The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Credit Acceptance (NASDAQ:CACC) and the rest of the consumer finance stocks fared in Q3.

Consumer finance companies provide loans and credit products to individuals. Growth drivers include increasing consumer spending, financial inclusion initiatives in developing markets, and digital lending platforms reducing distribution costs. Challenges include credit risk during economic downturns, regulatory scrutiny of lending practices, and intensifying competition from traditional banks and fintech firms offering innovative credit solutions.

The 21 consumer finance stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.9%.

Luckily, consumer finance stocks have performed well with share prices up 13% on average since the latest earnings results.

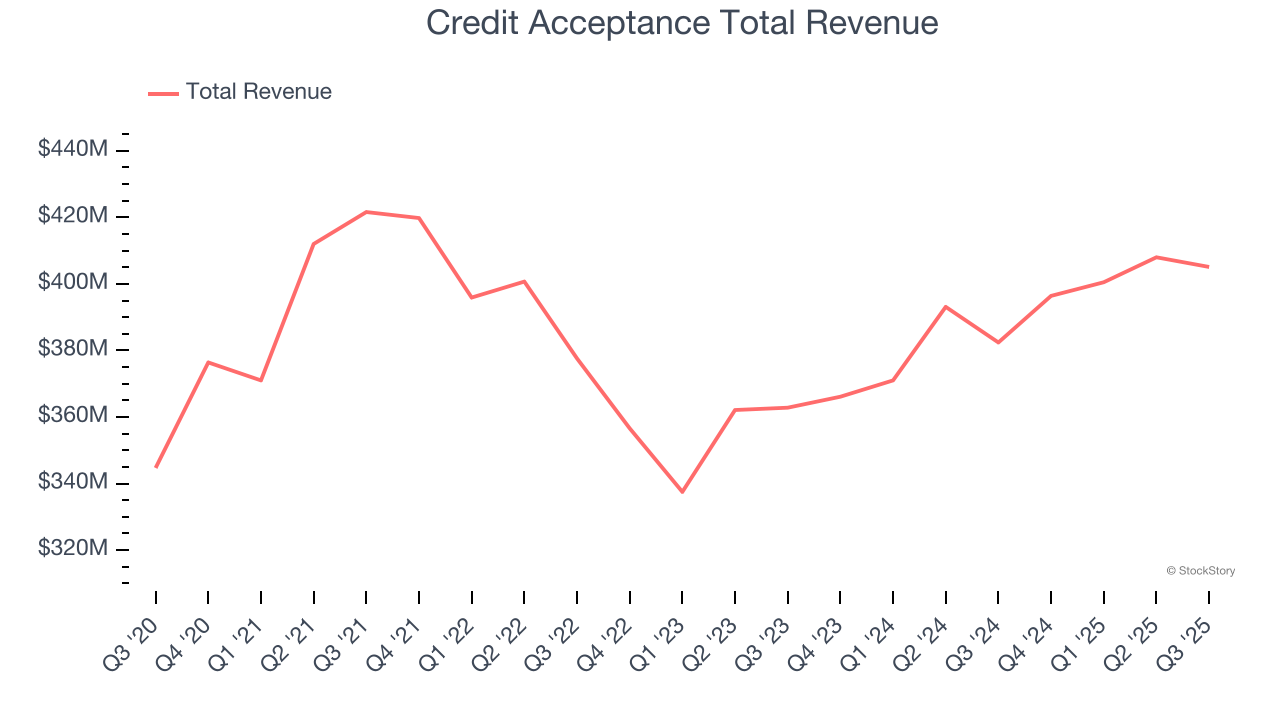

Credit Acceptance (NASDAQ:CACC)

Founded in 1972 by Donald Foss to serve customers overlooked by traditional lenders, Credit Acceptance (NASDAQ:CACC) provides auto financing solutions that enable car dealers to sell vehicles to consumers with limited or impaired credit histories.

Credit Acceptance reported revenues of $405.1 million, up 5.9% year on year. This print fell short of analysts’ expectations by 19.6%. Overall, it was a slower quarter for the company with a significant miss of analysts’ revenue estimates.

Credit Acceptance delivered the weakest performance against analyst estimates of the whole group. Interestingly, the stock is up 1.6% since reporting and currently trades at $460.70.

Read our full report on Credit Acceptance here, it’s free for active Edge members.

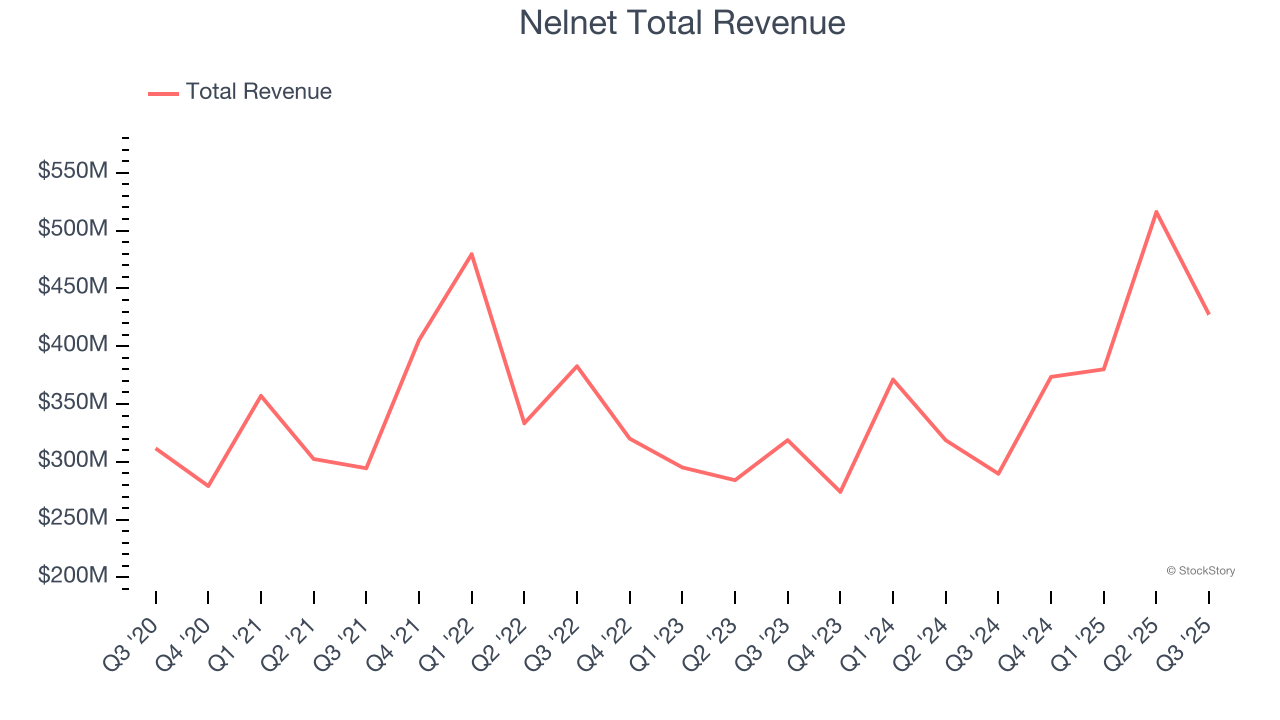

Best Q3: Nelnet (NYSE:NNI)

Starting as a student loan servicer in the 1970s and evolving through the changing landscape of education finance, Nelnet (NYSE:NNI) provides student loan servicing, education technology, payment processing, and banking services while managing a portfolio of education loans.

Nelnet reported revenues of $427.4 million, up 47.5% year on year, outperforming analysts’ expectations by 14.9%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

Nelnet achieved the biggest analyst estimates beat among its peers. The market seems content with the results as the stock is up 2.1% since reporting. It currently trades at $132.53.

Is now the time to buy Nelnet? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Atlanticus Holdings (NASDAQ:ATLC)

Using data analytics to serve the millions of Americans with less-than-perfect credit scores, Atlanticus Holdings (NASDAQ:ATLC) provides technology and services that help lenders offer credit products to consumers often overlooked by traditional financing providers.

Atlanticus Holdings reported revenues of $419.8 million, up 36.1% year on year, exceeding analysts’ expectations by 0.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ EPS estimates.

Interestingly, the stock is up 23.3% since the results and currently trades at $66.60.

Read our full analysis of Atlanticus Holdings’s results here.

OneMain (NYSE:OMF)

Dating back to 1912 and formerly known as Springleaf, OneMain Holdings (NYSE:OMF) provides personal loans, auto financing, and credit cards to nonprime consumers who have limited access to traditional banking services.

OneMain reported revenues of $1.27 billion, up 9.8% year on year. This result beat analysts’ expectations by 2.8%. It was an exceptional quarter as it also recorded a beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest income estimates.

The stock is up 25.8% since reporting and currently trades at $70.12.

Read our full, actionable report on OneMain here, it’s free for active Edge members.

Sezzle (NASDAQ:SEZL)

Founded in 2016 as an alternative to traditional credit cards for younger shoppers, Sezzle (NASDAQ:SEZL) provides a payment platform that allows consumers to split purchases into four interest-free installments over six weeks at participating retailers.

Sezzle reported revenues of $116.8 million, up 67% year on year. This number surpassed analysts’ expectations by 10.1%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ revenue estimates and an impressive beat of analysts’ EBITDA estimates.

Sezzle delivered the fastest revenue growth among its peers. The stock is up 5.3% since reporting and currently trades at $69.78.

Read our full, actionable report on Sezzle here, it’s free for active Edge members.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Growth Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.