Popular has had an impressive run over the past six months as its shares have beaten the S&P 500 by 16.6%. The stock now trades at $142.88, marking a 25% gain. This was partly thanks to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is it too late to buy BPOP? Find out in our full research report, it’s free.

Why Are We Positive On BPOP?

Founded in 1893 as the first bank in Puerto Rico to serve the working class, Popular (NASDAQ:BPOP) is a financial holding company that provides retail, mortgage, and commercial banking services primarily in Puerto Rico and the mainland United States.

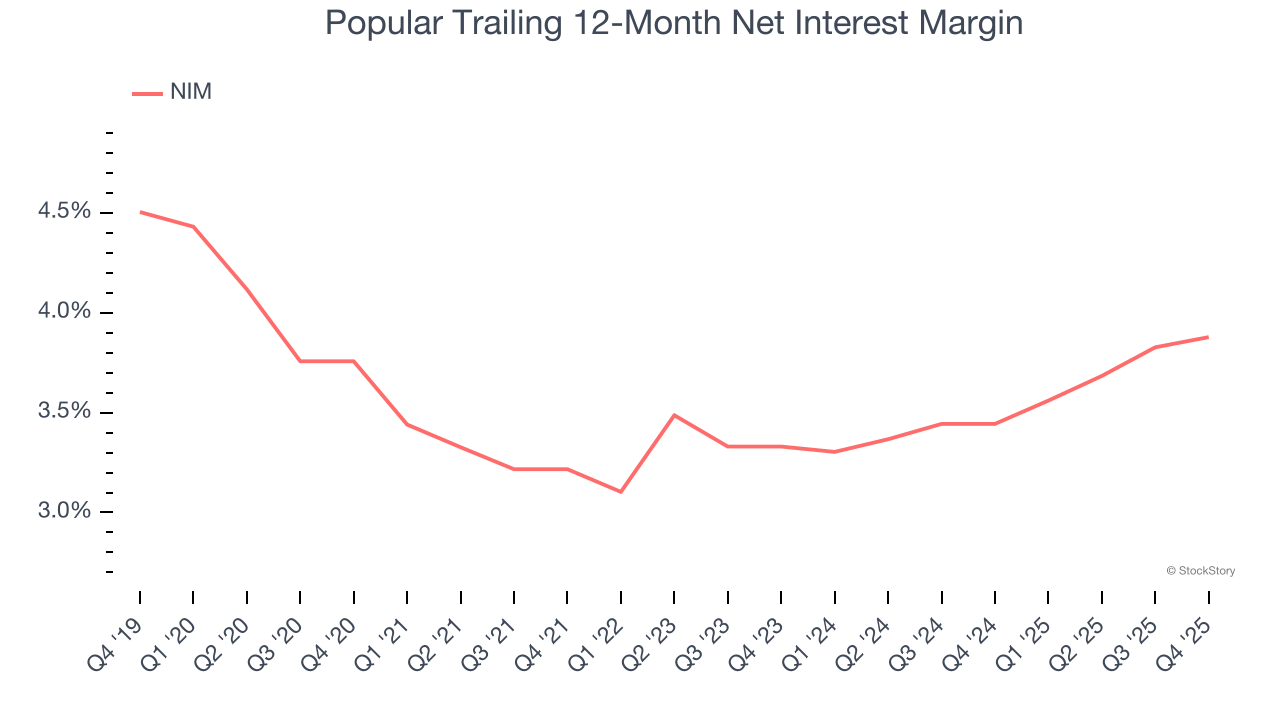

1. Increasing Net Interest Margin Juices Financials

The net interest margin (NIM) is a key profitability indicator that measures the difference between what a bank earns on its loans and what it pays on its deposits. This metric measures how efficiently one can generate income from its core lending activities.

Over the past two years, Popular’s net interest margin averaged 3.7%, climbing by 54.8 basis points (100 basis points = 1 percentage point) over that period.

This expansion was a tailwind for its net interest income, and while prevailing interest rates matter the most for industry net interest margins, banks that consistently increase this figure generally boast higher-earning loan books (all else equal such as the risk of those loans) or provide differentiated services that give them the ability to charge higher rates (pricing power).

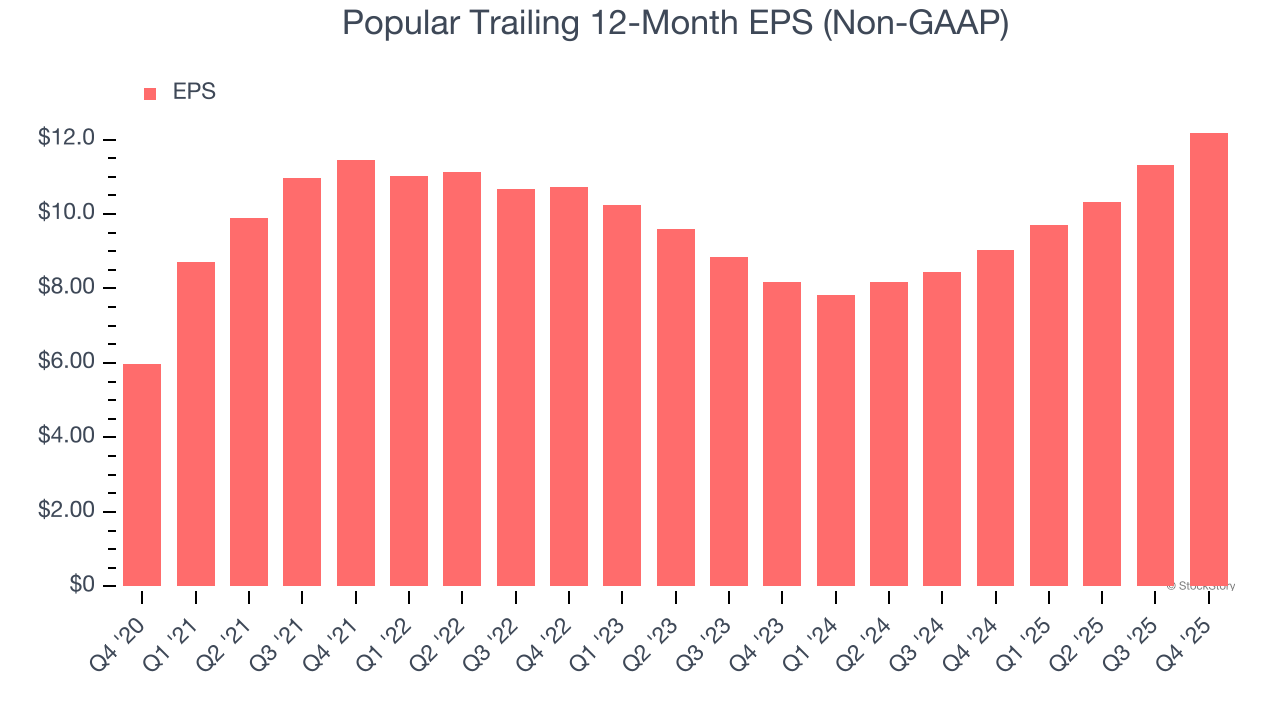

2. Outstanding Long-Term EPS Growth

Analyzing the long-term change in earnings per share (EPS) shows whether a company's incremental sales were profitable – for example, revenue could be inflated through excessive spending on advertising and promotions.

Popular’s EPS grew at a spectacular 15.4% compounded annual growth rate over the last five years, higher than its 8.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

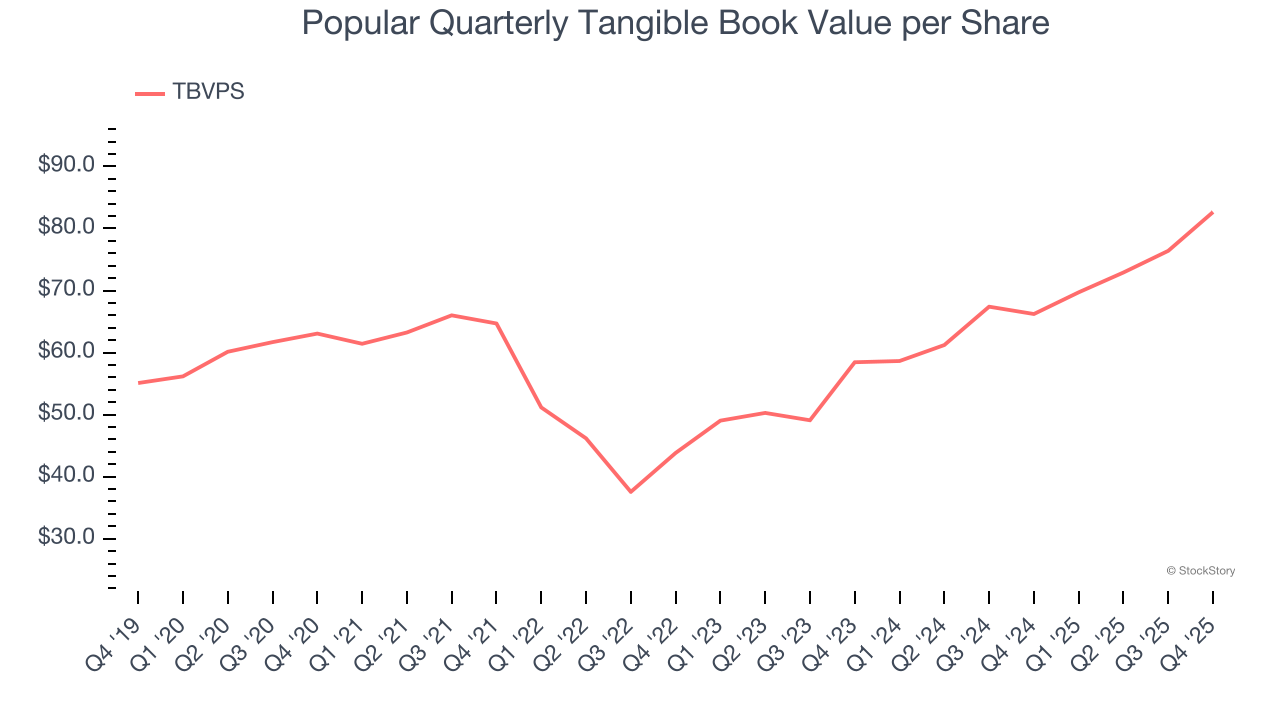

3. Growing TBVPS Reflects Strong Asset Base

Tangible book value per share (TBVPS) serves as a key indicator of a bank’s financial strength, representing the hard assets available to shareholders after removing intangible assets that could evaporate during financial distress.

Popular’s TBVPS increased by 5.6% annually over the last five years, and growth has recently accelerated as TBVPS grew at an exceptional 18.9% annual clip over the past two years (from $58.45 to $82.65 per share).

Final Judgment

These are just a few reasons why we think Popular is a great business, and with its shares topping the market in recent months, the stock trades at 1.3× forward P/B (or $142.88 per share). Is now the right time to buy? See for yourself in our full research report, it’s free.

Stocks We Like Even More Than Popular

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.