What a time it’s been for Astronics. In the past six months alone, the company’s stock price has increased by a massive 125%, reaching $77.29 per share. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Following the strength, is ATRO a buy right now? Or is the market overestimating its value? Find out in our full research report, it’s free.

Why Is ATRO a Good Business?

Integrating power outlets into many Boeing aircraft, Astronics (NASDAQ:ATRO) is a provider of technologies and services to the global aerospace, defense, and electronics industries.

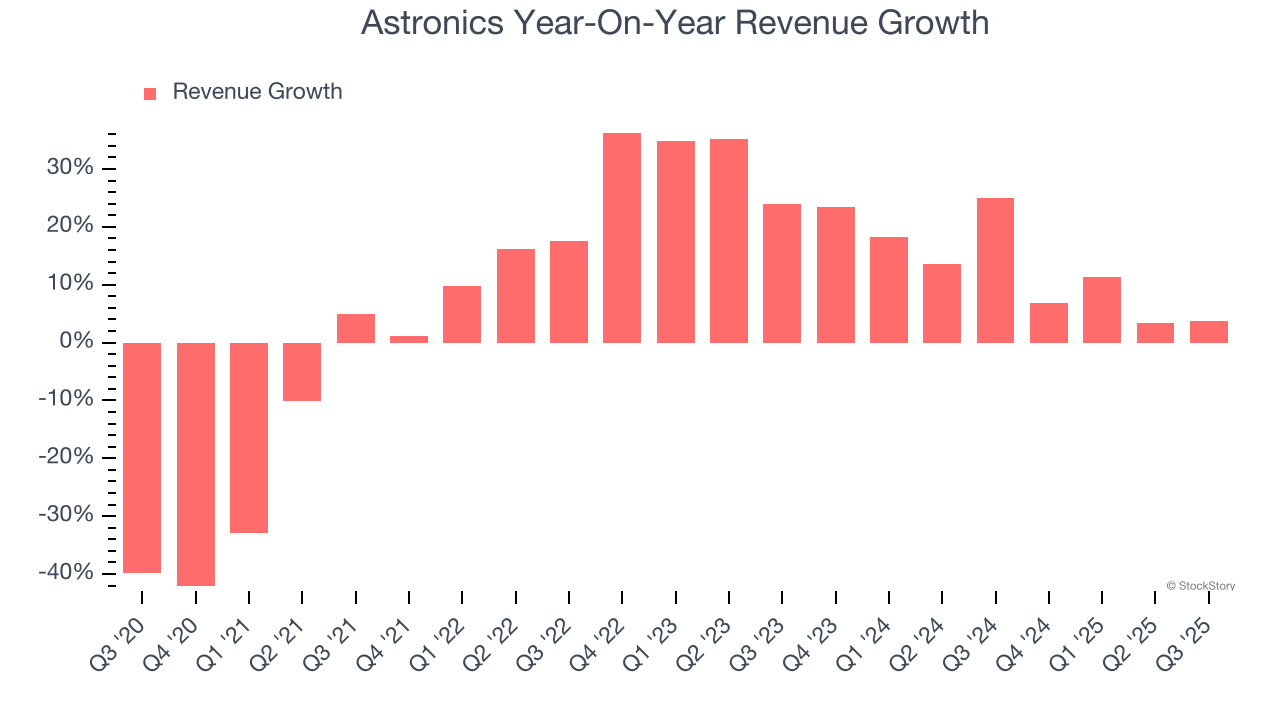

1. Skyrocketing Revenue Shows Strong Momentum

We at StockStory place the most emphasis on long-term growth, but within industrials, a stretched historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Astronics’s annualized revenue growth of 12.9% over the last two years is above its five-year trend, suggesting its demand recently accelerated.

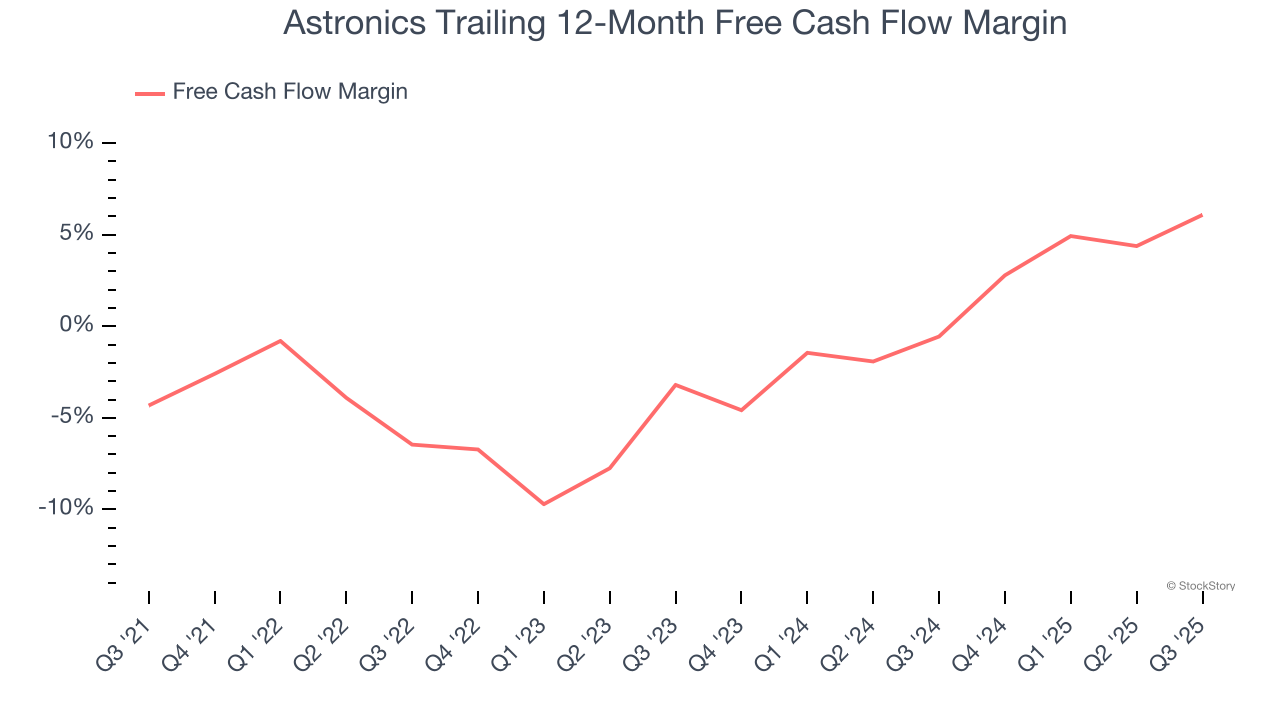

2. Increasing Free Cash Flow Margin Juices Financials

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Astronics’s margin expanded by 10.4 percentage points over the last five years. We have no doubt shareholders would like to continue seeing its cash conversion rise as it gives the company more optionality. Astronics’s free cash flow margin for the trailing 12 months was 6.1%.

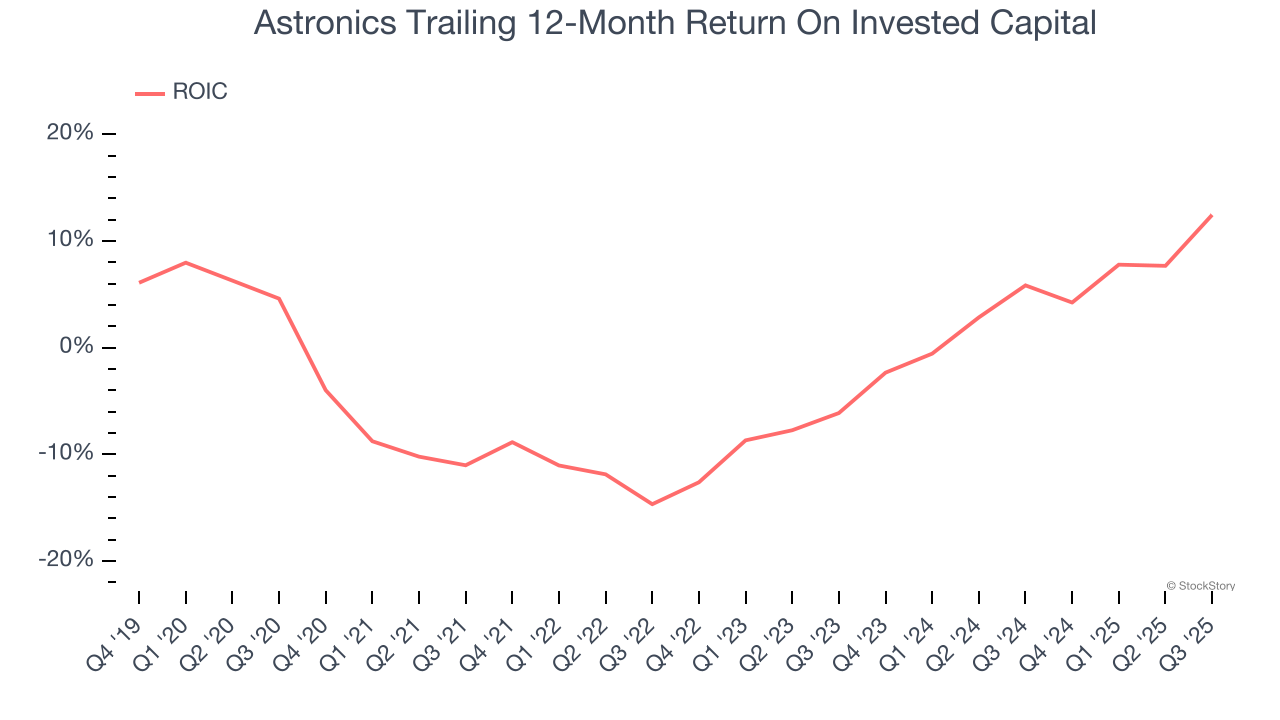

3. New Investments Bear Fruit as ROIC Jumps

A company’s ROIC, or return on invested capital, shows how much operating profit it makes compared to the money it has raised (debt and equity).

We like to invest in businesses with high returns, but the trend in a company’s ROIC is what often surprises the market and moves the stock price. Over the last few years, Astronics’s ROIC has increased. This is a good sign, but we recognize its lack of profitable growth during the COVID era was the primary reason for the change.

Final Judgment

These are just a few reasons why Astronics ranks highly on our list, and with the recent surge, the stock trades at 31.5× forward P/E (or $77.29 per share). Is now the right time to buy? See for yourself in our comprehensive research report, it’s free.

High-Quality Stocks for All Market Conditions

Your portfolio can’t afford to be based on yesterday’s story. The risk in a handful of heavily crowded stocks is rising daily.

The names generating the next wave of massive growth are right here in our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.