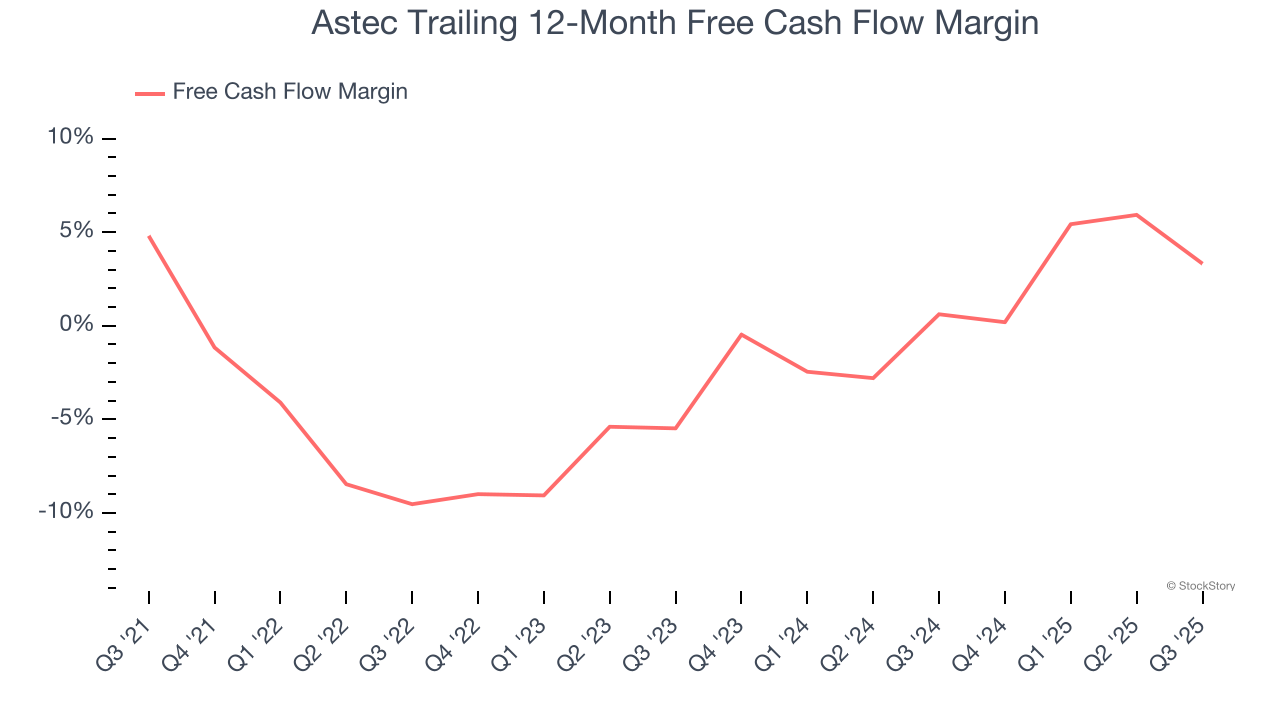

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Astec’s demanding reinvestments have drained its resources over the last five years, putting it in a pinch and limiting its ability to return capital to investors. Its free cash flow margin averaged negative 1.3%, meaning it lit $1.32 of cash on fire for every $100 in revenue.

Final Judgment

Astec isn’t a terrible business, but it doesn’t pass our bar. That said, the stock currently trades at 14.2× forward P/E (or $46.13 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better investments elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

Stocks We Would Buy Instead of Astec

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.