Astrana Health’s stock price has taken a beating over the past six months, shedding 34.6% of its value and falling to $19.04 per share. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Following the pullback, is now an opportune time to buy ASTH? Find out in our full research report, it’s free.

Why Does Astrana Health Spark Debate?

Formerly known as Apollo Medical Holdings until early 2024, Astrana Health (NASDAQ:ASTH) operates a technology-powered healthcare platform that enables physicians to deliver coordinated care while successfully participating in value-based payment models.

Two Things to Like:

1. Skyrocketing Revenue Shows Strong Momentum

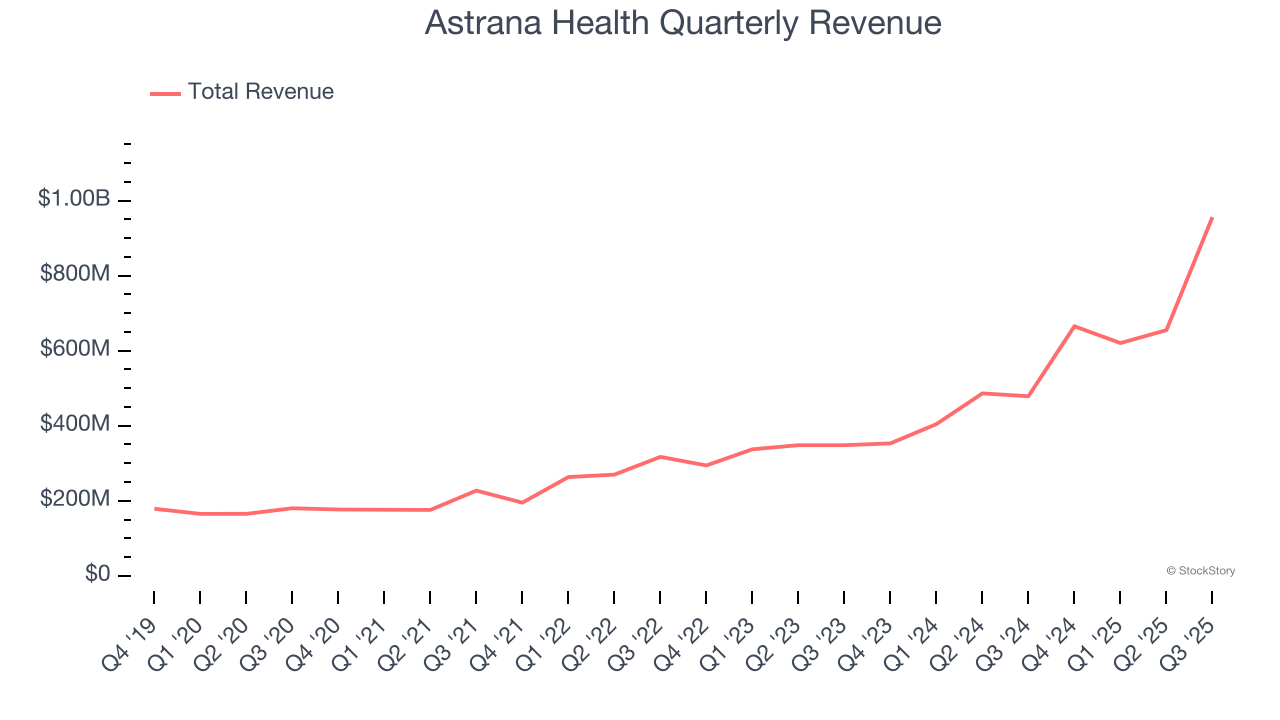

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Over the last five years, Astrana Health grew its sales at an incredible 33.3% compounded annual growth rate. Its growth beat the average healthcare company and shows its offerings resonate with customers.

2. Projected Revenue Growth Is Remarkable

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite, though some deceleration is natural as businesses become larger.

Over the next 12 months, sell-side analysts expect Astrana Health’s revenue to rise by 34%. While this projection is below its 47.7% annualized growth rate for the past two years, it is eye-popping and implies the market sees success for its products and services.

One Reason to be Careful:

New Investments Fail to Bear Fruit as ROIC Declines

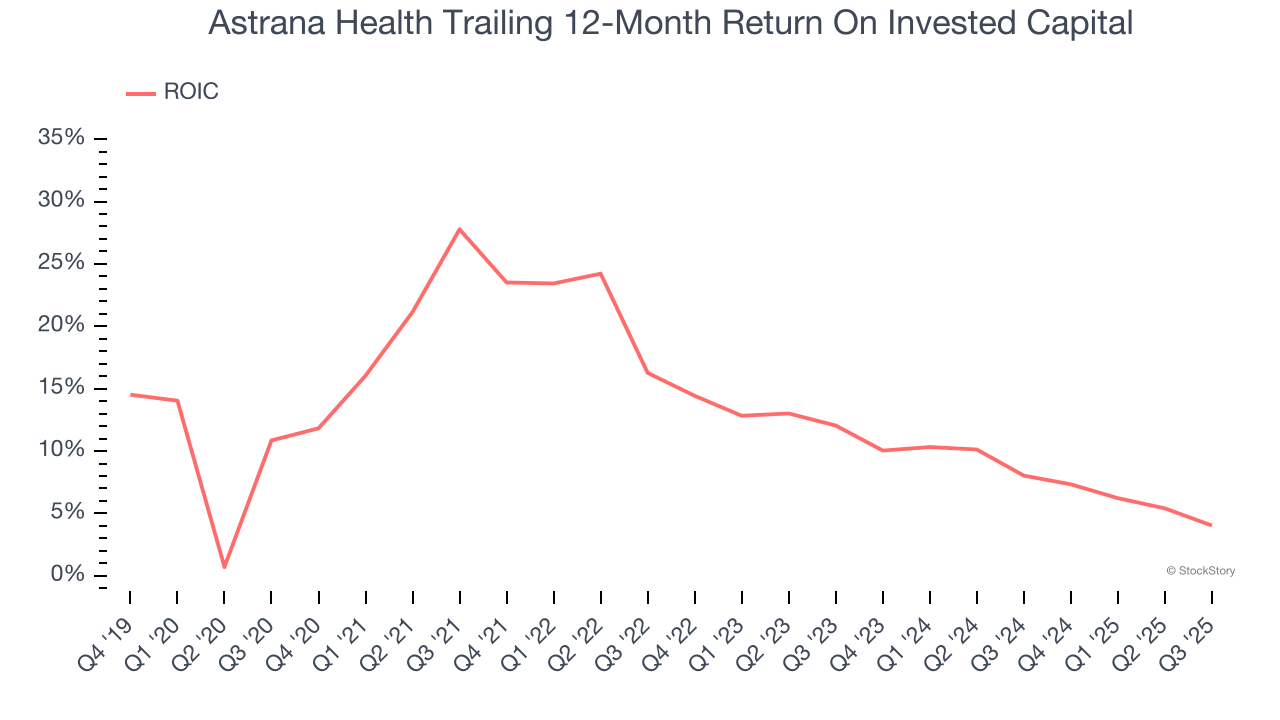

ROIC, or return on invested capital, is a metric showing how much operating profit a company generates relative to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Unfortunately, Astrana Health’s ROIC has decreased significantly over the last few years. Only time will tell if its new bets can bear fruit and potentially reverse the trend.

Final Judgment

Astrana Health has huge potential even though it has some open questions. After the recent drawdown, the stock trades at 6.1× forward EV-to-EBITDA (or $19.04 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free.

Stocks We Like Even More Than Astrana Health

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.