Over the past six months, BOK Financial has been a great trade, beating the S&P 500 by 20.5%. Its stock price has climbed to $130.30, representing a healthy 30.1% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is now the time to buy BOK Financial, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Do We Think BOK Financial Will Underperform?

We’re glad investors have benefited from the price increase, but we're sitting this one out for now. Here are three reasons why BOKF doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

From lending activities to service fees, most banks build their revenue model around two income sources. Interest rate spreads between loans and deposits create the first stream, with the second coming from charges on everything from basic bank accounts to complex investment banking transactions.

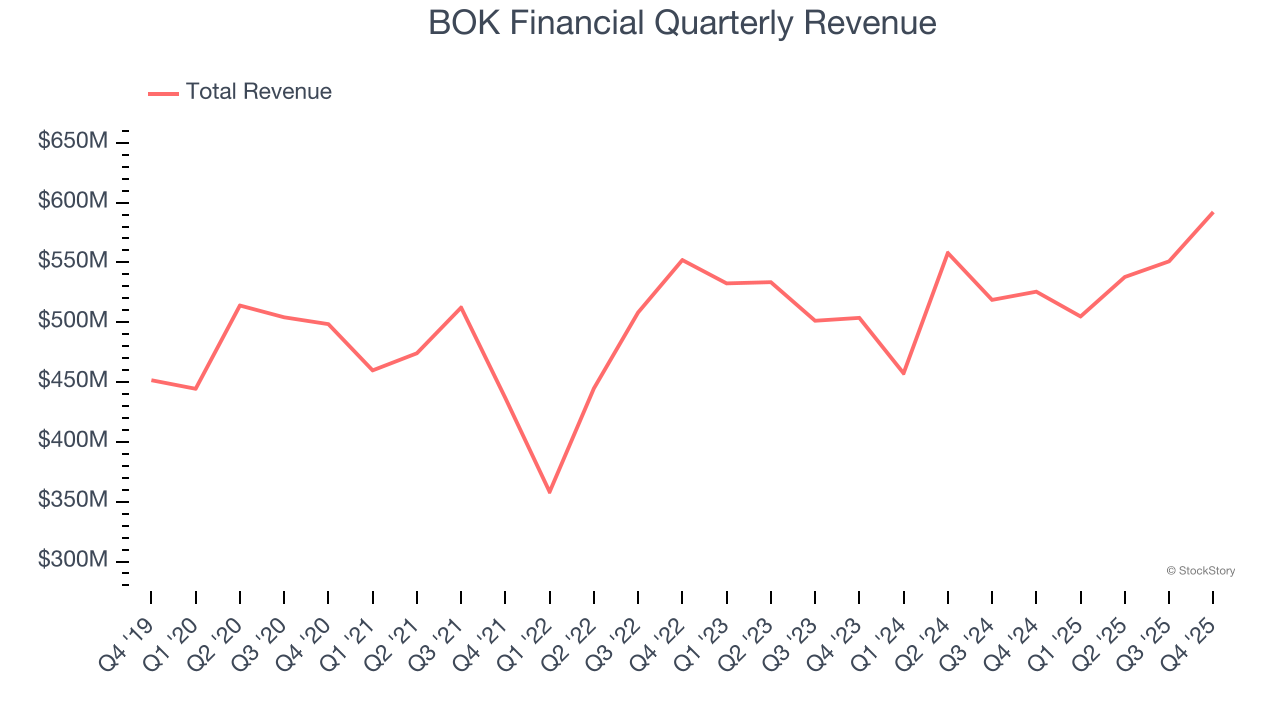

Over the last five years, BOK Financial grew its revenue at a sluggish 2.2% compounded annual growth rate. This was below our standards.

2. Net Interest Income Points to Soft Demand

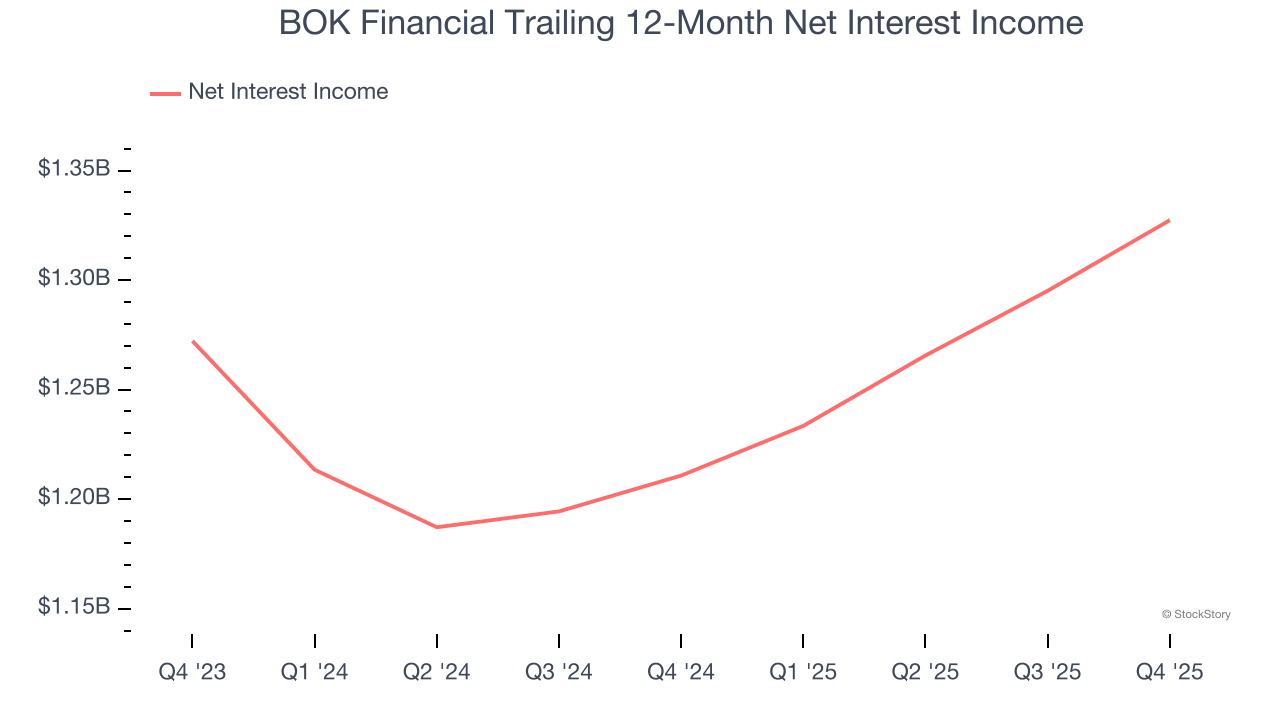

Net interest income commands greater market attention due to its reliability and consistency, whereas one-time fees are often seen as lower-quality revenue that lacks the same dependable characteristics.

BOK Financial’s net interest income has grown at a 3.7% annualized rate over the last five years, much worse than the broader banking industry.

3. Low Net Interest Margin Reveals Weak Loan Book Profitability

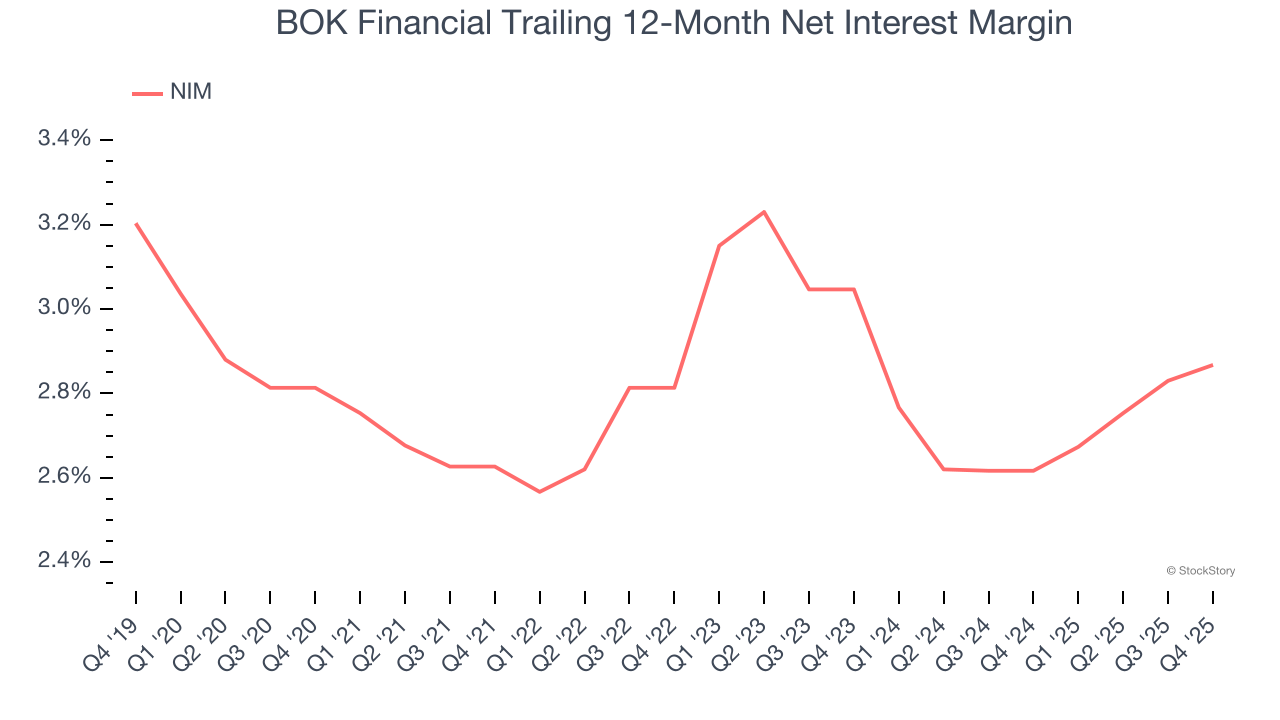

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, we can see that BOK Financial’s net interest margin averaged a weak 2.8%, meaning it must compensate for lower profitability through increased loan originations.

Final Judgment

We see the value of companies driving economic growth, but in the case of BOK Financial, we’re out. With its shares topping the market in recent months, the stock trades at 1.2× forward P/B (or $130.30 per share). This valuation tells us it’s a bit of a market darling with a lot of good news priced in - we think there are better opportunities elsewhere. We’d recommend looking at a dominant Aerospace business that has perfected its M&A strategy.

Stocks We Would Buy Instead of BOK Financial

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.