Coconut water company The Vita Coco Company (NASDAQ:COCO) reported results in line with analysts' expectations in Q1 CY2024, with revenue up 1.8% year on year to $111.7 million. The company's outlook for the full year was also close to analysts' estimates with revenue guided to $505 million at the midpoint. It made a GAAP profit of $0.24 per share, improving from its profit of $0.12 per share in the same quarter last year.

Is now the time to buy Vita Coco? Find out by accessing our full research report, it's free.

Vita Coco (COCO) Q1 CY2024 Highlights:

- Revenue: $111.7 million vs analyst estimates of $111.7 million (small beat)

- EPS: $0.24 vs analyst estimates of $0.18 (34.4% beat)

- The company lifted its revenue guidance for the full year from $500 million to $505 million at the midpoint, a 1% increase

- Full year adjusted EBITDA guidance of $79 million at the midpoint is above estimates of $75 million

- Gross Margin (GAAP): 42.2%, up from 30.7% in the same quarter last year

- Free Cash Flow was -$391,000, down from $37.09 million in the previous quarter

- Sales Volumes were down 0.5% year on year

- Market Capitalization: $1.37 billion

Founded in 2004 followed by a 2021 IPO, The Vita Coco Company (NASDAQ:COCO) offers coconut water products that are a natural way to quench thirst.

Beverages and Alcohol

These companies' performance is influenced by brand strength, marketing strategies, and shifts in consumer preferences. Changing consumption patterns are particularly relevant and can be seen in the explosion of alcoholic craft beer drinks or the steady decline of non-alcoholic sugary sodas. Companies that spend on innovation to meet consumers where they are with regards to trends can reap huge demand benefits while those who ignore trends can see stagnant volumes. Finally, with the advent of the social media, the cost of starting a brand from scratch is much lower, meaning that new entrants can chip away at the market shares of established players.

Sales Growth

Vita Coco is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefitting from better brand awareness and economies of scale. On the other hand, one advantage is that its growth rates can be higher because it's growing off a small base.

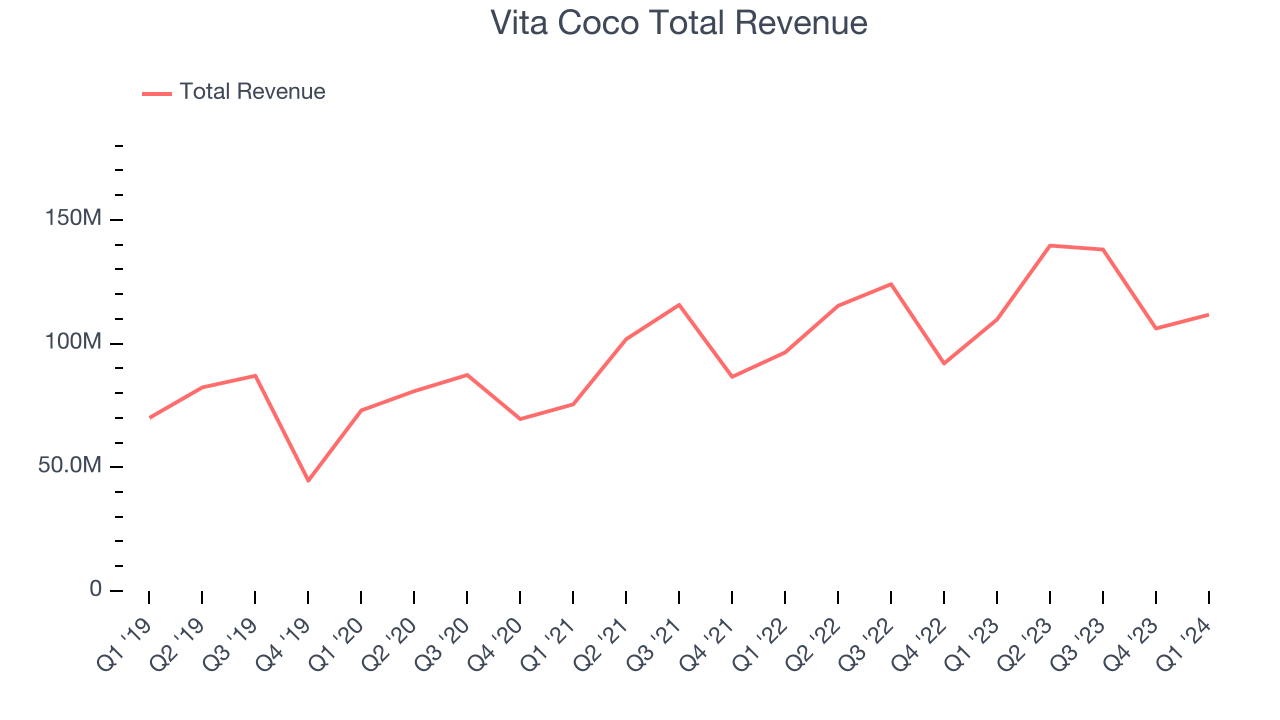

As you can see below, the company's annualized revenue growth rate of 16.5% over the last three years was impressive for a consumer staples business.

This quarter, Vita Coco grew its revenue by 1.8% year on year, and its $111.7 million in revenue was in line with Wall Street's estimates. Looking ahead, Wall Street expects sales to grow 3.5% over the next 12 months, an acceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

Cash Is King

If you've followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can't use accounting profits to pay the bills.

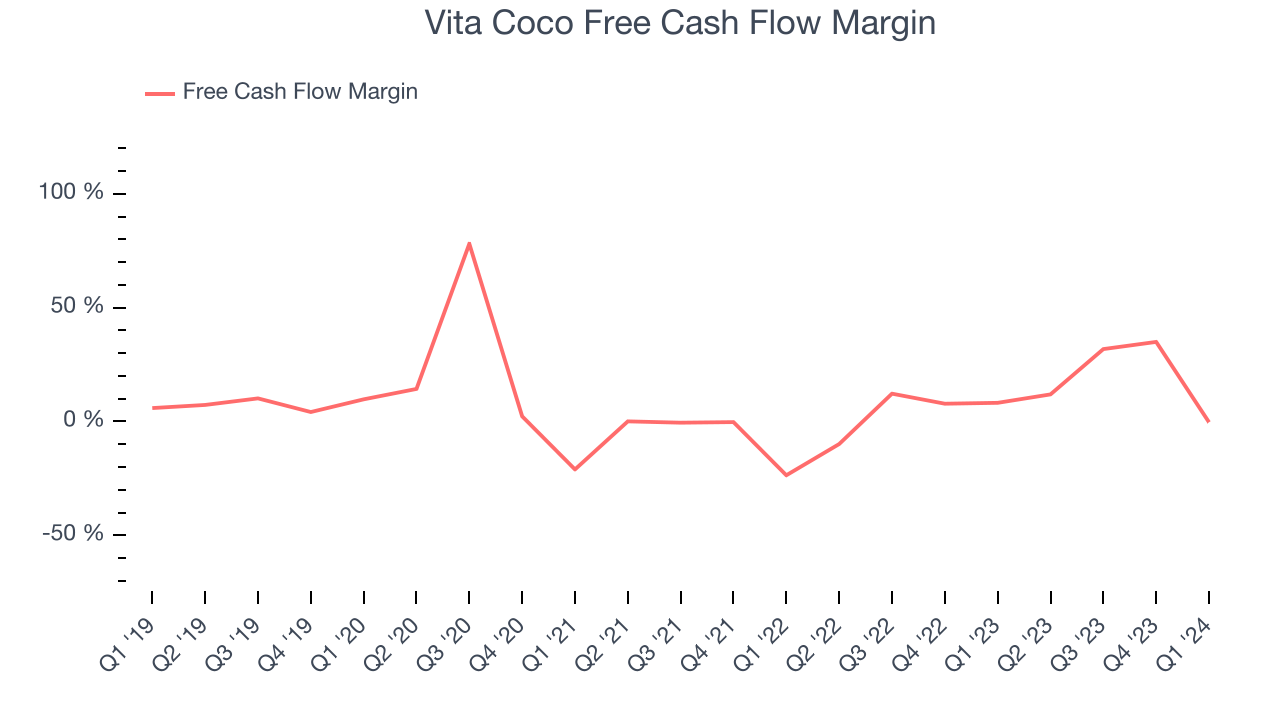

Vita Coco broke even from a free cash flow perspective in Q1. The company's margin regressed this quarter as it was 8.5 percentage points lower than in the same period last year.

Over the last two years, Vita Coco has shown strong cash profitability, giving it an edge over its competitors and the option to reinvest or return capital to investors while keeping cash on hand for emergencies. The company's free cash flow margin has averaged 12.5%, quite impressive for a consumer staples business. Furthermore, its margin has averaged year-on-year increases of 15.1 percentage points over the last 12 months. Shareholders should be excited as this will certainly help Vita Coco achieve its strategic long-term plans.

Key Takeaways from Vita Coco's Q1 Results

We liked how Vita Coco beat revenue, gross margin, and EPS expectations this quarter. It's also nice to see that full year guidance for revenue and adjusted EBITDA both came in slightly above Wall Street analysts' estimates. Zooming out, we think this was a great quarter that shareholders will appreciate. The stock is up 6.4% after reporting and currently trades at $25.79 per share.

Vita Coco may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.