E-commerce software company Commerce (NASDAQ:CMRC) fell short of the market’s revenue expectations in Q4 CY2025 as sales rose 2.9% year on year to $89.52 million. Next quarter’s revenue guidance of $83 million underwhelmed, coming in 3.5% below analysts’ estimates. Its non-GAAP profit of $0.07 per share was in line with analysts’ consensus estimates.

Is now the time to buy Commerce? Find out by accessing our full research report, it’s free.

Commerce (CMRC) Q4 CY2025 Highlights:

- Revenue: $89.52 million vs analyst estimates of $90.26 million (2.9% year-on-year growth, 0.8% miss)

- Adjusted EPS: $0.07 vs analyst estimates of $0.07 (in line)

- Adjusted Operating Income: $7.42 million vs analyst estimates of $7.08 million (8.3% margin, 4.8% beat)

- Revenue Guidance for Q1 CY2026 is $83 million at the midpoint, below analyst estimates of $85.99 million

- Operating Margin: -7.4%, down from -0.9% in the same quarter last year

- Free Cash Flow was -$266,000, down from $7.59 million in the previous quarter

- Annual Recurring Revenue: $359.1 million vs analyst estimates of $361.9 million (2.7% year-on-year growth, miss)

- Market Capitalization: $222.7 million

“2025 was a year of material business transformation. We improved efficiency, expanded margins, and realigned investment to our highest-impact growth areas, culminating in our rebrand as Commerce and a clear position in AI-powered agentic commerce,” said Travis Hess, CEO of Commerce.

Company Overview

As a founding member of the MACH Alliance advocating for modern tech standards, Commerce (NASDAQ:CMRC) provides a SaaS platform that enables businesses to build and manage online stores, connect with marketplaces, and integrate with point-of-sale systems.

Revenue Growth

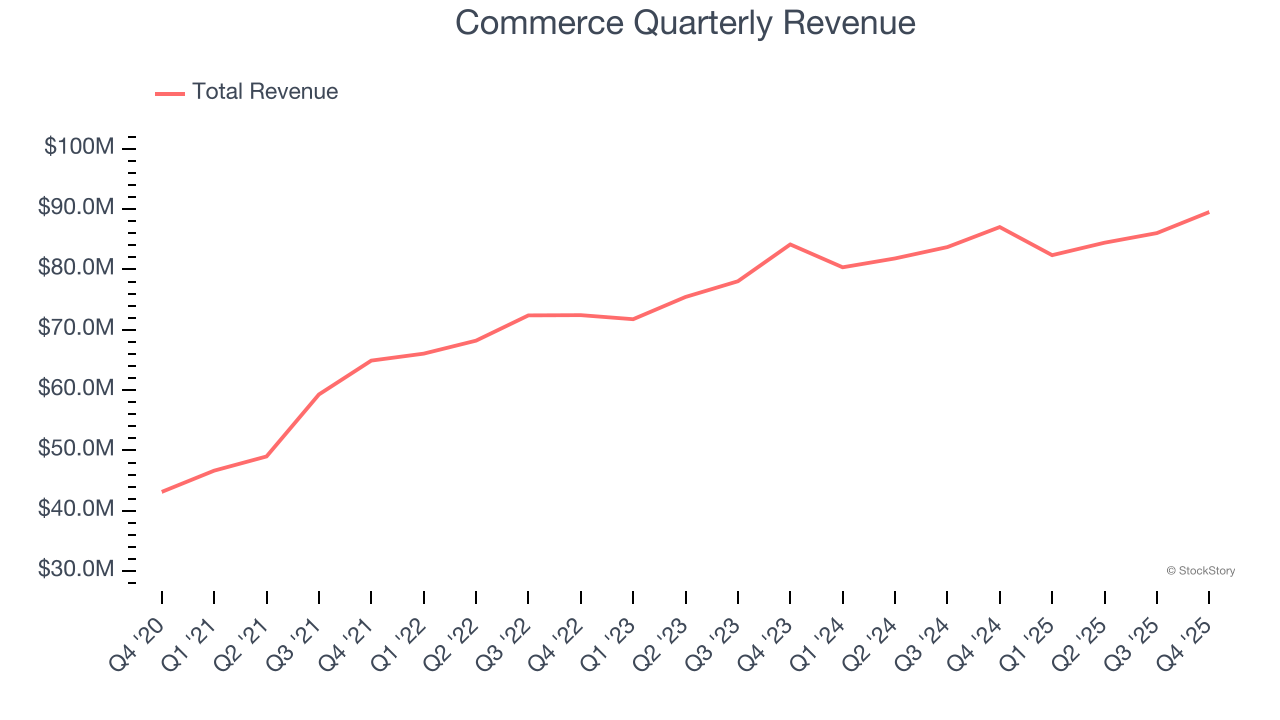

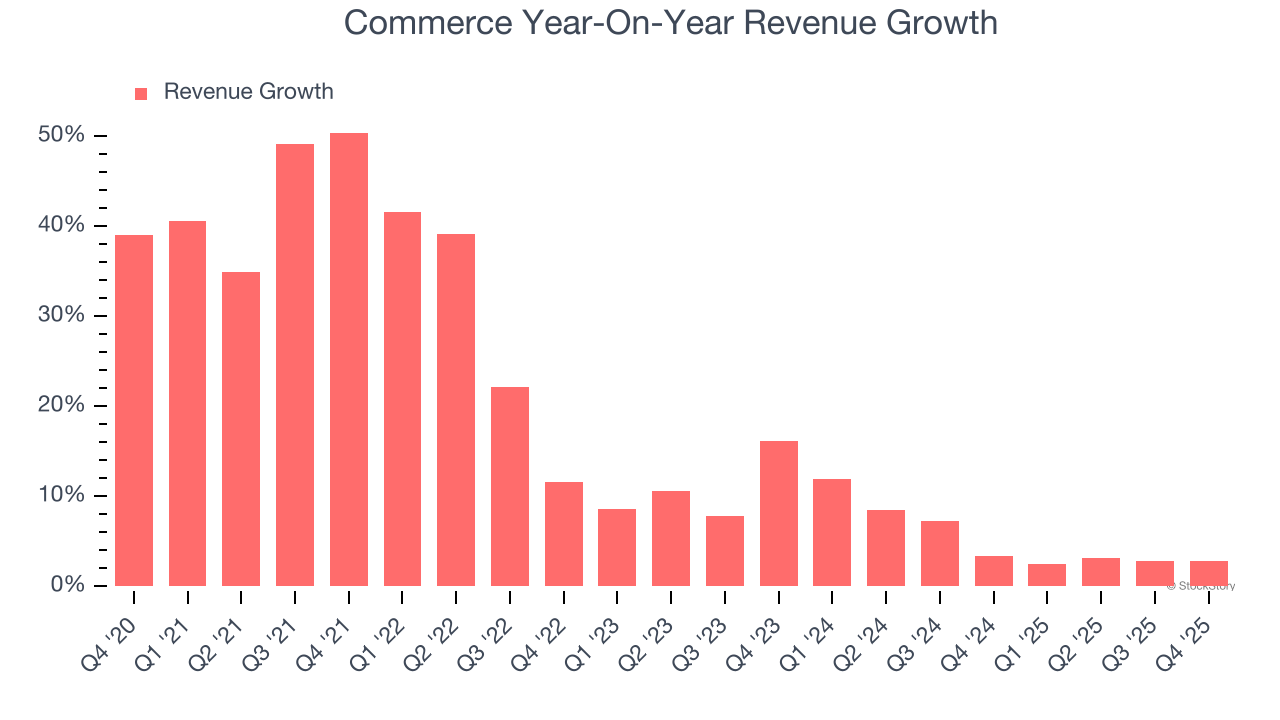

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Commerce’s 17.6% annualized revenue growth over the last five years was decent. Its growth was slightly above the average software company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within software, a half-decade historical view may miss recent innovations or disruptive industry trends. Commerce’s recent performance shows its demand has slowed as its annualized revenue growth of 5.2% over the last two years was below its five-year trend. We’re wary when companies in the sector see decelerations in revenue growth, as it could signal changing consumer tastes aided by low switching costs.

This quarter, Commerce’s revenue grew by 2.9% year on year to $89.52 million, falling short of Wall Street’s estimates. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 4.3% over the next 12 months, similar to its two-year rate. This projection is underwhelming and suggests its newer products and services will not accelerate its top-line performance yet.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

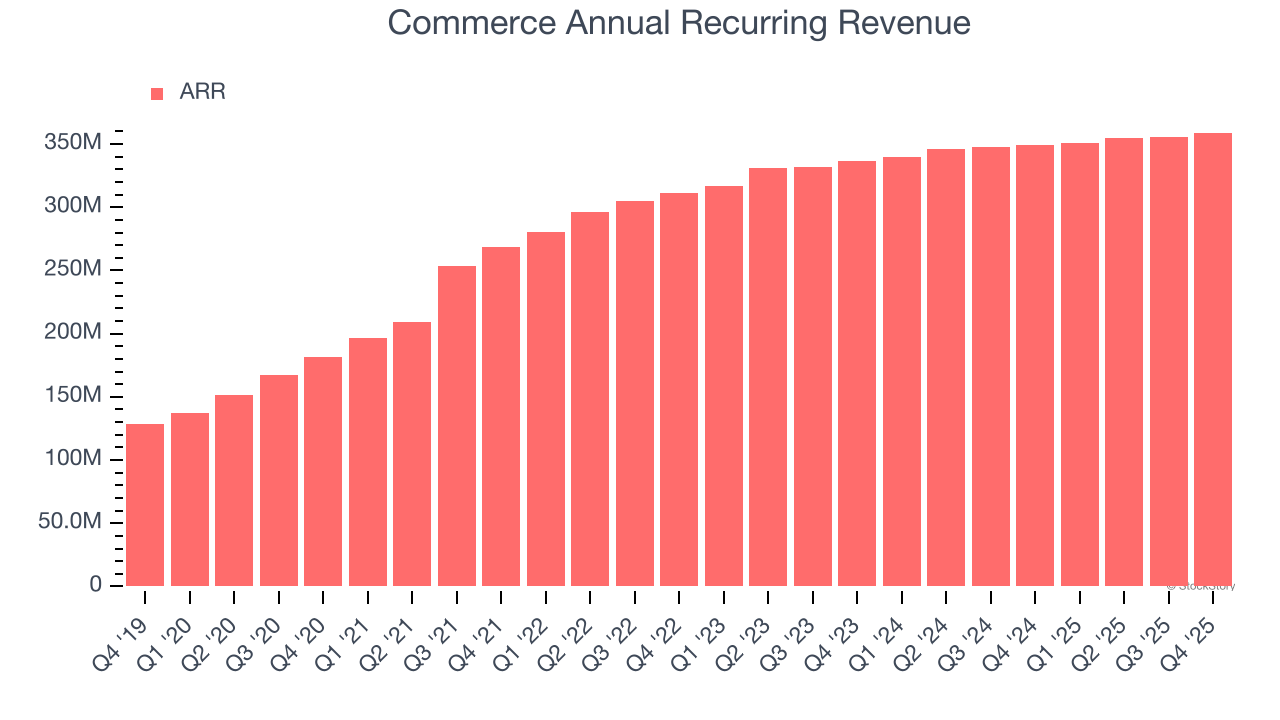

Annual Recurring Revenue

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

Commerce’s ARR came in at $359.1 million in Q4, and over the last four quarters, its growth was underwhelming as it averaged 2.7% year-on-year increases. This performance mirrored its total sales and suggests that increasing competition is causing challenges in securing longer-term commitments.

Customer Acquisition Efficiency

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Commerce is efficient at acquiring new customers, and its CAC payback period checked in at 39 months this quarter. The company’s relatively fast recovery of its customer acquisition costs means it can attempt to spur growth by increasing its sales and marketing investments.

Key Takeaways from Commerce’s Q4 Results

It was great to see Commerce expecting revenue growth to accelerate next year. We were also happy its EBITDA narrowly outperformed Wall Street’s estimates. On the other hand, its revenue guidance for next quarter missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 5.8% to $2.59 immediately after reporting.

Commerce’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).