Electronic Arts’s 35.4% return over the past six months has outpaced the S&P 500 by 22.4%, and its stock price has climbed to $203.89 per share. This performance may have investors wondering how to approach the situation.

Is now still a good time to buy EA? Or are investors being too optimistic? Find out in our full research report, it’s free for active Edge members.

Why Does EA Stock Spark Debate?

Best known for its Madden NFL and FIFA sports franchises, Electronic Arts (NASDAQ:EA) is one of the world’s largest video game publishers.

Two Positive Attributes:

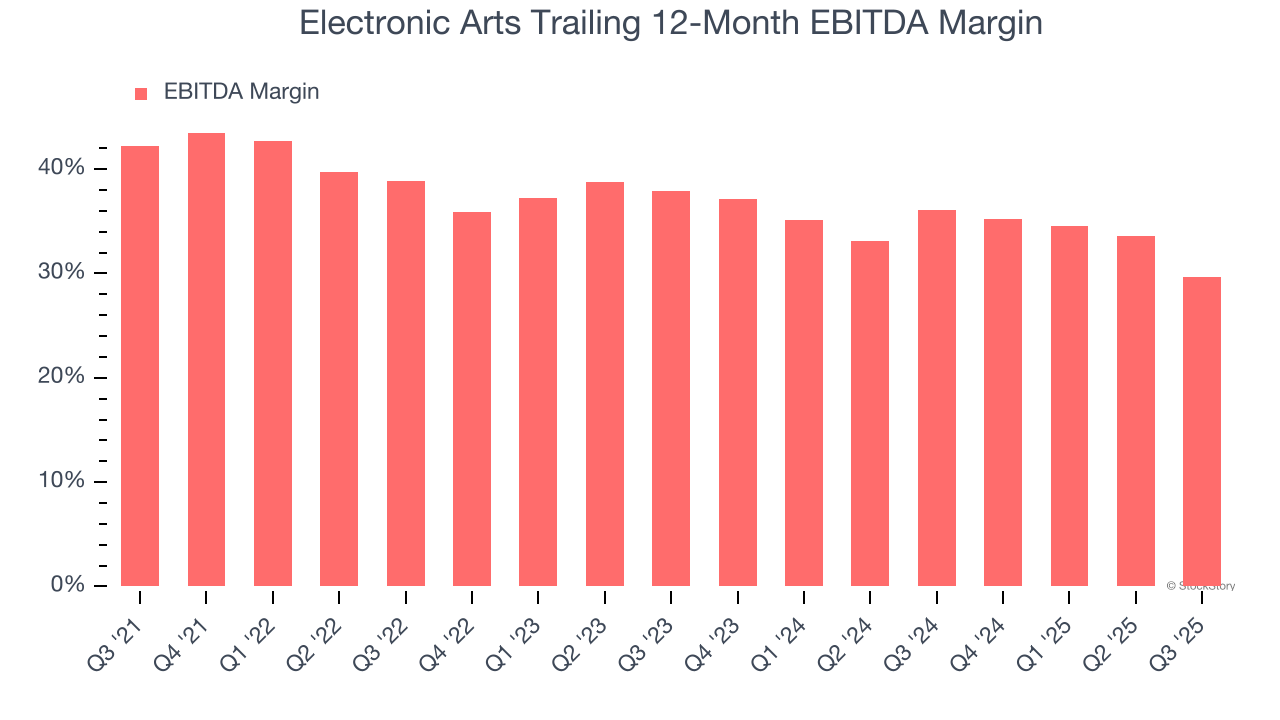

1. EBITDA Margin Reveals a Well-Run Organization

Investors frequently analyze operating income to understand a business’s core profitability. Similar to operating income, EBITDA is a common profitability metric for consumer internet companies because it removes various one-time or non-cash expenses, offering a more normalized view of profit potential.

Electronic Arts has been a well-oiled machine over the last two years. It demonstrated elite profitability for a consumer internet business, boasting an average EBITDA margin of 32.9%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

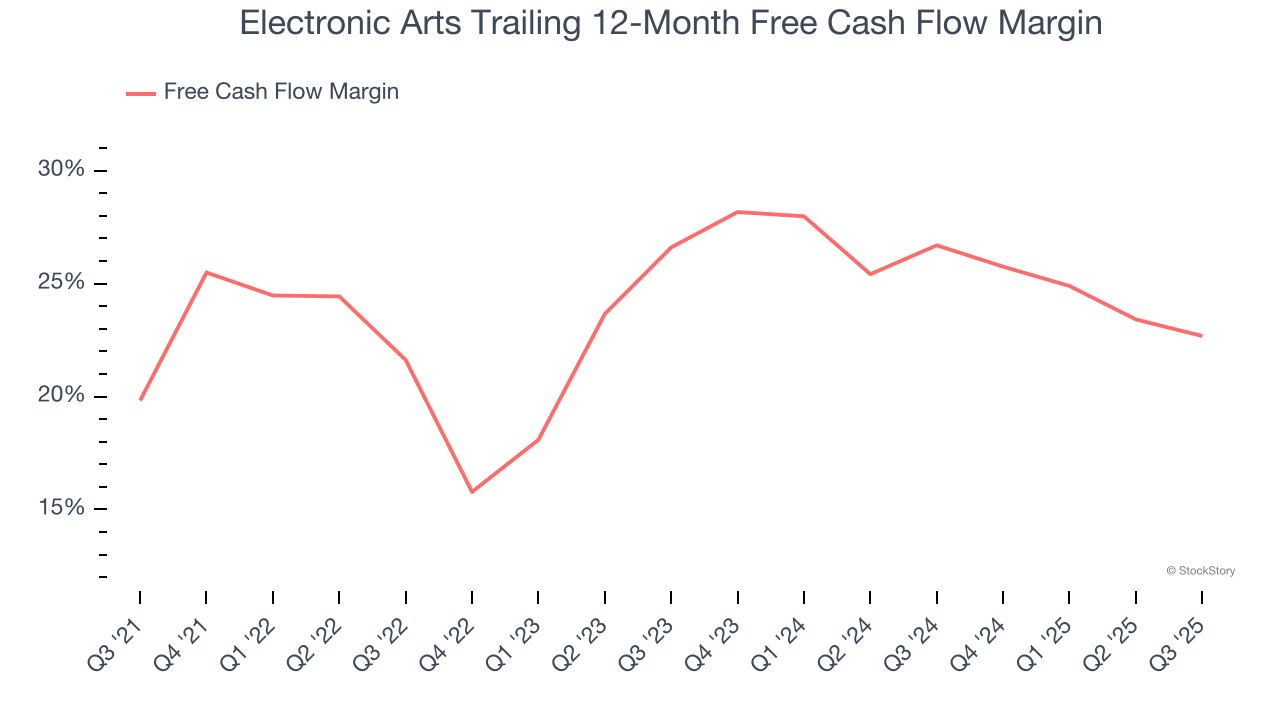

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Electronic Arts has shown terrific cash profitability, driven by its lucrative business model and cost-effective customer acquisition strategy that enable it to stay ahead of the competition through investments in new products rather than sales and marketing. The company’s free cash flow margin was among the best in the consumer internet sector, averaging 24.7% over the last two years.

One Reason to be Careful:

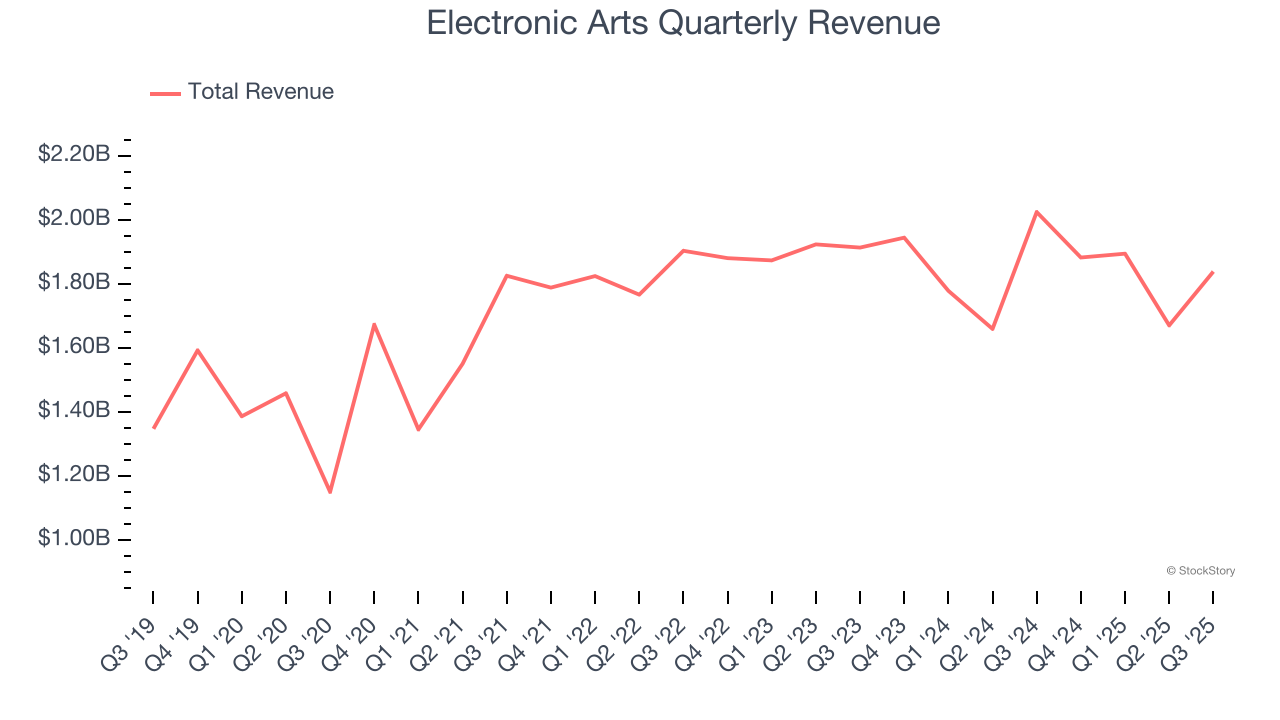

Long-Term Revenue Growth Flatter Than a Pancake

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Electronic Arts struggled to consistently increase demand as its $7.29 billion of sales for the trailing 12 months was close to its revenue three years ago. This wasn’t a great result, but there are still things to like about Electronic Arts.

Final Judgment

Electronic Arts has huge potential even though it has some open questions, and with its shares outperforming the market lately, the stock trades at 15.7× forward EV/EBITDA (or $203.89 per share). Is now a good time to initiate a position? See for yourself in our in-depth research report, it’s free for active Edge members.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.