Over the past six months, CME Group has been a great trade, beating the S&P 500 by 6.1%. Its stock price has climbed to $303.07, representing a healthy 12.1% increase. This run-up might have investors contemplating their next move.

Is now the time to buy CME Group, or should you be careful about including it in your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is CME Group Not Exciting?

We’re happy investors have made money, but we're cautious about CME Group. Here are two reasons we avoid CME and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

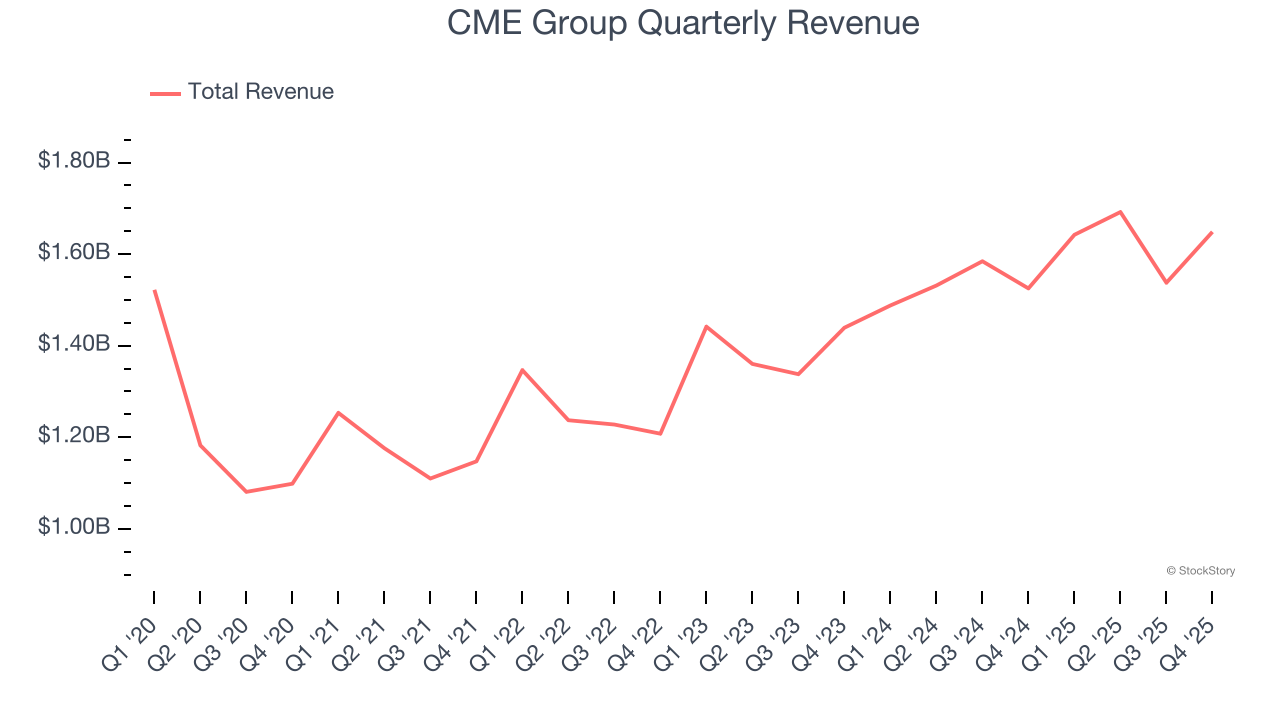

A company’s long-term sales performance can indicate its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

Unfortunately, CME Group’s 6% annualized revenue growth over the last five years was tepid. This fell short of our benchmark for the financials sector.

2. Recent EPS Growth Below Our Standards

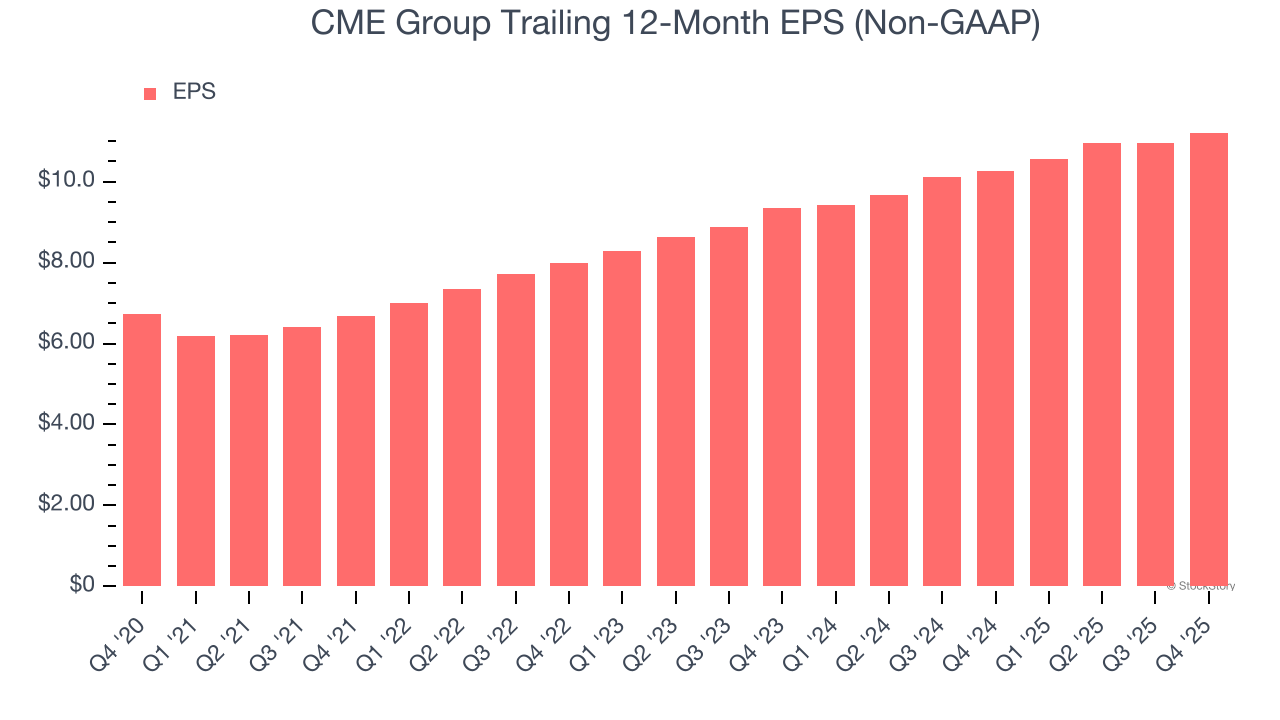

While long-term earnings trends give us the big picture, we also track EPS over a shorter period because it can provide insight into an emerging theme or development for the business.

CME Group’s unimpressive 9.6% annual EPS growth over the last two years aligns with its revenue trend. On the bright side, this tells us its incremental sales were profitable.

Final Judgment

CME Group isn’t a terrible business, but it doesn’t pass our quality test. With its shares outperforming the market lately, the stock trades at 25.4× forward P/E (or $303.07 per share). This valuation tells us a lot of optimism is priced in - we think other companies feature superior fundamentals at the moment. We’d suggest looking at a dominant Aerospace business that has perfected its M&A strategy.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.