Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Connection (NASDAQ:CNXN) and its peers.

IT Distribution & Solutions will be buoyed by the increasing complexity of IT ecosystems, rising cloud adoption, and demand for cybersecurity solutions. Enterprises are less likely than ever to embark on these complicated journeys solo, and companies in the sector boast expertise and scale in these areas. However, cloud migration also means less need for hardware, which could dent demand for large portions of the product portfolio and hurt margins. Additionally, planning for potentially supply chain disruptions is ongoing, as the COVID-19 pandemic showed how damaging a pause in global trade could be in areas like semiconductor procurement.

The 8 it distribution & solutions stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1.1% while next quarter’s revenue guidance was in line.

While some it distribution & solutions stocks have fared somewhat better than others, they have collectively declined. On average, share prices are down 3.6% since the latest earnings results.

Weakest Q3: Connection (NASDAQ:CNXN)

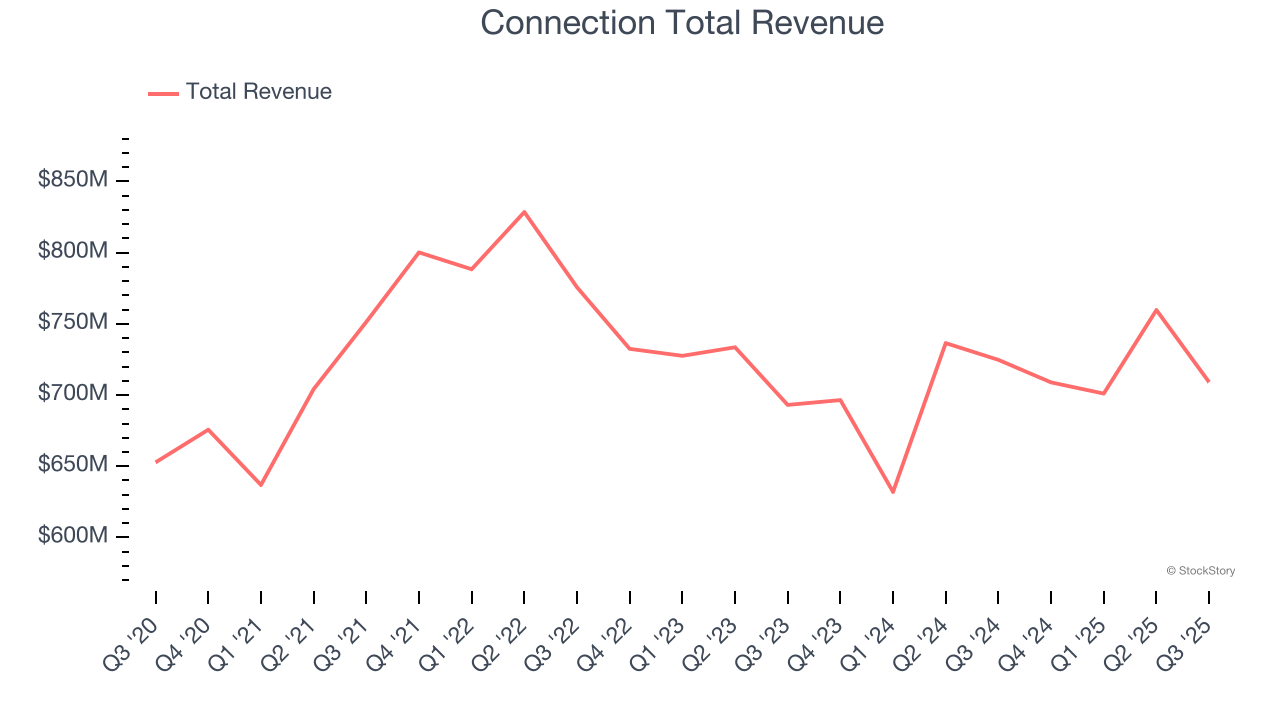

Starting as a small computer products seller in 1982 and evolving into a Fortune 1000 company, Connection (NASDAQ:CNXN) is a technology solutions provider that helps businesses and government agencies design, purchase, implement, and manage their IT infrastructure and systems.

Connection reported revenues of $709.1 million, down 2.2% year on year. This print fell short of analysts’ expectations by 4.7%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ revenue and EPS estimates.

Unsurprisingly, the stock is down 4% since reporting and currently trades at $58.46.

Read our full report on Connection here, it’s free.

Best Q3: ePlus (NASDAQ:PLUS)

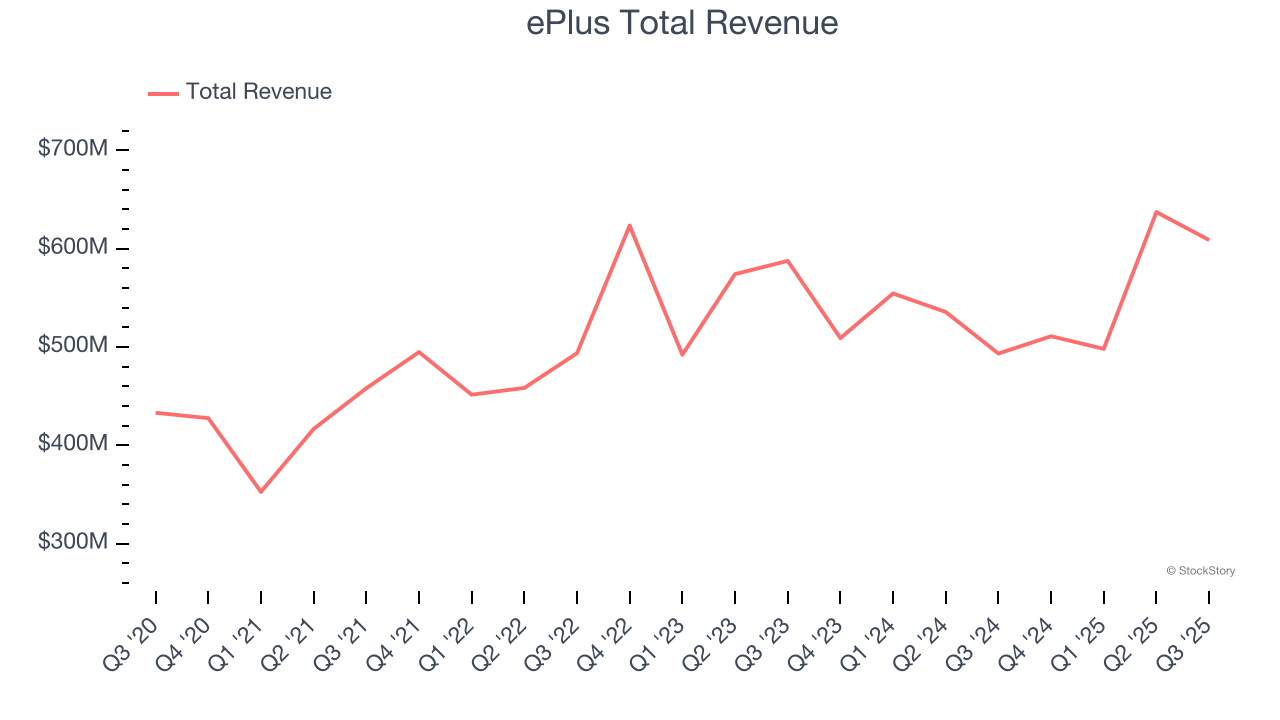

Starting as a financing company in 1990 before evolving into a full-service technology provider, ePlus (NASDAQ:PLUS) provides comprehensive IT solutions, professional services, and financing options to help organizations optimize their technology infrastructure and supply chain processes.

ePlus reported revenues of $608.8 million, up 23.4% year on year, outperforming analysts’ expectations by 17.5%. The business had an incredible quarter with a beat of analysts’ EPS and revenue estimates.

ePlus achieved the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 16.3% since reporting. It currently trades at $85.32.

Is now the time to buy ePlus? Access our full analysis of the earnings results here, it’s free.

Insight Enterprises (NASDAQ:NSIT)

With over 35 years of IT expertise and partnerships with more than 8,000 technology providers, Insight Enterprises (NASDAQ:NSIT) provides end-to-end digital transformation solutions that help businesses modernize their IT infrastructure and maximize the value of technology.

Insight Enterprises reported revenues of $2.00 billion, down 4% year on year, falling short of analysts’ expectations by 5.9%. It was a softer quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ EPS estimates.

As expected, the stock is down 17.3% since the results and currently trades at $85.78.

Read our full analysis of Insight Enterprises’s results here.

ScanSource (NASDAQ:SCSC)

Operating as a crucial link in the technology supply chain since 1992, ScanSource (NASDAQ:SCSC) is a hybrid distributor that connects hardware, software, and cloud services from technology suppliers to resellers and business customers.

ScanSource reported revenues of $739.7 million, down 4.6% year on year. This number came in 6.1% below analysts' expectations. More broadly, it was a satisfactory quarter as it also logged a beat of analysts’ EPS estimates but a significant miss of analysts’ revenue estimates.

ScanSource had the weakest performance against analyst estimates and slowest revenue growth among its peers. The stock is down 3.4% since reporting and currently trades at $40.45.

Read our full, actionable report on ScanSource here, it’s free.

Ingram Micro (NYSE:INGM)

Operating as the crucial link in the global technology supply chain with a presence in 57 countries, Ingram Micro (NYSE:INGM) is a global technology distributor that connects manufacturers with resellers, providing hardware, software, cloud services, and logistics expertise.

Ingram Micro reported revenues of $12.6 billion, up 7.2% year on year. This result beat analysts’ expectations by 3%. It was a strong quarter as it also produced revenue guidance for next quarter exceeding analysts’ expectations and a solid beat of analysts’ revenue estimates.

The stock is down 4.8% since reporting and currently trades at $21.

Read our full, actionable report on Ingram Micro here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Top 5 Quality Compounder Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.